SecUR Credentials (Securcred), is a small company that is listed on the NSE SME platform. It is a company into background check (BGC) industry. It is India’s first and only listed player in this space. I think the company forms a part of an interesting industry which has a long runway ahead.

Mcap of 120cr. CMP INR238. Company recently came up with an IPO in November 2017 raising funds aggregating to INR30cr. IPO price INR205 (600 lot size).

Screener link: SecUR Credentials Ltd financial results and price chart - Screener

Company website: http://secur.co.in/

About SecUR (website + prospectus):

SecUR Credentials is one of India’s largest background check companies with pan-India coverage and operational capabilities in 14 countries. 15 years of management experience and a 300+ workforce has powered our ability to weld innovation with technology and streamline the background screening process. As a result, our services have been integrated into HR systems for over 350 large companies across 30+ industries.

A thought-leader in the background verification space, SecUR verifies half a million resumes each year and that number is only growing. The key to our continued success is in our DNA; which is defined by our passion for business, innovation in products and processes, and customer focus.

Reach: Pan-India reach extending to all 39732 Pin codes

Innovation: Seamless authentication of information across geographies and institutions through innovation in both technology and processes.

Currently, we are an end-to-end screening services provider to various corporates in the country. We are one of the very few India-based BGC companies to be a member of the prestigious US-based National Association of Professional Background Screeners (NAPBS), APAC Chapter, which is the umbrella body of the largest BGC companies around the globe. We can provide background screening services, for organisations not just in India, but across the globe through our NAPBS connections and have provided our service in countries such as US, UK, Philippines, Srilanka to name a few. Our Company is headquartered in Andheri, Mumbai, with branch offices in Mumbai, Delhi, Bengaluru, Hyderabad and Chandigarh. We can cover every PIN code of the country through our intricate hub and spoke model, which multiplies the geographies we cover through the above branch offices.

Prospectus extract on the background of the company:

Our Company was earlier engaged in the business of providing insurance services and human resource solutions provider. During FY 2015 we recorded Nil revenues since our erstwhile promoters were preoccupied in their other ventures. During FY 2016 we received a single order from Reliance Life Insurance Company Limited. They were our single client during FY 2016. On July 26, 2016 our Promoter, Pankaj Vyas, took over the management and control our Company by acquiring then existing 100% paid-up equity share capital of our Company from our erstwhile promoter CRP Risk Management Limited. Post this change our company was transformed into a Company is engaged in the business of Background Screening (also known as BGC - Background Check) and Due Diligence.

Core focus areas:

BGC Corporates:

- Background screening of employees

- On-boarding processes

- Exit Management

- Employee support service

Checks conducted by the company:

- Education

- Employment

- Criminal

- Identity

- Database and media

- Residential

- Reference

- Credit check

- Drug test

- Psychometric test

BGC Individual:

- India’s first B2C background screening product

- Allows individuals to self-certify their CVs

- Shifts onus of responsibililty of clean resumes from employer to employee

Due Diligence:

- Due diligence for Senior Management hires

- Due diligence for partners / suppliers

- Due diligence for investments

- KYC services

Competitive strengths:

- Wide Range of Services

- National player, with global footprint

- Process: ISO/IEC 27001:2013 certified

- Focus on long term revenue stream

Business Strategy:

- Extension of target client segments

- Expansion of service and geographical offerings

- Use of SecUR Number to redefine the market space

- Strong Industry vertical based focus

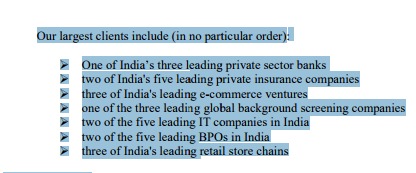

What gives confidence on their abilities is the kind of clientele that they have:

SecUR number - can be a decent opportunity in future, if they scale up big time (website):

'More That 30% Of Candidates Lie On Their Resume’s About Past Employment Details, Salary, Residential Address Or Criminal Record An Inflated CV Causes Damage To Your Bottom Line, Month-On-Month, While The Candidate Is Still In The System One Wrong Hire Can Tarnish The Work-Place, Its Productivity, And The Entire Company’s Reputation

When, on an average, there are 118 candidates applying for one vacancy, a pre-verified resume showcasing the authenticity of the candidate’s claims is a breath of fresh air. Add to that the fact that background screening in India is a trend that is catching on, especially in start-ups for whom valuations mean life or death. Any HR will attest to the value of a pre-verified resume and the ease it brings to the hiring process.The Secur Number is a 10 digit code which enables this benefit by providing a comprehensive verification report that meets industry benchmarks for background checks. Accessible online, this report will aid one in going the extra mile with their prospective employer by showcasing one’s integrity. The employer can then easily access the report with the help of the 10 digit number and download all the authentication proofs in the report.’

http://secur.co.in/secur-number/

Technology - Symphony 3.0 (prospectus):

Currently we are using the software “SYMPHONY 3.0” which is a proprietary integrated workflow software of CRP Risk Management Limited that seamlessly directs, tracks and controls the flow of work at SecUR. It is built on a Java Platform, and offers real-time, online movement of processes, as well as information. Symphony 3.0 has been audited and approved by most of our large IT clients from a n information security perspective. We have entered into a Memorandum of Understanding dated August 28, 2017 with CRP Risk Management Limited for buying the SYMPHONY 3.0 Software along with its database for an aggregate consideration of 797.03 Lakhs. CRP Risk Management Limited had developed in-house workflow software, which is currently in its version 3.0, named Symphony. This JAVA-based plat form is the essential glue which holds together all the operational delivery processes, and ensures that these processes deliver the promised output to the client.

