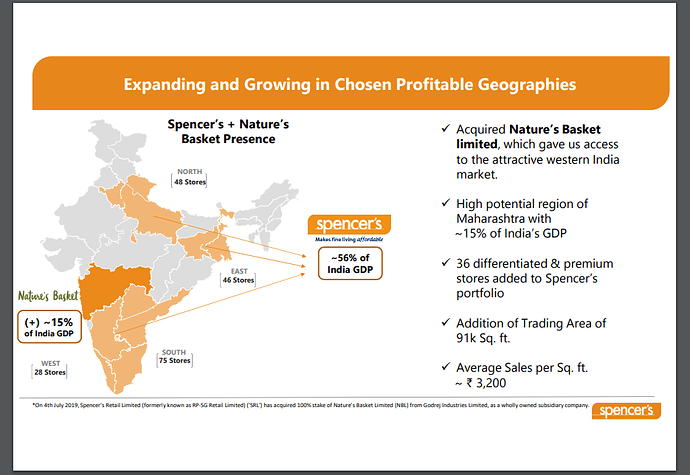

Spencers Retail is demerged entity from cesc LTD and got listed in Jan 2019 separately. Spencer is trying to position itself as lifestyle retail company and attempting to Increase share of fashion product in it’s sku otherwise currently it is food n Staples based retail company. In financial year ending March 2019 it has sale turnover of around 2200 cr with marginal operating profit n almost zero net profit. It was cash surplus with cash on books of more than 200 cr with net debt zero. In month of July 2019 it has acquired retail business of godrej natural basket at cash consideration of around 300 cr whose balance sheet integration with Spencer is underway. It is expected that it may cause Spencer of around 100 cr debt. Nature basket has turnover of around 335 cr and operating loss of around 60 cr in fy ending March 2019. Most interesting thing is about valuation Spencer is currently valued at market cap of around 540 cr and Enterprise value of close to 700 cr post nature basket acquisition and annual sales turnover in excess of around 2500 cr with zero operating profit. So overall is available at sales to Enterprise value of around 25 perc. Promoters is buyer of stock from open market worth around 50 cr since listing . It is speculated that few month back Amazon was interested to invest in this company at valuation of .8 times sales but promoters themselves wanted to grow the business. It has total store count of around 155 (by adding 35 store count of nature basket store count can cross around 190) with more than 60 lakh customer and annual transaction of around 3.1 cr and average customer spend per transaction of around RS 725. I guess market is concerned about management quality and uncertainty related with acquisition of nature basket which may push profit by few quarters and recent consumption slowdown related stories putting addition selling pressure on stock . Most pure play retail companies is still trading at near to their all time high so valuation for Spencer seem attractive. A company which acquired a company by paying 300 cr in cash is itself available at valuation of 540 cr. Also few month back company appointed former md of Walmart India as CEO to lead the company and chairman Sanjeev Geonka in media interview sounded positive about future outlook of the company . Company has strong presence in states like West Bengal Andhra and eastern up mostly tier 2 cities and acquisition of nature basket give it foot hold in Western market and metro cities like Mumbai Pune Bangalore n Delhi where Spencer has small presence. It is also important to note that Spencer is first retail company which brought concept of hyper Mart in Indian market in 1990 even before future group though management is not able to capitalize on retail opportunity and in 2015 closed around half of it’s loss making retail stores . Due to these kind of historial issues market is not judging this company favorably even though standalone basis company posted operating profit of around 35 cr in quarter ended June 2019.

Disc: I am already invested in this stock at higher level and currently in notional loss from this.

I agree with all your views. Have you looked at Goenka s privately held business and their long term intent. I understand they also demerged an FMCG type business and also at same time he has privately held FMCG business… certainly not what I would like as an investor. Can you throw some more light on this style of promoter and their long term intent on their recently demerged businesses?

Also, in retail, what is their strategy…like for eg. Dmart strategy is lowest price retailer, trents strength is in private labels, Biyani is trying hard to develop a blanket discount to regular purchasers with strong focus on fashion ( although I am still not clear on his long term intent and any clear Direction) …what is Spencer’s strategy to differentiate itself and grow? Why did it chose to buy nature’s basket , does it fit in its long term strategy except just getting presence in West India with 60cr loss annually? Disclosure: Had a small tracking position which I recently sold at nominal loss. I had found it really cheap and it went on to become cheaper while dmart and trent I had found really costly and they went on to become even costlier. I guess management quality, vision and intent is paramount and Spencer is a big looser in this…

I agree with the all the views. my only question mark is the promoter. its a big no-no for me. plus spencers is just a normal hypermarket and there no differentiating strategy to my mind. i was in AWE when i entered a d-mart store but did not get the same feeling in a spencers

