-

Revenue in Q3 FY23 was INR 61.3 crores, down 13% YoY

-

EBITDA was INR 27 crores with 43.5% margin

-

PAT was INR 16 crores with 26.3% margin

-

Revenue declined 13% YoY in Q3 FY23

-

EBITDA margin contracted to 43.5% in Q3 FY23 vs 46.7% in Q3 FY22

-

PAT margin was 26.3% in Q3 FY23

-

Exports revenue: INR 21 crores (34% of total)

-

Domestic revenue: INR 41 crores (66% of total)

-

Capacity utilization not specifically mentioned but implied to be lower than previous year

-

Company believes it has increased market share despite industry slowdown

-

Expects to be in a good position to capitalize when industry rebounds

-

Inventory of INR 112 crores

-

Receivables of INR 50 crores

-

Industry facing slowdown across segments like diagnostics, academia, research

-

Export markets impacted by global economic conditions

-

New facilities (Panchla and Amta) to start operations in Q2 FY24

-

No short-term revenue guidance provided due to market uncertainty

-

Company participating in international exhibitions to build brand

-

Expansion into new product lines through Panchla facility

-

Participating in international exhibitions to build export business

-

Focus on building branded sales in export markets

-

Overall industry slowdown post-COVID

-

Diagnostics segment undergoing transformation with new entrants

-

Research budgets constrained globally

-

Slowdown in diagnostic, pharma, research segments

-

Global economic uncertainty impacting export demand

-

High inventory levels with distributors

-

Expected rebound in research spending

-

Government focus on boosting medical device industry

-

Panchla facility to start operations around May 2023

-

Amta facility expected to be ready by July-August 2023

-

New product lines like PET bottles to be launched

-

Global economic slowdown impacting demand

-

Currency issues in some export markets

-

China+1 strategy providing opportunities

-

Building brand through international exhibitions

-

No specific guidance provided due to market uncertainty

-

Expect industry rebound in next few quarters

-

No specific order book or revenue guidance provided

-

Cautiously optimistic on medium to long-term industry outlook

-

INR 500 crore capex plan underway for new facilities and product lines

-

Phased investment in equipment for new facilities

-

Expansion into new product categories

-

Growing export business

-

Prolonged industry slowdown

-

Underutilization of new capacities

-

Favorable government stance on research and medical devices industry

-

Cautious spending across customer segments

-

Inventory destocking by distributors and end customers

-

Revenue in Q4 FY23 was INR 82 crores, down 3% YoY but up 34% QoQ

-

Full year FY23 revenue was INR 283 crores, down 6% from INR 301 crores in FY22

-

Q4 FY23 EBITDA margin improved to 47.8% from 43.5% in Q3 FY23

-

Full year FY23 EBITDA margin was 45.8%

-

Q4 revenue grew 34% QoQ but declined 3% YoY

-

Full year revenue declined 6% YoY

-

Q4 EBITDA margin improved to 47.8% from 43.5% in Q3

-

Full year EBITDA margin was 45.8%, down from 50.8% in FY22

-

Exports contributed 30% and domestic 70% of Q4 revenue

-

For full year, exports were 33% and domestic 67% of revenue

-

Consumables were 56% and reusables 39% of revenue

-

Company believes it is growing slightly faster than the industry and gaining market share

-

Focused on expanding exports, especially in Europe, US and key Asian markets

-

Inventory levels have increased due to imported raw materials, new product launches, and maintaining stock for 1700+ SKUs

-

New Panchla facility expected to start production by end of Q2 FY24

-

Full ramp-up of Panchla facility expected by Q4 FY24

-

Panchla facility has potential to generate INR 500 crores revenue at full capacity

-

Company exploring inorganic acquisition opportunities in international markets

-

No specific revenue guidance provided for FY24 and FY25

-

Expanding exports through OEM relationships and branded presence

-

Exploring inorganic acquisition opportunities in international markets

-

Launching new product lines like PET/PETG bottles and cell culture products

-

Recovery seen in pharma, biotech and CRO segments

-

Diagnostic segment still under pressure

-

Academia/research facing funding constraints

-

Headwinds: Slowdown in diagnostics, funding constraints in academia/research

-

Tailwinds: Growth in pharma, biotech, CRO segments

-

New Panchla facility to start production by end of Q2 FY24

-

Launching PET/PETG bottles and cell culture products

-

Serological pipettes showing strong growth from low base

-

Focusing on OEM relationships in developed markets

-

Building branded presence in developing markets

-

Exploring inorganic opportunities to boost international sales

-

No specific revenue guidance provided

-

Company positioning itself for growth through capacity expansion, new products and potential acquisitions

