I completely endorse the views of @chetanbharath and expect the management to deliver as per their plan.

Decent Results from Rossell India.

Also considering demerger of Rossell Techsys from Tea Business. Would love to hear your thoughts here @ayushmit sir.

This demerger development comes as a big positive surprise! I feel this sector has lot of tailwinds with manufacturing moving to India and Rossell has been aggressively getting more and more orders. In past many people used to reject the idea because of the tea business being present…perhaps this will now interest more people. On the concern - valuations are not cheap now and the company needs to scale up faster on the aviation segment.

Disc: same as before

With 500 jets, Air India seals mother of all aviation deals

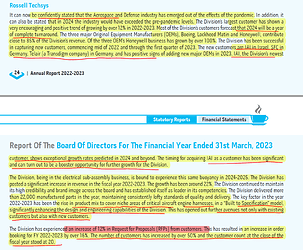

The latest annual report of the company is out and as usual its very optimistic ![]() Anyways given the tailwinds in the sector its good to see the developments…hopefully the co will start delivering the nos also

Anyways given the tailwinds in the sector its good to see the developments…hopefully the co will start delivering the nos also

There are few other interesting things too in the annual report. One negative is the increase in remuneration being proposed to 15% of NP…i feel investors should raise objection towards it.

Ayush

Disc: Invested in family and client acs

5 years ago there were the following subdivisions of the company, Rossell tea, Techsys, Aerospace Services, and Hospitality. In 2019, the company’s focus became clear that Techsys is the next growth engine and they proceeded to shut off hospitality and aerospace services. In 2019, revenues from Techsys was 98 crs which now has become 185 crs (which is a 13% cagr). Here revenue jumps are possible on the acquisition of new clients/new platforms which is a long business. Along with this, due to the nature of the industry, it had a very long cash conversion cycle due to high inventory levels. The company has been able to cater to this, this year by shifting some inventory purchases to be done locally. How they win contracts is by establishing a relationship with an aerospace company, then they are invited to RFP(request for proposal) by them. Once the company receives all RFPs the price is locked according to their proposal not subjected to be changed for the entirety of the duration. Wire Harness as a market is just under $2 Billion with the Industry going through a consolidation. The company believes in value unlocking due to 2 areas, demerger of both divisions and new business (expectation of Boeing and Lockheed to expand along with adding IAI as a client).

The company has reduced almost all of its long-term borrowing. Hoping to see the efforts end up bettering return rations.

Disclosure: Not invested

Ayush Ji they are not participating in TEJAS program.

What is the recording date for the eligibility to get Russelll Techsys shares, if someone buying Rosell India now still eligible to get the Rusesell Techsys share, or is the time over for that?

Looks like the competition is increasing in this space with increased interest in EMS companies. The recently listed company like Cyient DLM has aerospace wiring harness division with Honeywell as it’s main customer and it’s working with this company in many areas including the design and development and testing of avionics components through it’s parent organization Cyient Ltd. Because of this parent company link they are very strong in design lead manufacturing. As the market is big it may not be concern at this point in time, however it’s better to watch the competitor companies. I have invested in Rossell India and started tracking position in the Cyient DLM.

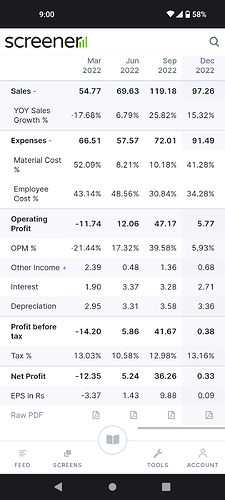

Financial Analysis of Rossell India Limited Q4 FY2023-24 Results

Financial Overview

-

Revenue Growth:

- Q4 FY2023-24: Revenue from operations stood at ₹6,338 lakh, compared to ₹6,513 lakh in Q4 FY2022-23.

- Full Year FY2023-24: Revenue from operations totaled ₹35,864 lakh, a marginal increase from ₹34,868 lakh in FY2022-23.

