Introduction to Indian Hospitality Sector

Hi Vp’s inviting your views and critical examination of the sector

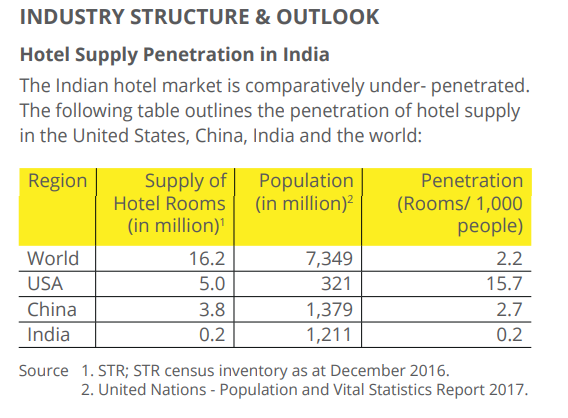

The Indian Hospitality Sector is witnessing one of its rare sustained growth trends. Hotel industry is inextricable linked to the tourism industry and the growth in the Indian tourism industry has fuelled the growth of Indian Hotel Industry.

A major reason for the demand for hotel rooms is the underlying boom in the economy, particularly the growth in the information technology enabled services and information technology industries. Rising stock indices and new business opportunities are also attracting foreign institutional investors, funds, equity and venture capitalist.

The financial year 2008 – 09 was an unforgettable one for the Indian tourism industry with the Mumbai terror attacks and the global economic downturn affecting the industry’s performance. The Hotel Industry, too, observed an overall decline in occupancy and revenue in most cities in India.

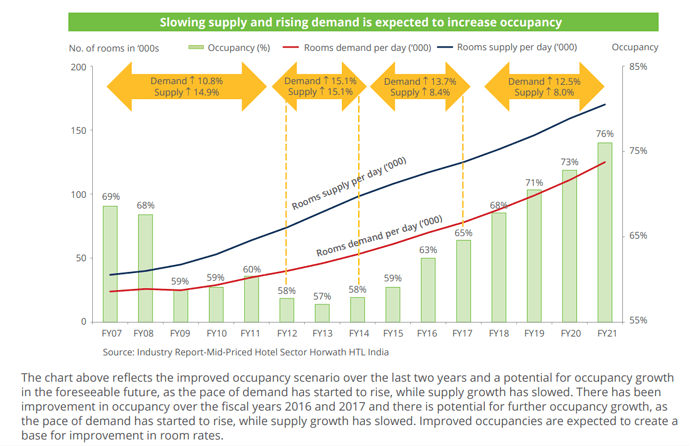

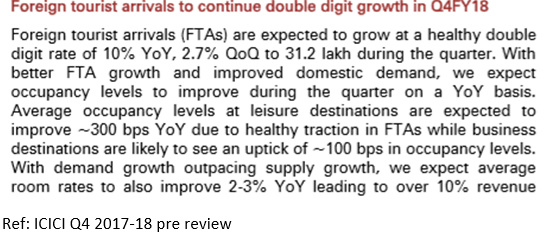

For the first time in a decade, occupancies at hotels have been higher than 65 per cent, and average room rates have grown by 8 per cent since 2008. In addition, supply is growing by 8 per cent but demand is growing at twice that rate, so occupancy is likely to grow even more, says Achin Khanna, managing partner (strategic advisory) at consulting firm Hotelivate.

Brands on play

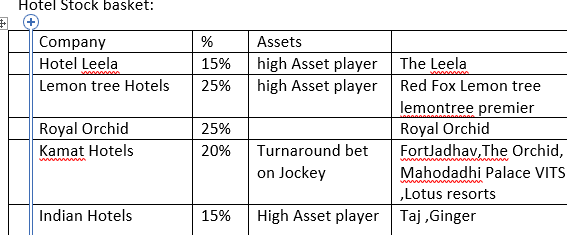

I am looking to invest taking basket apporach on

Market Dynamics:

Supply Growth : 3.2 % Demand Growth: 5.6%

Hotel sector performance indicators :

• Occupancy : increase from 62 to 64%

• Average room rate 5520 (Increase )

