Hi All

I thought this company - SANOFI India Ltd. - deserves a separate thread on this esteemed forum so sharing my analysis on this company below.

Before I begin, a standard disclaimer that the below does NOT constitute investment advice rather it is for knowledge purpose only.

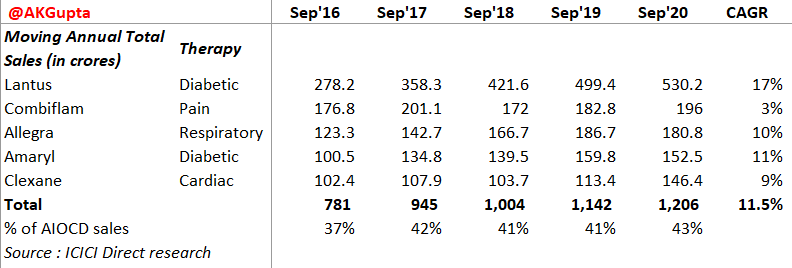

I. Product Profile : SANOFI’s top 5 brands have grown at 11.5% CAGR over last 5 years to make up 43% of total AIOCD sales. Focus areas for the company are Anti diabetic, respiratory, cardiac & pain relief drugs. 3/4th of the sales are in domestic market while rest is exports.

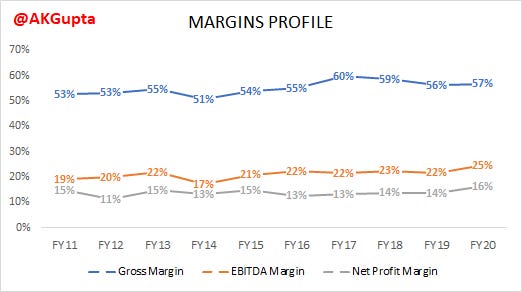

II. Margins Profile : (refer the below chart for Margins trend of SANOFI India Ltd.)

Companies which have consistency in Gross & EBITDA margins, as does SANOFI India, are more likely to have some degree of pricing power meaning they can pass on the impact of cost increases to their customers. This is a plus for SANOFI.

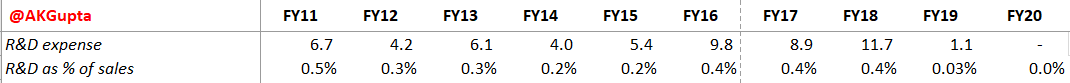

Another positive is that SANOFI doesn’t spend a lot on R&D. Expense on R&D as a %age of sales is only ~0.4% in the long term trend and only 0.03% in FY19. Company didn’t spend anything on R&D in FY20 which is a positive given that Pharma companies spend so much on R&D to develop new products.

However, the low R&D expense could change in the future given that SANOFI India is focusing on Branded drug formulations and manufacturing. If it sources the IP from its French parent, it might need to pay royalties as a %age of sales as well.

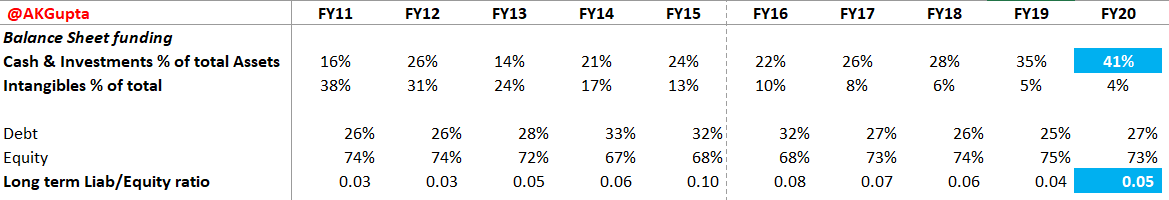

Another positive is that the company is debt free & cash rich : D/E ratio is only 0.05 as of FY20. And as a result of the sale of Ankleshwar facility to Zentiva in FY20, cash on books makes up 41% of total Assets (more on this deal below) !

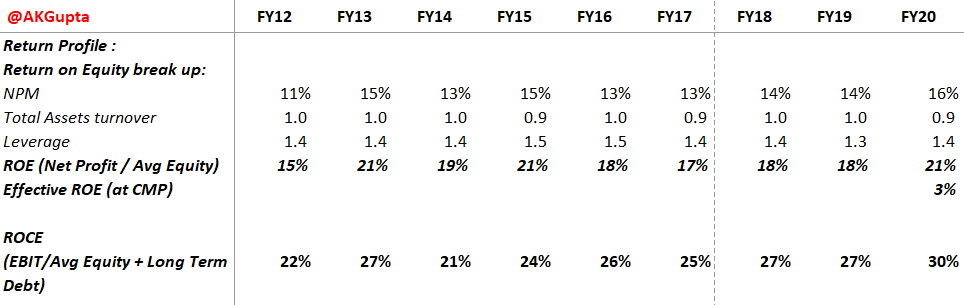

II. Returns Profile : SANOFI’s ROE is a function of Net Profit Margin since Assets turnover and Leverage is constant throughout the last 10 years; since margin profile is stable, ROE is expected to be ~18% with an upside possible if Sanofi decides to lever up (I am not counting on it though since the Company has lots of cash right now).

But 18%-20% is not what we investors get as we have to buy at the Market Price - so at a CMP of ~₹7,890 (as of 10th July) our “Effective ROE” or Earnings Yield, would be less than 3% which is very poor and is a sign of froth in the markets generally.