-

Profitability:

- Quarterly Performance: A loss before tax of ₹1,745 lakh was reported in Q4 FY2023-24 compared to a loss of ₹1,691 lakh in Q4 FY2022-23.

- Annual Performance: The company reported a profit before tax of ₹1,526 lakh for FY2023-24, down from ₹3,124 lakh in the previous fiscal year.

-

Expenses:

- Cost of Materials: The cost of materials consumed increased to ₹10,879 lakh for the full year FY2023-24 from ₹8,722 lakh in the previous year.

- Employee Benefits: Employee benefits expense rose to ₹14,254 lakh in FY2023-24, compared to ₹13,692 lakh in FY2022-23.

- Finance Costs: Finance costs increased to ₹1,423 lakh for the year, compared to ₹1,178 lakh in the previous year.

-

Exceptional Items:

- The company incurred ₹50 lakh in expenses related to the demerger process during FY2023-24.

-

Dividend:

- A dividend of ₹0.30 per fully paid-up equity share of ₹2 each (15%) was recommended for FY2023-24, down from 20% in the previous year.

Operational Highlights

-

Segment Performance:

- Tea Segment: The tea segment saw a reduction in revenue, contributing to the overall decline in quarterly revenue.

- Aerospace and Defense: Continued focus on long-term agreements and new project acquisitions in the aerospace and defense sectors.

-

Inventory Management:

- Inventories increased to ₹18,165 lakh at the end of FY2023-24 from ₹15,168 lakh at the end of FY2022-23, indicating a buildup of stock possibly due to anticipated future sales.

-

Debt Levels:

- Total borrowings were ₹19,402 lakh at the end of FY2023-24, compared to ₹16,161 lakh at the end of the previous fiscal year, reflecting an increase in debt to support operational and investment activities.

Sector Insights

-

Tea Industry:

- The tea industry faced challenges due to fluctuating prices and increased input costs.

- Rossell India Limited’s performance in the tea segment was impacted by these industry-wide issues.

-

Aerospace and Defense:

- The aerospace and defense sectors showed potential for growth with new long-term agreements and project acquisitions.

- Strategic investments and collaborations are expected to yield positive outcomes in the coming years.

Business Strategy

-

Diversification:

- The company is diversifying its portfolio to mitigate risks associated with dependence on any single segment.

- Focus on expanding in aerospace and defense sectors to balance the traditionally strong tea segment.

-

Cost Management:

- Implementation of cost management strategies to improve margins and operational efficiency.

- Continued investment in R&D to develop innovative products and solutions.

-

Sustainability Initiatives:

- Commitment to sustainable practices aligning with industry trends and regulatory requirements.

- Focus on long-term value creation through environmentally friendly operations.

Customer and Product Focus

-

Customer Base:

- Efforts to expand and diversify the customer base, particularly in the aerospace and defense sectors.

- Strong relationships with existing customers to ensure repeat business and long-term partnerships.

-

Product Development:

- Investment in developing new products and first articles to meet the needs of multinational corporations in the aerospace sector.

- Introduction of innovative solutions and products to stay competitive in the market.

Conclusion

Rossell India Limited faced a challenging FY2023-24 with a decline in profitability despite slight revenue growth. The company is strategically diversifying its portfolio, focusing on cost management, and investing in sustainable practices to ensure long-term growth. While the tea segment faced industry-wide challenges, the aerospace and defense sectors showed promise with new agreements and projects. The company’s commitment to innovation and sustainability positions it well for future opportunities.

This detailed analysis highlights the financial, operational, sector-wise, business, customer, and product-related aspects of Rossell India Limited’s performance for the fourth quarter and full fiscal year 2023-24 .

