Replacing higher management with their own management is not exceptional in merger and takeover. The new managements wants their people at the key positions.

However, CEO resignation earlier and now CFO resignation in quick succession does not auger well in the short term.

2 Likes

Whenever the top guy leaves, especially a long tenure CEO, expect others in the senior leadership team to leave. This may not be the last, we could expect more. This is quite common in companies which are not promoter driven and very common in the US/Europe

Whether it is good or bad for the company, is a different point and remains to be seen

18 Likes

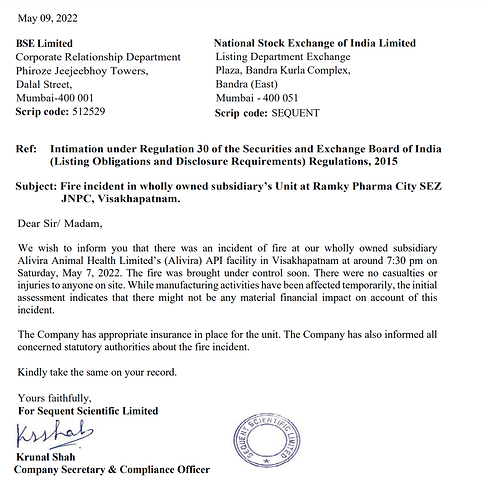

Fire accident reported a week ago at one of the API manufacturing facilities.

1 Like

With these numbers, Sequent’s valuation deserves to be even lower IMO.

I was left flabbergasted by how much my understanding was wrong about this business.

Management clearly indicated that it is out & out generic business (LFL commodity) , the ability to pass price rates even partially is a struggle.

Was all that Branded generic stuff just an illusion. But how can they have 40% gross margins entirely due to commodities. But operating and net profit margins of 8% do confirm the same.

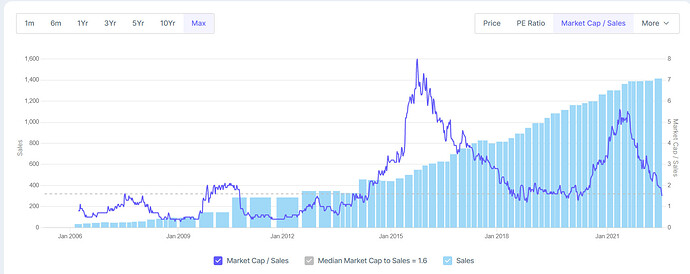

Disc: Invested since 210 levels. Not regretting but I did commit a mistake buying it at the mcap/sales I had entered here.

Update: after Q4FY22 concall, I truly am regretting and will definitely be learning from this. Hopefully, I will be able to avoid failures like this in future. Doesn’t deserve > 1.2 ~ 1.4 market cap times sales.

It’s a small portfolio quantity so not something I will lose sleep over but capital preservation is my first and most basic principle, hence the regret.

Currently have no choice but to basically sit back and trust the new mgmt to bring us back to top of circle numbers, steadily it maybe and slowly build conviction on the business based on them walking the talk. Re-acheiving Fy21 numbers is not a possibility at least in medium term.

Above are personal views. Your own due diligence is appreciated.

11 Likes

stock has bottomed out market has all ready discounted it, what ever worst can happen it happened with this stock, only Latam & India part played will, Turkey is in worst shape, Germany approval is pending , API is not working currently even human API is worst performing not for other co’s, But one thing is good that they have established S&D network through inorganic route which will eventually work out in future, Estd a brand Alivera , if

CDMO traction happened to India only player to avail bcoz of USFDA approved , I believe Carlyle can buy on these valuation as well, consolidation will be for another year for sure,

10 Likes

Key question for me regarding Sequent:

How commoditized is Sequent’s product portfolio?

Gross margins have contracted 500bps YoY. That’s a lot of contraction compared to other API players such as Laurus (Flat), Neulands (110 bps contraction), Divi’s (100 bps expansion). I understand the other companies have some CDMO components but the broad directional point stands.

New CEO’s comments in yesterday’s concall were revealing - his effective understanding is that although Sequent calls itself “branded generic”, distribution led animal pharma is mostly commoditized with low pricing power. He said Sequent will focus on transitioning to more specialty molecules and formats (injectables) where pricing power is higher. Not sure how much weight should be put on a newly appointed CEO’s words, but his comments are definitely a warning sign for me in terms of evaluating Sequent’s overall pricing power in the market.

If Sequent does not really command pricing power, then valued at its FY21 full year EPS of 3.84 also it may not really be cheap at current prices (28x PE).

Anybody bullish on Sequent in the near term should listen to yesterday’s concall. The sense I got from the new CEO was that a reset button is being pressed in terms of Sequent 2.0 strategies and speed of execution. The earlier strategy is being re-evaluated (Not in terms of planned capex but maybe in terms of molecules) and further committal steps will be taken cautiously.

Look forward to comments from folks bullish on Sequent at these levels from a 1-3 year POV.

