Company Overview:

Spandana is a microfinance company providing finance to underserved sector.It is a public limited company started in 1998 and registered with Reserve Bank of India (RBI) as an NBFC in 2003.

Company Structure:

- Spandana Sphoorty Financial Limited

- Criss Financial Holdings Limited (CFL) - 98.2% Subsidary

- Abhiram Marketing - Fully owned by promotor group

Product Offerings:

- Microfinance loans

- Loan Against Property

- Business Loans / Personal Loans

- Gold loans

- Consumer durable loans

Business model:

- Core business of the company is microfinance loans

- Spandana follows both, the group-based and the individual microcredit lending model, wherein, the loans are given to individuals based on their household economics.

- Other types of loans includes the Agri-family loans, Farm equipment loans, Small mortgages, and Loans against gold jewelry, among others.

- Microfinance loans are disbursed by SSFL and other loans are disbursed through CFL

- Company has a marketing arm “Abhiram Marketing” for providing loan for purchase of consumer durables. Loans are held in books of SSFL and sale is booked in Abhiram. Since MFI regulations restricts MFIs to have a marketing arm, this company is held by promotor itself and profits are passed on to SSFL

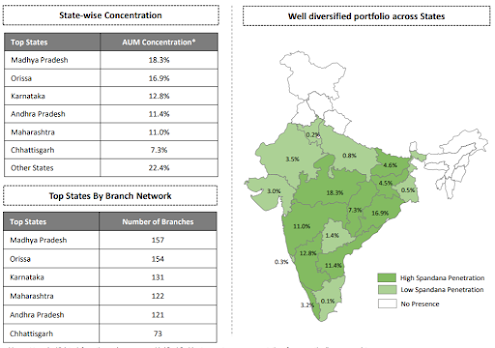

Geographical presence:

- Unlike larger peers like Bandhan and CreditAccess where having huge concentration in some states, company has well diversified among the states and top contributing state is less than 20% of total loan book.

- Major key states for other MFIs are deliberately avoided as part of risk management.

- Company has larger mix of rural portfolio at 94% of their loan book.

Key metrics:

