Business Overview

Sula Vineyards Limited is India’s largest wine producer and seller as of March 31, 2022. The company has been a consistent market leader in the Indian wine industry in terms of sales volume and value (on the basis of the total revenue from operations) since 2009 crossing 50% market share by value in the domestic and 100% grapes wine market in 2012. Sula Shiraz Cabernet was India’s largest-selling wine by value in 2021 (Source: Technopak Report). The gross billings of Sula Shiraz Cabernet amounted to ₹918.26 million, ₹475.64 million and ₹319.73million in FY2022 and for the six months period ended September 30, 2021 and September 30, 2022, respectively.

The business model of Sula Vineyards can be categorized into two divisions:

- The Wines Division: Involves the production of wines, import and distribution of wines and spirits etc.

- Wine Tourism: A complement of the former division, wine tourism involves wine tourism venues, resorts and tasting rooms.

The Company distributes wines under a bouquet of popular brands. In addition to the flagship brand “Sula,” popular brands include “RASA,” “Dindori”, “The source,” “Satori”, “Madera” & “Dia” with its flagship brand “Sula” being the “category creator” of wine in India. Presently, the company produces 56 different labels of wine at four owned and two leased production facilities in the states of Karnataka and Maharashtra.

The company’s wines are available at various price points between ₹250 to ₹1,895 per 750 ml bottle in Maharashtra, making them accessible for consumers with different budgets appealing to mass markets as well as having a premium product strategy. In particular, the wines are classified under four broad categories, namely the ‘Elite’ category with 21 labels, followed by the ‘Premium’ category with 13 labels, the ‘Economy’ category with 13 labels and the ‘Popular’ category offering 9 labels.

The products have been segment leaders under each of these four categories in the last six years from FY2017 to FY2022. The company also regularly introduces new products, with seven labels launched in the last five years.

The resorts under the company’s domain are the most visited vineyards in India, with approximately 368,000 people visiting in FY2020. The management launched the first wine-themed music festival in India, “SulaFest”, at its Nashik facility in 2008. “SulaFest” has been widely recognized as the largest wine music festival in India and one of the largest wine music festivals in Asia, based on attendance.

The company is one of the fastest-growing alcohol businesses in India with a CAGR of 13.3% between FY2011 and FY2022. The company emerged even stronger in the aftermath of Covid with its EBITDA moving from 9.68% in 2020 to 15.44% in 2021. The company services close to 8,000 hotels, restaurants and caterers, which makes it the leader in terms of footprint among wine players in India. The company continues to focus on its operating efficiency and tries to introduce wines to a larger portion of the population.

Industry Analysis

Macro Economy: India is the fifth largest economy in the world presently and is soon to be in the top 3. While the global economies are facing a setback, the Indian economy continues to present a favourable growth rate of over 7% which pushes demand and cash flow into the country. The growing disposable income of the population and the median age is one of the lowest compared to the western economies and China. Indian domestic consumption is going to drive the Indian economy in the upcoming years.

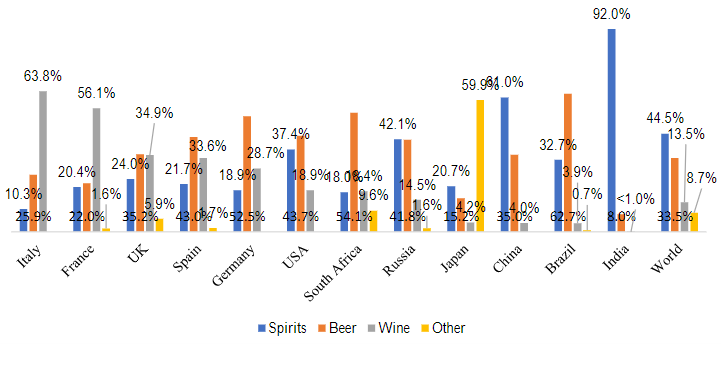

Alcoholic beverage Industry: World per capita alcohol consumption in CY 2021 is estimated at 6.6 litres of pure alcohol per year for the world population of 15 years above. The recorded alcohol per capita consumption for CY 2021 is estimated at 4.8 litres. The alcohol industry can be divided into 3 sub-sections: Beer, Spirits and Wine.

Fig: World Per capita recorded alcohol consumption in 2021

India is one of the fastest-growing alcohol markets among the top economies in the world. The recorded per capita consumption of pure alcohol in India has moved from 0.9 litres in 2000 to 3 litres in 2015 at a CAGR of more than 8%. The percentage drinking population of the world is close to 41.7% and is projected to stabilize at around 40%. India’s percentage of drinking population is projected to be close to ~33%.

India, just like any other developing country is a leader in the spirits market but other segments hold promise to grow, as a result of the rise in per capita income, trends and taste shifts and urbanization. India, with its share of low alcoholic beverages at close to 8%, is at a very low base and a prolonged period of correction in favour of wine and beer categories is bound to take place.

