Is TechEra Engineering Poised to Ride India’s Defense & Aerospace Manufacturing Wave?

India’s push toward self-reliance in defense and high-end manufacturing has opened significant opportunities for companies operating in niche segments of aerospace tooling, electric propulsion systems, and precision engineering. One emerging player quietly making strides in this direction is TechEra Engineering—a company that, while currently flying under the radar, may be strategically positioned to benefit from both government policies and private sector demand.

Thoughts

TechEra Engineering’s story is still unfolding, but the building blocks are compelling: proven experience in aerospace tooling, an innovative acquisition in Kalbroz Electric, and strategic exposure to India’s expanding defense procurement and indigenization mandates.

While scale and financial transparency may take time to evolve, the company appears well-positioned to benefit from structural tailwinds in defense and advanced manufacturing. With real IP, a credible promoter group, and niche capabilities in both tooling and propulsion systems, TechEra might be a dark horse worth tracking.

That said, this remains a relatively under-researched company. If you’re someone with insights into aerospace supply chains, defense procurement cycles, or electric mobility technologies, your inputs would be invaluable. It would be great to see the community dive deeper — whether by analyzing filings, connecting with industry insiders, or decoding the exact nature of their contracts and execution capabilities.

Let’s use this thread to collaborate and uncover whether TechEra Engineering truly has the makings of a long-term compounder or is simply riding a temporary wave. Looking forward to thoughts, data points, and discussion from fellow members.

Background: From Automation Roots to Aerospace Ambitions

TechEra Engineering traces its roots to the 1990s when founder Nimesh Desai began operations under the banner of “Techexcellency,” initially serving the automation and tooling needs of Pune’s automotive belt. Over time, the company transitioned into aerospace tooling—an area requiring extremely high precision and tight quality controls.

This shift was catalyzed further when Techexcellency partnered with Jendamark Automation, a South African multinational, to scale operations. However, by 2019, the original promoters, including Desai’s son Meet Desai, exited the joint venture amid strategic differences. This marked the beginning of a new chapter—one that would see the Desais regroup under the TechEra Engineering brand.

Key Projects: C295 Aircraft Tooling for Tata-Airbus

One of TechEra’s major credentials lies in its contribution to the Airbus C295 aircraft program, executed in collaboration with Tata Advanced Systems. The company has reportedly developed and supplied over 250 tooling components for the C295 manufacturing line—tools that are critical for assembling the aircraft fuselage and sub-systems.

This level of involvement suggests not only a high degree of engineering capability but also alignment with global aerospace quality standards. TechEra’s role in the C295 ecosystem lends it strong credibility as a reliable Indian aerospace tooling partner.

Strategic Acquisition: Kalbroz Electric

In 2024, TechEra Engineering acquired Kalbroz Electric, a company focused on advanced axial flux electric motors—a niche but highly promising technology within the electric mobility and defense propulsion sectors.

Kalbroz was founded by Eshan Kalbhor, a technocrat with deep experience in electric powertrain design, including stints working with Formula E teams and winning three IDEX awards for innovation in axial flux motors. These motors differ from conventional radial flux motors by offering higher torque density, lighter weight, and improved efficiency—making them ideal for applications ranging from drones to electric naval vessels.

Kalbroz had previously collaborated with the Indian Navy and had participated in key defense expos, showcasing advanced propulsion solutions. With the acquisition, TechEra now gains access to both proprietary motor designs and defense-oriented R&D capabilities—enabling vertical integration from tooling to final propulsion components.

