Thanks for sharing.

On JK Paper - how do you feel about its recent acquisition in animal nutrition space, which is totally unrelated to its core business?

I don’t think diversification into unrelated areas is cause of concern especially when prudently done. Paper business is self sustaining and what they did with this Vet health business acquisition seems interesting on paper atleast. Below are KPIs of the business. It remains to be seen how this business evolves in future though. I will wait for some time before forming judgement on it for now.

Reading annual reports and listening to management over concalls gives me some hint that they do think carefully about capital allocation, so I have some comfort in my head that they wont screw up so easily but lets see.

Over the past year, while the NIFTY 50 and BSE 500 have largely moved sideways, the market beneath the surface told a very different story. Some stocks delivered supernormal returns, turning into big winners, while others suffered steep drawdowns.

In this post, we’ll explore what truly drove performance during this period, the common traits behind the winners and laggards, and most importantly what lessons investors can carry forward into future bear or flat markets.

Variant Perception Capital is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

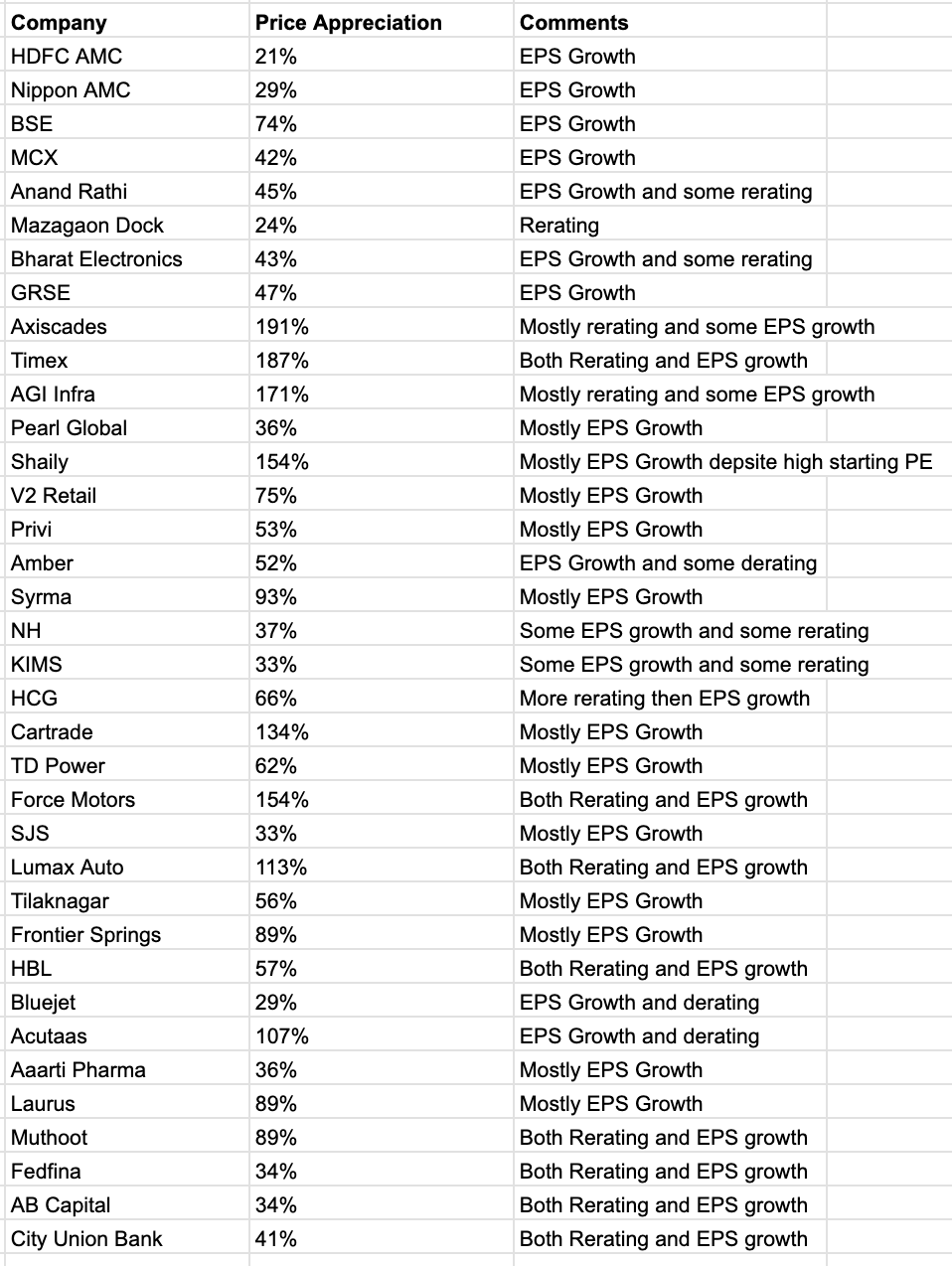

One-Year Winners: What Drove Share Price Appreciation

Over the past year, several companies delivered exceptional share price performance , some even turning multibaggers.

Names like Axiscades, AGI Infra, Timex, Shaily Engineering, Lumax Auto, Force Motors, and Acutaas Chemicals stood out with extraordinary gains.

