(Disc: I am not a SEBI registered analyst. These are my personal opinions and should not be considered investment advice. Please consult a registered investment advisor for investment decisions. As of publishing this article i am personally invested in Silkflex Polymers (India) ltd as a shareholder)

Investment Thesis

The market still views Silkflex Polymers as a trading company, while it is transitioning into a manufacturing-led, higher-margin business with full technology ownership.

- Historical financials reflect a trading model, not manufacturing economics

- Manufacturing capacity has only recently come online and is not yet reflected in margins

- SME stocks often remain under-researched and under-followed with only 407 shareholders as of September 2025.

Introduction

Incorporated in 2016 and having a relatively shorter stint as a company, Silkflex Polymers (India) ltd is in the trading of the textile printing inks and water-based wood coating polymers products of a Malaysian based brand - “Silkflex” produced by Silkflex Polymers SDN BHD (“Silkflex Malaysia”). It has five offices all over India and has recently commenced its manufacturing facility in Vadodara.

At first glance it simply looks like a trading company that imports from Malaysia and sells in India with the only caveat being that they have a license to sell Silkflex products in India. However there is hidden value in this stock which the market is not discounting yet.

Understanding the Value chain, the products and the business

This is the value chain analysis of water based textile inks

- Raw material suppliers - Raw material suppliers are the weakest layers when we try to analyze the value chain because they operate in a commoditized segment where the margins are the weakest. Products include pigments, binders, additives and speciality chemicals. BASF is a classic example of this

- IP Owner - You can make big money when you own some kind of an IP. IP owners help in formulating and performing R&D. They do all the scientific work and therefore are the biggest winners of the value chain. They help maintaining brand trust and the compliance. Key players include Silkflex ( Note not Silkflex India but Silkflex the global entity)

- Master Distributors - These are third in the value chain who hold exclusive licenses and rights for distributing products. All IP related products are routed through them in the country and therefore gain significant value without doing much of the grunt work. Although risk lies in cancelling of the license.

- Regional Distributors - They have regional reach and are responsible for regional sales and on site troubleshooting. There is not much of a value created in this space as margins and credit terms are tight for smaller players.

- Garment Printers - They take part in the critical adoption layer and are responsible for process integration like ( curling,mesh and drying). Shahi exports’s printing division is a good example of this.

- Garment Manufacturers - They are responsible for converting printed fabric into finished apparel. Usually a very competitive and commoditized space with less to no margins. They supply to global brands.

- Global Apparel Brands - They are the demand drivers and are responsible to push water based inks down the value chain. They dictate standards. Brands like Nike, Adidas, and H&M are classic examples here.

