Purpose of this topic: To record my general thoughts about investing/finance. However, you are most welcome to share your learnings or question my thought process.

Background: During youth, I passed mechanical engineering, relying on the good counsel of well-wishers around me. Post that I worked for 15+ years in the service industry. Most of these times, finance was never in thought and equity investing was an alien concept. With ever evolving interest in this field over the years, I now know a few things about finance in general and equity investing in particular. To reinforce my self-learning of equity investment, I am enrolled in the CFA (US) course and have already have passed CFA Level-1 and Level-2. Result for CFA Level-3 is awaited. As of now, I also create digital courses that are hosted at Udemy.

Let’s begin:

#Risk:

- What is it? Expected things are just a small subset of many things that can happen.

- What are the investor’s main risks? Only Two - Loss of own capital and Earning return lower than an alternative risk-free opportunity.

- How to measure risk? It can’t be neither measured (either before or after) nor eliminated. However, you can control or transfer or spread it. Risk is hidden, subjective and non-quantifiable.

- What are the sources of risk? Paying beyond Value | Business quality | High Volatility | High Leverage | Illiquid Asset | Lack of diversification | High Risk Correlation across portfolio positions.

- How to handle risk? Be Aware | Analyze | Diversify | Pay right Price.

#InvestmentAdvisorLitmusTest:

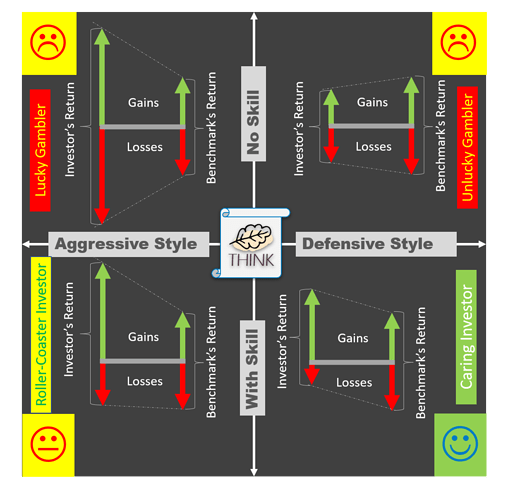

2x2 matrix | Tool to use while evaluating an investment advisor | Differentiate b/w a lucky (Top 2 quadrant) investor and skilled investor (Bottom-Right quadrant). In TMIT, Howard Marks illustrated in words and I illustrate pictorially (shown below).

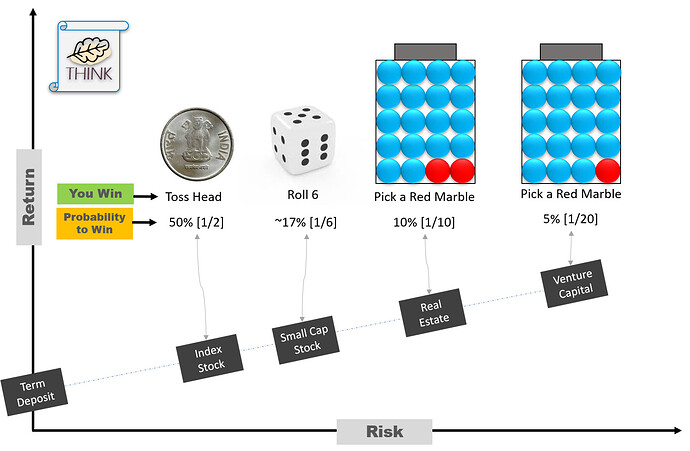

#RiskReturnProbability

Investor: I must earn higher return

1st Level Thinker: Simple. Take higher risk since "Return = Risk”

2nd Level Thinker: Not that simple since “Return =(Probability-To-Win)*Risk”

In Nutshell: Increase both ‘Probability-To-Win’ & ‘Risk’ to earn ‘higher return’.

13 Likes

Nice read, i see your probability to pick right RE is 1/10 … Wanted to know how you arrived at this as if you pick any area in any city, more or less over long term real estate returns are similar in that area. So probability to pick right RE in that area is more or less same.