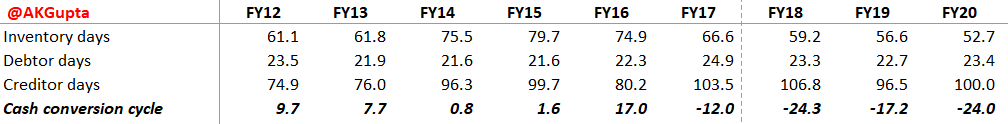

III. Cash Conversion Cycle : SANOFI’s cash conversion performance is also commendable - it’s able to collect receivables in ~22-23 days and boasts an impressive Inventory turnover of 6+ times over last 3 years resulting in a negative cash conversion cycle of ~(24) days. A negative conversion cycle means healthy terms of trade for SANOFI where it sells & collects from customer much sooner than it pays to its suppliers.

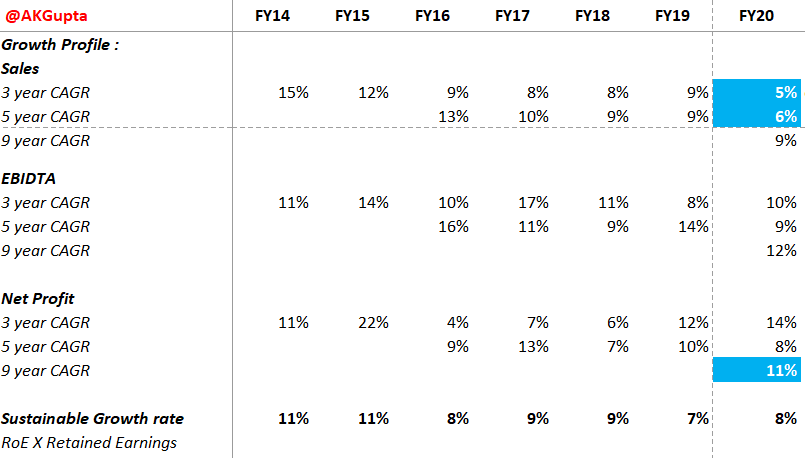

IV. Growth Profile : A dampener

Given ROE of 18% & a retention ratio of 40% , SANOFI’s Sustainable Net Profit Growth in the future will be ~8%. Deceleration is already visible in SANOFI’s sales from 12% 3 year CAGR in FY15 to 9% in FY19 (pre-COVID) and only 5% in FY20. Similar deceleration is visible in EBITDA as well though Net Profit is artificially inflated because of the corporate tax cuts in FY19.

So going forward, the growth rate will be a function of new product launches like the diabetic drug Toujeo and what traction they get in the market. Also, SANOFI is working on stage 3 trials of a COVID vaccine in India along with GSK.

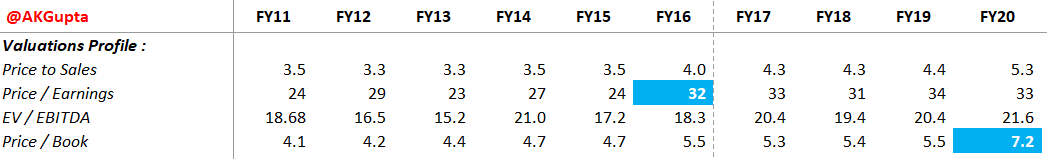

V. Valuations : The stock is trading at a hefty P/S of 6.3X, TTM P/E of 33.2X, trailing P/B of 8.6X! If we look at the historical trend below, FY20 valuation ratios are very very high in comparison to previous 9 years.

These valuation multiples look too pricey given that Net Profit growth (excluding impact of tax cut) has been decelerating and is now expected to be in the range of 8%. The company has also sold its Ankleshwar unit & distributed special dividends to shareholders (₹240 per share over the last 2 years) Going forward, the company is going to shift focus from 3rd party bulk generics to branded formulations which are better margin products. Only time will tell how much growth will they drive.

VI. Sanofi - Advent - Zentiva deal :

- In 2008, SANOFI (France) had bought Zentiva for $2.6B to build generic drug capability.

- In 2018, SANOFI (France) sold Zentiva to Advent (a PE firm) for $2.2B.

- In 2019, SANOFI (India) decided to sell its Ankleshwar manufacturing facility to Zentiva (India) for ₹261 crores to shift focus on SANOFI Branded products.

VII. Related Party Transactions : SANOFI’s Achilles Heel

Almost all MNC Pharma companies enter into long term contracts between their Global subsidiaries, located in tax efficient jurisdictions, and their local Indian subsidiaries. SANOFI India is no different. In terms of RPTs, SANOFI has extended a loan of ₹445 crores to a Privately held company, SANOFI Healthcare India Pvt Ltd. at a generous interest rate of 7.5% pa (reduced by 2% in FY20 itself). The interest rate and loan tenure is at Board’s discretion.

SANOFI also has a purchase & supply contract with SANOFI-Aventis Singapore Ltd. In FY20, 26% of revenues & 61% of Cost of sales were with SANOFI-Aventis. Also, RPTs account for a whopping ~70% of Trade receivables & ~50% of Trade Payables as of FY20. Such RPTs are rarely ever favorable towards minority shareholders & are driven by the whims & interest of Global parent in most cases.

VIII. Sum up :

- SANOFI is a good company to own with stable margins, debt free, cash rich, IP driven business with favorable terms of trade - but the latest sale of Ankleshwar unit puts future growth plans into uncertainty & past growth trends are not supportive of the premium valuations the stock is getting currently.

- Company is shifting focus from low margin bulk generics to high margin branded drugs which is a plus.

- Related Party transactions account for big proportions of the P&L and Balance Sheet which is a negative for minority shareholders as they don’t get much say over such transactions.

Inviting views of all members on this company.

Disclosure : Invested just tracking quantity