Quick Background - I am a newbie to direct stock investing, and I used to invest through mutual funds earlier. Fortunately I got done with a lot of obligations - student loan, marriage ka kharcha, house loan just before the COVID crash. This pushed up my savings rate to 75% from the earlier 20% at which point I decided to start investing directly.

A lot of my picks have come through research on Valupickr, a close knit stock group and my own job - I work as a consultant at an MBB firm where I get to work directly with CXO in some of the stocks/sectors I invested in.

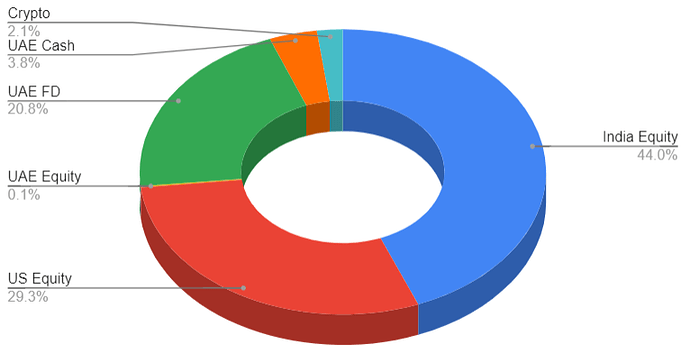

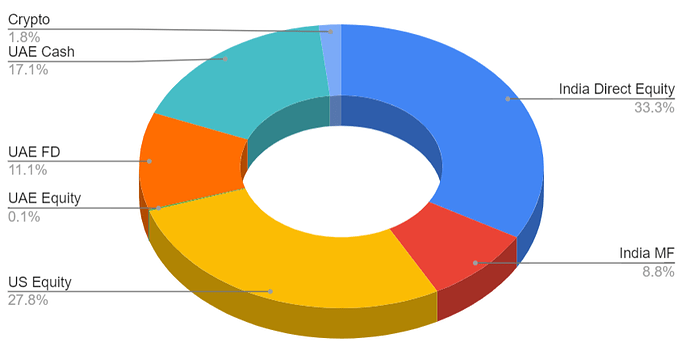

I invest my cash flow in the following manner:

a. 60% Direct Equities

b. 10% Crypto

c. 15% Mutual Funds

d. 15% Debt/Cash on Hand

I think of my portfolio in terms of baskets - I tend to buy 2-3 players in same space. Would be great to have everyone’s opinion as we enter into a choppy territory ahead. Feedbacks on stocks and cash flow allocation will be greatly appreciated

EDIT - I also have 5% tracking positions in IBullReal, Valiant, Stylam, LTTS. Additionally I have booked around 30% of capital as gains till now

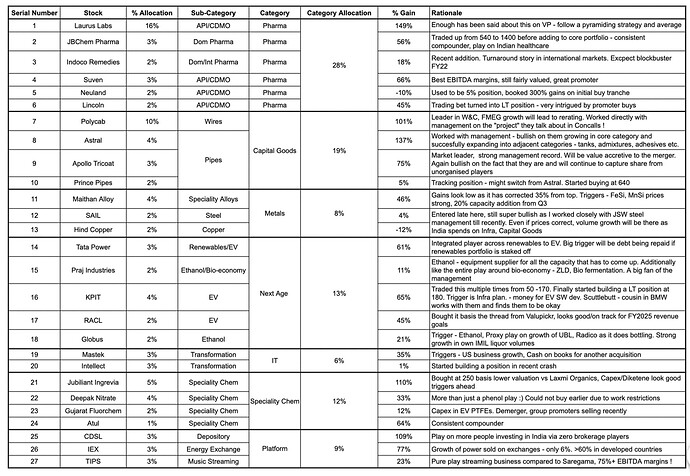

Here are my picks and rationale:

13 Likes

Great picks! Prince pipes should start its upward journey again…I am also tracking it to initiate position

Hi Rohit,

Your stock selections are good. But, can you explain why there is no financial, infrastructure & Auto stocks.

