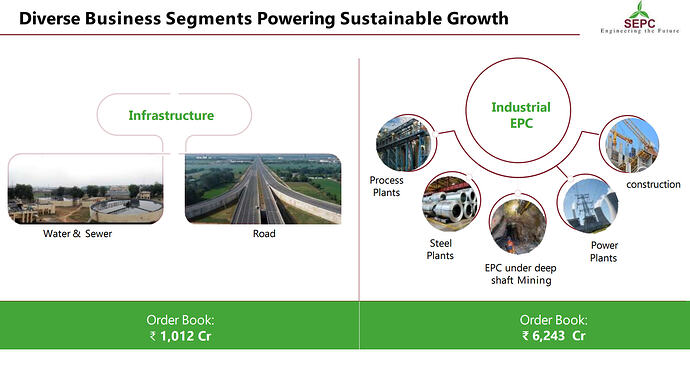

Spec is engaged in Engineering Procurement and Construction Company (EPC Contractor) business with the experience of executing turnkey contracts in Engineering, Procurement, and Construction (EPC) and providing end-to-end solutions offering multi-disciplinary services and project management solutions.

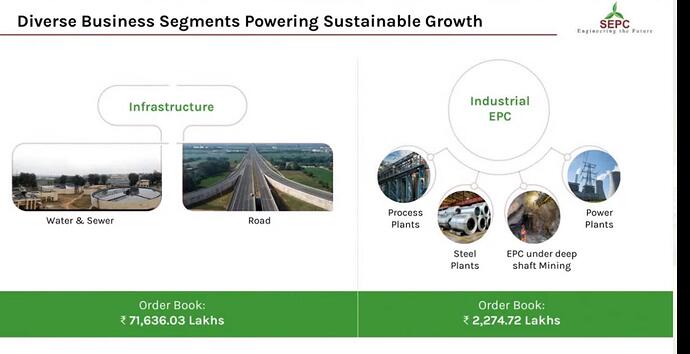

SEPC Limited (“SEPC") is focused on providing turnkey solutions in the following business areas:

- Infrastructure

a. Water & Sewer

•Drinking water projects

• Sewerage Treatment projects

• Rehabilitation projects

b. Road

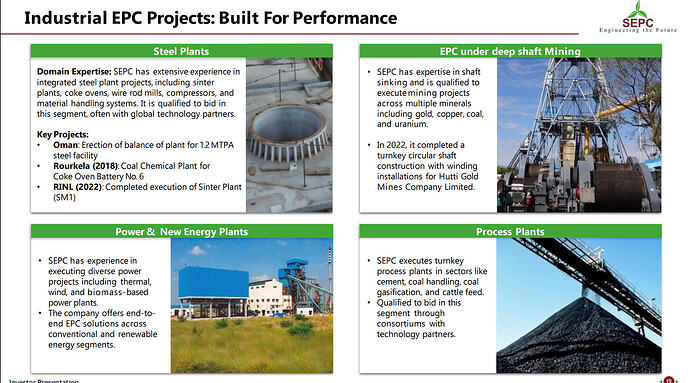

- Industrial EPC

a. Process Plants

b. Steel Plants

c. EPC under deep shaft Mining

d. Power Plants

Detailed info about the business

- Infrastructure

- Drinking water projects- identifying water sources < constructing treatment plant < laying pipes ( to carry water from treatment plant to overhead tanks and houses)

- Sewerage Treatment projects- collecting sewage from houses through pipes < construction of sewerage treatment plants < laying common pipeline to carry the sewerage collected through to nearby water sources to discharge the treated sewerage water.

- Rehabilitation projects- (Rehabilitation projects are generally carried out in places where normal sewerage treatment project cannot be carried out) These projects involve using special imported resins pumped into the existing pipeline to form a layer and using mechanical pressure solidified resin is pushed in to form as a new pipe over the existing dilapidated pipe. Finally, the old pipe will be removed and sewerage will pass through the newly laid resin based pipes.

