Executive summary

- Aeroflex business is expected to be a major value driver for the company as it expands.

- The startup investment presents a significant optionality.

- MR Organization business scaling up.

- Sah polymers growing on back of capacity expansion

About

SAT Industries Limited is a dynamic and diversified business group & incubator that strategically curates a portfolio of businesses and investments across various sectors. Its business interests span knowledge-based engineering, innovative packaging solutions, fintech, lending, and cutting-edge startup investments.

List of companies held by SAT Industries

- Aeroflex Industries Limited - A Vision for Growth

The company manufactures metallic flexible flow solutions used for the controlled flow of all forms of substances including Solid, Liquid, and Gas.

Product mix of Aeroflex Industries -

- Stainless Steel Flexible hoses (52% of revenue) -

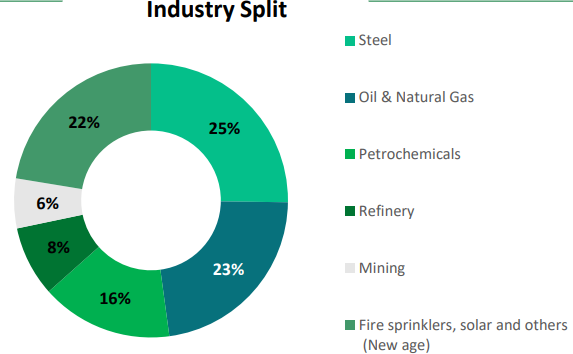

End-user industry distribution

They are expanding in different verticals now - Fire Sprinklers, Solar, Robotics, Semiconductors, Aerospace and Satellite, and Electric Mobility.

- Assemblies & fittings (39% of revenue) - fittings are assembled onto SS hoses which are manufactured in-house

- Composite Hose & Others (9% of revenue) - Composite hoses are manufactured from multiple layers of thermoplastic fabrics & films that are spirally wrapped and supported by internal & external wire helices. The multiple material layers make the structure of the hose firm, thus making it pressure-resistant. The high-grade material used to make composite hoses also provides greater safety.

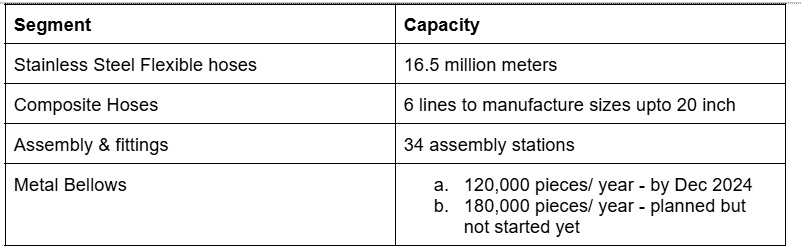

Existing capacity of Aeroflex

New product addition - Metal Bellows

A bellows expansion joint, also known as an expansion joint or flexible bellows, is a flexible element in a piping system that absorbs vibrations, shock, and other movements. At optimum utilization of 85-90% of Phase 1, it can bring revenue of 80-90cr in 1.5-2 years with 25-30% EBITDA margins as company would tap export market.

Acquisition of Hyd Air Engineering Pvt Ltd

Hyd Air manufactures hydro fittings and flanges & was acquired in April 2024 for 17cr & was financed through internal accruals and IPO proceeds of Aeroflex. It was done to enter into sectors such as Railways, Shipbuilding, and other heavy industries.

Hyd Air had a turnover of 8cr at 30% utilization in FY24 & has utilized only 17,000 Sq. Ft. compared to 60,000 Sq. Ft. space available. Aeroflex will spend 18 crores over next 6 quarters for new machines, refurbishment, and R&D. Once, Hyd Air starts operations in FY26 the facility is expected to generate 30-35 cr revenue & would be reported under the fittings business of Aeroflex. Hyd Air has also received 1st trial order from the railway coach factory. Also, Hyd-Air can manufacture a lot of the fittings that Aeroflex outsources.

Key Highlights for Aeroflex

- The company can reach peak revenue of Rs 500 crore with potential margins of 22-23% within 1-2 years if capacity addition is completed on time & demand stays buoyant for the company.

- 80% of their revenues are from replacement demand, this is a recurring source of revenue for them which occurs within 6-24 months depending upon the industry.

Guidance of Aeroflex

FY25 - 25% EBITDA growth for FY25.

FY26 - 500 cr revenue expected with 20% EBITDA Margin.

Long-term Goal - 60-70% of revenues from assembly business in the next 3-4 years (said in Q2FY25) & revenue target for the next 4-5 years is 1000cr

Risk

- Non-achievement of guidance - The company had guided for 30-40% growth for FY24 but was able to achieve only 18% growth.

Sah Polymers - Listed with a market cap of 228 cr

The company manufactures Flexible Intermediate Bulk Containers (FIBCs), HDPE bags & Woven Fabric. It has an installed capacity of 9,120 TPA & is expanding its capacity by 3,960 TPA. The in current facility located in Udaipur, Rajasthan is operating at an optimum utilization level of 81%. The company derives 85% revenue from exports.

