Introduction

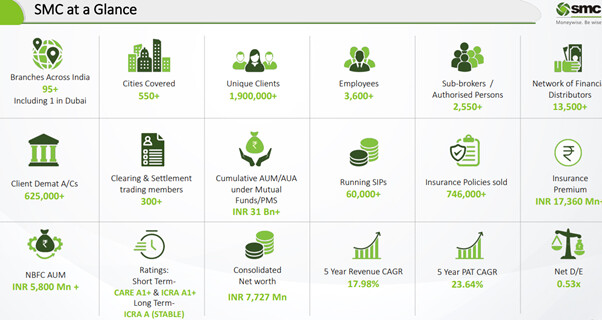

Established in 1990, SMC is a well-diversified financial services company in India offering services across brokerage (across the asset classes of Equities, Commodities and Currency), Investment Banking, Wealth Management, Distribution of Third Party Financial Products, Research, Financing, Depository Services, Insurance Broking, Clearing Services and Real Estate Advisory Services to Corporate, Institutional, HNI, Ultra-HNI and other Retail Clients.

• Market Cap₹ 853 Cr.

• Current Price₹ 75.4 ( Face Value Rs 2/- )

• 52 week High / Low₹ 110 / 65.0

As one of the financial institutions in India in the broking and financial products distribution segment, SMC believe that SMC’s ability to identify emerging trends in the Indian capital markets sector and creating business lines and service offerings around them, has given it a competitive edge over other participants in the industry. Company believe the wide range of products and services that enables it to build stronger relationships with it’s clients and cross sell its products.

- SMC service our clients through a network of 98 branches including overseas office at Dubai

- More than 2,500+ Authorized Persons with PAN India presence in over 500+ cities

- 18 Lac+ unique clients.

- It has 3000+ work force to support our associates.

- SMC also provide clearing settlement services to 290+ Trading Members.

- Additionally, to support our distribution of third party financial products, SMC have more than 24,000+ Registered Associates/Service Providers who are engaged with SMC on a non-exclusive basis under SMC’s banner.

infographics

SERVICES OFFERED -

Broking:

Trading in Equities, Derivatives, Commodities, Currency, Debt & Securities Lending and Borrowing (SLB) • Depository in Equity & Commodity – NSDL, CDSL, COMTRACK & COMRIS

Distribution:

IPOs, Mutual Funds, Bonds, Fixed Deposits

Insurance - Life & General (Through SMC POS in all major insurance Companies).

Debt Segment – Retail Bond, G-Sec Bonds, NPS

Advisory:

Investment banking - IPO, FPO

Mergers & Acquisitions, Private Equity

Term Loan, Bond Issuance

Debt Restructuring, Rights, QIPs, etc

Wealth Management:

Portfolio Management – Moderate, Aggressive, Conservative & Growth

Multi Manager Investment Solutions, Structured Products (SMC Pie)

Real Estate Solutions –Commercial & Residential (Domestic & International)

Private Equity, Portfolio Advisory, Financial Planning

Arbitrage & Hedging

Financing:

Margin Funding facility available through our own NBFC

Funding also available for Retail & HNI clients in ETF, OFS, IPO, Bonds, Buy Back etc • Loan against shares (LAS),

Retail IPO financing

General Funding

Home Loan

Mortgage Loan (Loan against Property)

Unsecured loan (Personal Loan)

Other Specialized Services:

Institutional Broking, Research, NRI & FPI Services

Clearing Services

Fixed Investment Desk

Trading & Clearing in DGCX

Negatives

• it has inherent negatives of capita markets such as volatility in earnings and thin broking margins .

• Deterioration in asset quality at NBFC level or credit losses in the broking segment thereby impacting the profitability and capitalization levels.

• Nearly 27% of the portfolio entails loans of ticket size more than Rs.5 crore. The Top 10 borrowers constituted 19% of the loan book as on Dec-20 improved from 27% of the loan book as on Dec-19.

Some positives

• Company has delivered good profit growth of 23.81% CAGR over last 5 years

• Company has been maintaining a healthy dividend pay-out of 27.73% as per policy it is 30%)

• Debtor days have improved from 207.98 to 117.34 days

• Cash sitting in book as on march 2021 is 1093 Crs ( more than market cap )

• No DII and no FII high promoter holding 62.33%.

• SMC launched its discount broking arm in 2019 under the brand name of Stoxkart which is the first of its kind placed on in the broking industry with investments of 10 crores

• Strong technical background of promoters The group is promoted by first generation entrepreneurs, Mr. Subhash C. Aggarwal (Chairman and MD) and Mr. Mahesh C. Gupta (Vice-Chairman and MD). Both the promoters are Chartered Accountant by qualification and have more than 35 years of diverse experience in financial services and securities market.

• Strategic partnerships including being the preferred insurance broker for Honda cars under Honda Assure, for KIA cars with KIA motors, preferred broker for PNB providing trading facilities and demit services.

• Recently The company entered into new banking tie-up with Dhanlaxmi Bank as an execution partner for broking services

Concall august 22 link https://www.bseindia.com/xml-data/corpfiling/AttachLive/b7b53245-3c13-4b0c-b5f2-dd709f1ca3db.pdf

Earning presentation:

https://www.bseindia.com/xml-data/corpfiling/AttachHis/b74659e3-1783-42ba-b7ec-ad49744dc6e1.pdf

TRIGGER ; Currently less than 3% Indian invest in capital markets so bet is on growth of india and inflation is higher than the saving account interest . Tech savvy generation are more informed and take quick action regard to their own saved money. it can be given long rope for wealth creation …

Disc: invested , i am not any SEBI approved broker or consultant one may study or consult registered broker before investment . this is not any buy sell or hold recommendation