-

No specific order book or revenue guidance provided

-

Optimistic on medium-term growth prospects of life sciences industry

-

Capex of INR 500-550 crores for Panchla facility expansion

-

Exploring inorganic acquisition opportunities

-

Expanding exports, especially in Europe, US and Asia

-

New product launches like PET/PETG bottles and cell culture

-

Potential inorganic acquisitions

-

Slowdown in diagnostics segment

-

Funding constraints in academia/research

-

Revenue from operations for Q1 FY24 was INR 53 crores, down 9% YoY

-

Adjusted EBITDA was INR 24.1 crores with 38.5% margin

-

PAT was INR 9.6 crores with 15.3% margin

-

Revenue declined 9% YoY in Q1 FY24

-

Adjusted EBITDA margin was 38.5%, down from previous quarters

-

Reported EBITDA margin was 34%

-

Domestic revenue: INR 45 crores (73% of total)

-

Export revenue: INR 17 crores (27% of total)

-

Company believes it is gaining market share despite industry contraction

-

Expects to increase revenues compared to last year, but cautious on industry trends

-

Inventory as of June 30th was INR 112 crores

-

Raw material inventory reduced significantly compared to last quarter

-

Demand trends weak, especially in consumables segment

-

Destocking impact expected to continue in near term

-

Acquisition strategy remains in place despite recent unsuccessful attempt

-

New product launches (cell culture, PET/PETG bottles) progressing well

-

Panchla plant to start commercial production in Q3

-

Pursuing inorganic growth opportunities in export markets

-

Launching new product lines like cell culture and PET/PETG bottles

-

Expanding manufacturing capacity through Panchla and Amta plants

-

Overall life sciences industry facing slowdown

-

High inventory levels at customers and distributors

-

Gradual recovery expected but timing uncertain

-

Reduced demand for plastic labware products

-

Inventory destocking by customers

-

Competitive pressures globally

-

Panchla plant to start commercial production in Q3 FY24

-

Amta plant expected to be ready by December 2023

-

New product lines: Cell culture, PET/PETG bottles, serological pipettes

-

Export markets facing more pressure than domestic

-

Currency depreciation increasing raw material costs for imports

-

Expects to increase revenues compared to last year

-

Margins impacted by lower absorption of fixed costs

-

Fresh order inflow 4-5% higher YoY

-

Cautiously optimistic on full year growth

-

Near-term outlook remains sluggish

-

Total capex of ~INR 525-530 crores

-

Asset turnover ratio target of 0.65-0.7 on gross block

-

New product lines (cell culture, PET/PETG)