The share of wine and beer is projected to increase both through the expansion of the market and by taking a share of the market from spirits. While earlier, family celebrations with alcohol were very infrequent and viewed as taboo, it is more acceptable now in all kinds of social settings, be it birthday parties, get-togethers, official meetings, etc. Beer and wine with low alcoholic content are the preferred choice of drinks in such celebrations and are big opportunities in the Indian alco-beverage industry.

India’s per capita consumption of wine is less than 100ml. The contribution of wine to overall alcohol consumption in India is less than 1% against the world average of close to 13%. Consumption of wine is higher in developed countries which is as high as close to 30% in Europe. A comparison between India and China shows that in China, even though the contribution of wine to overall alcohol consumption is close to only 3 %, China’s per capita consumption of wine is more than 50 times that of India.

Fig: Contribution of alcoholic beverages in 100% alcohol in CY2021 (volume per cent)

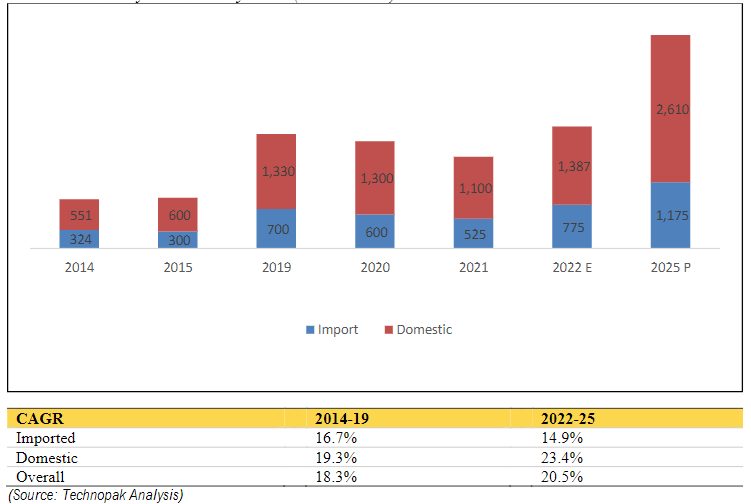

Indian wines industry is growing at a much quicker pace at 18.3% by value between FY 2014 to FY 2019 than the IMFL market growing at 12.3%. by value for the same period. There is growing awareness towards the perceived health benefits of wine which makes it more acceptable as compared to spirits. The supply of domestic wines that are reasonably priced and easily available as compared to imported wines has also helped expand the market as leaders in the domestic market have invested in the complete value chain of wines and winemaking. Growth in income, increasing urbanisation, a high share of young population as well as an increasing preference for wines among women are driving higher consumption of wines.

Fig: Key players in the Indian Alcoholic Beverages

Recent trends in the industry include premiumisation where people are ready to pay and consume higher-priced premium products as a result of an increase in per-capita income and urbanisation. The covid period also saw the restructuring of the distribution and delivery networks of various sectors including beverages which has allowed a lot of cost-cutting and has increased the accessibility of wines and other beverages in the country. Reduction in social taboos centred around drinking and increased in-house drinking has opened up a new line of products which are more affordable, easy to produce and store and has developed brand equity.

With the increase in disposable income, especially among women, urban earning women are driving the growth of the wine segment in India. There is a shift in trend from binge drinking towards social drinking, which has also led to a widespread inclusion of wine in parties and gatherings. Wine is becoming a preferred drink for millennials156 who look to socialize after office hours and on weekends.

The Indian Wine Market is projected to reach INR 3,785 cr by FY2025 with a CAGR of 20% from FY2022 to FY2025.

Fig: Indian Wine Industry Market Size by value (in INR cr)

The drivers of growth in the Indian Wine Industry:

- Growing Income levels and rapid urbanization

- Growing awareness about wines

- Wider appeal

- Growing perception of health benefits

- Growth of wine tourism

- Increase in home consumption

- Change in social perception

Business analysis

Strengths:

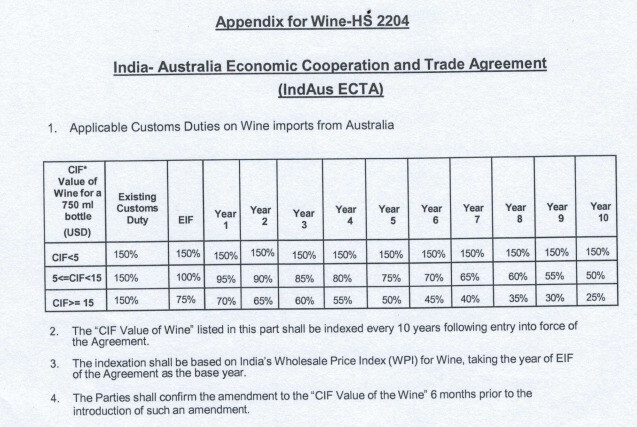

- High barriers to entry: The wine market in India will remain concentrated, with high barriers to entry due to the nature of the product, as well as trade barriers prevalent in the alcoholic beverage market.

- Regulations and trade barriers

- Initial cost of Investment

- Long gestation period and production cycle before realising any profits demotivate new companies to venture into winemaking.