2. Industrial EPC

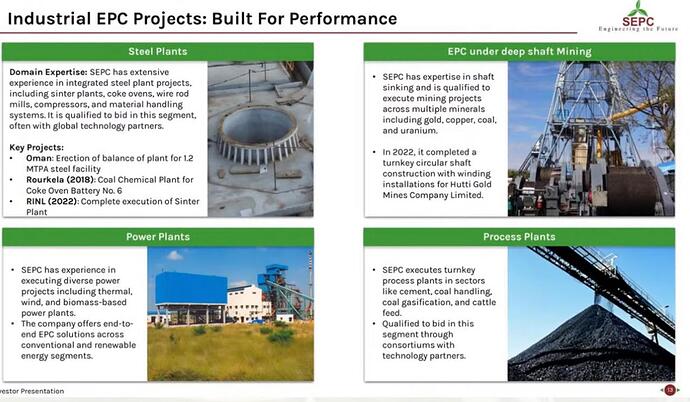

- Steel Plants - SEPC has domain knowledge and good customer base for having executed various projects in Integrated steel plants in areas like Construction of Special Bar mills, Sinter plants, Wire Rod mill, medium structural mills, hot strip mills, Coke oven, Coal chemical plants, Coal dust injection system, air and oxygen turbo compressor, raw material handling systems, secondary refining units etc. and have qualification to participate in this segment alongwith technology provider. SEPC has also completed the balance of plant and main equipment erection for a 1.2 MTPA steel plant in Oman.

- EPC under deep shaft Mining- SEPC has done mine development project using the advanced Shaft Sinking technology for mine development and qualified to do several types of mining and various minerals like copper, gold, coal, chrome, manganese, uranium etc. In 2022 we completed the Construction of New Circular Shaft with complete Winding Installations on turnkey basis for Hutti Gold Mines Company Limited.

- Power Plants- SEPC has executed various types of Power projects like conventional thermal power plant, Wind mill-based power plant, Bio mass based power plant etc.

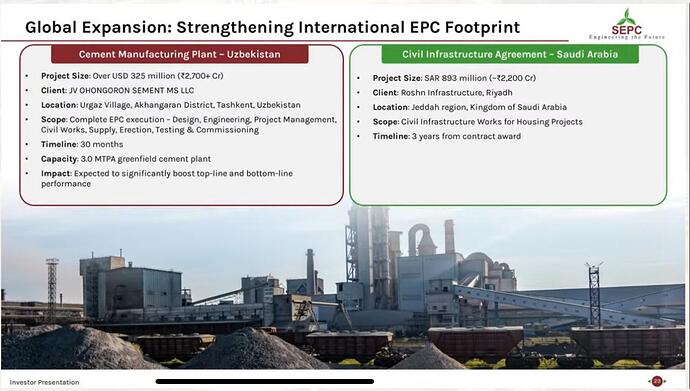

Process Plants- Construction of process plants on turnkey basis is under the sub business vertical of Specialized Industrial EPC segment. SEPC has done complete projects for cement, Coal handling, Coal gasification, Cattle feed plants etc. and have qualification to participate in this segment along with technology provider on consortium basis.