-

Potential acquisitions in export markets

-

Continued industry slowdown

-

Inventory destocking pressures

-

Customers facing inventory overhang issues

-

Hesitant to engage new suppliers currently

-

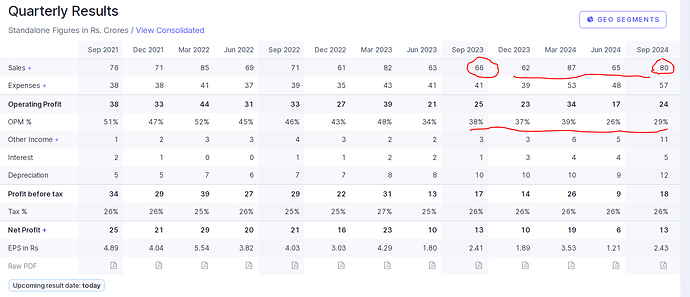

Q2FY24 revenue was INR 66 crores, up 6% QoQ

-

H1FY24 revenue was INR 129 crores vs INR 140 crores in H1FY23

-

Q2FY24 EBITDA margin was 38.3%

-

H1FY24 PAT was INR 22 crores with 17.4% margin

-

6% QoQ revenue growth in Q2FY24

-

EBITDA margin declined to 38.3% in Q2FY24 from over 45% last year

-

Margins impacted by lower revenue growth, higher costs for new facility

-

Exports 35%, Domestic 65% of Q2FY24 revenue

-

Current capacity utilization around 75%

-

Can do INR 50-60 crores more revenue with existing setup

-

Expects to gain market share as industry recovers

-

Opportunity to take share from European players facing high costs

-

Inventory of INR 118 crores, including INR 39 crores raw material

-

4-5 months inventory required to run operations

-

INR 550 crore capex - 60% for capacity expansion, 40% for new products

-

Expects 4-5 years to fully ramp up new capacity

-

No revised guidance for FY25, INR 500 crore target looks unlikely

-

Looking at international acquisitions to grow overseas business

-

Cell culture seen as more complex product with stronger moat

-

Setting up subsidiary in Singapore for overseas acquisitions/partnerships

-

Actively evaluating international acquisitions to grow exports

-

Investing in new product lines like cell culture

-

Industry facing destocking, but showing signs of recovery

-

Shift from glass to plastic continues, no major threat seen

-

Headwinds: Destocking, slower demand post-COVID

-

Tailwinds: Recovery expected, opportunity vs European players

-

New Panchla facility to start production from December 2023

-

Cell culture and expanded capacity for existing products

-

Total capex of INR 550 crores, INR 400 crores already incurred

-

European manufacturing challenges provide opportunity

-

Looking at acquisitions to grow exports

-

No specific guidance, but expects growth in coming quarters

-

Margins expected to improve as industry recovers and new facility ramps up

-

No specific order book guidance provided

-

Expects industry recovery and better conditions going forward

-

INR 550 crore capex for expansion and new products

-

Looking at international acquisitions

-

Opportunity to gain share from European players

-

Risk of continued industry slowdown

-

Price sensitivity has increased post-COVID

-

Revenue for Q3 FY24 was Rs. 62 crores, up 1% year-on-year

-

EBITDA for Q3 FY24 was Rs. 23 crores, down 14% year-on-year

-

PAT for Q3 FY24 was Rs. 10 crores with 16% margin

-

Domestic revenue grew 14% year-on-year in Q3

-

Export revenue declined year-on-year due to subdued global demand

-

Gross margins declined due to changes in product mix

-

EBITDA margin for Q3 FY24 was 37%

-

About 2/3rd of revenue comes from single-use/consumable products

-

1/3rd comes from reusable products

-

Export sales contributed 29% and domestic 71% for 9 months FY24

-

Current infrastructure allows business up to Rs. 320-350 crores

-

Market share in diagnostics segment returning to pre-COVID levels

-

Expect to maintain/grow market share in domestic market

-

Focusing on expanding market share in international markets, especially Europe

-

Cash flow from operations was Rs. 83 crores for 9 months FY24

-

Inventory days have increased due to new product launches

-

Acquired Nerbe, a Hamburg-based distributor, to expand presence in Europe

-

Focusing on expanding ODM business in North America and Europe

-

Launching new cell culture products and expanding capacity

-

Gradual recovery seen in plastic labware markets

-

Shift towards single-use/consumable products globally

-

China Plus One strategy benefiting Indian manufacturers

-

Gradual recovery in global plastic labware demand

-

China Plus One strategy benefiting Indian manufacturers

-

Subdued demand in key global markets

-

Red Sea crisis impacting exports and freight costs

-

Inventory overstocking in some product categories like PCR

-

Panchla facility nearing completion, initial production to start in Q4 FY24

-

Commercial production of cell culture products expected in Q3 FY25

-

Launching 7-8 new product categories next year across segments

-

Red Sea crisis increasing freight costs and lead times

-

Subdued demand in key global markets

-

Expect gradual improvement in coming quarters

-

EBITDA margins not expected to go below current levels

-

Domestic order book stronger than previous year but below FY22 levels

-

No specific revenue guidance provided

-

Expect gradual improvement in coming quarters

-

Total capex plan of Rs. 550-575 crores, of which Rs. 450 crores already incurred

-

Remaining Rs. 100-125 crores to be spent over next 12 months

-

Current net debt of Rs. 230 crores, expected to peak at Rs. 270-280 crores

-

Plan to repay debt through cash accruals over 3-5 years

-

Expanding presence in European market through Nerbe acquisition

-

Growing single-use/consumable product segment

-

Launching new cell culture products

-

Continued subdued demand in global markets

-

Freight cost increases due to geopolitical issues

-

Intense competition in domestic market

-

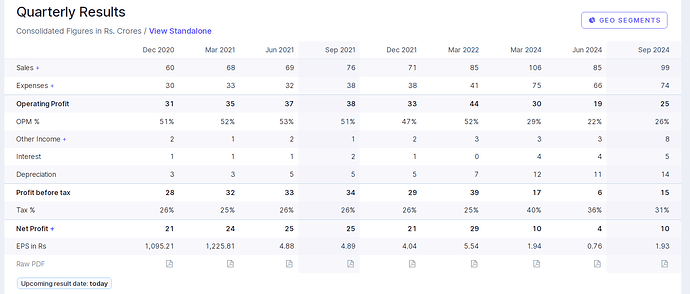

Highest quarterly standalone revenue of ₹87 crores in Q4 FY24, up 6% YoY and 40% QoQ

