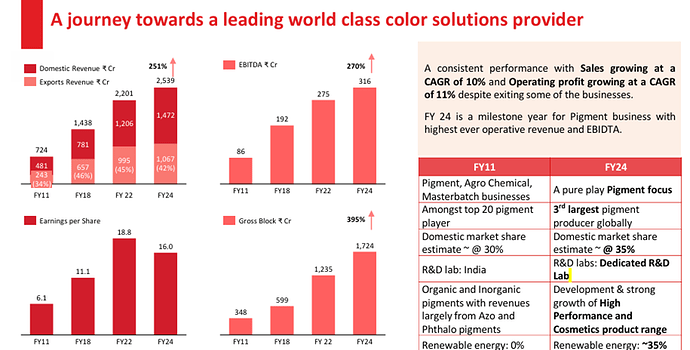

Sudarshan Chemical is the 3rd largest pigments player globally. Its laser sharp focus on only the pigments business has enabled it to emerge as a strong profitable player in an otherwise consolidating industry. With recent insolvency of the second largest player (Heubach), Sudarshan has a vast opportunity ahead to capture this share especially considering its recently concluded capex of 750cr. This would be aided by higher share from High performance pigments

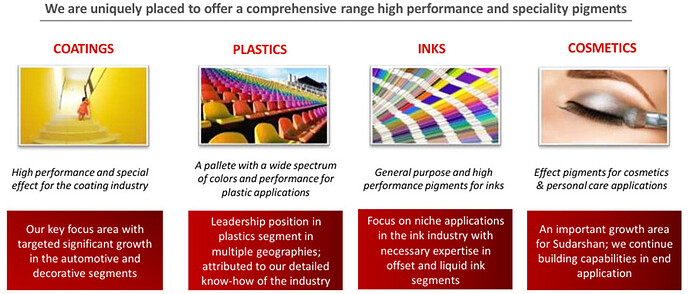

Products

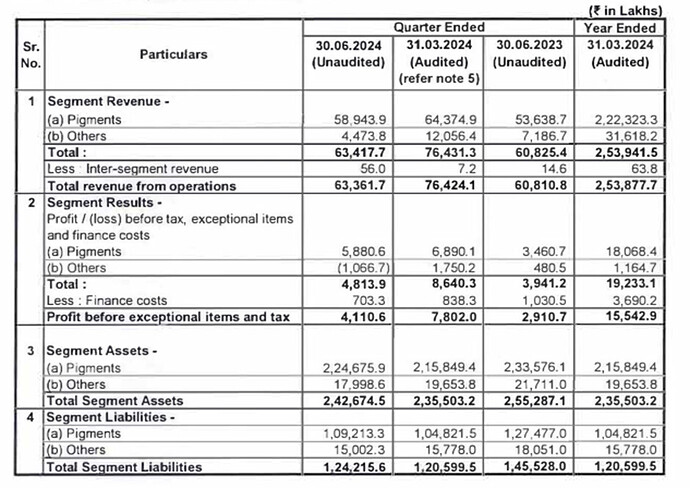

Standalone business comprises pigments while consolidated business additionally comprises its industrial business , REICO. REICO has been an underperformer historically and the main thesis revolves around its pigments business.

Pigments market

Pigments is a ~9bn USD market globally with DIC being the largest player (post-acquisition of BASF). 2nd largest player is Heubach followed by Sudarshan Chemical at a distant third. Sudarshan is the only pure play pigments player amongst the top 3. It has not diversified into other areas and maintained a laser sharp focus on this segment. It has more than 90% product overlap with its global peers vs limited portfolio for other domestic players. Sudarshan is the leader in domestic market with ~30% market share.

Why now?