It is the best time to enter when they are low and hated.

Thanks ! Yes, Piping sector should do well from here.

Thank you ! As i mentioned I have 15% exposure in Mutual funds - it’s largely Bluechip (Large Cap IT/Financials), so didn’t see the point in buying again directly. But I added Equitas at 3% of PF

On the Infra front - I added IBull Real as 4% of portfolio. I keep trading in KNR/PNC/NCC - I don’t want to hold them as LT stocks as receivables will always be under pressure.

I have limited understanding of Auto so have avoided till now - always seems to be some headwind !

Hi Rohit…can you please tell the name of your MF schemes…

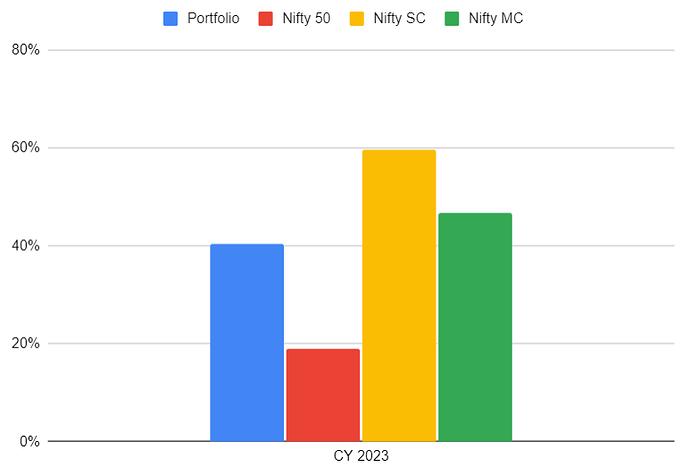

Been a long time since the last update - have shifted countries and jobs. Made a ton of mistakes including completely ignoring equities once the downturn started leading to bad exits (Lincoln) or not exiting stocks at the right time (Laurus Labs). Want to make it a habit of tracking my portfolio monthly - as of now the goal is to have 90% of India PF as long-term positions and 10% to chase positional/momentum ideas. Also want to exit the stocks marked ‘Exits’

Not really planning to share any rationale unless someone is interested - the plan is to more maintain a journal for myself

Portfolio as of 27th Dec 2023

| Category |

Stock Name |

Allocation |

% Change |

| Long - Term |

POLYCAB |

9.7% |

494% |

|

NEULANDLAB |

6.1% |

92% |

|

TATAPOWER |

6.1% |

48% |

|

FLUOROCHEM |

5.2% |

21% |

|

GRAVITA |

4.9% |

80% |

|

ICICIBANK |

4.8% |

6% |

|

APLAPOLLO |

4.7% |

22% |

|

NH |

4.5% |

48% |

|

RACLGEAR |

4.4% |

90% |

|

SWSOLAR |

4.1% |

21% |

|

AARTIIND |

3.9% |

16% |

|

MASTEK |

3.4% |

7% |

|

RELIANCE |

3.0% |

11% |

|

KPITTECH |

2.8% |

107% |

|

TIPSINDLTD |

2.6% |

-4% |

|

TITAGARH |

2.5% |

75% |

|

IEX |

2.2% |

-1% |

|

JBCHEPHARM |

2.1% |

19% |

|

MAYURUNIQ |

2.0% |

5% |

|

PRICOLLTD |

1.9% |

14% |

|

LAURUSLABS |

1.8% |

2% |

|

JUBLINGREA |

1.5% |

19% |

|

SHBCL |

1.4% |

4% |

|

INTELLECT |

1.0% |

5% |

|

AVANTIFEED |

0.6% |

0% |

|

NIFTYBEES |

0.6% |

4% |

| Positional |

NCC |

4.6% |

11% |

|

PRAKASH-T |

2.3% |

14% |

|

DEEPAKFERT |

2.1% |

1% |

| Exit |

GLOBUSSPR |

2.3% |

-13% |

|

LUXIND |

0.8% |

-24% |

Hi Rohit

Could you explain your reason to exit Globus spirits and Lux Ind ?