There is some reason why it may be cheap. However in India consumer facing business is highly valued and when sentiment improve it may reach it’s fair value which is around .7 times sales. Only issue is high soon it started reporting profit. Godrej is a high class management but still it struggle to scale nature basket or make it profitable. My sense is once a retail company reach turnover of 2000 cr or more it chances of making profit increase and rise in profit is higher than rise in sales as operating leverage kicks in as in India cost of rent and logistics is at higher side. Also Kishore biryani has far worse management still if market give his company high valuation and has never meet market expectation in last 10 years. Even Britannia management wadia is considered third rate for many years before market start giving it high valuation in last 5 years may be. Due to management concern most group company trade at lower valuation however building a business with 3 cr retail transaction is not easy.

My thesis is if 650 cr is given to good management can 3.1 cr customer transaction is possible . Evenn Trent was loss making and selling at lower valuation for many years before market in last 3 years started giving it good valuation . So my sense is that it may happen to Spencer as well as in last 3 years only retail companies is fancied by market. If nothing Spencer can be sold to some big retailer like more of Aditya birla at some higher valuation. All management like to get higher market value for their company.

There is a spencer walking distance from my home (in gurgaon). Earlier there was SRS at same location which shut down. I went to this Spencer once and for a shopping of more than 5000 Rs I got a princely discount on MRP (what they call savings) of a total of 40 Rs. Never went back again. My Amazon Prime is better value than that any day and delivers right at my doorstep.

Yes you are correct but still organised retail is hardly 10 perc of total retail sales in India and opportunity size is huge and there is all kind of market and all kind of customers. For Staples buy customers usually prefer nearest store considering traffic situation in Indian cities . I seriously think all discount is marketing gimmics and in reality nobody is offering much discount except on few product to get eyeball. Many retail companies has turned profitable so other can able to adopt profitable business model and also consolidation has happened in last few years .I think now this company is more focussed towards turning profitable n they are trying to develop nich areas in food and gamunet segment and there presentation say they may not be into discounting or pricing game. Tier 2 cities in India now enjoying shopping into these kind of retail chain than traditional kirana shops. Ultimately it boil down to able to show growth and profit if company can achieve it there is no stopping stock price. Now market is in a mood where it don’t have much patience for these kind of turnaround companies but it may change with improved sentiments or else it may fissle out . At 500 cr market cap it may be a value n patience game. Atleast Spencer has business issue or management issue but not fraud situation to warrant such level of undervaluation unless something come out in future that another story. Balance sheet is clean with manageable debt level which is another plus.

I’m form eastern part of India (Kolkata) & Spencer’s has a good presence in my city.

Following are my subjective opinions about the company.

I’ve been to their stores since childhood and the experience has always been decent. There are decent footfalls always, same in line with Big Bazaar. Shopping experience had been slightly better than Bigbazaar. I’ve never been to a D-Mart store & so can’t compare.

They have recently re-aligned their stores, at least the one which I visit once in a while, to give more visibility to their 2BMe brand of fashion products. I’ve also seen Nature’s Basket in that shop but wonder how many will get interested in those kind of products in India.

e-grocery

They have entered the e-grocery space in probably 2016. The initial experiences were aweful. Most times the delivery used to be late & some items were unavailable at the time of delivery. So, I always used to pay by Card on Delivery. Since last few months, both these things have fixed. I like the fact that the delivery associates now bring new types of small POS machines which sends receipts as SMS.

They also now offer uncomplicated discount offers in e-grocery. Uncomplicated means flat discount over some order value. Usually the discount coupons are available even for orders as low as ₹200 (Flat ₹30 or ₹40 off above ₹200 etc.). In fact such flat offers are rarely available for larger orders, e.g. for ₹500 & above. This is why I order on Spencer’s mostly for smaller orders, and do that at least 5 times a month, whereas place orders in Bigbasket or Grofers hardly once a month.

They used to run such offers for the entire months but nowadays such offers stay for some hours but available on most days. They also offer free delivery for orders over ₹200 (before discount), which is much lower compared to Grofers, Bigbasket & Amazon Pantry.

The only annoying thing about their e-grocery venture is a poorly coded app & website. Also, once in the recent past their CC number was down for days. In that time I had to contact them via Twitter.

In fact poorly coded website is a feature of CESC also, which is also a Sanjiv Goenka venture.

All in all, Spencer’s offers decent experience. Their offline offering is more reliable but online e-grocery has some glitches. CESC or Spencer’s offering is more like a PSU: buggy but reliable. (In fact many believe that CESC is a PSU.) I believe that it is this reliability factor which will make Spencer’s retain its older customers at least.