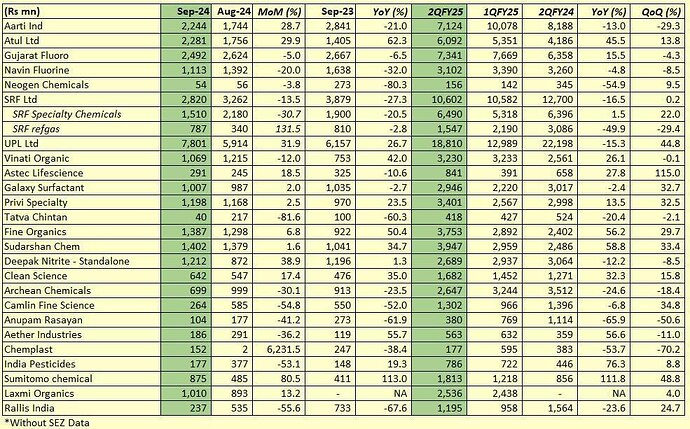

- Demand recovery after a tough FY 23

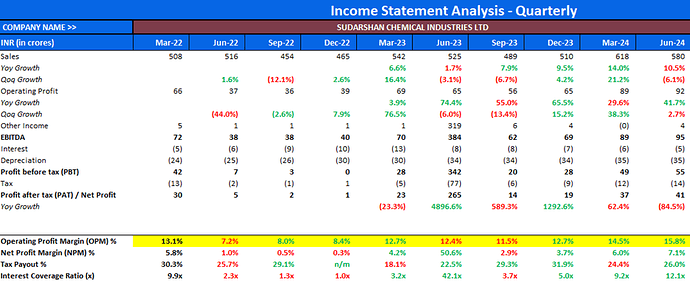

- Globally the pigments industry struggled due to weak demand in FY 23. This was led by inventory destocking and slowdown in demand from Europe and USA for its core industries like paints and textiles. This adversely impacted the performance of Sudardhan as its EBITDA margins collapsed to 9% vs 12% in the year prior.

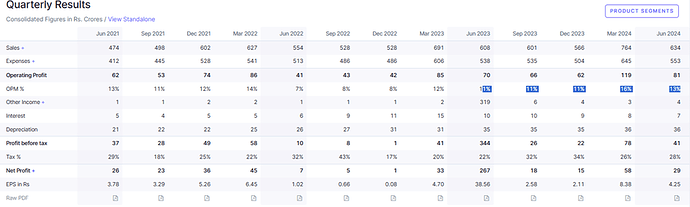

- 2nd half of FY 24 witnessed demand recovery from its customers as Sudarshan started reporting revenue growth along with improving profitability. Infact by q4 FY 24, the company reported 16% consolidated and 14% standalone business (only pigments).

- Global consolidation

- Pigments industry has been witnessing large consolidation globally. It started with BASF selling its pigment business to DIC in June 21 for 1.3bn USD.

- Clariant sold its pigment business to Heubach for 900 mn USD in early 2022

- Oxerra acquiring Venators iron oxide business in 2022

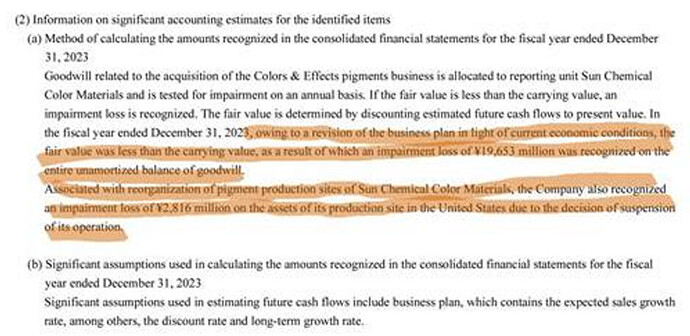

- High operating costs , increasing power costs in Europe amid reducing demand made operations of many large pigment players unviable leading to shutting down of operations and write offs.