Praveen

Lux will continue to have the promoter overhang - would want to shift to Dollar once the cycle turns. Globus always seems very promising and deep value, but promoter guidance and results have not aligned at all with good times always in the next quarter. Would like to cut and pyramid up in new winners - Gravita, TIPS, Aarti etc

1 Like

As always, this thread is more of a tracker for myself and open for reviews from other people. Key takeaway over the last month has been to:

a. Trim position size if any adverse news on top holdings - e.g., Polycab. Was late to cut the position as it meant selling my position I had built at ~600. Lost quite a bit of gains

b. Track trends more closely on Social Media and follow-up with technical and fundamental analysis. e.g., SW Solar has been a big win, but at the same time lost out on other railway stocks (could have used a sharp SL for quick entry and exit) -this adds to overall portfolio XIRR

Have entered a few new positions (Tanla, Equitas SFB etc.) and do expect to churn out underperformers post concalls to reduce number of stocks e.g., Mayur Uniquoters, Globus Spirits.

Portfolio returns in Jan have been just 1%, in-line with small and mid-cap indices due to blow-up of my large 10% Polycab position but still delighted that I was diversified enough (Neuland, SW Solar, Tata Power) that I escaped damage at portfolio level.

On a overall portfolio level still at a healthy cash level (~30%) and will move money to India/US to BTFD

| Category |

Symbol |

Allocation% |

PnL% |

| Long-Term |

TATAPOWER |

6.63% |

58.5% |

|

NEULANDLAB |

6.41% |

105.3% |

|

POLYCAB |

5.69% |

96.0% |

|

SWSOLAR |

5.31% |

48.7% |

|

NCC |

5.21% |

27.8% |

|

FLUOROCHEM |

5.16% |

22.5% |

|

ICICIBANK |

4.68% |

5.5% |

|

NH |

4.64% |

54.3% |

|

APLAPOLLO |

4.38% |

15.6% |

|

RACLGEAR |

4.36% |

78.3% |

|

GRAVITA |

4.12% |

43.3% |

|

AARTIIND |

4.04% |

13.8% |

|

MASTEK |

3.16% |

1.4% |

|

RELIANCE |

3.05% |

14.2% |

|

TIPSINDLTD

|

2.94% |

9.1% |

|

KPITTECH |

2.69% |

104.9% |

|

JBCHEPHARM |

2.17% |

23.2% |

|

IEX |

2.07% |

-13.0% |

|

MAYURUNIQ |

1.89% |

2.6% |

|

EQUITASBNK |

1.86% |

-3.8% |

|

PRICOLLTD |

1.79% |

8.7% |

|

INTELLECT |

1.64% |

9.9% |

|

TANLA |

1.45% |

-7.6% |

|

SBCL |

1.42% |

8.4% |

|

LAURUSLABS |

0.93% |

-6.5% |

| Positional |

DEEPAKFERT |

0.59% |

-10.7% |

|

AVANTIFEED |

1.81% |

11.8% |

|

PRAKASH |

2.37% |

21.9% |

|

COSMOFIRST |

0.24% |

-3.8% |

| Exit |

GLOBUSSPR |

2.14% |

-18.7% |

|

SGBSEP27-GB |

0.62% |

63.2% |

| Other |

Cash |

4.55% |

N.A |

Trying to stick to my habit of journalling my investing journey and try and develop a strong investing process. Used the recent pullback to exit positions with strong headwinds - Globus Spirit, Deepak Fert, SBCL, Mayur Uniquoters and enter new positions with strong tailwinds - IWEL, Jindal Stainless, STAR and Garware HiTech.

Learning is to not get married to “hopium” for stocks like Deepak Fert/Globus Spirit and absorb a loss. Am almost at break-even now with the profits in my new positions bought during the dip.