I haven’t found anything wrong about Sanjiv Goenka, but don’t feel comfortable in the idea of owing a company where he is the promoter. Somehow I don’t feel that he is competent and aggressive enough to take any company to the next level. But, I am reiterating that this is my subjective feeling only.

I also asked view regular shoppers in various malls n they told me Spencer have better experience than big Bazar or reliance fresh but less than dmart which offers best value and discount. I think if Spencer guy bring some strategic mnc partner than it may enhance the valuation of the business. Currently a retail company with 3000 cr sales is available at around 500 cr kind of market cap so if company survives it can give decent return however if they continue weak number like last quarter than it is tough situation as there balance sheet now have debt after nature basket aquisition. Recent changes in accounting standard about leasing calculation n depreciation affected profitability of all retail companies .

Just to add my 2 cents:

There was a Spencers besides my apartment (walking distance - in Pune). The feel that it used to give was never like a megastore. It looked as if it was just a plain combination of grocery and kirana shops, with not much value add (either in terms of Pricepoints or variety).

They quite often ran out of stock for grocery or even had low quality vegetable stocks. Eventually they had to shut down.

As friends mentioned here, I too feel there is no theme or strategy for the business and looks just like a best effort shop chain.

why the continous falling this week ?? anyone has some info?

I think management is busy with one self goal to another without any concern about minority and other stakeholders. Company posted 40 cr loss and balance sheet also become debt heavy . In place of focusing on improving there existing profitability than gone for bad aquisition . Market don’t seem confident about their ability to o turn around operation in near term n market participant don’t seem to have any patience

rk damani has bought 16 lakh shares as can be seen in dec shareholding pattern, this is big

Its not debt but due to reporting has changed Leased Liability is transfered to Liabilities.

what if dmart acquires spencer in the future that could be very big rerating

For natures basket which has sale of less than 400 cr the Enterprise value was 300 crore (debt of around 200 crore). Spencer standalone has 6x sales with minor debt so the Enterprise value should be 2400 crore plus 300 crore for natures baskets…means spencer consolidated will have Enterprise value of Rs.2700 crore. Now if we reduce the debt of 200 crore the market capitalisation comes to 2500 crore and its is currently trading at 800 crore mcap.

Guys please respond if the above doesn’t seems logical.

Hey there.

My 2 cents: I don’t think we (as investors) can use the metric to value Spencers as the metric used by Spencers to value Nature’s Basket. We don’t know what kind of value Spencers saw in Nature’s Basket. They haven’t been very public about it either except for a couple of generic Press Releases.

Personally, I would exclude Nature’s Basket when valuing Spencers. I’m not sure of the vision Spencers has for Nature’s Basket and hence the acquisition could result either ways.

Standlone for Spencers, we need to keep in mind that traditional supermarket retail formats need to address the question of headwinds from digital retail as well as mega-format hypermarket formats. On top of that, the digital initiatives of Spencers lack the aggression and zeal needed to fight the VC money.

So I feel that at 700c mcap for 2500c of sales, Spencers might be a good risk-reward but not a screaming buy. These valuations are mouth-watering to enter only if we know for sure that the management can take it from 2500c sales to 5000c in 5 or 7 years.

I will wait and watch.

Amazon bought stake in aditya birla retail limited with valuation of Rs.4200 crore i.e. EV/ Sales of 1x. The performance metrics of aditya birla retail limited and Spencer retail ltd is almost same. Even spencer bought big basket at EV/ Sales of 1x. Even shoppers stop which has PAT losses in H1FY20 and very decent past 4 yr performance is trading at EV/ Sales of 1x. Even amazon offered to buy stake in spencer retail in 2018 with valuation of Ev/sales at 1x… although the deal didn’t go through as promoter thought the valuation is cheap. All these instances reflect fair value of spencer should be some where near 2800 crore of mcap…but currently its trading at mcap of 700 crore…

Guys any reason why spencer is trading at such a discount??

Evaluating Spencer Retail

Positives

- Attractive valuations – Rs 440 Cr M-Cap for a significant retail footprint & operation

- Spencers Brand

- Investment by Radhakishan Damani (Is this a strategic investment or just a trading bet?)

Negatives

- Acquisition of loss making Godrej Nature’s Basket

- Debt

- Equity dilution (impending rights issue)

- Low operating margins and ROE

- Stagnating sales in the last few quarters

- Docile management / promoters group (lacks aggression)

- Ability to respond to competition – Offline & online

The negatives outnumber the positives, but valuations look attractive at current prices with limited downside

Appreciate views

regards

Disc: Hold a very small position

Hi,

The tie up with Flipkart should be positive in this lockdown situation.but anyone having any idea about the sales from Flipkart??

Also the big basket acquisition should boost their sales now.

Thanks,

Deb