The Business

Tata Power (TPR) is India’s Largest Integrated Power Company with a generation capacity of 12,808 MW reaching 12.1 million customers. It has been the No 1 Solar EPC player seven years in a row with more than 30% in clean energy.

Tata Power, formerly a part of the three entities jointly known as Tata Electric Companies, is a pioneer in technology adoption and is India’s largest integrated power company.

TPR has started focusing on new age businesses in addition to its regulated business of power generation, transmission & distribution. EV charging, Solar rooftops, Solar pumps, Solar modules and cells, micro grids, utility scale solar EPC, solar RO systems and home automation systems are its new ventures and will drive the business of the future.

They have started investing in intellectual property and has received 2 patents in FY21.

GLOBAL INDUSTRY DETAILS

- With an increasing number of nations responding to the challenge of climate change, the energy landscape is undergoing change, with greater focus being lent to cleaner sources of energy. More than 100 countries have pledged carbon neutrality by 2050 and many more such commitments are on the horizon.

- Renewable capacity addition has beaten all previous records, with more than 260 GW being added in 2020, exceeding 2019 growth by 50% as reported by IRENA (International Renewable Energy Agency)

- Share of renewables in new capacity additions rose considerably for the second year in a row, accounting for more than 80% of the capacity additions, with solar and wind accounting for 91% of the renewables.

- As per International Energy Agency (IEA) World Energy Outlook 2020, renewables are expected to overtake coal as the primary means of producing global electricity in 2025.

- As per a Hydrogen Council report, there are more than 200 large-scale projects for a combined $ 300 billion of proposed investment through 2030.

- The three Ds – Decentralisation, Decarbonisation and Digitalisation – are driving transformation of the energy sector, creating opportunities for new business models like Energy-asa-Service (EaaS), which is likely to further disrupt the utility sector.

INDIA INDUSTRY DETAILS

- Govt of India plans to raise renewable energy capacity from targeted level of 175 GW in 2022 to 450 GW by 2030.

- Another major focus area of the government has been increased participation of private players in the Transmission and Distribution (T&D) space, through the Tariff-based Competitive Bidding (TBCB) route in transmission and PPP (Public-Private Partnership) or franchisee models in the distribution segment in a bid to improve performance. Distribution continues to be

- The weakest link in the power value chain, which faces challenges of high Aggregate Technical & Commercial (AT&C) losses, insufficient tariff hikes resulting in a widening Average Cost of Supply (ACS)–Average Revenue Realised (ARR) gap, accumulation of regulatory assets and cross-subsidisation.

Transformation plans for the future:

- New business: From a commodity player to a service provider for the end consumer.

- Customer growth in focus: From a ~ 3 million customer base in FY’ 20 to 20 million customer base in FY’25.

- Portfolio transformation: From a 30% clean portfolio to over 60 % Renewables portfolio in FY’25.

- Growth scale-up: From 12.8 GW to 25 GW capacity in FY’25.

Rooftop solar

- Market to grow from 6.6MW to 30MW by FY25

- Target of 5000 cr of revenues from solar roof tops by FY25

Residential and Industrial rooftop solar:

- 30,000+ total & 15,000+ residential customers.

- 500+ MW installed, ~40% CAGR (FY18-21)

- Ranked No 1 Solar EPC Player for 7 years in a row

- Pan India network of 250+ Channel Partners

Solar-powered water pumps:

- Over 35,000 Pumps across India

- Market Leader in Solar Pumps.

- Govt is encouraging the use of solar pumps for irrigation purposes under the KUSUM scheme with a 60% subsidy. The aim is to reach 3.5 mn farmers. Tata Power has 30K+ and is expecting to reach 1L+ by FY26.

Future Plans

- TPR has decided not to invest any further capital into coal based generation. TPR will phase out coal-based generation completely as their respective power purchase agreements (PPAs) expire, e.g. Maithon FY35, Mundra FY37, Trombay extended by five years to FY24 and Jojobera FY31/32.

- TPR has planned to move to 60% clean energy by FY25, 80% by FY30 and 100% by FY50.

- TPR expects commissioning of 900MW of its Renewable Energy projects over the next 6-9 months. It has doubled its solar PV manufacturing capacity to 1,100 MW of cell and modules under Tata Power Solar Systems Limited.

- The management expects to incur a capex of Rs.7000-8000 cr in FY22. Around 50% of this would be for its Renewables portfolio, while another Rs.1000 cr is related to Odisha DISCOMs.

