History:

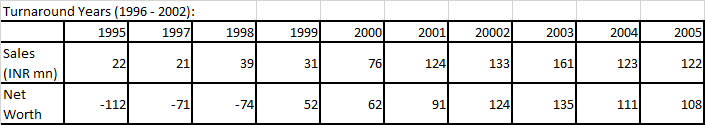

Tasty Bite Eatables Ltd. (TBEL) was incorporated in 1986, as a wholly-owned subsidiary of Grand Foods. In 1988-89, it set up a state-of-the-art Ready-toServe (RTS) food and frozen vegetables production facility in India. Its sales failed to pick up. In 1992, Pepsi, owing to its export obligation (due to a Government of India’s regulation for foreign multinationals), collaborated with TBEL for exports of TBEL products. At that time, Preferred Brands International (PBI), a US-based natural food marketing and distribution company, was given the charge of marketing TBEL products internationally. TBEL committed resources to the joint efforts. In 1994, the reforms in the Government of India regulations released Pepsi of its export obligations. Pepsi decided to stay with its core business and exited the collaboration with TBEL. In 1995, PBI was given exclusive brand rights in key global markets of TBEL and Tasty Bite products were launched in the US. In 1996, Hindustan Lever Ltd. (HLL) acquired Grand Foods. At that time, TBEL had accumulated losses to the tune of Indian Rupee (INR) 112 mn. It was declared a sick unit and referred to BIFR. In 1997. However, HLL had decided against venturing into frozen foods business. Therefore, except for representation on the Board, HLL withdrew from all the other activities. Ashok Vasudevan and Kartik Kilachand of PBI who had been responsible for marketing TBEL products in the foreign markets along with three more members took charge as members of the Board of Directors of TBEL with Ashok Vasudevan as the Chairman. Ravi Nigam from Britannia Industries was appointed as the CEO.

Transformative Years:

Some of the major problems that the management had to face during these years were:

a) Changing the employee culture (multiple meanings). Since the company was in food processing business it had to ask the female employees to re-consider the usage of vermilion/Bindi/Mangalsutra etc to ensure none of these causes any contamination. It also had to deal with employee unions and their concerns about an American management. The problem was further accentuated due to delays in salary payouts.

b) Establishing presence across food chains: Product placement in US food chains is very costly ranging between 5000$ to 10000$. Placing products across two hundred stores of each chain was a financially daunting task.

c) Quality issues. Someone in USA found a worm in their packets and they had to pay US$ 160000 to settle the claims. Also a deviation in color of food led to settlement of insurance claims.

The management successfully faced these issues and have stuck to the company throughout these years.

Current Scenario:

The company has two business segments

a) RTE segment: Exports to US and other countries

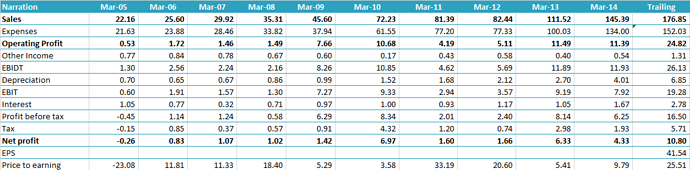

It is a well known brand and is available across multiple channels and almost all mainstream food chains (Walmart, Costco, Safeway etc.). Revenue from this business has grown from 56.56 crore in FY11 to 86.34 crore in FY14.

b) Supply to QSR and HORECA: Company manufactures products like Patties, Sauces and other Veg products. This business has grown at 55% CAGR in last four years from 15.89 crores to 5.59 crores. The list of clients include Domino’s, McDonald’s Pizza Hut, Subway, HUL, Burger King.

Industry:

a) RTE Segment: The RTE segment of international/ethnic foods is approximately $ 2.5 billion and growing at a rate of 15%. The company has constantly introduced newer varieties in this segment including thai foods.

b) QSR segment: According to multiple research reports the QSR segment is going to grow between 20% to 25% on account of increase in QSR penetration and increased disposable income.

Financials (https://www.screener.in/company/?q=519091)

Important Points:

Sales/RM: There is a constant reduction in RM/Sales ratio. It has moved from .65 to .59 last quarter.

WC: Strong WC management as the company follows a very strict debtor day period.

Asset Turns: Current assets turns are low but the management has indicated that the asset turns can go as high as 3.5 to 4 times (from research report below not first hand)

Management: Excellent mgmt. which has stayed with the company for last 15 years.

Joker in the pack:

Recently 120 year old Japanese company Kagome has acquired majority stack in PFI the promoter company of TBEL. By virtue of this TBEL’s majority (nearly 51%) is Kagome now.

Disclosure: Invested at an average price of 600 with greater than 10% allocation. No purchase in last 3 months. This is not a buy or sell recommendation.

References:

The following is a management case study done by Dr. Gita Bajaj, Currently Professor at MDI Gurgaon on TBEL in 2008.

http://www.vikalpa.com/pdf/articles/2008/vol333-07-99-109.pdf

Research report by Stalwart Advisors:

Anil Tulsiram (a fellow VPian’s blog)

I have also attached the BQ template that Akshay Nehru and I have worked upon. This should take care of BQ related questions that you might have

And ofcourse a big thank you to Screener.in

). I think the investment horizons are vastly different for a promoter and an investor. Think about rolling 3 year returns and see whether it’s a good buy or not.

). I think the investment horizons are vastly different for a promoter and an investor. Think about rolling 3 year returns and see whether it’s a good buy or not.