Area to area also one is well aware of the risk, time frame and return profile (i.e if one knows the city, people and if has been living there, even better)…in any case I see the probability to pick right RE greater than small cap stocks i e. 1/6… Can you pls elaborate your thoughts…thnx

@Investor_No_1 | Welcome Onboard.

To underline ‘the range of uncertainty’ among asset classes, probability values are ‘for instance’. Yes, It would likely be higher for the specific investor, matching your description. In general, probability represents the average investor’s chance in a large group.

Multi-Skilled investors are rare compared to the number of participants in the RE asset class. However, a specific description short-circuits the mind. Consequently, the mind magnifies the numerator and shrinks the denominator. ‘Denominator Neglect’ bias sets in and probability is overestimated.

To debias, remember that MORE (specific) is LESS (common) and LESS (specific) is MORE (common).

1 Like

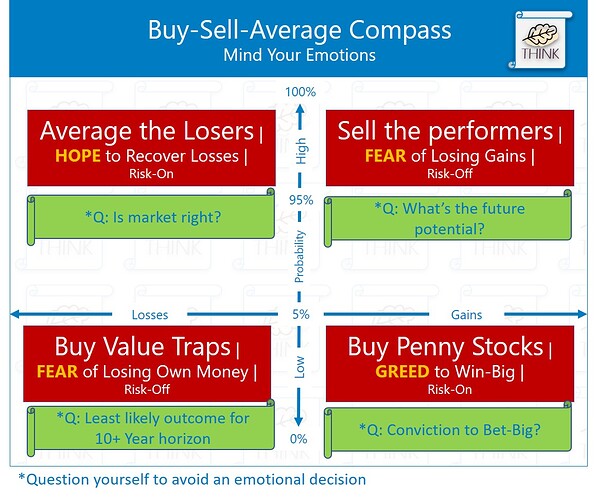

Buy-Sell-Average | Hope-Fear-Greed Compass:

How emotions [such as greed, fear, and hope] influence one to buy [Value Traps, Penny], sell [the performer], and average [the loser] stocks? Below image illustrates it pictorially in the form of a 2x2 matrix [X-Axis represents: Gains/Losses and Y-Axis represents: Probability]. All the 4-Quadrant depict highly likely/unlikely situations.

Commentary for the ‘Top-Right Quadrant’ shown below, hoping you would love to self-deduce the rest :

Why do people sell their performing stocks? In this case, gains are certain [high probability: 95%~100%]. Choice is to pick from gains [current amount or may be more amount at a later date]. Fear of losing the current profits and pleasure of booking profits dominate thoughts. Risk averse attitude invokes and Investor capitulates.

What’s the MBB [Miniature Bias Breaker] technique to follow? Question Yourself - What’s the future potential for the stock?

2 Likes

Interesting…On SELL lines, what are your thoughts about CANSLIM? selling at 21% upside or 7 % downside, does it fit into Investing or trading?

Also algo-based investing and Fundamental Business understanding oriented investing…Which camp you favour?

On a very high level, both investing and trading are a means to profit from stock price appreciation. On a granular level, Investing is similar to 95% highway driving (bypassing pass through cities) while trading is similar to city driving. Compared to trading mindset, investing mindset requires fewer decisions (fact-based) in a given period, long term thinking, decisions based on the business fundamentals, leading to a life with less emotional drudgery. One shall choose as per their aptitude and interest.

CAN-SLIM or WILLNOT-FAT or ANY-OTHER-EUREKA strategy rules may have worked for someone in some market environment and can not be universal. All strategy lose their edge overtime because too many folks adopt them and the market environments are dynamic/wicked. On reading a little bit about CANSLIM, after you note, I understand that the strategy recommends buying on the basis of fundamental and qualitative parameters. But, inference from your note is that it suggests an exit based on hard numbers

What if the business still passes the CANSLIM criteria when the time to sell arrives? Before adopting any strategy, better to do a back testing or pilot to validate one’s understanding and the expected results.