Industry Positioning and Contract Pipeline

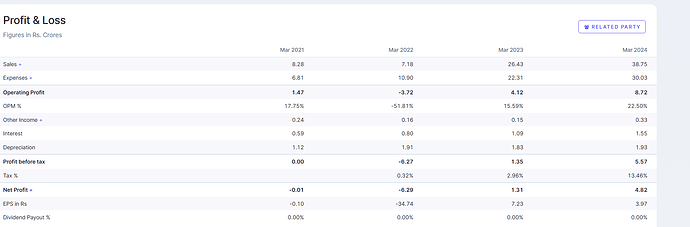

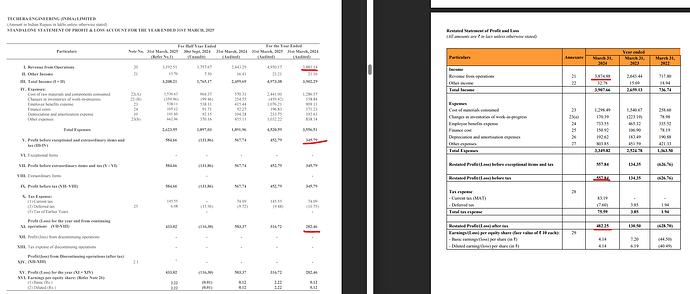

While financial disclosures remain limited, it’s reported that Kalbroz holds a six-month order book valued at ₹37 crore, primarily tied to electric propulsion systems and naval applications. In parallel, TechEra continues to serve contracts in the aerospace tooling segment, some of which may span five-year terms with global original equipment manufacturers (OEMs) or their licensed suppliers.

This dual positioning—tooling for aerospace and propulsion systems for defense—gives TechEra a unique edge in India’s high-tech manufacturing value chain. Few listed companies operate at the intersection of such specialized segments, and even fewer have real IP and execution experience.

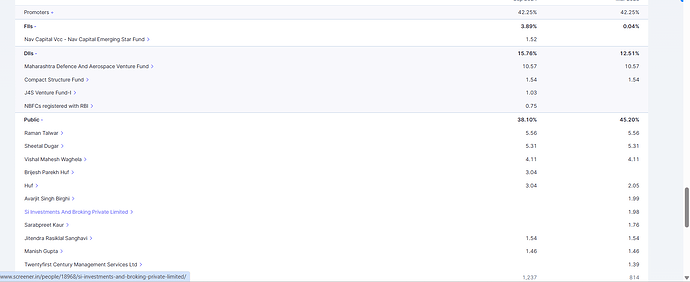

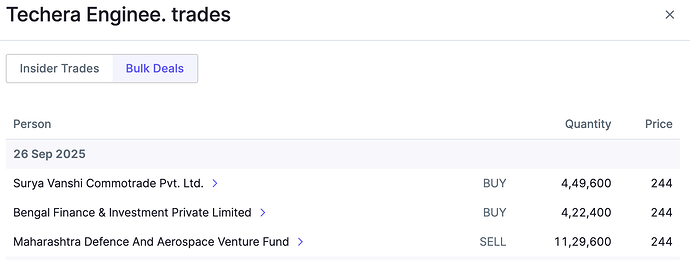

Shareholding and Promoter Strength

TechEra’s shareholding structure appears tightly held, with just around 800 shareholders. Some reputed names from the defense ecosystem, including seasoned investors with domain expertise, are reportedly on the cap table. Moreover, the promoters’ track record is considered clean and execution-focused—particularly relevant in sectors where credibility, discretion, and precision are paramount.

TechEra Engineering’s story is still unfolding, but the building blocks are compelling: proven experience in aerospace tooling, an innovative acquisition in Kalbroz Electric, and strategic exposure to India’s expanding defense procurement and indigenization mandates.

While scale and financial transparency may take time to evolve, the company appears well-positioned to benefit from structural tailwinds in defense and advanced manufacturing. With real IP, a credible promoter group, and niche capabilities in both tooling and propulsion systems, TechEra might be a dark horse worth tracking.

That said, this remains a relatively under-researched company. If you’re someone with insights into aerospace supply chains, defense procurement cycles, or electric mobility technologies, your inputs would be invaluable. It would be great to see the community dive deeper — whether by analyzing filings, connecting with industry insiders, or decoding the exact nature of their contracts and execution capabilities.

Let’s use this thread to collaborate and uncover whether TechEra Engineering truly has the makings of a long-term compounder or is simply riding a temporary wave. Looking forward to thoughts, data points, and discussion from fellow members.

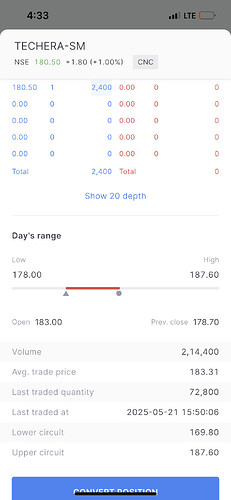

INVESTED: 130 LEVEL