Sealmatic India Limited

Sealmatic India Ltd manufactures mechanical seals, seal supply systems, pumps, valves, motors and high precision mechanical engineering spares and assemblies. The company designs and manufactures engineered mechanical seals and sealing support systems, used in rotating equipment, including pumps, compressors, mixers, steam turbines and other speciality equipment.

Product Profile:

a) Engineered Seals

b) Mechanical Seals

c) Standard Cartridge Seals

d) Supply System & Components

e) Gas-Lubricated Seals

f) Split Seals

g) Pusher Seals

h) Elastomer Bellows Seals

i) Metal Bellows Seals

The products are used in various industries like Oil & gas, refinery, petrochemical, chemical, pharmaceutical, fertiliser, power, mining, pulp & paper, aerospace, marine, etc. The Company is an Original Equipment supplier to KSB, Flowserve, Sundyne, KEPL, Andritz, KBL, RuhrPumpen, Wilo, SPX, Seepex, Düchting, ITT (USA), BHEL, Circor, Idex, Egger, PMSL, MSL, Xylem, Metso, Atlas Copco, Netzsch, Burckhardt, Idex, etc.

The Company has presence in 53+ countries including USA, Sweden, UK, Germany, Italy, Japan, Norway, Switzerland, Denmark, Netherlands, Australia, France, etc. As per 2023 AR, 62% of the revenue is generated from exports. The company’s margins are higher in the domestic market where it deals directly with end-users, while in exports, margins are lower due to dealing with distributors.

Sealmatic IPO came last year in Feb 2023 at a price of Rs. 225/-.

Financials:

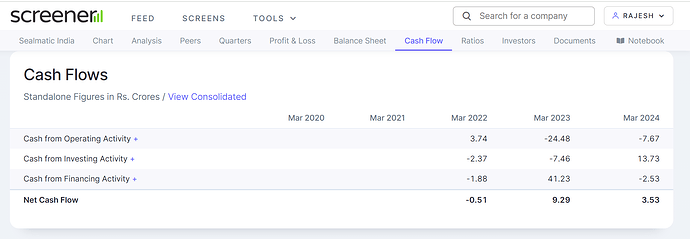

Sealmatic has been a consistent performer, last five year financials on screener-

The growth has not been spectacular, but consistent. Operating margin has been hovering around 25%, though less than 20% in FY 2024. Cash flow of the company has been negative throughout.

The company has proposed maiden dividend of Rs. 1 [10%] in the current financial year. Presently the company’s market cap is 614 crores [CMP Rs. 678].

Fresh Investment:

The company has invested in new manufacturing facility which is likely to increase the capacity by 60%. It is continuously investing in research and development to evolve as a sealing technology leader, and Sealmatic India’s vision for the next five years is to become the fourth player in the global mechanical seals market, with a strong product portfolio and understanding of the business. The company has developed strategic partnerships in high growth areas within the UAE, Thailand, and the USA.

Operation &Maintenance Business:

The company is heavily investing in O&M business. The company explained in a concall,

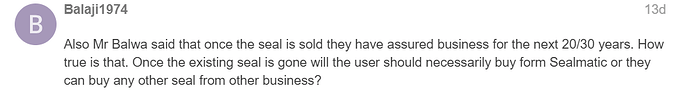

“The reason being is that a huge amount of money is being invested into the O&Ms and project business. So that is going to remain until 2026. Once we start our O&M business which is more profitable as compared to any other business for us. So that ratio between inventory and sales realization will be much more better than what we see today. So that is the answer to question one and as regards to O&M business as I partly answered in the first aspect of this answer. O&M business will as I mentioned in many occasions that it will start from 1st April 2026 because the investment that we have made over the last year and the years that will ensue from today will make us realize more O&M business as we speak starting from 2026. And the profitability as we all know that on the O&M business is far far higher. It’s a business of you know proprietary. So once your mechanical seals go fitted as an original equipment you are there to enjoy the benefit of the annuity business which will remain the lifetime of the equipment which is 25 to 35 years depending on the type of equipment we are talking about. So that business is secured as I see today that we are investing into an O&M business which will result into a strong O&M business.