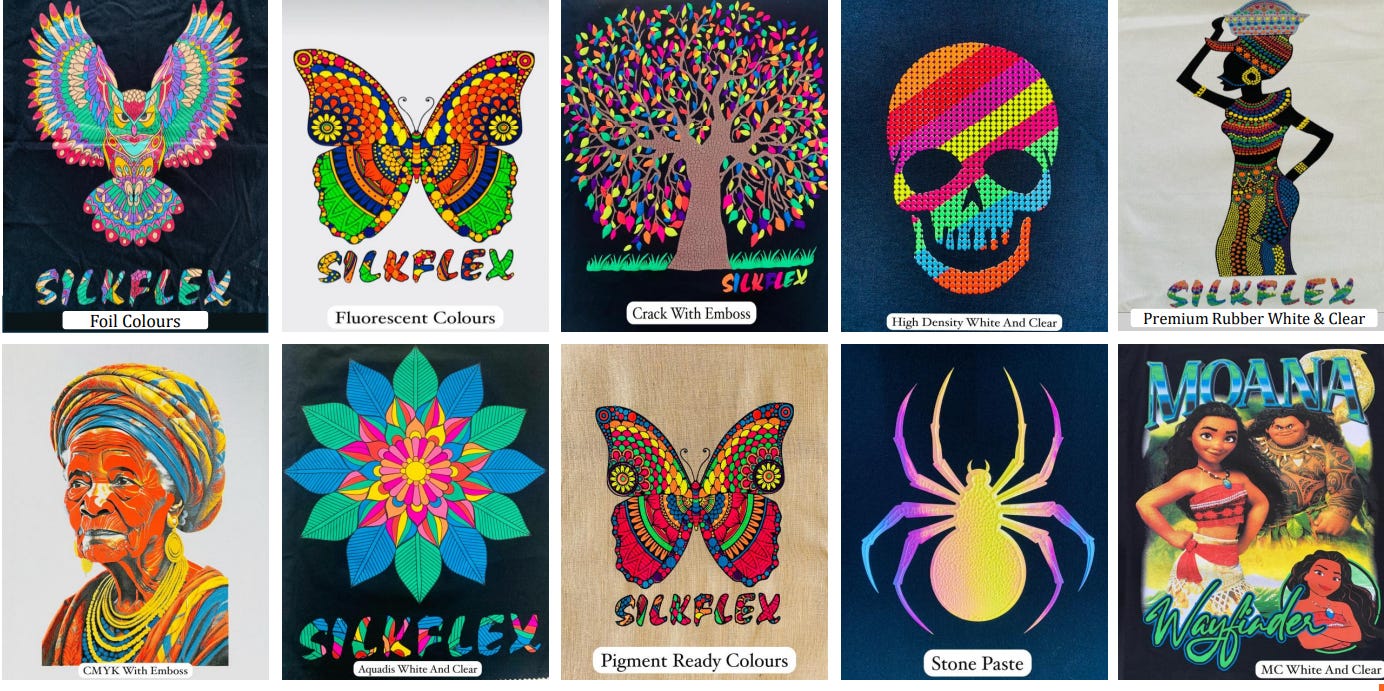

Products

They broadly supply two products

- Textile Inks - They provide eco based inks that replace traditional toxic mechanism in textile inks. They are primarily water based inks which have soft, absorbed finish and give a more natural look when compared to traditional textiles. In textile inks they also provide glues, screen coating, special effects, additives and colour.

- Wood coatings - These are premium wood coatings, usually water-based, made with advanced polymer technology for eco-friendly, durable finishes that can replace traditional solvent-based lacquers. They are used for furniture finishing, interior woodwork and special effects.

Products make from water based textile inks

Investment thesis

- Shifting from a trading based to manufacturing based company - Silkflex India was primarily a trading company where the only IP they had was having a license to distribute the products of Silkflex Malaysia in India. With the Make in India initiative, they are now transitioning into a manufacturer thereby having more control on costs, quality and the process. The state of the art manufacturing facility is located in Vadodara, Gujarat. The production capacity is 500 tons per month. Initially they will operate it at 250 tons per month and later would increase it phase wise. Initially production will be of two flagship products the silkbond 35 binder and the silkflex glue. Once the manufacturing comes into play the EBITDA margins are expected to increase to 24-25% from the current 15% thereby adding significant value.

- Complete Tech Transfer - Silkflex India has paid near about USD 6M in 2023 to Silkflex Malaysia. It is a perpetual agreement with no expiration and no royalty. The agreement states complete tech transfer and know how from Silkflex Malaysia to Silkflex India which prevents future tech related litigation issues.

- Reputed Client base -The company caters to premium suppliers like PUMA, H&M and Levi Strauss and Co cementing its value add to top global apparel manufacturers. This shows that they adhere to strict quality standards.

Risks

- Criminal disputes - The promoter of the Company is involved in ongoing legal disputes with Silkflex Trexim Pvt. Ltd., which is a separate company and not part of the Company’s business. These disputes arise from past business relationships and relate to allegations made for the period 2015–16. One case is still under court proceedings, while in another case the police have treated the matter as a business dispute rather than a criminal offence. There has been no conclusion or finding of wrongdoing so far, and the Company itself is not involved in these cases. However, if the outcome is unfavourable, it could affect the reputation of the Company.

- Customer concentration and supplier dependency - No surprises that most of the products purchased are from Silkflex Malaysia therefore there is a high supplier dependency. They have mitigated it by started their own production process and will now procure some material domestically . Customer concentration is around 80% which is on the higher side. Company is actively trying to diversify its customer base to avoid high dependency.

- IPR Infringement - The promoter had applied the trademark Silkflex in his personal name which has been opposed by berger paints both in years 2018 and 2021. The case is pending but Berger may take the matter to court and therefore Silkflex India may lose the rights to the trade mark thereby affecting the business and the reputation.