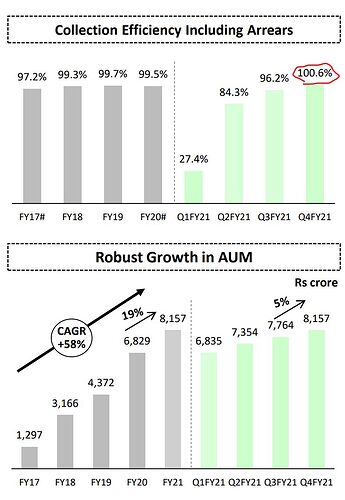

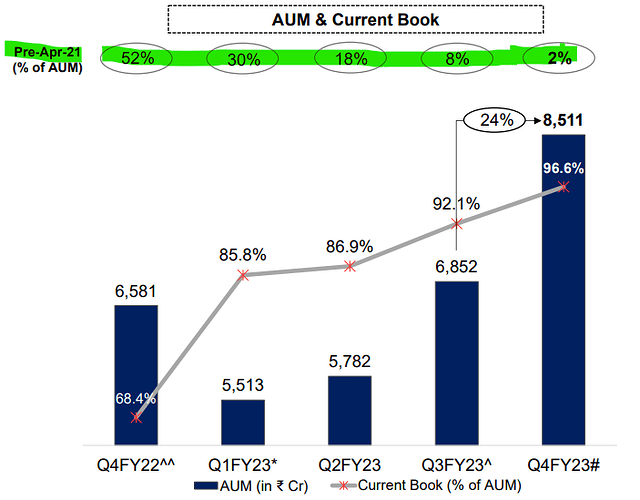

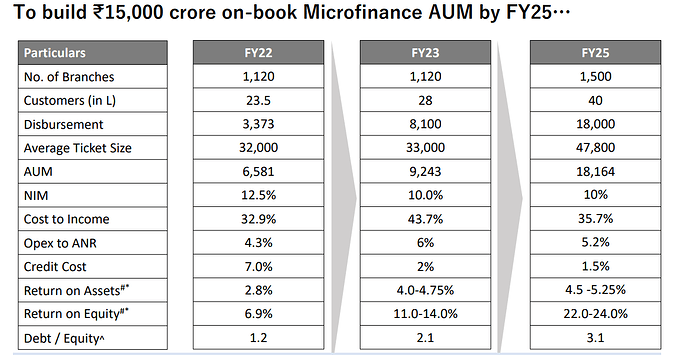

- Loan Book growth

- 97% of loan book is microfinance loan and 3% is other set of loans such as LAP, Gold.

- Post CDR issue, company growing its book at very rapid speed. Even during the covid time, they can able to disburse at good pace

- Currently they are disbursing more than 2000 crores of loans in a quarter.

- CFL currently has a loan book of 403 crore.

- From management commentary, they are focusing on growing significantly CFL book.

- Capital Adequacy ratio:

- As of 31 march 2021, Currently having 40% ratio even after providing huge provisions for covid portfolio.

- CFL is also having a healthy ratio of 33%

- Operating metrics:

- Cost to income at 20% range and opex of 3-4% leads to higher EDITDA margins compared to other MFIs

- having a spread of 10% and with lower leverage ratio, spandana has a superior NIM of 15-16%

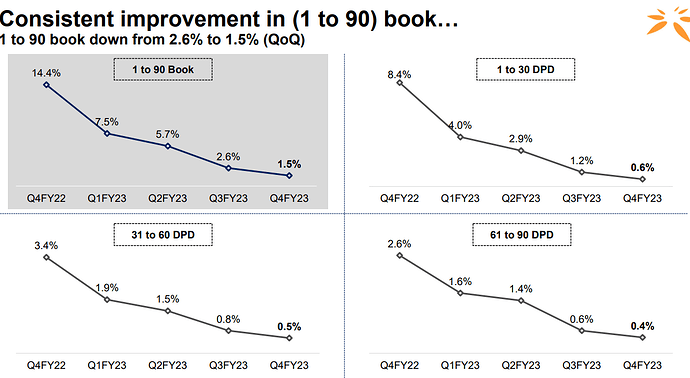

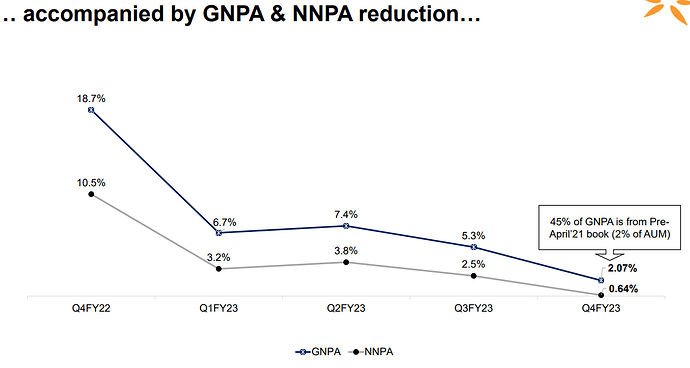

- Asset quality:

- Company currently having PAR 1-30 at 3.6%, 31-60 @ 2.0%, 61-90 @ 1.6%

- Gross NPA of 3.1%

- Company started providing provisions from q4 FY20 for this covid stress

- Already written of 5% of portfolio and has 5% in provision bucket.

- having GNPA of 3.1% and PAR 30-90 of 3.6%, current provision seems inadequate and it will take further hits in next two quarters

Crisis Management:

- Company, being a 2 decade old, has seen enough crisis and survived most of crisis except AP crisis

- AP Crisis:

- Spandana is one of the two firms that survived the AP crisis.

- For all MFIs, which operated in AP, only spandana able to collect 44% of its portfolio till date.

