It is an Reality Play. It is a small company having presence in South India. It has presence in Chennai, Hyderabad, Kerala and Bangalore.

Only BSE listed company. But Circuit Filter is at 20%.

From Annual Report:

-

Company is primarily focusing on the development of land, plotted lands, mid-size houses, etc. and reduce the construction contracts work.

-

In view of the projects of the Company under execution and in pipe line, the management is expecting better prospects in future for the company.

-

During the year under review Company given loan of Rs 2.80 crore bearing 18% interest per annum to M/s. BHEL Employees Model Mutually Aided Co-operative House Building Society Limited for meeting the shortfall of amount in paying stamp duty for registering plots in Society’s Name.

-

Projects completed during the year 2014-15: - (1). Frangipani, Pudupakkam, and (2). Meeting House/Service Centre, Bangalore.

Regarding Ongoing Projects:

23 Cr is yet to receive from IT park (Alpha City project) in Chennai. It will be completed in 2017. It is hoping that IT business will grow this year and it can recover the money this year.

Matrix Towers:

1,40,000 Sft. IT Park is almost completed. 8,500 Sft. is unsold. Chennai.

Green Acres :

SSPDL Green Acres LLP has entered into partnership with M/s. Godrej Properties Limited to develop a residential project in Padur, OMR, Chennai on profit sharing model on 27.03.2014. Most of the approvals have been received and construction is proposed be launched in October, 2015.

SSPDL Lakewood Enclave/Mayfair Apartments:

A Residential Villa/Apartment project on a 3.89 Ac plot of land situated at Thalambur Village of Old Mahabalipuram, (IT Express Highway), Chennai.

This project is being done in phases. 1st Phase consists of 32 Villas and 2nd phase is 76 apartments i.e., Mayfair Apartments.

Company has already sold its share of Apartment. Due to slowness in projects, the rest of the Villas will be completed by Sep 2016.

The Retreat, Hyderabad (BHEL Employees Cyber Colony):

The company entered into partnership with HEL Employees Model Mutully Aided Co-operative House Building Society Ltd on 5thSeptember, 2012 for the total sale value of Rs. 317 Crores.

In three years time, it will complete.

SSPDL Northwoods:

SSPDL Ltd and Indiareit Fund Advisors Pvt. Ltd. through their SPVs have acquired 42 acres in Gundla Pochampally village, Hyderabad.

Initial booking to the extent of 30% is complete. Rest will complete by Dec, 2016.

The Retreat (In Kerala):

The Company has acquired about 300 acres through itself and its subsidiaries, a Cardamom plantation land at Kallar Valley, Idukki District, Kerala. The Company is planning to use the SPV’s for operating a) Villa Development, b) Jungle Resort Development and c) Jungle and Plantation Development.

Some problem due to central govt report and that need to be cleared for further development.

Fairfield & Marriot Hotel:

Value of the project is 21 Cr. Final claim is settled and waiting for retention money in Oct, 2015

News:

-

SSPDL Ltd has informed BSE that SSPDL Green Acres LLP has entered into partnership with M/s. Godrej Properties Limited to develop a residential project in Padur, OMR, Chennai on profit sharing model. Source : BSE

-

2015-01-15

SSPDL clarifies on project for BHEL Employees co-operative society:

The company had “entered into a memorandum of understanding with BHEL Employees Model” Mutually Aided Co-operative House Building Society Ltd, Hyderabad for developing 1262 homes on 5th day of September, 2012, This information was communicated to the stock exchange vide our Letter dated 05.09.2012. It took about two years’ time to get the project approval, which came in the 3 week of December, 2014.

In terms of the agreement, 40% of the amount as an advance has been received by the Company recently in the first week of January, 2015. And, we are expecting to execute necessary sale deed shortly. -

M/s. SSPDL Infratech Private Limited (formerly SSPDL Interserve Private Limited) with effect from 16.05.2015 become a wholly owned subsidiary of the company.

-

SSPDL to resume work at its project in Medak. Oct 27, 2015.

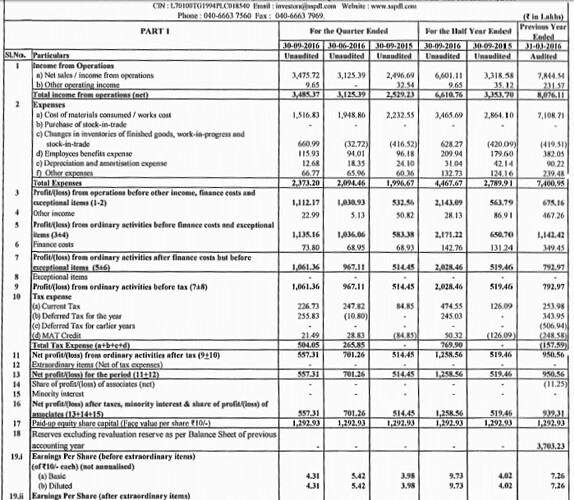

Ratio:

CMP: Rs 61.40

Stock P/E: 6.71

Price to Sales: 0.47

Price to book value: 1.64

Debt to equity: 0.23

DebtToAsset: 0.08

Promoter holding: 54.20%

Reserves: 32.73

MCap: Rs. 85.14 Cr

Cash End of Last Year: 7 Cr.

Volume: Decent. 24,703

Disclosure: I am invested.