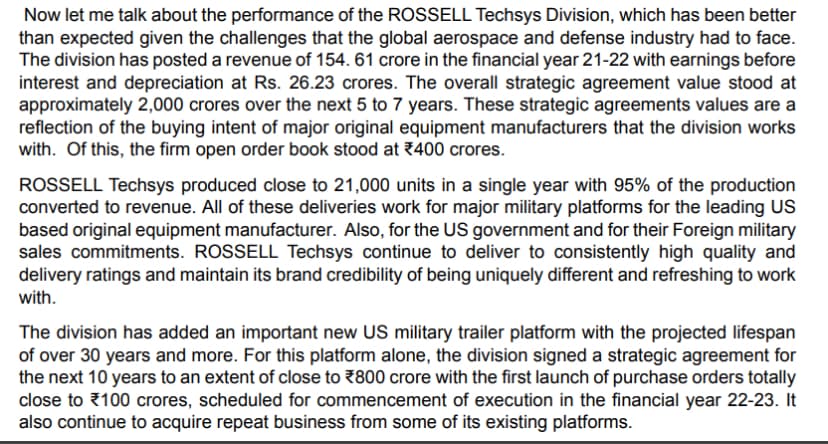

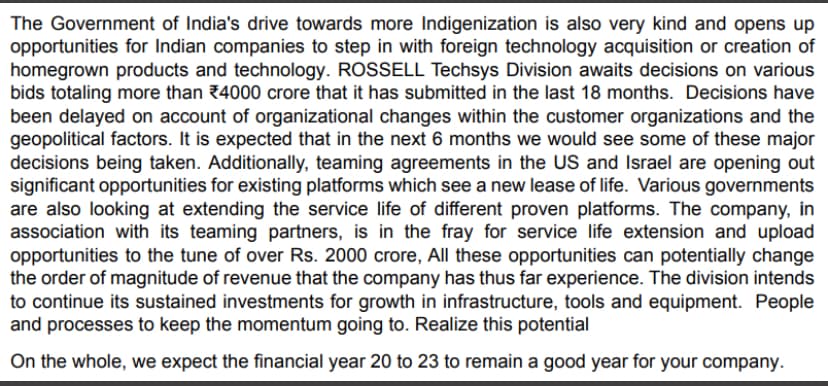

From the Annual Report

Rossell Tea produces some of the finest CTC and Orthodox Tea, exported to many countries like Canada, UK, Germany, Netherland, UAE, Saudi Arabia, Egypt etc.

Rossell Techsys offers value added services for leading global OEMs in Aerospace & Defence, for both military and commercial platforms. We cater to different platforms such as fighters, trainers, helicopters, unmanned ground vehicles, unmanned aerial vehicles, rockets, battle tanks, commercial jets and aero engine derivatives. We serve both the export and domestic sector. Major exports (~80%) are to USA, Europe and Israel. Rossell Techsys is specialized in Build to Specifications (BTS) and Build to Print (BTP).

To summarize, we anticipate the production being lower than last year due to adverse weather conditions and the increased testing of teas will restrict the use of chemicals. CTC prices may be somewhat similar to last year but marginally better for us owing to our compliance and quality. The orthodox prices will be better than the previous year. The biggest challenge will be to protect the crop and rein in the escalating costs particularly wages and fuel.

The total Operational revenue for the financial year 2023-2024 stands at 216.88 Crores, an increase of around 16.32% over the previous fiscal year 2022-2023. The Division added confirmed orders worth 638.00 Crores and confirmed strategic agreements worth around ` 2,800 Crores

The Operating Profit before depreciation and interest (EBITDA) of the Rossell Tea Division for the year was 1,198.59 lakhs as against 3,007.59 lakhs in the previous year. At the same time the Operating Profit before depreciation and interest (EBITDA) of the Rossell Techsys Division for the year was 3,553.36 lakhs as against 3,127.04 lakhs in the previous year. With the strong financial fundamentals over the year, the financial base of your Company remains strong, and it shall be further strengthened with better operating and financial performance in the years ahead, subject to the impact of demerger process being in progress at this stage.

Soft copy of the approved order of the scheme of amalgamation has been uploaded on the NCLT website on 02/08/2024.

Have anyone got Rossell Techsys shares in their dmat account?

Not reflecting yet.

