Steel Strips Infrastructures Ltd., incorporated in the year 1973, is a Small Cap company (having a market cap of Rs 26.32 Crore) operating in Construction sector. It’s is part of Steel Strip group which has Steel Strips wheels as flagship company.

Steel Strips Infrastructures Ltd.has promoted, developed & manages the ultra modern SAB Mall in the heart of Noida. The shopping complex which has been designed by world renowned Hafeez contractor and the matchless elegance of its premium retail space is no small part of the breathtaking beauty of its architechture. The multi storey shopping mall offers luxury retail & has been designed as a superior platform for buyer seller matchmaking.

Steel Strips Infrastructures Ltd also classified as promtor in Steel strips wheels and Indian acrylic ltd.It holds 2.73% in Indian acrylic.

Steel Strips Infrastructures has an Associate by the name of Malwa Chemtex Udyog Limited. It holds 42.96% in this associate company. Malwa chemtex udyog involes in Production, processing and preservation of meat, fish, fruit vegetables, oils and fats. Malwa chemtex udyog also hold 2.47% stake in Steel Strips wheels company as a promotor company.

Associate company Malwa chemtex udyog has turned profit making company last year. It has started posting profit and reflecting in steel strip infra.

Steel strip infra current mcap is around 26 cr and it’s consolidate profit will be around 20 cr for this FY with 25 rs EPS. It’s available below 2 PE.

In future there may be reverse merger with associate company or other corporate action is possible in this stock.

It’s huge undervalued stock from reputed Steel strip group.

Disc. Invested

Risk:

-

Covid risk which will impact most of listed/unlisted companies topline and bottomline, decrease in demand, as well owing to the covid locdown factor. It has SAB mall in noida which revenue is impacted due to covid.

-

Trade receivables are unsecured and are derived from revenue earned from Rent and Services provided at SAB Mall, Noida. No interest is charged on the outstanding balance.

What is the basis for saying that the profit will jump 4x in this year?

Also why would SSWL reverse merge? Has there been any indication to that effect by the management?

Reverse merger is one of possibility with associate company Malwa chemtex udyog or any other corporate development. only guessing. Dont have much more details from management.

On profit front it’s showing consistent profit from associate company. Just estimated FY 22 profit.

This is not sswl thread. This is separate listed group company Steel strips Infrastructure which CMP 32 rs. Steel strip infra is also one of promotor company in SSWL.

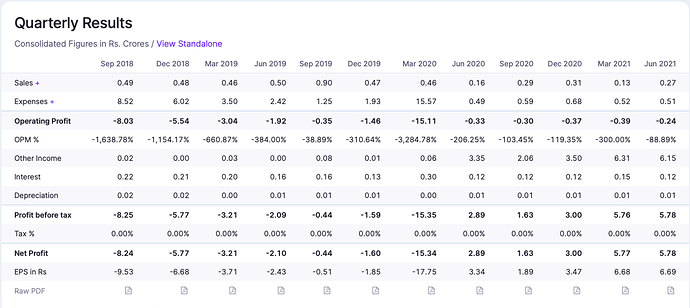

The ‘other income’ and presumably the income of the associate company have been negligible before March 2020. This raises doubt about the continued profitability of the associate company.

1 Like

True. It’s been started performing since 4 quarter. Every quarter profit increasing. It’s small cap company which mcap is around 30 cr and consolidated net profit will be around 22 cr, EPS is 25 and stock price is 35 only

One more thing associate company Malwa chem udhyog holds 2.47% in SSWL which value come around 60 cr+ and Steel Strip infra holds 42%+ in associate company. As mentioned on company website it has SAB mall in Noida which value around 200 cr.

I like the best thing that this is big group and Tata steel also holds around 7% in SSWL. It looks promising story for long term and have to keep eagle eye on quarterly result and corporate development. This thread is opened to share more info related to company. Pls share.

1 Like

Is the SAB mall owned by Steel Strip Infra (SSI)? If yes, where is it reflected in the balance sheet? Fixed Assets is 0. From reading the latest Annual Report, I could not find any official statement that SAB mall is owned by SSI.

There are various companies like SAB Developers, SAB Industries, etc., whose relationship with SSI is unclear. It is possible that one of them owns the SAB mall.

Since the company does not confirm ownership explicitly, since there seem to be a network of other companies having similar names, the company does not appear to be friendly to the minority shareholders. Not surprisingly, there is no dividend paid last year.

Such companies are very difficult to value, not merely because there is a lot of information is hidden from the investors. The market can discard them quickly once the bull market gets over, leading to crash in stock price. Based on the current information, I am tempted to say that it can be considered as a speculative bet which can potentially offer very good returns if the management decides to become investor-friendly, but this is unlikely.

1 Like

Steel strip infra posted 30 cr profit for this quarter. It’s mcap around 33 cr. Got profit share 31 cr from associate company Malwa chemtex. It holds 42.7% in Malwa chemtex. https://www.bseindia.com/xml-data/corpfiling/AttachHis/d67a2d1d-6b61-4ba2-acae-97295ca02500.pdf

2 Likes

We have to be careful since this seems to be one-off income in Malwa Chemtex. Did Malwa sell some of its assets for this income? What is its business? It seems to be loss-making before 2020. Has it turned around or is this a temporary phase of profits?

Besides Malwa Chemtex, the company also has enormous investments in Indian Acrylics and Steel Strips Limited. The reserves of 3x the market cap, low debt and the recent profits make it a good value-investment case. However, there is zero dividend which means a shareholder can’t get any share of the profits made by the investee companies. And there is an almost total lack of information.

Steel strip infra posted 21 cr profit for this quarter. It’s mcap around 18 cr. Got profit share 22 cr from associate company Malwa chemtex. It holds 42.7% in Malwa chemtex. https://www.bseindia.com/xml-data/corpfiling/AttachLive/9cb0cd86-60ef-43ea-addb-1b6c62b43a92.pdf

2 Likes

So you see this going the Waree route ?

There is no info about this. Steel strip group is doing good. Steel strip infra is micro cap which mcap is 28 cr now and got 45 crore profit in last 2 quarter from associate company. I tried to find more info about Malwa chemtex but unable to get detail info. It is involved in Production, processing and preservation of meat, fish, fruit vegetables, oils and fats. and holding around 2.5% stake (104 cr) in Steel strip group flagship listed company Steel strip wheels ltd.

I will try to find . Does it fit the criteria for backdoor listing ?

Also in Indian Acrylics. Can we get anyone who has expertise in reverse merger opportunities to comment on this

Consistent high volume today big volumes

It is continuously giving LC now will it bounce back do you think it can reach atleast 40/-

Optimistic in the very long term

Are you tracking after latest result ?