• REvRAR%: 3516 (Increase 4.1%) {RevPAR is a performance metric calculated by multiplying a hotel’s average daily room rate (ADR) by its occupancy levels}

Key Markets : Tier 1: Bangoluru ,Pune,Bombay Ne DElhi Kolkata

Tier 2 : Ahmedabad ,Jaipur Chandigarh Hydrabad Agra

My investment will be Total Porfolio allocation 15-20% to hotel sector out of this is subdivided in

Hotel Leela (20% Allocation ) :

It is among the high Asset player and expanding the capacity in the growth cities .The group is an award winning chain of premium 5 star luxury business and leisure hotels with multiple properties across India

Upcoming 5 hotels

• The Leela Gandhinagar Gujarat 300 room Spread across 34 acres, it is one of the biggest, state-of-art convention facilities in India, uniquely designed to combine a sense of aesthetics, functionality and flexibility. Already started India’s largest convection centre

• The Leela Palace Jaipur: Near the Amber fort on Delhi-Jaipur highway on 10 acres,

• The Leela Hyderabad: Spread over 2.5 acres, located in Banjara Hills.

• The Leela Hotel and Residences Bhartiya City Bengaluru : Will Be located on 126 acres of vast green landscape. Strategically located, the hotel will be about a 25-minute drive from the International Airport and less than a 30-minute drive from MG Road.

• The Leela Palace Agra: All 140 rooms enjoy the view of the magnificent and historical Taj Mahal Agra Airport is about 12.5 Km from city center.

Lemon tree Hotels (25%) :

It operated 4,697 rooms in 45 hotels across 28 cities in India as of January 31, 2018.

Brands - Lemon Tree Premier, Lemon Tree Hotels, Red Fox

These hotels are located across India in metro regions, including the NCR, Bengaluru, Hyderabad and Chennai, as well as tier-I and tier-II cities, such as Pune, Ahmadabad, Chandigarh, Jaipur, Indore and Aurangabad.

Mix model of operation: Direct ownership, Long-term lease or license arrangements for the land on which it constructs the hotels,Long-term leases for existing hotels which are owned by third parties, Operating and management agreements.

As of January 31, 2018, its portfolio consisted of 19 owned hotels, 3 owned hotels located on leased or licensed land, 5 leased hotels and 18 managed hotels.

Royal Orchid (25%):

Royal Orchid Hotels Ltd (ROHL) is a 31-year-old company which owns and operates hotels in India. It is promoted by Mr Chander Baljee, who is a IIM Ahmedabad alumnus with over 40 years of experience in the hotel industry. Key brands include Royal Orchid (five-star), Royal Orchid Central (four-star), Regenta Hotels (four-star), Royal Orchid Suites (service apartments) and Regenta Inn (budget hotel).

Statutory auditors are from “Big 4” Deloitte. Therefore, they have a sound accounting system.

Kamat Hotels (20%):

Investment in Kamat is more driven by the underlying turnaround story and management’s intent to clean up the financial mess so as to bring it back to the old glory presence at

The Room Mix and ARR can be found at http://res.cloudinary.com/simplotel/image/upload/v1516189958/khil/Khil_PPT___new_bgdj0z.pdf

