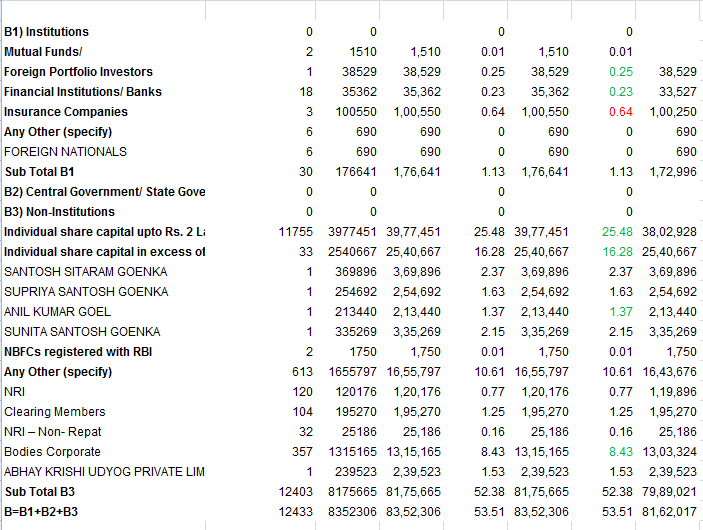

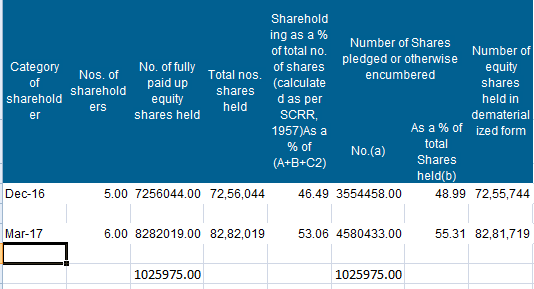

Updates on the share holding pattern

Positives

FPI’s is new entry

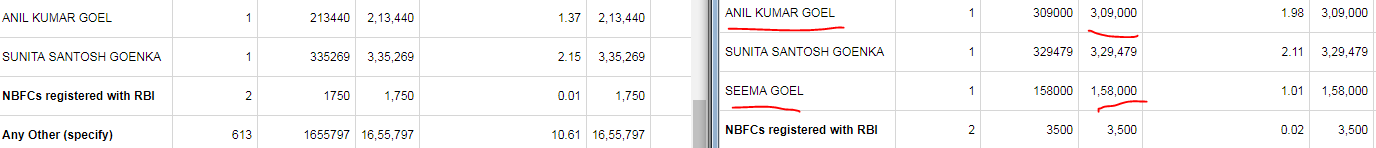

Anil Kumar Goel is new entry

Corporate Bodies have increased stake from around 5% in previous quarter to 8% presently…

Negatives

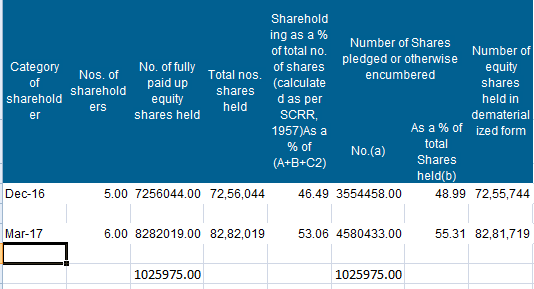

Promoter shareholding reduced due to pledge invocation i believe…by 10%

Does anyone expect further growth in revenue and PAT? Its already up a lot. Dont find much info about the co, current capacity utilization, any expansion etc… If Anil Goel has invested recently then there has to be some trigger.

trigger is drought in south india which may cause acute water crisis for paper mills in that region as paper mills are water extensive industries…already many mills are closed there .listed co TNPL 2 mills were closed for a month or two,but today it has resumed it operations back…

so good Q1 most of the cos will njoy healthy margins like we saw in IPAPPM results.

also read this

-

http://www.deccanchronicle.com/nation/current-affairs/100517/chennai-price-of-notebooks-may-shoot-up-by-20-per-cent-in-june.html

-

http://www.business-standard.com/article/companies/clean-paper-mills-make-better-profits-117072500061_1.html

Interesting… Lets wait for Q1 results…

This stock has given good returns in the last few years. However, it seems a little overpriced currently. Should wait for some corrections before buying.

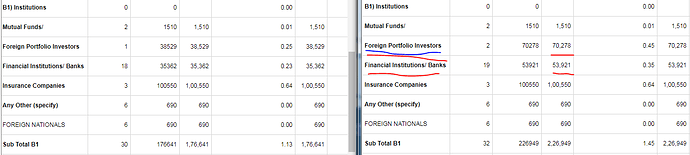

Interesting SHP… FPI and Banks Institutions stake has increased

Anil Kumar Goel increasing stake

AGM on 14th September… Expecting Good Profits due to close of some paper mills in South

1 Like

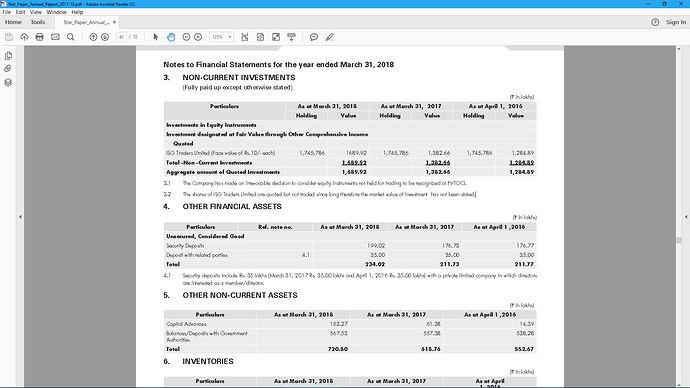

Why nobody talks about companies’ Investments (35.79 cr) in ISG Traders Limited.