- Venator – a major supplier of titanium dioxide filed for bankruptcy in May 2023

- DCL corporation, headquartered in Canada did 200 mn usd in sales filed for bankruptcy in 2022

- Chemours closed its facility in Canada and USA

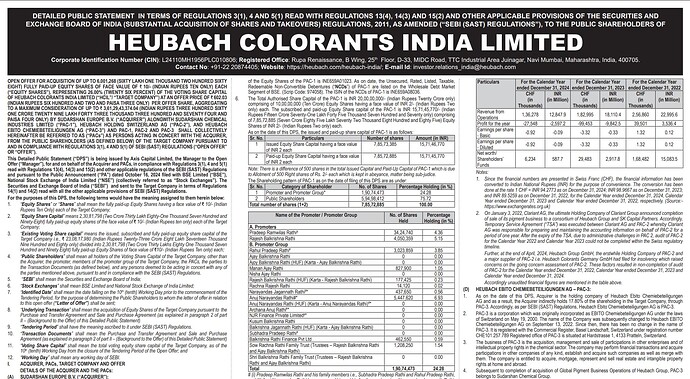

- Heubach which did around 1.1 bn USD sales filed for bankruptcy in April 2024

- DIC (Sun Chemical), largest player globally impaired goodwill from its BASF acquisition and other assets due to weak demand. It does approx. 1.6 bn usd sales in its colour and display segment.

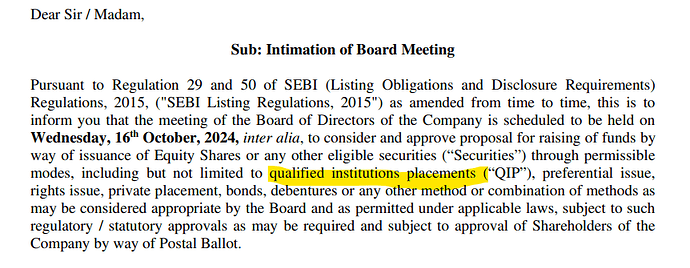

Resultant consolidation and vast supply vacated can be a big opportunity for Sudarshan. Clean balance sheet and recent conclusion of 750 cr capex positions the company strongly for capturing this opportunity.

The company has been witnessing impressive improvement in margin and sales in its standalone business as can be witnessed below. In fact it has reported 16% EBITDA margin in Q1 FY 25 despite low utilisation of its new capex, which shows a clear recovery in its pigments business. The reported GM In q1 FY 25 was 47% vs 42% in Q1 Fy 24.

Interestingly, the management mentioned (Q1 FY 25 call) that there is no impact of Heubach insolvency yet. The number of enquiries has increased materially and its takes around 6 months of approval (although expedited in this case) to supply to a new customer. One can expect strong ramp up in sales going forward along with operating leverage as Sudarshan starts capturing more business. Despite reporting multi quarter high EBITDA margin, mgmt. expects strong improvement as the new capacity gets utilized. The mgmt. had initially guided to fully utilise the 750 cr capex in 4 years, which has now been reduced to 3 years in light of increasing demand. It can generate additional 12-1500 cr revenue from the new capex.

Risks

REICO can play spoil sport. The industrial business has been volatile historically. The company wanted to sell of the business but changed its mind after improving financials in recent quarters due to capital goods cycle. This was reflected in consol numbers as the margins improved to 16%. However, it reported abysmal numbers in Q1 FY 25 which optically impacted the consolidated numbers and overshadowed improvement in its pigment business.

As can be seen above, the company reported loss of 10 cr in others, while pigments business saw strong improvement YoY. The management has stated that REICO will show improvement in profitability going forward, and this becomes a key monitorable. One can choose to give the mgmt. benefit of doubt as Q1 has been a bad quarter for most capital goods companies.

Valuation

Company did ~ 2200 cr in standalone in FY 24. Assuming it can add 800 cr sales from the new and existing capex over the next 2 years and with EBITDA margin of ~ 18% and PAT of ~10-11%, Sudarshan will report ~ 300-330cr of PAT in FY 26. Hopefully REICO will start reporting positive numbers from the coming quarters and can add additional profits to the consolidated statement. Current MCAP is 6300 cr.

Disclaimer : Invested and biased.