Others such as TD Power, BSE, Muthoot Finance were strong winners, while HDFC AMC, Nippon AMC continued their steady compounding journey.

An obvious pattern emerges, none of these outperformers reported earnings decline during the year.

In fact, most posted blockbuster results across multiple quarters, which directly fuelled their price rallies.

How Earnings Growth Propelled Share Prices

- Asset managers (AMCs) defied the capital markets drawdown by consistently growing earnings. The market rewarded them broadly in line with their EPS growth. The rerating was missing in most cases, because there was no capital markets fillip.

- Blue Jet, despite intra-year volatility, ended up ~29% higher, thanks to strong earnings momentum earlier in the year.

- TD Power Systems’s rise was almost entirely earnings-driven.

- Privi Speciality stood out in a weak chemical sector purely due to resilient EPS growth.

- In some cases, sectoral tailwinds supported even moderate earnings growers, while strong earnings growth led to rerating in others.

- Axiscades, up nearly 200%, benefited equally from EPS growth and valuation expansion.

- Mazagon Dock outperformed the market despite a slowdown in earnings indicating lingering optimism and sectoral strength.

- Even in “cold” sectors like financials, Muthoot Finance and Fedfina thrived as rising gold prices and favorable macro themes played in their favor.

The Discovery Element

Stocks like Timex, Force Motors, AGI Infra, and Lumax Auto had a discovery angle, where earnings acceleration met low starting valuations that didn’t price in such strong growth.