The company received BRC certification which is necessary for exports in Food & Beverages and Pharma. This will allow the company to fetch higher margins.

MR Organization - 100% subsidiary of SAT

The company manufactures and exports for more than 35 different Air Compressor brands for aftermarket, replacement, and equivalent parts and kits. It supplies more than 60000 different aftermarket, replacement, equivalent parts and kits for screw, reciprocating, and centrifugal air compressors which includes all kinds of service, maintenance, and overhaul kits. It also provides last-mile services for multi-brand air compressors.

It was acquired in July 2024 for 115 cr & was delisted from the exchange once it became a wholly owned subsidiary. MR Organization acquired 100 % equity of Standard Air Limited UK to increase its presence in UK of which the amount wasn’t disclosed.

Aeroflex Finance

The company provides SME & Business Loans, Working Capital Loans & Consumer Loans. It has a outstanding loan book of 25.12 cr with a Net Interest Margin (NIM) of 12.66%. The company disbursed 120 cr in FY24.

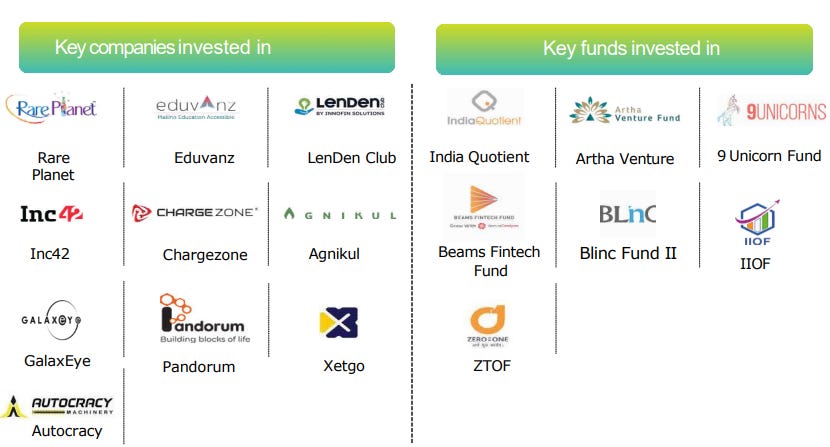

Startup Investments

The company has invested total of Rs 20 cr across multiple companies. Their investment strategy is to look for the ones in the pre-seed or seed-stage with innovative technology. It has defined processes and a professional team of analysts to conduct thorough research and due

diligence, providing operational inputs and necessary bandwidth to manage the startup portfolio.

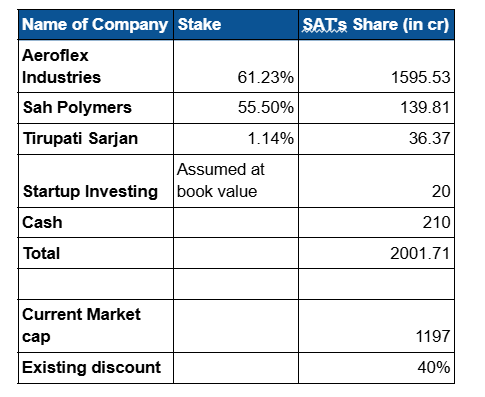

Valuations - Sum of the part

The company trades at a 40% holding discount which is the general trend of the market. But the key takeaway is startup investments have been considered at book value due to the non-availability of the latest market value data.

Management

- Mr. Harikant Turgalia (Whole-time Director) - He has 36 years across manufacturing, trading, and finance. He has a Bachelor’s degree in Commerce from the University of Udaipur.

- Mr Asad Daud (Non-Executive Director & promoter) - He holds a Master of Science in Accounting & Finance from The London School of Economics and Political Science. He possesses more than 12 years of experience in the polymer packaging Industry. He looks after the management and operations of the company and is in involved in bringing about innovation in the operations and products of the Company.

Risks

- Holding company discount staying constant - I have assumed a 40% holding discount currently which exists due to the inefficiency of taxation & no intention of selling the stock. This might increase when the market starts to correct. Some companies trade at a 70% discount too, which might lead to cases where subsidiary prices increase but the SAT Industries price remains the same.

- Startup investments - The investment of a startup might not be realized due to the startup’s failure or the intent of selling it or no value creation by it.

- Aeroflex Industries non-performance - Aeroflex Industries accounts for the major value of SAT Industries. Any change in Aeroflex Industries to directly impact the company.

Conclusion

The company appears to be on the right track, with its growth expected to continue driven by the performance of its core businesses. It holds Rs 210 crore in cash, which can be strategically deployed as new opportunities arise, and for further investments in the existing MR Organization and Aeroflex finance.

The company is managed by a professional corporate and subsidiary team, ensuring strong decision-making capabilities. It trades at a 40% holding company discount, assuming its startup investments are valued at book value without accounting for unrealized gains. As these startups scale, they could become a valuable bonus for investors, offering potential exits for SAT Industries over time.

Disclosure - No position yet.