Can anyone comment on the future prospects of Rossell India post demerger

Apportionment of Cost of Acquisition_Rossell India.pdf (884.0 KB)

Rossell India posted a good set of numbers for the Q2FY25. However, I feel the whole focus should be on its Resulting company i.e Rossell Techsys Ltd. which is into defence and related activities.

PFA, the apportionment of cost of acquisition published by the company yesterday 6th Nov 24.

per this for IT purposes the cost will be apportioned as below

a) Rossell India - 58.48%

b) Rossell Techsys - 41.52%

Please find below a brief about Rossell Techsys, hope this helps

Rossell Techsys: A Strategic Play in India’s Defence Sector - Future Prospects and Stock Prediction

Rossell Techsys, a key player in the Indian defence and aerospace industry, has been gaining significant attention for its contributions to defense technology and the rapidly growing aerospace sector. As India prioritizes self-reliance in defense manufacturing under the Atmanirbhar Bharat initiative, Rossell Techsys is uniquely positioned to benefit from this shift. Here’s a detailed outlook on the company’s financial standing and future growth potential.

Company Overview:

Rossell Techsys operates in the defense electronics space, specializing in custom-built systems and equipment for both Indian and global defense contractors. Its collaboration with renowned global defense players like Boeing and Lockheed Martin further strengthens its credibility and prospects in the market.

Financial Performance (Balance Sheet Highlights):

Revenue Growth:Rossell Techsys has experienced a steady rise in revenue over the past few years, thanks to increasing orders from both domestic and international clients. For the last fiscal year, revenue showed a year-on-year (YoY) increase of around 20-25%, a strong indicator of its expanding market presence.

Debt and Liabilities: The company maintains a low debt-to-equity ratio, which is a positive sign for investors. Minimal reliance on external debt means the company can sustain its growth trajectory without the burden of high-interest payments, positioning it well for future expansion.

Cash Flow: The company has been generating consistent positive cash flow from operations. This is essential for future growth investments and sustaining business activities in the competitive defense sector.

Profit Margins: Rossell Techsys operates with healthy profit margins due to the high-value, niche nature of its products. Margins are expected to improve further with operational efficiencies and localization of production, aligning with the government’s push for indigenization.

Future Growth Prospects:

Government Contracts & Defense Budget: India’s growing defense budget offers a promising outlook for Rossell Techsys. The government’s focus on indigenous production and modernization of defense equipment will likely result in more contracts for Rossell Techsys in the coming years.

Global Collaborations: The company’s partnerships with global defense contractors are expected to drive future revenue. These collaborations not only increase the volume of orders but also enhance technological capabilities, positioning Rossell Techsys as a competitive player in global markets.

Emerging Technologies: As defense technologies evolve, the company’s focus on aerospace systems, electronic warfare, and automation will provide opportunities to tap into emerging defense technologies. With increased government spending on R&D, Rossell Techsys can lead in adopting cutting-edge solutions.

Stock Prediction:

Based on its financials and strategic positioning, the future outlook for Rossell Techsys shares appears promising:

With steady government contracts and increased production efficiency, we expect the stock to see moderate growth, potentially increasing by 10-15% from its current levels.

As the company secures more defense orders and continues its global collaborations, the stock could rise by 20-30%, driven by revenue growth and improving profitability.

Over the long term, Rossell Techsys has the potential to double its stock price, backed by increased market penetration, rising defense spending, and its low debt levels. Investors can anticipate a 40-50% increase in stock price, assuming continued positive performance in the defense sector and successful execution of ongoing projects.

Conclusion:

Rossell Techsys presents a compelling investment opportunity for those looking to tap into India’s booming defense and aerospace sector. With a strong balance sheet, consistent revenue growth, and an expanding order book, the stock holds significant potential for growth in the short, mid, and long term.

Strategy: Long-term investors should consider accumulating the stock at current levels for solid growth, while short-term traders can look for opportunities to capitalize on short-term price movements.

Sharing recording of the 2022 AGM