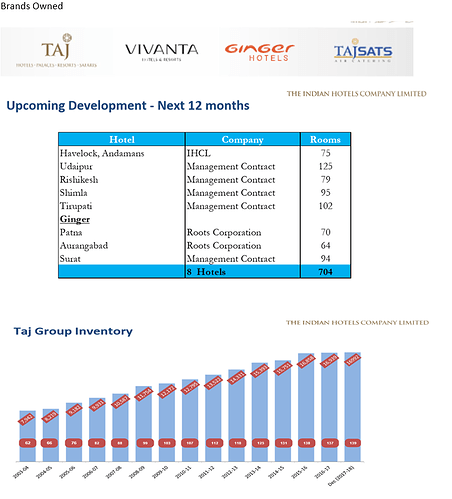

IHCL 15%

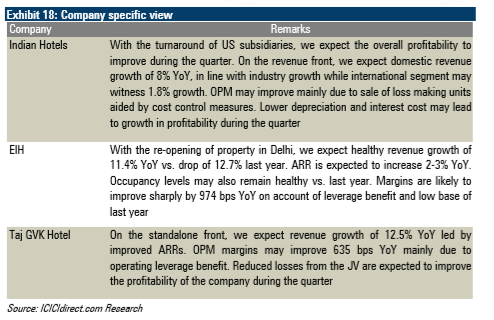

The Indian Hotels Company (IHCL) and its subsidiaries, collectively known as Taj Group. Taj Group comprises 108 hotels in 63 locations, including 25 Ginger hotels across India, with an additional 17 international hotels in the Maldives, Malaysia, Australia, UK, US, Bhutan, Sri Lanka, Africa and the Middle East . Turnaround of US subsidiary. Margins will improve due to sale of loss making facility and cost cut measures

Source: https://www.tajhotels.com/content/dam/thrp/financial-report/analyst-meet/2017/The%20Indian%20Hotels%20Company%20Limited%20(IHCL)/IHCL_Financials_Results_Update_9M17-18.pdf

Source: The Indian Hotels Company | Business | Tata group

Industry Views:

As per Mr Arif Patel, VP Sales, Marketing, Distribution & Loyalty, AccorHotels, highlights the growth in the hospitality sector : “Data trends, domestic aviation growth, e-visa, we have reached the highest level of occupancies in last 10 years. 68 per cent occupancy are seen in the hotels that are ramping up overall occupancy and airline passenger traffic are increasing; would you say that the sector is now poised for a turnaround “

Bullish rational

The tourism sector is looking forward to the expansion of e-visa scheme, which is expected to double the tourist footfall in India

The central government has contributed significantly to the development and growth of the sector by providing various tax incentives, policy measures and other various supports. Some of the government steps include making medical visas available for tourists

The sector had been under pressure and into a near-debt trap after the global economic recession in FY09. The tourism and hospitality sector in India accounts for 9.6 per cent of GDP.

Better growth is expected to the leisure destinations than the business destinations in next two quarters 2018-19 Q1 and Q2

New momentum in national highway infrastructure such as Bharatmala, the regional connectivity scheme to connect remote India by air under the Ude Desh ka Aam Nagrik (UDAN) scheme and initiatives to improve cruise tourism infrastructure, growth in the hotel sector is expected to take off in a big way

Bear in mind the associated general risks

Lack of revival in domestic growth can hinder growth. Increase in supply through formal or informal channels (like Airbnb, oyo rooms etc) can keep a lid on ARRs. Any geopolitical incident can severely impact foreign tourist inflow. Large and foreign brands coming into India can provide stiff competition.

Hotel’s strategic location geographical regions and any adverse developments on such hotels or regions could have an adverse effect on business.

Hotel Business is subject to seasonal and cyclical variations that could result in fluctuations in results of operations.

Hotel industry is exposed to a variety of risks associated with safety, security and crisis management, customer litigation

Hotel industry got a significant portion of its revenue from corporate customers, and the loss of such customers, could adversely affect businesses.

Hotel industry is subject to extensive government regulation with respect to safety, health, environmental and labour laws. Any non-compliance with or changes in regulations may adversely affect business.

Web links and report to read:

Horwath report https://www.hospitalitynet.org/file/152008349.pdf

Regards

Disc: Holding Lemon Hotel portfolio 4% as intial bet .Inviting opposing views which can negate my rartional of investment in the sector .This is not any investment proposal or advice .One an study carefully before investing

And the full impact of upswing in profitability due to tailwinds for the sector have not borne fruit. I have an indirect expsoure to the sector through tourism finance corporation ltd TFCIL which is lender mainly to hospitality sector and which has undergone a management change from govt owned IFCI to private players viz. SSG group. You can go through an HDFC initiating coverage report on the company if you wish to pursue it.

And the full impact of upswing in profitability due to tailwinds for the sector have not borne fruit. I have an indirect expsoure to the sector through tourism finance corporation ltd TFCIL which is lender mainly to hospitality sector and which has undergone a management change from govt owned IFCI to private players viz. SSG group. You can go through an HDFC initiating coverage report on the company if you wish to pursue it.