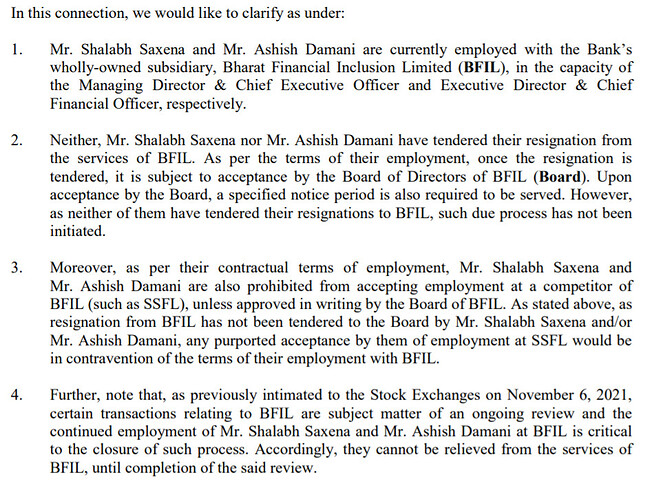

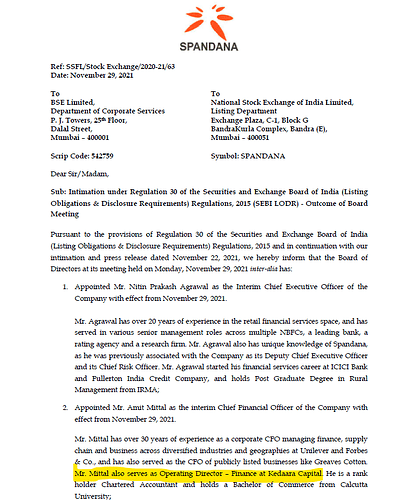

- Even though AP event is an existential crisis of MFIs, spandana managed to steer through Corporate Debt Restructure scheme by larger collection and additional capital raise from Kedaara capital.

Where the company distinguish itself:

- When CreditAccess is trying to convert the collection model to fortnight basis, Spandana is trying to convert to monthly model, as this will reduce the number of visits of collection agents which will eventually improve the opex metric. (But surprisingly, Spandana says monthly model has superior collection, whereas CreditAccess says fortnight model has superior collection

- Geographical selection differs from its peers. Being one of the largest MFI, company avoided some key states

- Uttar Pradesh – stopped disbursals in FY17 due to overleverage of the borrowers in many districts, when peers were entering aggressively

- Tamilnadu - Since state has higher microfinance penetration, SSFL did not have MFI portfolio and only has secured portfolio is TN.

- Assam - Spandana was conscious of too many MFIs entering the state, and the resultant high per-borrower loan amounts

- West Bengal - Spandana tested the market, but quickly understood that borrowers were highly over-leveraged and hence pulled back significantly and reducing the portfolio from a peak of 3% of AUM to the current 0.5% of AUM

Shareholding structure:

- Nearly 93.36% of the entire company shareholding was held by promotors, institutional investors. This shows the greater confidence in the company.

Pros:

- Company growing book rapidly in previous years and also disbursements are higher in covid times also.

- High capital adequacy ratio

- Low opex

- Better asset quality than industry average

- Absence in some troubled states.

Key Risks:

- Company will have to make provisions in future quarters also to writeoff NPAs

- Employee reviews in glassdoor and ambitionbox are terrible

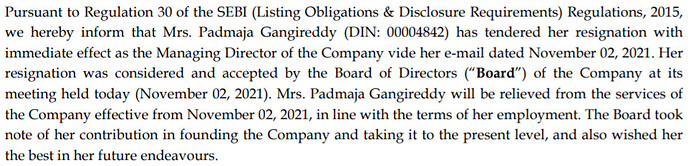

- Every activities are managed by Ms. Padmaja Reddy itself, not a professionally managed company

- Comparing with standalone CreditAccess for branch numbers and AUM per employee metrics, CAGL is best in terms of numbers but Spandana got superior Opex, due to lower employee and other expenses. This can be both positive and negative

Disclaimer: Invested. All details are taken from company website, annual report and quarterly investor presentation.