Introduction To Industry in Focus

Firstly, we are talking about the semiconductor industry landscape. And in that, the knowledge of this author is restricted to only the brains of the machine (Not diode/led/modems/ etc.)

-

CPU (Central Processing Unit) – Desktop and Laptops. Leaving mobile phones out of the picture. I will explain why later. This thing is the brains in a computer

-

GPU (graphics processing unit) – We are focusing only on discrete GPU. NWe are interested in those that go into datacenters/used for compute. Not integrated GPU, that goes into laptops. Discrete GPUs in datacenters are the real power horse. This thing that used to only help with graphics a decade ago. And that which now is used for computation (Math… in short). All the crypto mining craze that happened, GPUs enabled it. https://www.researchgate.net/figure/Graph-detailing-incredible-performance-increase-over-the-last-several-years-of-the-GPU_fig2_26547680

What do you care?

Secular growth possibility: Well, it would not be a big deal during normal times. But, if you think covid is disrupting workplace like never before and that online work is the future, then you cannot miss the brains behind every single cloud infrastructure – The processors. Games, virtual reality, Cloud, Computing.Research folks know. Especially if you had to book slots in super computers in 90s and 2000s for doing some big compute. If the growth is fast enough, then not one company will be able to supply all datacenter processor needs. To top it off, Intel the giant is faltering in its ‘fab’.

Terminologies

Fabs

Processors are all made from sand. Yes, just sand to make these things. Some high end technology is what bridges the gap from sand to CPU/GPU. The place where this happens is called a fab - https://en.wikipedia.org/wiki/Semiconductor_fabrication_plant

OEM

Other Equipment manufacturers. The guys that put together laptop/desktop. HP/DELL/LENOVO.

Process Node https://www.howtogeek.com/394267/what-do-7nm-and-10nm-mean-and-why-do-they-matter/ - This is important – understand what is process node before proceeding.

Do not miss reading about process node. In short, lesser your current process node - more efficient your processor for the same performance. And corollary to that, you could maintain the same power envelope as your competitor with same design and give more performance this way. The leading players are Intel,TSMC & Samsung(recent entry) in fabs.

Data Center

Processing farm . The infrastructure behind your cloud. https://www.youtube.com/watch?v=kfvbCggY_nI

Perf/watt

How much performance you get per watt.

Perf/$

People talk about perf/watt mainly influenced by mobile space. Due to limited battery life.

With datacenters, people are now talking about perf/$. How much does it cost to get certain performance.

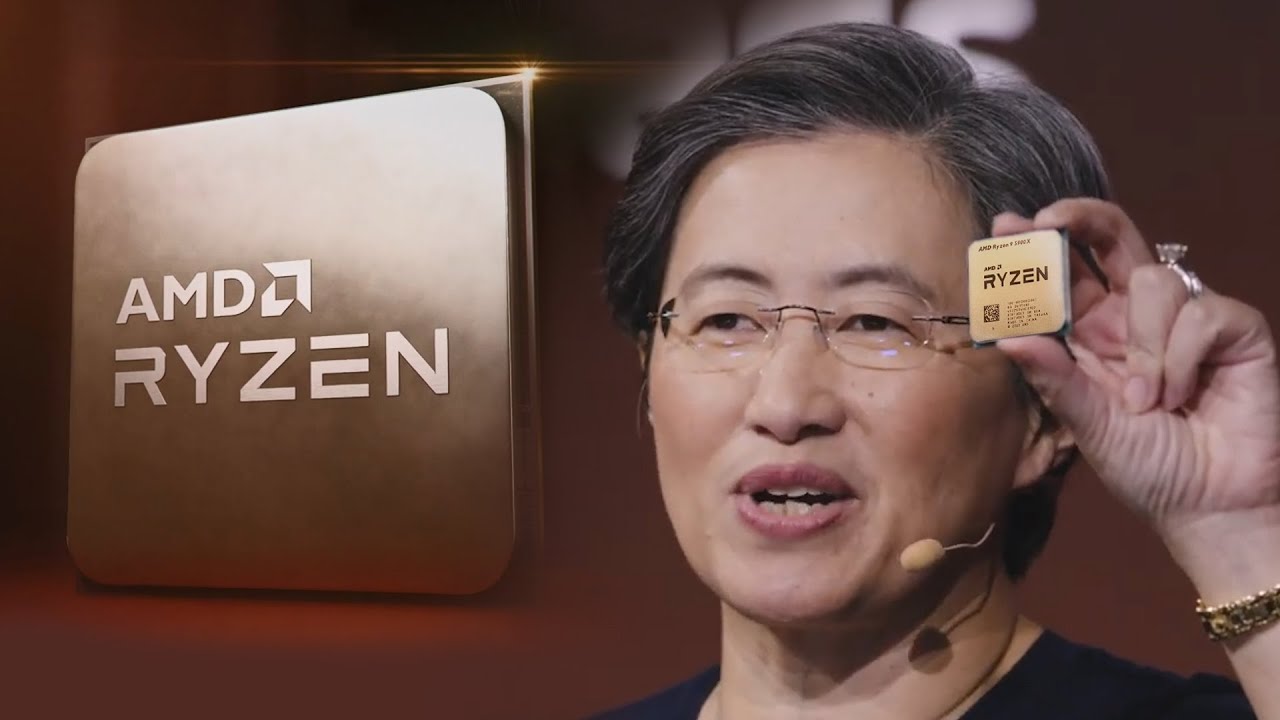

ISA

Instruction Set Architecture – The language that a processor understands. Intel’s language is x86 and ARM’s is well, ARM. ISA impacts design. ISA itself is licensed. Apple has licensed ARM ISA (lifelong or something that). They design their own processors on top of ARM ISA. They design better performing ARM processors than ARM! And design is what we are paying for. Some design is power hungry and some other use less power for ’similar’ perf. ISA plays a major role here. Lines are blurring now because ARM, which was known for low power consumption, also makes very complex CPUs now (recent X-series announcement), which will consume more power – We can go deeper here but we will stick to macro view here. I will avoid this part until we talk about datacenter and perf/$ numbers.

Core

Each core is one ‘brain’. One can put multiple brains in a die and it becomes a multi core processor

Thread

Multiple execution paths in a core. But shares some stages. Imagine execution of jobs in a pipeline. If there are 10 stages and 2 execution paths(thread) with 3 stages being shared among them along with one level of memory.

Workload

What a processor runs. Different workloads sweat different processors in different ways. Some workloads use all cores, some workloads extract the max out of one core.

Edge compute

Opposite of cloud compute. First there will be many tasks moving to cloud and then, the expectation is that there will be an outward movement to ‘edge’ devices.

. I don’t mind deleting this post.

. I don’t mind deleting this post.