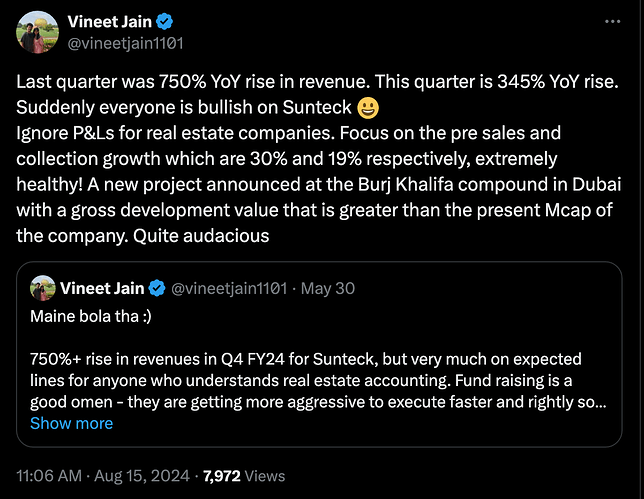

I think Sunteck is one of the most exciting RE developers today given inflection in growth (30%+ growth in H1, 40-50% expected in H2 on back of new launches in FY25, further growth expected in FY26/27 due to new launches of NS Road and Dubai). A short thesis from my side below –

Introduction

Sunteck is a leading MMR based developer that engages in large-format, township type projects, primarily in Mumbai and its suburbs. The stock appears cheap versus other Mumbai homebuilders, like Lodha, Oberoi, or Rustomjee and has lagged over the past year in terms of stock price. A large shareholder in the Pabrai Funds has been selling shares for the past year, however their ownership has been significantly reduced, creating an opportunity to buy shares at an undervalued price. Sunteck is a lower liquidity stock, so selling from a large shareholder like Pabrai caused the stock to underperform peers from a stock price perspective, even though the business is firing on all cylinders. Sunteck never IPO’d via a traditional roadshow, but instead listed via a reverse merger, and thus shares have always been unusually illiquid for its size, so when a large holder like Mohnish who acquired his shares via a QIP sells, it can significantly pressure the stock. Mohnish has publicly stated that he is exiting India, so his reasons for selling Sunteck have nothing to do with the merits or demerits of the company, and are more of a market-call.

Sunteck is one of the few stocks in the RE sector that is still trading below NAV (sector has re-rated due to strong macro tailwinds/cycle), and the outlook for growth is very strong in terms of pre-sales, as the company has guided to 30-35% pre-sales growth this year. Sunteck has consistently delivered >20% growth in pre-sales over the past few years, and we expect growth to accelerate going forward. Sales in MMR did not see the same correction in the last decade, so sales growth in MMR has been lower than Bangalore or North India based players in the last few years. These markets had a large bust in sales leading to a low base, which makes it easy for companies in those markets to show growth over past few years. Sales in MMR on the other hand, kept growing on a more steady type pace as there was less investor interest, so end demand continued at a steady pace, and Sunteck has generally grown faster than the market/taken share.

Macro/cycle

MMR market has seen less speculation than some of the north based or Bangalore markets, and the supply constrained nature of Mumbai being surrounded by water on 3 sides means that it is harder to bring on new supply, as compared to Bangalore or NCR where the city continues to grow outward/urban sprawl occurs. Over the long term, home prices in Mumbai should rise in line with purchasing power, creating value for owners of land and finished apartments like Sunteck, whose value grows disproportionately to RE price appreciation. MMR is an especially attractive market to be a homebuilder due to its high average selling price and margins relative to other geographies, which means that margins are higher and more consistent through a cycle, with less sensitivity to construction costs.

Fundamentals and outlook

In terms of financials, Sunteck has the best balance sheet in the sector, with zero adjusted net-debt accounting for loans secured by land given to their JV partners, and negligible gross debt relative to assets or free-cash-flow. The company has been steadily paying down debt the last 3-5 years using free-cash-flow, and is in an excellent position to create value for shareholders.

Over the next three years, Sunteck has the potential to nearly double its pre-sales of 1,900 crore in FY24 – new launches in the existing bucket of projects should lead to ~2,500 crore of sales in FY25e per the company’s guidance, and new launches of projects in Dubai, Nepeansea Road, Bandra, and Borivali over the next 2 years should add another 1,000 to 2,000 crore of run-rate pre-sales, positioning the company for exceptional growth. Sunteck already owns or has development rights to construct on these land parcels, so these investments are weighing on ROIC today but produce limited pre-sales or free-cash-flow, which will change soon.

The company is growing not just its residential book of business, but also constructing annuity commercial assets for lease on its owned land parcels, soaking up the free-cash-flow from residential development at very high ROICs. The company’s existing commercial annuity portfolio already generates north of a 25%+ return on capital, and the company plans to grow this significant over the next 3-5 years, such that a large part of today’s market cap is covered by the company’s annuity assets. In the future, these assets can be put into a REIT to help highlight and unlock value.

Finally, over the longer term, Sunteck is an attractive business because it is controlled by Mr Kamal Khetan, who is a first generation entrepreneur that has built Sunteck into a leading player in just two decades, despite starting without a land-bank unlike other players in the space. We view him to be a shrewd and ethical allocator of shareholder’s capital who is razor focused on maximizing ROIC – to this end, Sunteck typically enters RE project via asset-light joint venture agreements or distressed outright land purchases, allowing the company to earn a higher ROIC than its peers. Sunteck’s ROIC on its JV’d projects has historically been off-the charts, and we expect Sunteck to continue to engage in additional project addition due to its unleveraged balance sheet and strong on going free-cash-flows. Sunteck is a value oriented buyer of RE, so they will likely acquire assets counter cyclically, being more dormant in terms of new project acquisition in heated markets like today, but not afraid to go on a shopping spree, if attractive prices present themselves.

Upside potential

Between growth in pre-sales and net-asset-value, as well as a re-rating closer to peer multiples, we think Sunteck stock has significant potential upside from current levels. While corporate governance is always a risk in the sector, Sunteck has partnered with marquee institutions like Kotak, Piramal, and IFC which is a positive signal for investors.

Sunteck currently trades at ~0.8x NAV, while peers like Lodha and Oberoi trade at ~1.3-1.6x NAV using sell-side research models – on book value, Sunteck trades roughly 2-3x book, as compared 4-6x for the sector – given that land is held at historical cost on Sunteck’s book, the undervaluation in absolute terms as well as relative terms is quite large. Over two years, we should see strong NAV growth along with a re-rating, as the company executes on growth and launches new projects, so there is room for 50-100% upside from current levels