For investing, I favour active investing as business is the basis for decision making. For trading, algo will be the tool as price is the basis for decision making and emotions must be kept out.

How much conviction one may have to bet heavily because a software dashboard shows all green?

2 Likes

# Habit: Monitoring daily share price | Loss Aversion

For a common equity investor, the habit of monitoring share price on a daily basis is a losing proposition. Since psychological value of losses (even if virtual) is ~2x of gains, this innocent habit causes mental agony. Other negative consequences are overtrading, waste of time, and heightened loss aversion [more strong response to losses than gains].

Heightened loss aversion is too light to be felt but leads to emotional decisions such as continue holding the losers, hoping for a breakeven and direct more energy in avoiding losses instead of achieving gains. In order to debias:

- Tell yourself -This as one of many bets in my stock picking journey. Some I will win and rest I will lose.

- Ask yourself - How much do I want to have this stock, compared with other stocks I could have instead?

However, best is to stop seeing the share price on daily basis since prevention is always better than cure.

3 Likes

Among all the sources of risk that an equity investor face, some need to be addressed at the portfolio level (Correlation, Concentration, Liquidity, and Leverage) and the rest at the individual position level (Low Quality, High Volatility, and High Valuation). Among the ones that must be controlled at individual position levels, a thoughtful investor would welcome Low Quality and High Volatility but avoid High Valuation consciously. Why so?

- Low Quality: Result of factors such as leveraged balance sheet, limited opportunity size, limited longevity of the business, questionable management’s integrity, and lack of disclosures (both qualitative and quantitative). This risk could be welcomed as an opportunity if the price paid reflects excessive pessimism and one holds multiple such positions in the portfolio.

- High Volatility: Driven chiefly by external factors that are uncontrollable - Investor sentiments, Interest Rates, Inflation and may be 1~3% due to company-specific factors. This could be welcomed as an opportunity to buy more when the sale starts if portfolio-level risks are well addressed.

- High Valuation: This must be consciously avoided as it makes one panic and capitulate during stressful market environments, which are bound to happen sooner or later.

Low quality should be avoided at all cost. No risk is reduced by buying a low quality stock at lower price. A stock gives the same return from 100 to 0 and 10 to 0. Diversification can help but these are the stocks which fall the most during downturn. All of them fall together. There will be buyers for the high quality expensive stock in bear market also but not for these low quality ones.

2 Likes

Pocket-friendly framework to identify businesses for long-term investing -

- Total Addressable market

* Limited/Mammoth

- Proven business model

* Profitable at the operating level

* Sufficient Net Cash generation from operations to self-sustain future growth initiatives

* Differentiation that will continue to attract customers and ambush competitors

- Scalable

* Products

* Geography

- Customer Pain

* Need/Aspirational | Repeat/One-Time

* Wallet Share

* Alternatives

- Quality of Promoter/Management

* Incentives Alignment - Stake, Reputation

* Communication during difficult times

* Capital Allocation

* Rewarding all stakeholders

- Expected steady state Return on Equity

* Levers to achieve the same if suppressed today

4 Likes

Hi, what you have written is very impressive. Each portfolio has risk, based on historical data one can estimate probability scores of risks. Example say one has large cap from Indian Equity market it has 284 equities but for long term investors from historical reference 10% of them are black sheep. If a user is having say 6 portfolios in large cap. From hyper geometric distribution one can find out exactly what is the probability of 1 being black-sheep, 2 being black sheep, 3 being black sheep like that. We can assume safety level of 2 Sigma or 95% level or 99% level that how many of them will crash. Second one, one need to consider is Markowitz Modern portfolio Theory to optimize portfolio based on minimum variance. Usually, global fund managers use this method (Modern method is slightly modified but basically derive from this) one can minimize the risk yet can have portfolio that give same return on investment as original portfolio just by tweaking number of units one buys in each scrip! quite impressive results one can get. I am tracing my portfolio since last 3 years, optimized portfolio (need a tool-connect with me to get web-based tool) is giving good results well above original portfolio, this is justifiable since minimum variance portfolio offers good resistance to fall when market corrects or crashes.