15 Likes

Branded generic in human pharma actually means something. Not so sure about animal pharma.A small and rather simplistic view- those looking to self medicate for a fever will ask for a crocin or dolo at their local Pharmacy. Most people won’t buy paracetamol from an unknown drug maker even if it’s way cheaper but if you are rearing cattle and your so called branded generic is up 20% you are unlikely to care about your cattle’s preference. You want the cheaper version

16 Likes

I have seen those videos and watching the Twitter community but not from the army  , one thing is clear people hardly check the anti thesis points . comparing animal Pharma to fmcg products and comparing sequent to biggest competitor was the biggest mistake . I have seen same narrative by fund managers and couple of brokerages not sure whether everybody falls by the story or just fail to identify it .in last conference call new ceo clearly told there is nothing branded and all they do is in generic .Depreciation of Turkish lira was part of the anti thesis but nobody cared it much untill it shows up in results. When those videos surfaced p/e of a ‘commodity API’ company was above 50 and still people blindly buy ( me too). There is nothing wrong in selling out and move on when ur thesis is not working .

, one thing is clear people hardly check the anti thesis points . comparing animal Pharma to fmcg products and comparing sequent to biggest competitor was the biggest mistake . I have seen same narrative by fund managers and couple of brokerages not sure whether everybody falls by the story or just fail to identify it .in last conference call new ceo clearly told there is nothing branded and all they do is in generic .Depreciation of Turkish lira was part of the anti thesis but nobody cared it much untill it shows up in results. When those videos surfaced p/e of a ‘commodity API’ company was above 50 and still people blindly buy ( me too). There is nothing wrong in selling out and move on when ur thesis is not working .

10 Likes

Any stock spedific reason for todays fall?, couldn’t find anything in filings. 75% down from June 2021 top.

1 Like

Not a technicals guy but weak days like these(especially with what looks like tons of margin calls in smallcap space) there is tons of overhead supply(people who hold the stock from higher selling out, which is a lot of people in sequents case).

Stock is in a classical downtrend, for those of us who would like to buy the narrative of RM cooling off and picking up animal apis at a cyclical lows, I would wait for a base formation.

6 Likes

In my pov its the effect of many factors into play, which can be stated as follows,

-

Hyper inflation in Turkey - Now this reason is country specific. Of course it will have an impact on Sequent but will it be an effect which will cause long term degradation in fundamentals is doubtful.

-

Resignation of top level management - This was bound to happen due to change in management. When a big private equity firm enters into management they usually prefer to run business according to their plans and needs. Of course the resignation is something which initially reflects an image of loss of trust but the new management can be as efficient if not better.

-

Market Sentiment - This reason is quite out in the open. Bear Markets are brutal for stocks which even cast a doubt on the overall story. The above 2 points are the doubts due to which the markets have been delivering negative eulogies for Sequent.( I will still refrain from calling them “RED FLAGS”).

The above points are purely my pov. I might be highly optimistic or naive to have these understandings but for now this is how the overall picture seems to me. The watch is going to be long. I would be adding when the fundamentals look better or technical base seems to be made.

Disc. - Invested

4 Likes

If you heard the concall, the management clearly said they don’t have pricing power despite them being branded players, and their distributors/ consumers are price sensitive. In my opinion, this is a clear fundamental divergence to what the earlier narrative was. Add to this, your points, no wonder it’s facing drawdowns.

The story might change in a year but it’s not investable today due to the thesis being broken.

9 Likes

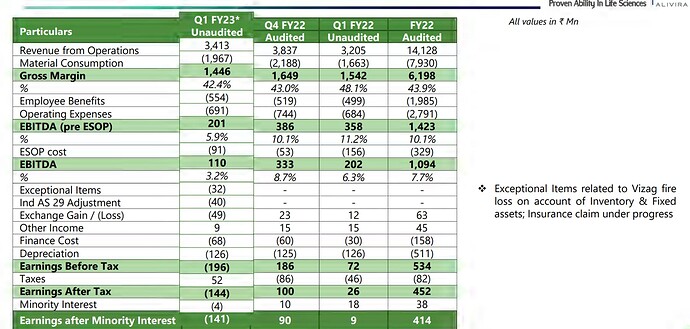

Costs, RM pressure, API De-growth. No signs of recovery in the business. Miserable results to say the least+A truly humbling moment for me in how wrong investments can go if exits aren’t made at the right time.

Disc:- Not invested, sold in FEB earlier this year.

A good case study in

Bent, Broken & Beyond Belief Posting here- I can come after few years to realise my own mistakes in judging the business direction, and be humble…

35 Likes

Ishmohit, Having followed this story for over a year (albeit not significantly invested at any point of time), this seems to me like a lesson in understanding true moats of a company on the basis of one’s own research rather than blindly believing in moats presented by Management or experts. Sometimes experts can go wrong and Management can paint an overly rosy picture.

The “thesis bent and broken” moment came for me in the last concall when the new MD said Sequest doesn’t command any significant brand power in the market. That came as a shocker.