There is a tremendous amount of data which is stored in Symphony 3.0. This is the result of all data being accumulated over a period of close to 10 years, as part of the BGC process being delivered by CRP to its clients. Also, because of the inherent design of the Symphony architecture, the database needs to be acquired in tandem with the software application, as it cannot be extracted from the software.

The key components of this database structure are briefly described below:

Education data accumulated over 10 years: Over the past 10 years, as a systematic and thorough effort, the CRP team had accumulated close to 3 crore education records which have been made part of the Symphony database. These education records include a lot of education record archives from colleges and Universities across the country, which have been acquired and digitized with a lot of effort, and at great expense. On a regular basis, the Operational delivery team accesses this data for conducting education checks, as this process is online (and hence faster), and at no incremental transaction cost. Re-creating this database will not just be cumbersome and expensive.

Symphony 3.0 is also home to another key component of our business IP: All the database of educational institutes – colleges, universities, training institutes, schools – along with the process of verifying education records from them is stored in the form of a Master Database in Symphony. This Master Database extends to all the corporates and employers, who have ever been contacted, along with the detailed process of these employers provide verifications. (Detailed information about the software can be found in the prospectus).

Need for background check (website):

Employee related frauds such as inflated salary slips, exaggerated past designations and misleading academic history can cause damage to the bottom-line month on month while the employee is still in the system. Criminal history, questionable political affiliations and a negative personality can cause severe damage to a company’s reputation and future earning potential. Therefore, it is imperative that companies safeguard themselves by performing background checks on all hires.

Interesting reads:

Emerging trends (prospectus):

While the growth of the background screening industry in India over the past decade has by itself been very exciting, the future holds even more promise. A part from the clear growth drivers of the Indian economic growth story, and the increasing number of sectors adopting it as a good HR practice, we are seeing some clear trends which will give an added impetus to the Indian background check industry.

- Expansion across sectors, and organization sizes

- Extension to contract and other support staff

- Prospective employers asking for a 360 degree view

- AADHAAR, and its implications for employee screening

- Adoption of employee screening by Government and its affiliated institutions

- Ancillary extension, such as Education sector

To summarise:

About the company:

- The only listed BGC company

- Technology and innovation driven

- Good clientele as mentioned above

- Serves over 350+ large companies across 30+ industries

- 300+ employees

- Verifies 5lakh+ resumes every year

- Reaches 39732 pin codes in India

About the numbers:

- FY17 revenue/EBITDA/PAT – 10.2 cr./2.74 cr./1.81 cr.; Q1FY18 – 5.9 cr./1.79 cr./1.25 cr.

- Short history but company looks decently placed in an interesting industry.

- Low base, size of opportunity large and niche product offering.

- 1QFY18 revenues have been more than half of FY17 revenues.

- At this pace they might conservatively exceed revenues of 15cr and PAT of 3cr for FY18. However, I am looking at this more from a very long term horizon. It is close to 120cr mcap right now.

- I believe EBITDA margins on a steady state basis can be 25-30%.

- Valuations - very difficult to assess for a small company with such a short history - so will leave it upto you to judge.

Summary of financials (INR lakhs):

Risks/Concerns:

- Company started operations recently hence has a short history of performance.

- Company still small in terms of revenue.

- One of the objects of IPO was to buy out Symphony 3.0 software.

- Any slowdown, tepid growth in hiring / human capital across industries.

- Receivables are high.

- Typical risks associated with SME companies - liquidity is low, lot size is high and others.

All the above details have been taken from public material, largely their prospectus, website.

PS: My personal view is given the low base, large opportunity size and niche product offering, it is a play on jobs growth and ever increasing jugaadisation.

Disclaimer: This note is not a research report but assimilation of information available on public domain and it should not be treated as a research report, investment advice or Buy/Hold/Sell recommendation. I am not registered with SEBI under the (Research Analyst) Regulations, 2014 and as per clarifications provided by SEBI: “Any person who makes recommendation or offers an opinion concerning securities or public offers only through public media is not required to obtain registration as research analyst under RA Regulations”. It is safe to assume that I might have the company in my portfolio and hence my point of view can be biased. Investors are advised to do their due diligence and consult a qualified financial advisor prior to taking any actual investment or trading decisions.

Holding disclosure: Invested