STAR is associate of ISG Traders Ltd. 34.28% of shares in STAR is held by ISG Traders Ltd.

What does ISG Traders do??

What do the company derive from this Non-Current Investments??

Yes a very good question even i searched what ISG Traders do found that they have invested in NRC, Gujarat Carbon, Unimers india, stone india all of them Suspended due to Penal reasons and ISG holded major chunk of their shares if am not wrong and they also invested in Star paper too we should search more about ISG Traders.

ISG Traders is a promoter entity and holding company with 34.2% holding in star paper. How should we treat this?

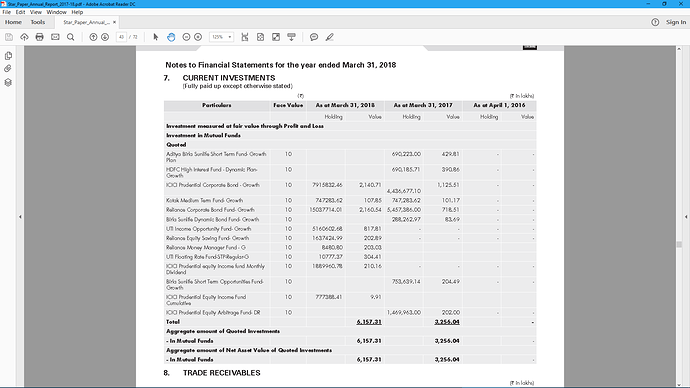

Company is earning good ROE and is accruing cash. As on March’17 it has 32 crs liquid funds investment. As on todays price of 187 it seems pretty attractive at around 5 PE. Any views from seniors?

The company has been getting operating cash flows of about 30-35 crores for the last 2 years. But the money is being ‘reinvested’ into shares of ‘ISG Traders’. Minor dividends, minor reinvestments into the core business; Almost all of it is being ‘siphoned’(?) off.

ISG Traders had 3-4 investments previously which all closed down. Thus, going by the previous track record, money is almost gone from my perspective as an investor in Star Paper Mills. Either it’s being used to bail out ISG Traders from debt/losses or is being used to siphon off money. BTW, SV Goenka is on boards of both the companies - ISG and Star Paper. From his perspective, he might consider both of them his own personal businesses and is fair in putting money from one entity from another. As minority shareholders, my investment in Star Paper is being hurt.

Maybe that’s why the share is trading so low on EPS.

I was invested in this share; However, I have earned decent returns on it and don’t feel confident about the future after finding this out. Selling out!

Edit: I misunderstood point 36 of the notes to the financial statements. Apologies for that. @chetanb

Where do you see this? The latest annual report (2017-18) shows Star Paper’s investment in ISG Traders’ shares is constant at 17.45 lac shares.

All operating cashflows are invested in mutual funds (mainly bond funds) despite precarious financial position of the group companies. Rs.62cr are invested in these funds on 310318 (33cr on 310317 and nil on 310316)

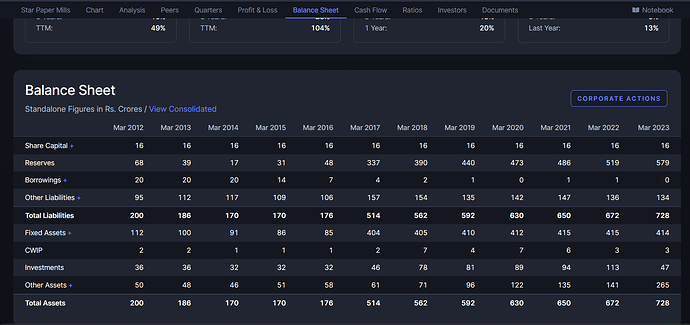

What is the reason for spike in net worth from 2016 to 2017. I saw the Annual reports too but couldnt find the reason in financial statemets atleast.

Asset revaluation is the reason

1 Like

Asset revaluation is freehold land which is valued at 321 cr even in 2017. Now it should be 600 cr. Any idea how many acres of land? Are they all agricultural ecolyptus land or any other type?

I saw in corporate video that it holds 40 acre of agri land used for raw material cultivation. But in Sahranpur, 1 acre of agri may be 1 cr, it cant be more than 50 cr.

With cash equivalent being 230 cr which is close to mkt cap, now investors get land and paper mill for free (Trade receivable=Inventories). Hence this land information is crucial as it forms 50% of book value.

Any one tracking this company now?

I had asked the land area question in last AGM, along with data for production volume, sale volume, capex plans etc but management brushed it aside.

I was also attracted to it as a cigar-butt, but considering lack of management enthusiasm to entertain shareholder queries, promoter share pledge and past track record of invocation, weakness in other group cos. (Duncan Industries), minimal investment by promoters in the business and potential for leakage of cash to related parties - I’d avoided scaling up the position.

Disc, invested token amount as cigar butt.

1 Like

Fair point…2 points attracted me apart from steep valuation discount.

- Company is still giving dividend which yields 2% unlike other cashrich small cap traps.

- Paper industry is around trough, cycle turnaround is going to help.

Yes i agree with the industry cyclicality thing. Lots of paper companies trading at beaten down valuations, even the good ones investing regularly in the business to expand capacity and squeeze down costs.

Hope the turnaround comes soon.