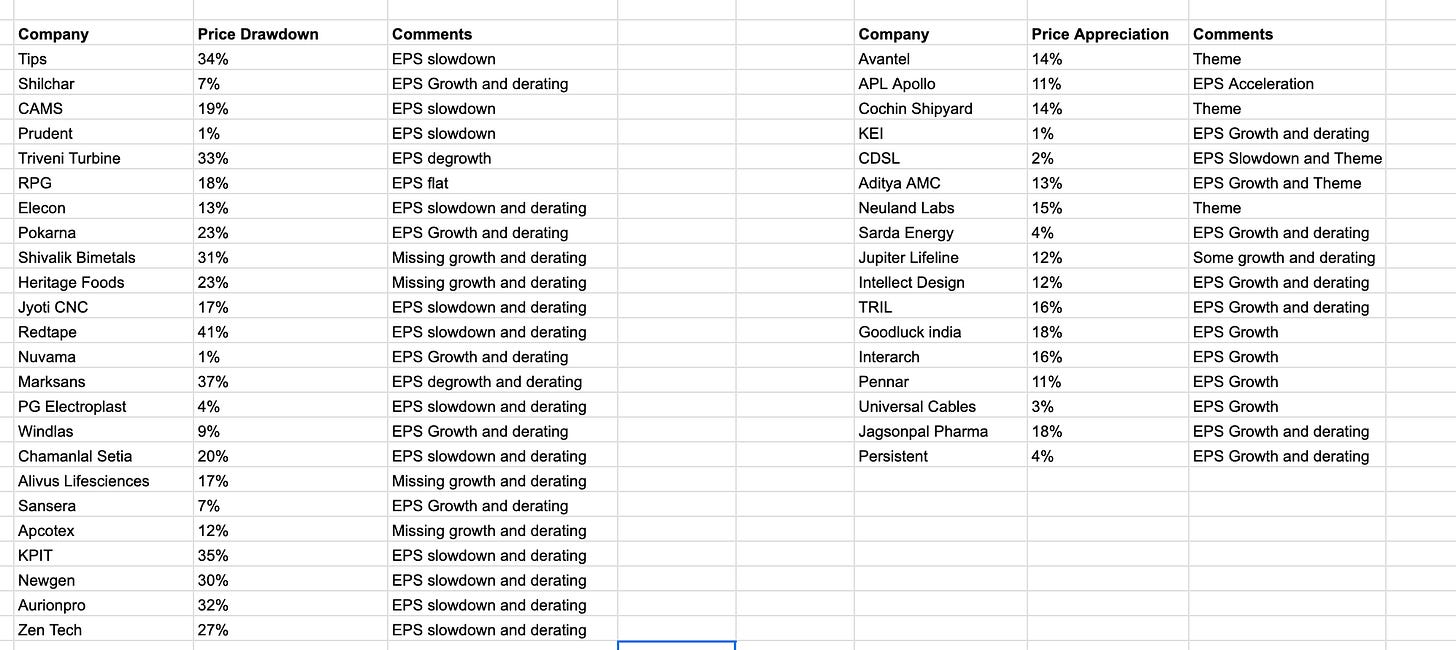

The Other Side: Modest or Negative Price Performance

Now lets look at companies where there was significant drawdown or price appreciation was modest.

Companies with modest gains generally either had:

- A supportive theme but limited EPS growth, or

- Reasonable to good earnings growth but valuation derating by the market.

Meanwhile, those that declined saw clear earnings slowdown or de-growth, often accompanied by multiple compression.

Exceptions such as Pokarna, Sansera, Windlas, and Nuvama faced temporary headwinds (like tariff issues or short-term disruptions), not structural deterioration.

Summary

Earnings growth is the ultimate driver.

If a company in your portfolio delivers good enough earnings growth, it can not only hold up well in volatile or flat markets but also turn into a multibagger over time.

Valuations matter, but context matters more.

- Low starting valuations create room for re-rating, especially in under-discovered companies where the market hasn’t priced in strong growth. Take AGI Infra or Lumax Auto or Force Motors as last 1 year’s example

- High valuations aren’t inherently bad, as long as there’s commensurate growth to justify them. Think of names like Amber, Shaily, MCX, or Acutaas, where premium multiples were backed by robust earnings momentum.

Earnings slowdown or de-growth is a red flag.

When earnings momentum weakens, it’s often best to trim or exit positions, regardless of how “cheap” the stock may appear. Markets tend to derate such stories quickly.

Top-down investing improves odds.

Analyzing from a thematic or sectoral lens helps you avoid duds. Sectors enjoying structural tailwinds make it easier for most players to grow, as demand naturally flows toward them. Similar point was said by Mr. Madhu Kela in recent TV interview.

The magic happens when three forces align - theme, valuations, and earnings growth.

That’s your ideal multibagger setup. Even having two out of these three, say, a strong theme with earnings growth, or low valuations with earnings growth, can still produce exceptional results.

Bottom-up investing works too, but it demands selectivity. You either need:

- Low starting valuations (e.g., AGI Infra, Lumax Auto), or

- A theme in transition - one that moves from bad → better → good → great.

- Potential future opportunities could lie in tariff-related plays or select financial subsectors, though caution is warranted. Structural headwinds in such areas can delay profitability until conditions normalize.

Hence,

Markets may appear directionless at the index level, but alpha always hides beneath the averages. Recognizing patterns of earnings acceleration, thematic tailwinds, and valuation gaps early and avoiding stories with slowing momentum is how one can not only survive but thrive even in flat or bearish markets.

Utimately, pattern recognition and applying it with discipline is what separates mediocre returns from good ones.

I share more of my writings here https://variantperceptions.substack.com/