Raymond Realty is by far one of the most interesting special-situation opportunities in Indian equities. It’s the closest to buying a company for 50 cents on the dollar. And if this plays out, it would make many investors pleased that value investing is very much alive and works.

TLDR Summary at the end if you don’t want to read

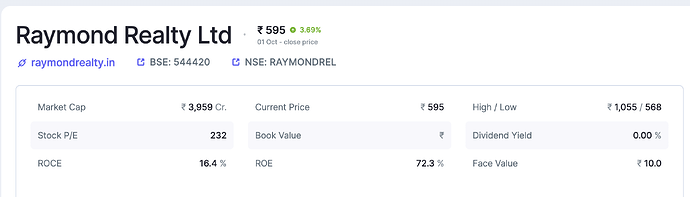

Quick review of the financials

Note: these are pro-forma financials that I was able to reconstruct, adjusting for things like accounting treatment of discontinued operations, demerger effects etc but they represent the financials on a like-for-like metrics, so they will not always match with published figures

FY 2025-26E numbers are based on management guidance

I’ve checked as much guidance as I could, and so far, the verdict is that management has delivered on guidance.

In July 2024, during their Q1 FY25 Results, they guided >20% Revenue Growth and >20% EBITDA Margin.

At FY25 end, Revenue was INR 2313 cr, up 45% (compared to INR 1593cr in FY24) and delivered 22% EBITDA Margin

I had the chance to speak with the CEO and CFO during the recent Arihant Capital conference, and they reiterated the guidance of 20% growth in revenue and 20% EBITDA Margin, and were quite confident about it.

While I have my skepticism after the Q1 FY2025-26 Revenue numbers that came in at INR 400cr due to lower inventory, I still think if the revenues remain flat (unlikely situation - given the current macro outlook)

Bear case could look something like -

EPS of 43, CMP of 600 → available at a forward P/E of 14. Still a bargain. I think the problem is due to the presentation of numbers.

Demerger/Spinoff Mechanics

The boring accounting explanations -

The discrepancy is likely due to the accounting treatment of a discontinued operation following a corporate demerger.

Pursuant to the approval of the Composite Scheme of Arrangement by the Hon’ble National Company Law Tribunal, the Realty business of Raymond Limited was demerged into a separate entity, Raymond Realty Limited, with effect from April 1, 2025 - the appointed date for the demerger.

It is important to note that prior to the demerger, the Realty business formed an integral part of Raymond Limited. Hence, in the consolidated financial statements for the period preceding the demerger, its results were presented as a discontinued operation in the Raymond Limited Annual Report FY24-25. Following this demerger, the financial results of Raymond Realty Limited from April 1, 2025, onwards are reported independently.

Before the demerger, Raymond Realty Limited operated as a wholly-owned subsidiary holding Ten X Realty Limited, which housed the operations of the Address by GS - Bandra project. The appointed date for the demerger was April 1, 2025. As of this date, the entire Real Estate business is now housed within Raymond Realty Limited.”

- Hiren Sonawala, Company Secretary, Raymond Realty Limited

Which is why FY24 numbers on several screeners like screener.com or even the audited financial statements are not representative, and as a result, the PE looks extremely high

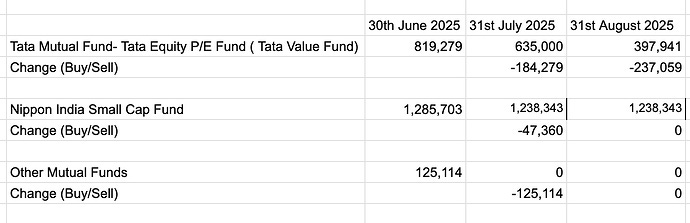

I’ve also been tracking the holders of Raymond Realty, especially mutual funds that got Raymond Realty shares for their holding in Raymond Ltd.

Tata Value Fund is restricted from holding stocks that have a very high trailing P/E, so understandably, they will sell regardless of what the actual economic reality is.

Nippon Small Cap Fund seems to be holding on.