Although I firmly believe every business can be bought at the right price and I think Sequent will also reach that price. Continue to track the story in order to figure out if they are capable of winning CDMO contracts in the future or how they execute wrt the Bremer capacity.

Circle of competence lessons learnt with this one and another IT stock recently.

23 Likes

Very very disappointing result, even worst part management don’t have any vision or plan to revive & simply skip question, with these kind of top line stock will reach 100+ PE which is really detrimental for it, another 50% down side is evident, no vision on CDMO, simply deals in commodity API, M&A in Brazil/ Spain/ Germany where production cost & employee cost will rise with inflation, So worst part is not over yet, this is for sure

3 Likes

Hi,

The stock is Tanla. You can read my thoughts on the Tanla thread on VP - Tanla Platforms ~ Leading player in the fast-growing CPaaS market - #198 by nirvana_laha

The general learning for me for both Sequent and Tanla has been to go deep into the business model and strive to understand how the business works. What I learnt was, when stocks have strong tailwinds and the stories around them are bullish (Tanla - Wisely launch & huge CPaaS runway; Sequent - Only Indian USFDA approved animal pharma company, plays in regulated markets, brand is a moat), its easy to keep holding the stocks based on these sentiments and experts’ views, without getting one’s hands dirty by looking under the hood of the business.

The conclusions for me are as follows :

-

If you don’t understand the business inside out i.e. you are sort of straying outside your circle of competence, then manage risk with position sizing. I let my position in Tanla become too big and failed to book significant profits when valuations were high. What had become 2x for me, came down to 0.7x.

-

In general, one should try to understand the businesses one owns in-depth, not just at a surface level. For e.g. the story around Wisely made me forget/ignore that Tanla still derives about 90%+ revenues from Enterprise SMS business and I did not due any due diligence on competitive dynamics developing there. I am not saying that I would have necessarily been successful in flagging the risk and reducing my position, but I would have been more wary and less complacent). The same story and pattern has played out for several investors in Sequent I believe.

-

Learn to be extra careful when a stock keeps falling and enters the 200DMA zone and below. Price action is to be respected because often bearish price action means insiders or institutional investors are acting on information that you may not yet have. So when prices fall consistently, one needs to go back and re-check their thesis thoroughly. If one isn’t sure about what’s wrong, booking some profits and reducing the position proportionately maybe the right thing to do. Of course there are some investors who have high conviction and the power to stay invested in a stock for 10 years, for them such things may not matter. I am not a 10Y horizon investor, my horizon is 3 years for most stocks and 5 years for high conviction ones. So technicals and price action matter for me.

PS: Admins may delete this post if its not relevant to Sequent. Tried sharing my learnings here, part of which came from Sequent.

23 Likes

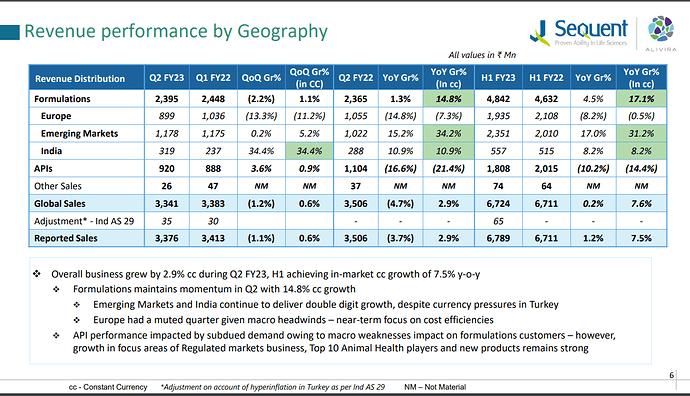

Another eye-watering set of numbers from Sequent. Gross margins haven’t improved QoQ and revenues are flat. EBITDA margin down to 0.8%, almost same as last Q.

Europe struggling

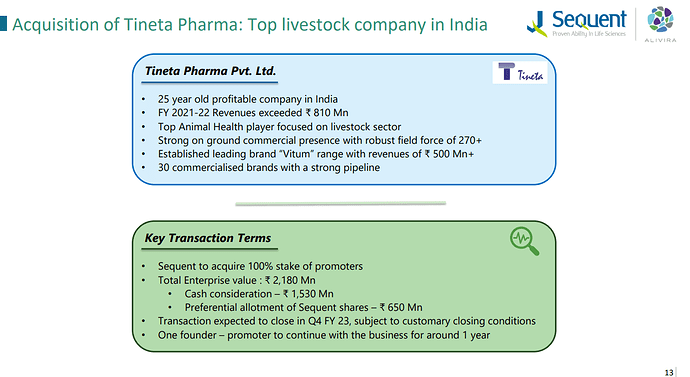

Acquired an Indian company called Tineta Pharma which is into livestock and aquaculture formulations. Claim to have a 25 year old presence, strong brand and field force of 270+ in India.

8 Likes