- SME Stock - Silkflex Polymers is a SME stock and therefore has liquidity risks and information risks. It is therefore advised to trade with caution considering there are less disclosures required by SME companies

Financials

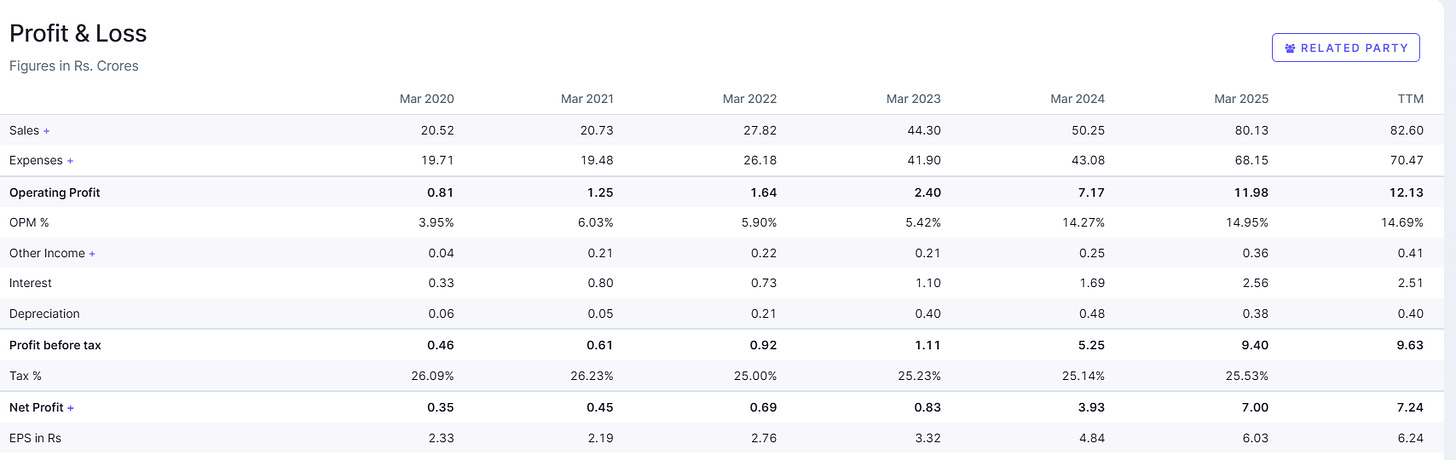

Sales grew rapidly from March 2024 to March 2025, primarily due to increased working capital availability. EBITDA margins were more and less similar but pretty high for a trading company. Interest cost increased by 50% primarily due to capex related loans. Tax rate seems normal. An important question is “Are the margins sustainable ?”. EBITDA margins before the IPO were hovering from 3-5% and after IPO have increased significantly to 14-15%. Is this IPO window dressing or the margins have increased due to fluctuations in raw material prices. Management has guided the margins to be sustainable and have guided a further increase in margins from 12-15% to 24% which seems excessive for a small sized player in a hyper competitive industry operating in a fragmented market.