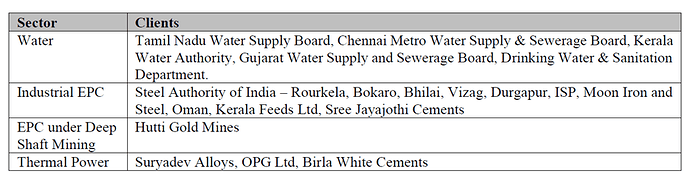

Customer –

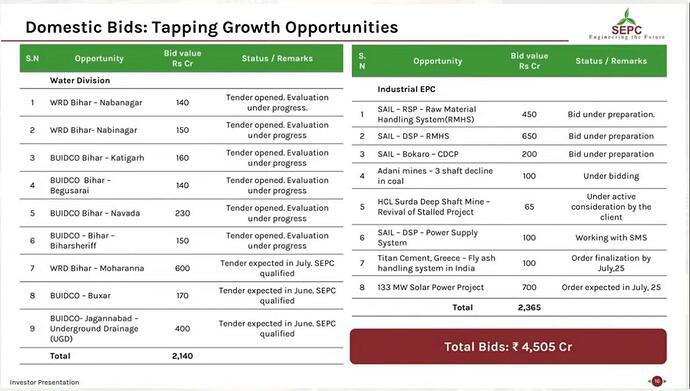

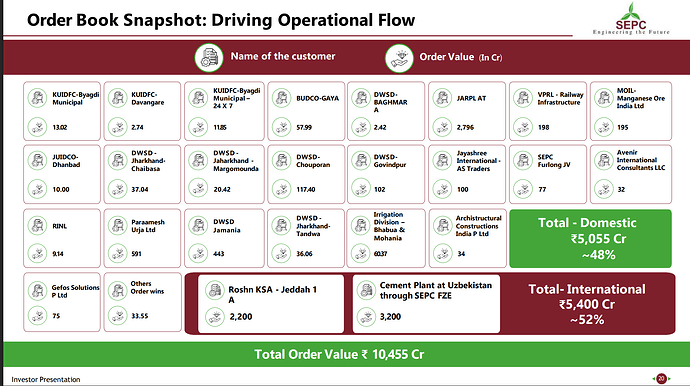

RECENT BIDS -

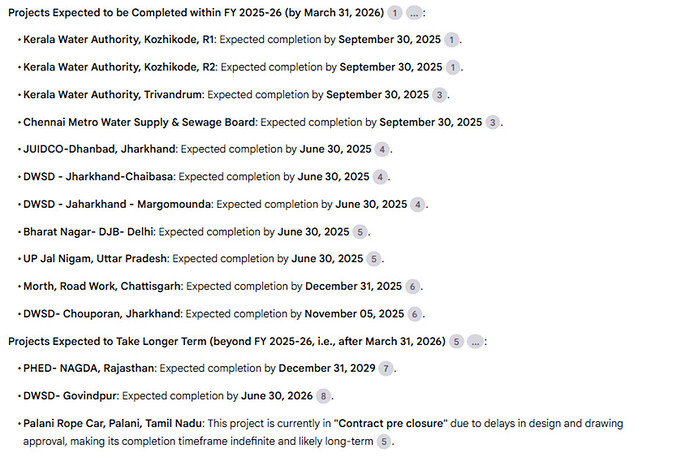

recent order

- The contract involves the Design, Engineering, Supply, Installation, Testing, and Commissioning (EPC)of a 133 MW Solar Power Project, including all associated civil and structural works. It will span four districts in Maharashtra—Sambhaji Nagar, Dhule, Solapur, and Nanded—and is being implemented under the PM-KUSUM Yojana, a flagship initiative of the Government of India promoting solar energy for agricultural and rural development. The execution timeline is expected to range between 12 to18 months from the start of the project.

- REVENUE BREAK - UP

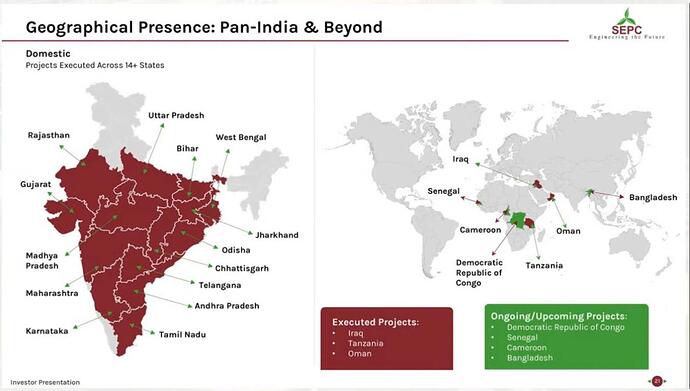

Management said in the meetup that they will reduce their geographical presence in India and will restrict their business to a few states only because it becomes more and more difficult for them to manage work at so many different states

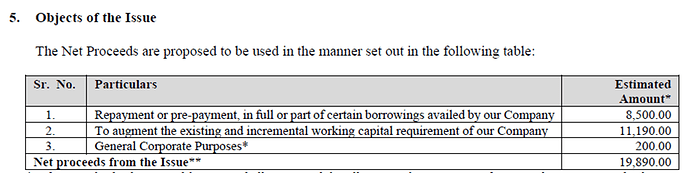

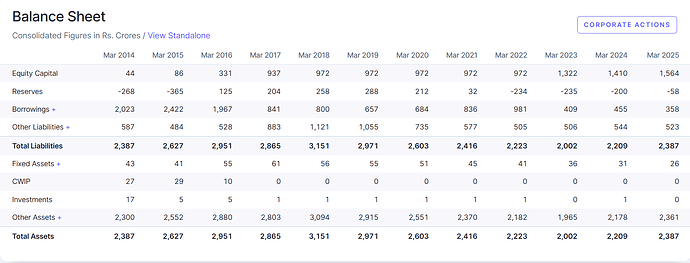

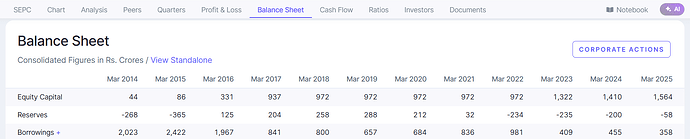

RIGHT ISSUE-

They recently issued right worth 350crs at 10rs at a ratio of 11:50

it was subscribed about - 2.12x

Future vision -

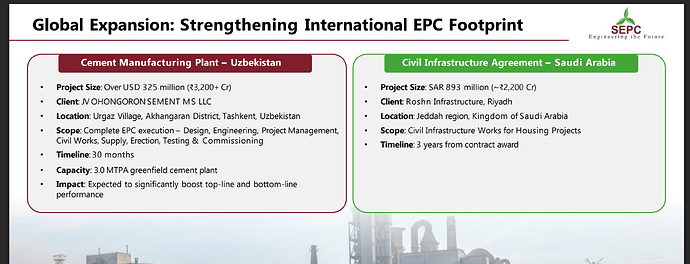

Oversea business expansion plans –SEPC has done overseas projects in Australia, Zambia, Iraq (Though Mokul Shriram EPC JV), Tanzania, Ezan (through L&T SEPC JV), Oman (through its Wholly owned Subsidiary) through its subsidiaries. Also, working on do a project in Kingdom of Saudi Arabia through its wholly owned subsidiary, formed specifically for this purpose.