Stocks I am looking for an entry point/want to add more - KDDL, Jindal Stainless, Gujarat Fluorochem, Shilchar Technology and Vaibhav Global

Stocks I am tracking for a reversal - Laurus Labs, Jubilant Ingrevia, Cosmo First - kick-in of operating leverage in the first two like Aarti Industries

Stock I am looking to exit - IEX

Current portfolio stands as below (PF up +5% from the last update 22 days ago):

| Symbol |

Sector |

P&L chg. |

% Allocation |

| NEULANDLAB |

Pharma |

159.74% |

7.8% |

| TATAPOWER |

Energy |

69.03% |

6.8% |

| NCC |

Infrastructure |

42.46% |

6.5% |

| SWSOLAR |

Energy |

52.76% |

6.2% |

| POLYCAB |

Infrastructure |

119.80% |

6.1% |

| NH |

Pharma |

69.86% |

4.9% |

| AARTIIND |

Speciality Chemicals |

20.34% |

4.9% |

| RACLGEAR |

Auto |

61.58% |

4.8% |

| ICICIBANK |

Financials |

7.71% |

4.6% |

| GRAVITA |

Others |

43.25% |

4.2% |

TIPSINDLTD

|

Consumption |

32.31% |

3.6% |

| RELIANCE |

Consumption |

25.28% |

3.2% |

| PRAKASH |

Metals |

11.70% |

3.1% |

| APLAPOLLO |

Infrastructure |

10.51% |

2.9% |

| KPITTECH |

IT |

128.40% |

2.9% |

| MASTEK |

IT |

15.09% |

2.7% |

| SOUTHBANK |

Financials |

-7.56% |

2.6% |

| EQUITASBNK |

Financials |

-2.12% |

2.2% |

| IEX |

Energy |

-6.12% |

2.1% |

| JBCHEPHARM |

Pharma |

20.67% |

2.0% |

| PRICOLLTD |

Auto |

22.83% |

1.9% |

| GRWRHITECH |

Auto |

8.73% |

1.7% |

| INTELLECT |

IT |

11.87% |

1.6% |

| SHILCHTECH |

Energy |

8.03% |

1.6% |

| STAR |

Pharma |

3.00% |

1.5% |

| TANLA |

IT |

-12.76% |

1.3% |

| FLUOROCHEM |

Speciality Chemicals |

-1.58% |

1.3% |

| IWEL |

Energy |

7.85% |

1.2% |

| VAIBHAVGBL |

Consumption |

1.87% |

1.2% |

| JSL |

Metals |

1.01% |

0.7% |

| LAURUSLABS |

Pharma |

-4.76% |

0.6% |

| SGBSEP27-GB |

Gold |

63.18% |

0.6% |

| PHARMABEES |

Pharma |

0.58% |

0.4% |

| JUBLINGREA |

Speciality Chemicals |

6.70% |

0.3% |

| COSMOFIRST |

Speciality Chemicals |

-3.79% |

0.2% |

1 Like

How you decide the percentage of the any specific stock?

No of stocks or amount or some other parameter?

Hi Rohit,

Great set of stocks!

Two points if you have please suggest your thought process about -

- Prakash - If you can share your hypothesis for taking exposure to Prakash

- Globus - How the hypothesis in this got broken

Thanks

-Manohar

Trying to follow this thumb rule of investing when taking up initial positions (inspired by SOIC):

1% - Tracking

2% - Low conviction/exploring thesis

4% - Medium conviction and results show thesis has started playing out (e.g., Aarti industries)

6%/8% - High conviction with thesis getting validated

No position >8% due to concentration risk (Learned this the hard way after Polycab fiasco)

Obviously these are very different from what you see above because the total portfolio value keeps changing but on a high-level

1 Like

- Prakash Industries - key triggers are

- Coal block getting commissioned going into summer

- Promoter releasing pledges

- Metal upcycle starting - results have seen steady upwards tick

Will play this with a strict SL.

- Globus Spirits - its more about opportunity cost here. Management seems to have become pessimistic on Ethanol business given flip flop on goverment policy impacting RM costs. Their liquor businesses will still take a lot of time to scale. In a market where more promising opportunities are there, happy to come back when things look-up.