-

FY24 standalone revenue at ₹277 crores, down 2% YoY

-

Standalone EBITDA for FY24 at ₹103 crores

-

Consolidated revenue (including Nerbe) at ₹296 crores for FY24

-

Q4 FY24 standalone EBITDA margin at 39.1%

-

Adjusted FY24 standalone EBITDA margin at 40% (excluding one-off expenses)

-

Consolidated margins impacted by inclusion of lower-margin Nerbe business

-

Export sales contributed 30% and domestic sales 70% in FY24 standalone

-

Current capacity utilization at approximately 75-80%

-

25% market share in India for products manufactured

-

Expects gradual improvement in pharma, CRO, research and diagnostic sectors

-

One-time inventory provision of ₹3.7 crores in Q4 FY24

-

Acquisition of Nerbe to expand presence in European market

-

Focus on leveraging synergies between Tarsons and Nerbe

-

Early signs of recovery in life sciences industry in second half of FY24

-

Inventory levels reducing across industry

-

Tailwinds: Increasing investments in R&D, growing demand from emerging economies

-

Headwinds: Geopolitical tensions, supply chain disruptions

-

Panchla facility to focus on cell culture products and expand existing product capacities

-

Amta plant to include radiation facility and centralized warehouse

-

China Plus One strategy benefiting Indian manufacturers

-

Logistics and supply chain disruptions impacting international business

-

No specific revenue guidance provided

-

Aims to maintain early 40% EBITDA margins on standalone basis with sustainable growth

-

Total planned capex of ₹600 crores, of which ₹475 crores already incurred

-

Q1 FY25 standalone revenue was INR 64.9 crores, up 3.6% YoY

-

Consolidated revenue was INR 84.8 crores, including INR 20 crores from Nerbe acquisition

-

Standalone adjusted EBITDA was INR 20 crores with 30.9% margin

-

Consolidated adjusted EBITDA margin was 25.7%

-

Standalone PAT was INR 6.5 crores with 10% margin

-

Consolidated PAT was INR 4 crores with 4.7% margin

-

Standalone revenue grew 3.6% YoY despite industry slowdown

-

Margins impacted by product mix changes, employee expenses, and Nerbe acquisition

-

Standalone adjusted EBITDA margin of 30.9%, down from previous quarters

-

Domestic revenue INR 42 crores vs INR 45 crores last year

-

Export revenue INR 22 crores vs INR 17 crores last year

-

Nerbe revenue INR 20 crores in Q1 FY25

-

Current capacity utilization not specified, but significant capacity available

-

Company maintained market share better than industry average

-

Seeing signs of recovery in domestic and overseas markets

-

Aiming to increase market share through new products and Panchla facility

-

Domestic diagnostics industry recovering but back to pre-COVID levels

-

Panchla facility commissioning delayed due to machinery damage, expected in H2 FY25

-

Nerbe acquisition to provide platform for European expansion

-

Gross margin decline due to competitive market and product mix changes

-

Global tender participation expected to yield results in coming quarters

-

Acquired Nerbe Plus in Germany to expand European presence

-

Participating in global tenders and RFQs to grow international business

-

New product introductions planned through Panchla facility

-

Recovery signs in domestic and overseas plastic labware markets

-

Shift towards more value-added and new product categories

-

Focus on expanding global presence, especially in Europe

-

Overall industry slowdown in past 18 months

-

Competitive market pressures

-

Lower demand for high-margin products like PCR and liquid handling

-

Panchla facility (greenfield) to commence operations in H2 FY25

-

INR 300 crores invested in Panchla for manufacturing and growth

-

70% of Panchla capacity for new products, 30% for existing product expansion

-

Logistics issues, container availability, and higher shipping costs

-

Longer waiting times for vessel availability

-

Increasing order inquiries from international markets

-

Expect growth as new capacities come online and market recovers

-

Order book increasing compared to last year

-

Optimistic about future revenue and profitability growth as demand recovers

-

Total capex program of INR 550-600 crores

-

INR 525 crores already spent, remaining to be incurred in next 6-12 months

-

Focus on optimizing new capacity utilization, especially Panchla facility

-

Continued industry slowdown

-

Competitive pressures impacting margins

-

Delays in new facility ramp-up