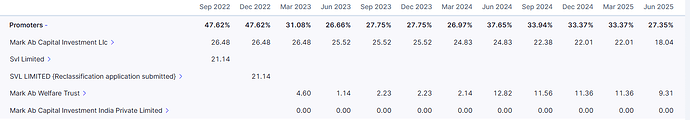

Promotor and management changes –

- Mark AB Capital LLC

In September 2022, Mark AB Capital LLC, a Dubai-based investment company, acquired a 26.48% stake in SEPC Ltd, becoming the new promoter and largest shareholder. (SEPC was in financial trouble. Under RBI’s rules to save stressed companies, SEPC went through a revival plan. As part of that, Mark AB Capital invested money and became the largest shareholder to help turn the company around.) - On June 2022, shortly before the change in promoter control there was a change in the management, Mr. N K Suryanarayanan was appointed as the new Managing Director and CEO and Mr. T Shivaraman (Managing Director & CEO) and Mr. M Amjat Shariff (Joint Managing Director) retired.

RISK FACTOR

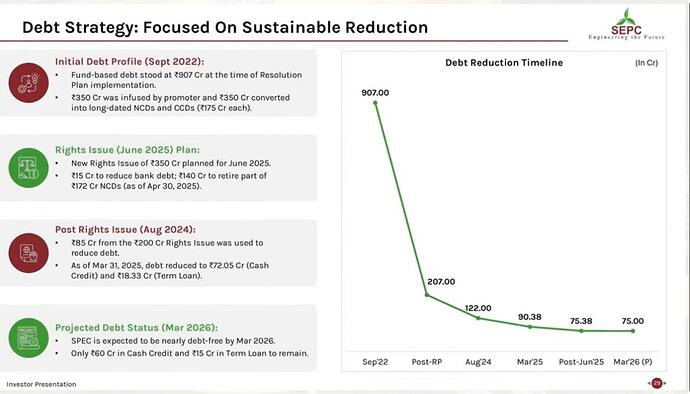

- In the past, SEPC has delayed or missed payments to lenders, its plan included a change in ownership — the old promoter (SVL Limited) was replaced by the new promoter (Mark A B Capital Investment LLC). The new promoter invested funds and helped restructure old loans into long-term debt. However, if the company fails to repay loans or interest again in the future, it could seriously affect our business operations and financial health.

- Pledged percentage- 34.0 %

HEADWINDS-

- Increase govt spending on infra

- Clean ganga mission

- Steel plants expansion all over india

- Har Ghar Jal program

- Gati Sakti project

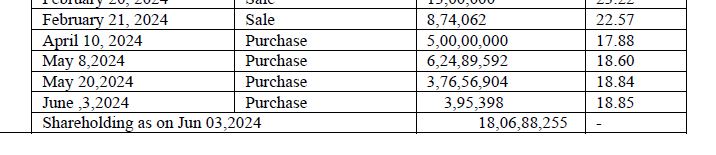

Promotor buying - (Mark AB Welfare Trust)

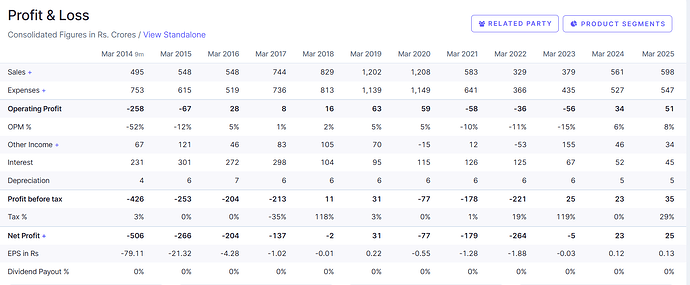

Financials -

- Debt reducing ( around 500crs repaid in FY23)

- Growth in sales and profits

- Negative operating cash flow due to increase in contract assets

- the company has zero inventory on its books and the receivables are decreasing

Note: Please feel free to share your opinions or insights on the company. I welcome diverse perspectives and constructive discussion.

Special Thanks: A heartfelt thank you to Abhishek Pokharna from Udaipur

Disclaimer- Invested in the company