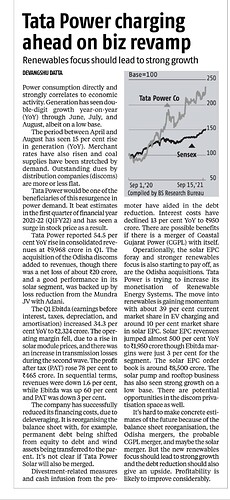

- The company has prepaid 1,500 crs of 11.4% perpetual debt. The net debt slightly increased to 38,898 crs. The prepayment of high-cost debt has helped reduce the interest cost from 7.99% last year to 6.95% this year. The net debt to equity stood at 1.7-1.57 compared to 1.81 last year. Net debt to underlying EBITDA has also come down to a healthy 4.1x.

- Company expects Solar EPC to boost up its earnings for the next two years. The large-scale utility EPC order book continues to grow, with orders worth 743 crs won in Q1FY22, taking the total order book as on 30 June at 7,257 crs.

The future focus is on renewables

- Renewable energy unit IPO: Company is planning to raise just over Rs. 3,500cr by listing its renewables business.

- The company has a roadmap to be one of the major players in India in EV charging. It has tied up with OEM partners to provide home charging facilities to EV car buyers.

- It has set up close to 500 public charging points in nearly 100 cities and plans to expand to over 3,000 charging points in the next one year. It has also collaborated with fleet owners which serves as an assured revenue model. TPR plans to extend their charging points to 1 lakh by FY25.

- They have collaborated with Central Railway to launch EV charging points at Mumbai’s railway stations.

Electricity Amendment Bill 2021

De-license power distribution

- Allowing private sector players to enter the sector and compete with state-owned power discoms

- Giving consumers a choice to choose a distribution company in their area

- Universal service obligation to ensure companies do not cherry pick customers

Mandatory Renewable Purchase Obligation (RPO)

- Penal provision for missing purchase obligation

Experience from Orissa to manage urban, rural and semi-rural to be very helpful

- Tata Power has taken over the entire state’s power distribution

- Orissa distribution to be profitable by FY22

Tata Sons is backing the changes

- Tata Sons has reposed faith in the company and has bought into 2,600 cr of equity share capital on preferential basis. This has resulted in Tata Sons’ shareholding going from 35.27% in FY20 to 45.21% in FY21.

- Dr. Praveer Sinha is the CEO & Managing Director of the company and is a PhD. from IIT, Delhi with over 36 years of industry experience. He is also the Co-Chairman of the CII National Committee on Power as also on various Industry bodies. He is one of the most well-respected people in the industry.

- TPR tops the CRISIL ESG score for power companies in India.

Risks and Challenges

- Distribution continues to be the weakest link in the power value chain, which faces challenges of high Aggregate Technical & Commercial (AT&C) losses, insufficient tariff hikes resulting in a widening Average Cost of Supply (ACS)–Average Revenue Realised (ARR) gap, accumulation of regulatory assets and cross-subsidisation.

- COVID-19 induced challenges led to further deterioration in the financial position of Discoms as the deferment of bill payments by consumers reduced collections, thereby putting pressure on their revenues and limiting their ability to pay the Generating Companies.

- Receivables have increased from 4500 cr as of Mar-20 to Rs5600 cr as of Mar-21, however, they have remained stable at 55 days of sales in FY21.

- Fluctuation in coal prices and / or USD-INR currency can create challenges for the Mundra UMPP as it is dependent on imported coal.

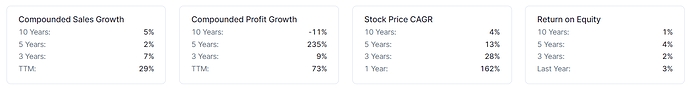

Financials

Screener - Tata Power Company Ltd financial results and price chart - Screener

-

The company has a low ROCE of 7.36% which is likely to increase with reduction in debt and increase in margins with higher margins coming in from new customer focused businesses.

-

Orissa discom was loss making in FY19. It is expected to be profitable in FY22 under TPR which should aid in the increase in profits.

-

The company has been generating healthy free cash flows in the last 2 financial years.

-

TPR is planning to merge Mundra UMPP with the parent company. This is help in reducing tax outgo due to accumulated losses.

DISCLOSURE: INVESTED. MAY CHANGE OPINION AT ANY TIME.