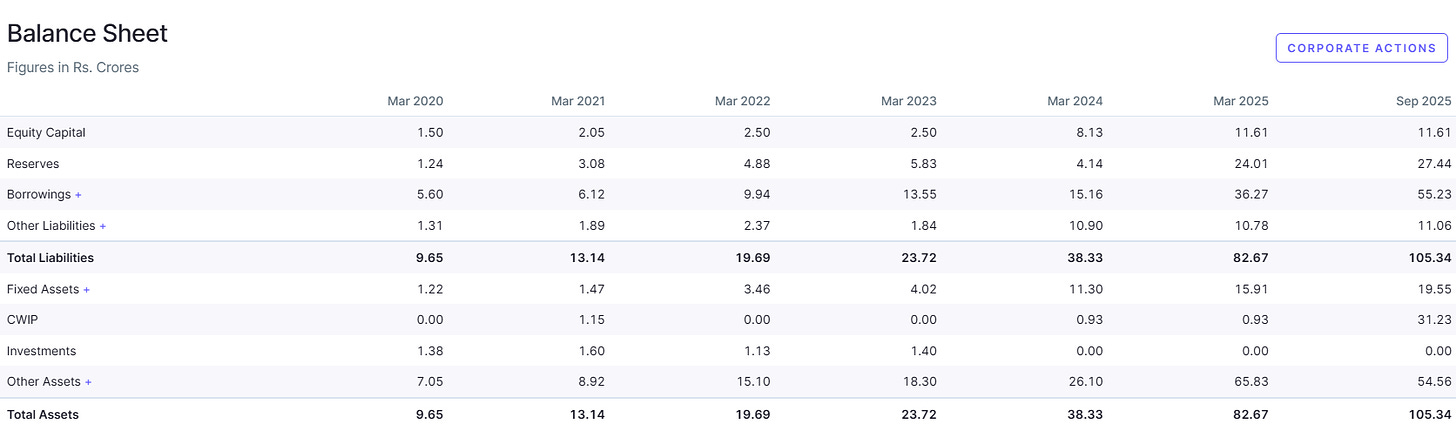

Balance sheet has seen a rapid growth from FY2023 to FY2025. Major increase in borrowings due to capex of the new factory in Vadodara. Around 40-50 crores are to be spent out of which 30 crore is from bank loans, 7-8 crores from IPO funds and rest from internal accruals. If we talk about leverage, it seems to be under control. Due to government subsidies and low cost debt there is not much pressure on the PNL and the leverage seems pretty normal here.

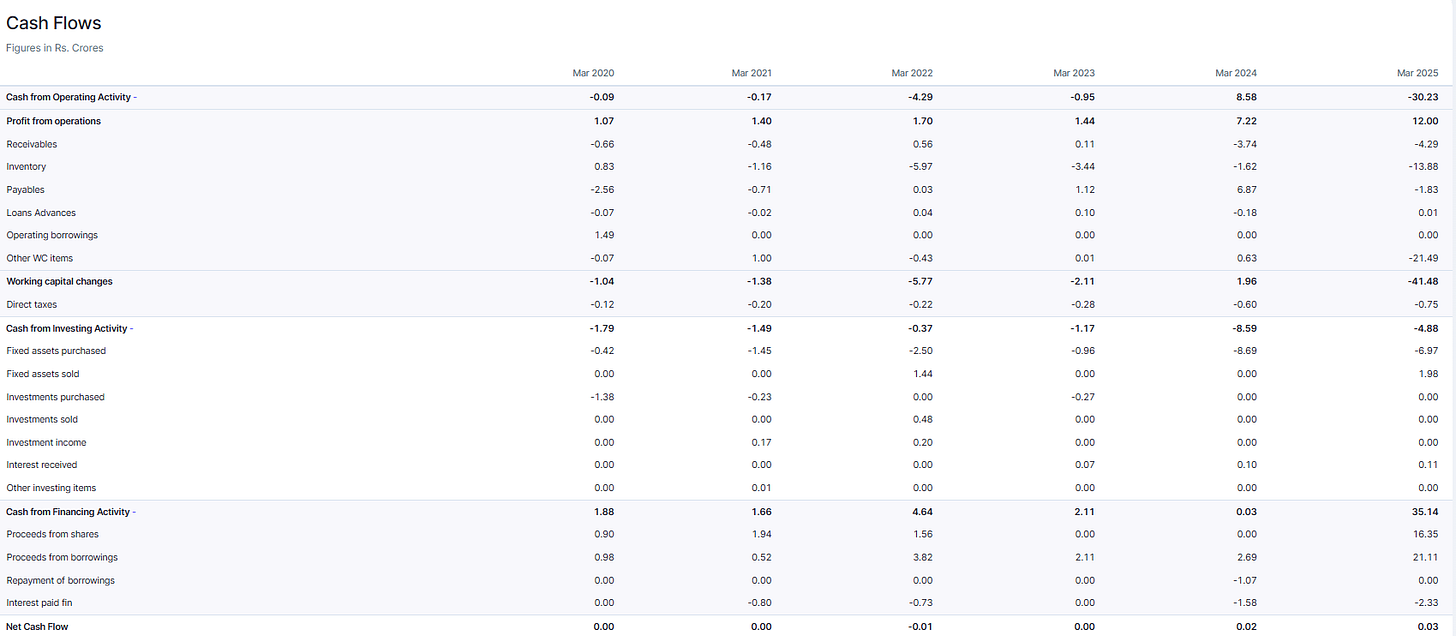

FY2025 cash flow from operations is negative due to inventory on the books. There has been some expenditure on fixes assets which are related to land purchased. Cash flow from financing includes 16 crore raised from the IPO and 21 crores raised as bank debt in FY2025.