1 Like

With time have started to get more confident in timing entry/exit into stocks. Up 27% for the year (decent considering the size of the portfolio and no SMEs/new IPOs)

Key exits:

a)Narayana Hrudalaya - Mgmt is guiding for revenue and profit normalization. Still decently valued but why be bullish when mgmt is conservative?

b) Reliance - sold @2970. Was always a trading bet for me, will reenter if/when it corrects 10-15%. As always the play is to get the free businesses - Reliance Retail, Jio etc.

c) ICICI Bank - Sold at all time high P/B. Bit of a headwind in the financials space, stocks isn’t moving much - felt prudent to take profits and re-enter if correction happens

d) KPIT Tech - Sold @1500, missed 30% more rally but I feel we are at peak growth and peak PE. Kind of feel that another TATA ELXSI will play out soon. But its an insanely good business and superb execution by promoters. When I first bought it, it was 1/10 of ELXSI MCap, now its 20% more.

| Symbol |

Sector |

P&L |

%Allocation |

| NEULANDLAB |

Pharma |

221.24% |

8.8% |

TIPSINDLTD

|

Consumption |

59.73% |

8.4% |

| POLYCAB |

Infrastructure |

105.95% |

7.8% |

| GRWRHITECH |

Auto |

33.75% |

6.9% |

| GRAVITA |

Waste Management |

133.52% |

6.7% |

| NCC |

Infrastructure |

111.51% |

6.6% |

| SWSOLAR |

Energy |

57.62% |

6.2% |

| TATAPOWER |

Energy |

98.58% |

5.6% |

| RACLGEAR |

Auto |

47.95% |

4.4% |

| IEX |

Energy |

20.90% |

3.5% |

| AARTIIND |

Speciality Chemicals |

21.09% |

2.4% |

| VAIBHAVGBL |

Consumption |

-11.49% |

2.4% |

| PRAKASH |

Metals |

22.24% |

2.3% |

| KDDL |

Consumption |

37.48% |

2.3% |

| SENCO |

Consumer |

12.78% |

2.2% |

| MASTEK |

IT |

21.30% |

2.1% |

| EQUITASBNK |

Financials |

-18.57% |

2.1% |

| SAMHI |

Consumption |

-1.65% |

1.8% |

| SBCL |

Energy |

20.82% |

1.6% |

| GPIL |

Metals |

4.08% |

1.6% |

| INOXWIND |

Energy |

21.43% |

1.5% |

| POLYPLEX |

Consumption |

12.92% |

1.4% |

| BALAJI AMINES |

Speciality Chemicals |

8.53% |

1.0% |

| VALOR ESTATE |

Real Estate |

-1.71% |

1.0% |

| APLAPOLLO |

Infrastructure |

-5.63% |

0.9% |

| KAJARIA CERAMICS |

Infrastructure |

1.97% |

0.8% |

| NITIN SPINNER |

Textiles |

1.57% |

0.7% |

| WAAREE RTL |

Energy |

-12.09% |

0.3% |

| EYANTRA Ventures |

Consumptions |

16.20% |

0.2% |

| Gold Bond |

Gold |

92.16% |

0.6% |

Would be great to get feedback on top allocations and new sectors to look at

2 Likes

@RohitNarayanam - I would suggest Oil & Gas, Agrochem, Water Recycling and Textile for analysis. I liked your portfolio.

Thank you - any names that are on top of your mind that I should look at? For textiles I am studying Nitin Spinners, Indocount, Welspun. For Water - Vabag, EMS, Jash. For O&G - HOEL, Selan, Deep Ind. Agrochem - PI(?)

For Agrochem - I have studied India Pesticides and invested there. Other names worth studying in my view are Punjab Chem, Sharda Crop, UPL, PI (is the best in Agrochem), and Sumitomo.

1 Like

Hello Bro !

Been watching this thread and found ive similar number of names in pf, may be more

Would you like to share your latest entry/exits ?

What are new names / sector are your studying ?

![]()