……

On a not very scientific but I can give you a ballpark arrangement to this kind of business. So when you typically invest into any project which is you know sometimes below your cost of raw material but when you are doing O&M business so you are going at the first fit as a OEM to the end user say for example a company like Reliance or a BPCL or HPCL so your revenue generation gross margins are hovering in the range of 85% to 90%. So that’s the kind of, margins we are talking about.”

Transcript of the concall is attached herewith-

Sealmatic-Concall.pdf (488.5 KB)

Certification:

The company has received various certifications like nuclear, marine work, DGQA, Ministry of Science & Tech, EU FDA, Russian TRCU, ASME U certification for pressure vessels etc.

Valuation:

In the last 4 years, the company topline and bottomline has grown at 20% CAGR. The company is presently valued at 62 times P/E, almost 7 times book value and almost 9 times FY 2024 sales. Thus, on various value parameters the company is excessively valued.

Reasons for Investment:

-

New capacity has come in line, which may give a jump to the topline and bottom line as expected by the management.

-

The area in which is company is operating is dominated by multinational players. Make in India theme will help the company in capturing bigger domestic market share with better profitability.

-

The promoters are well experienced in this line of business- The promoter Mr Umar Balwa was the founding promoter of Burgmann India Pvt Ltd which was a subsidiary of Feodor Burgmann Dichtungswerke GmbH & Co KG in the years 1993. Burgmann India Pvt Ltd was a joint venture between Feodor Burgmann Dichtungswerke GmbH & Co KG and the Balwa family with 51:49% equity participation. Mr Umar Balwa successfully led the company in India with a sizeable market share until 2007, when the parent company Feodor Burgmann Dichtungswerke GmbH & Co KG was taken over by the Freudenberg Group and under a friendly agreement the Balwa family sold their 49% shares in the company to the parent organisation.

-

O&M business, which is likely to start contributing from 2026 onwards meaningfully may become a game changer.

-

The business area of defense and nuclear is now well open to the company by achieving the certification of ISO 19443 which is nuclear and DGQA defense. Further, marine sector certification can open naval sector to the company.

-

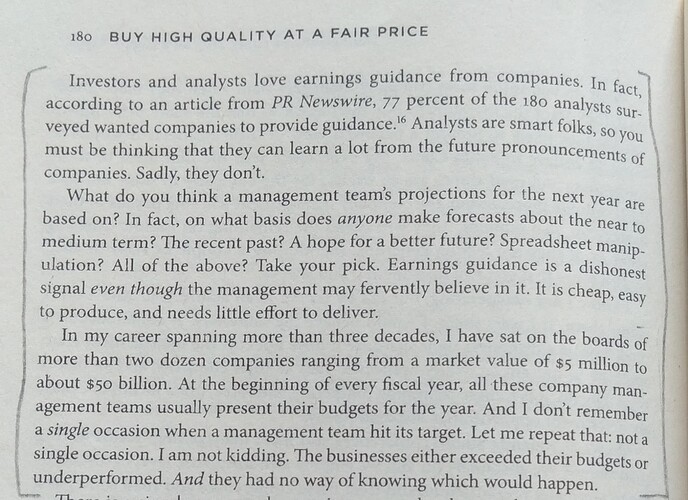

The management is expecting 60% topline growth with 24-26% EBITDA in FY2025 as per concall talk. On this expected growth, in my view higher valuation is not exorbitant.

RISK:

-

The company is generating negative cash flow, which may affect its financials.

-

Though the market is lucrative, it is very competitive. KSB Ltd. entering into mechanical seals manufacturing for captive use plus aftermarket. SKF (SKF AB), John Crane (Smiths Group Plc.), and Flowserve Corporation are the leading market players. SKF holds the largest market share, as per the mechanical seals market report. Some of the other leading players include Trelleborg AB, EnPro Industries Inc. (Garlock Gmbh), Dover Corporation (Waukesha Bearings), SHV (ERIKS Group), Freudenberg SE, Tenneco Inc, Fenner Group Holdings Limited (Hallite Seals).

-

Future plans are mere estimates/guess; they may not materialise.

-

Investing in Microcap company may results in 100% capital loss.

Disclosure:

Invested and biased.