Peer Analysis

As stated company operates into two different product segments and therefore faces heavy competition from big players like BASF in the textile ink segments. BASF is trading at 40x PE and is not comparable to an apples to apples basis as it also operates into different segments like the Material segment, the nutritional segment and the chemicals segment. In south, domestic unlisted players include GlobalINK and DCC .

For wood coating segments they face competition from players like Asian paints and Berger paints and from foreign players like PCG and ICA.

Promoter background and related party transactions

The company is promoter by Mr Tushar Sanghavi who is 58 years old and has completed his B.Sc degree from M.G Science Institute, Ahmedabad. He has an experience of over 20 years in the textile inks segment. He is responsible for the expansion and overall management of the business.

Ms Urmi mehta aged 27 years is the CFO of the company. She has completed her B.Com from St Xaviers College in the year 2017. She has an experience of 5 years with the company and looks after the overall accounts and finance functions of the company.

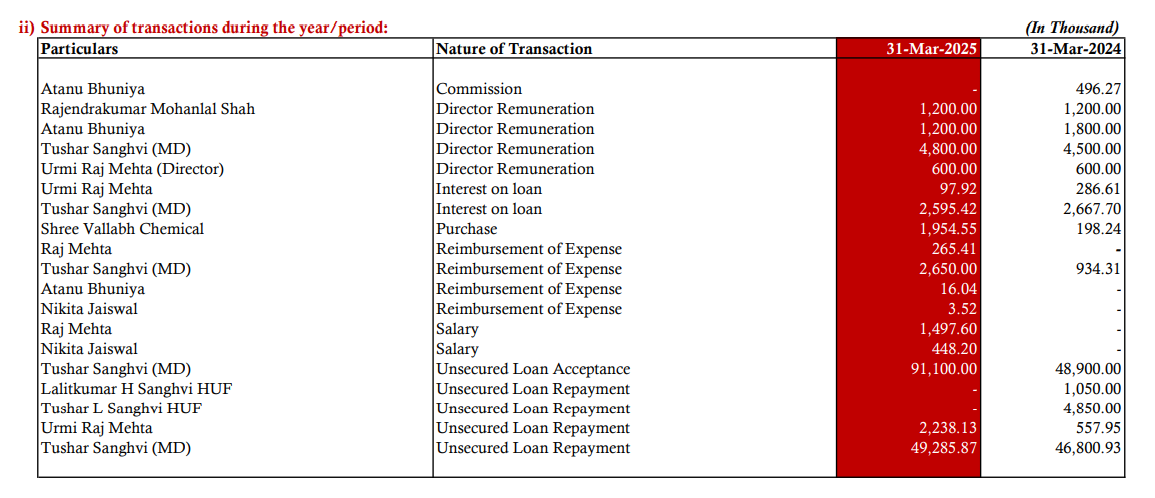

Related party transactions look mostly in control with sales and purchase being a very small amount of related party transactions. Salaries are pretty much in line and are not too high.

Valuations

With the new manufacturing capacity coming into play, there is an expectation of a sharp increase in revenue. Management has guided an increase of 40-50% in revenue. The business is slightly H2 heavy than H1. We can expect a profit of 10 crores for FY26, 13 for FY 27 and 16 for FY28 as per management guidance.

It is difficult to give it a PE of 40x as BASF as they are not comparables. However given the scale and the shift from soluble based textile inks to water based inks and the commencement of the new facility in November 2025 and considering the risks related to litigation and competition, a fair valuation of the company should be in the range of 230-250 cr. This is considering all negatives and positives as per current situation. This is not a pricing target but my justification regarding valuations. I may be wrong.

Conclusion

Overall Silkflex seems to be at an inflection point considering their capex plans and dealings in high margin products. Investors should watch for management guidance and raw material prices to avoid margin fluctuations.

(Disc: I am not a SEBI registered analyst. These are my personal opinions and should not be considered investment advice. Please consult a registered investment advisor for investment decisions. As of publishing this article i am personally invested in Silkflex Polymers (India) ltd as a shareholder)