- Branding:

- Sula is the largest and one of the oldest producers of wine and associated products in the country

- Sula is one of the top 10 vineyards followed by social media handles in the entire world.

- Innovative product ideas and a portfolio of offerings

- Caters to all income groups with products in all pricing ranges. It is also to be noted that the product from the company is the market leader in their respective sections

- Largest Wine distribution chain and historic sales record and strategic relationships

- The raw materials required in winemaking are rare to come by or costly to grow and procure. Sula has developed a good relationship with the farmers in the country and has a good standing contracted relationship.

- Leader and pioneer of wine tourism in India.

- Experienced management and the increase in EBIDTA Margins suggest a huge growth potential.

Risks associated with the business:

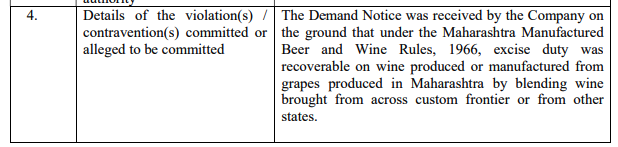

- Subject to licensing, excise regime, rules and regulations, including the adverse application of corporate and tax laws

- Adverse climate conditions could affect the harvest of grapes

- Supply restrictions or delays could seriously impact the business

- Revenue is dependent on a limited number of customers. The inability to diversify into new relationships or the failure to keep up with the existing customers could seriously impact the business

- The wine market is relatively young in India

- Advertising or promoting alcohol products is discouraged in India and the wine market needs more awareness among the population. Thereby any promotional effort taken by the company will be subject to great risk.

- There are outstanding legal proceedings involving the company, its promotors and its directors

- Against the company – 1 criminal proceeding and 9 tax proceedings

- Capital-intensive business is subject to seasonality in its sales.

- Business nature requires inventory build-up which increases storage risk, insurance and risks

- Two vineyards and a few offices, resorts and guest houses are not owned by the company and are taken on lease

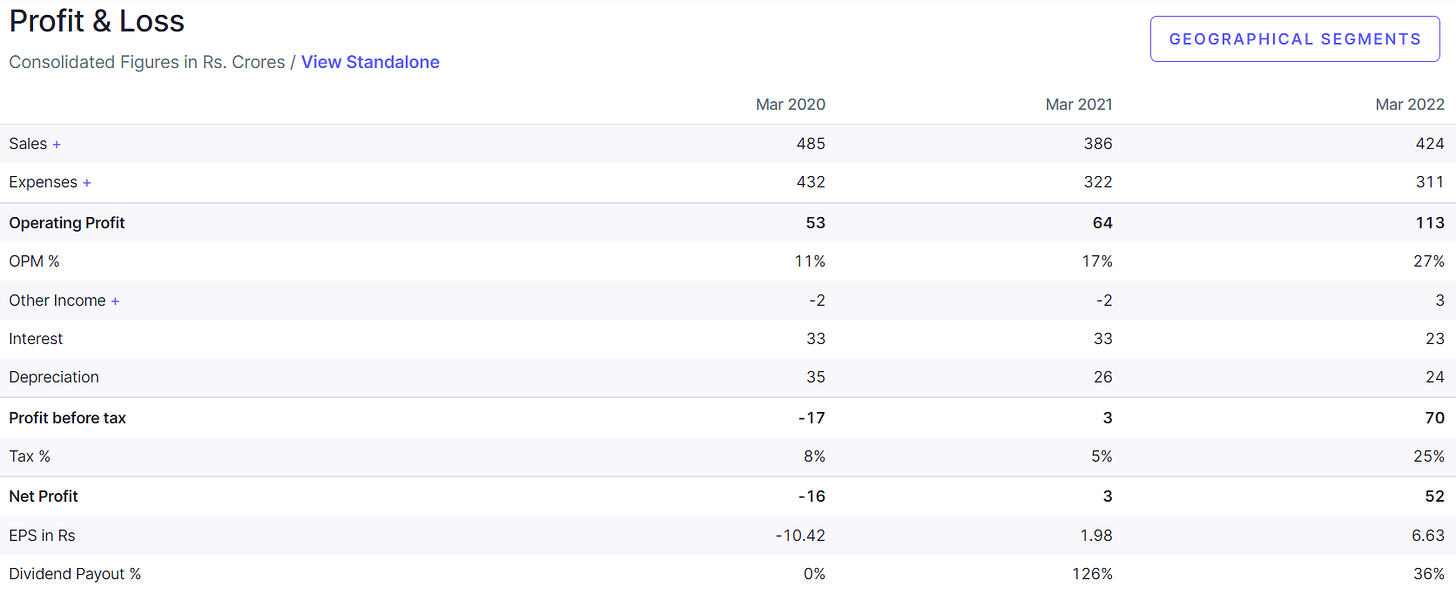

Financials

For detailed financials: Sula Vineyards Ltd share price | About Sula Vineyards | Key Insights - Screener

DISCLAIMER: This is for educational purposes only and is NOT a buy or sell recommendation.

Disclosure: I am a SEBI Registered Research Analyst - Registration Number: INH300006607. I have no position in the stock at the time of publishing this article.