The other funds were mostly holding Raymond Realty due to their initial holding in Raymond Ltd, and have had to sell out of their holdings due to the exclusion of Raymond Realty from certain indices.

https://www.niftyindices.com/Press_Release/ind_prs08072025.pdf

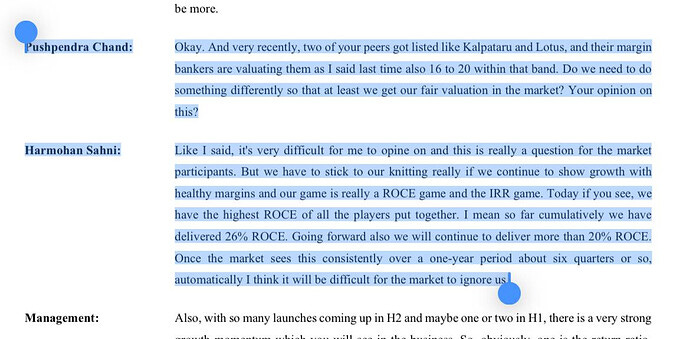

I think it’s only a matter of a few quarters before the price moves closer to its fair value, as echoed by remarks on the earnings call

Valuation

Indian Realty Peers Valuation

Kolte Patil Developers received a takeover offer at INR 329 per share, with an FY25 EPS of INR 14, that sets the P/E at 23.5x

These multiples imply the following values for Raymond Realty

Spinoffs and demergers have a huge amount of selling post listing, largely institutional selling, which has been a widely studied phenomenon, and nobody else puts it better than Joel Greenblatt in his book

Additionally, due to what the accounting standards allow, and prior corporate structure as explained above, the P/E multiple looks artificially high, and does not accurately represent the true earnings of the company. So the stock wouldn’t even show up on most investors’ stock screeners.

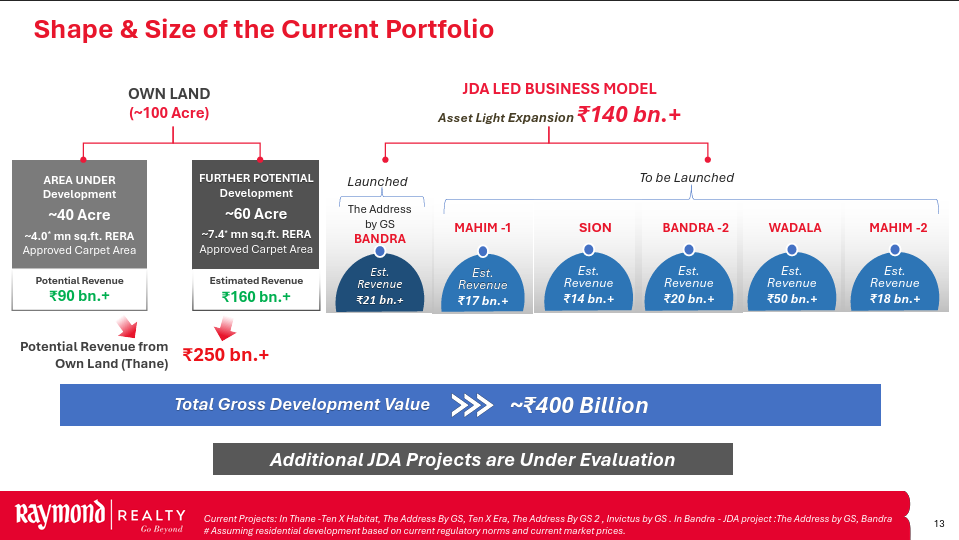

Liquidation scenario

Now, let’s think of absolute worst-case scenarios, where the company ceases to operate for whatever reason and now has to liquidate.

Here’s what they own

They own a 100-acre land parcel in Thane, of which they have sold 40 acres (not exactly). Leaves them with about a 60-acre land parcel with 7.4mn sqft RERA-approved carpet area.

Based on listings in the area, purely the land alone is worth more than INR 23-24 cr per acre; the land parcels are worth INR 1380 - 1440 cr

They also have rights to the joint development agreements (JDAs), which they have paid for, with a Gross Development Value of 16,000 crore. Assuming that these JDAs were underwritten with a 20% EBITDA for Raymond Realty, the EBITDA for Raymond Realty from these JDAs to be executed over 5-7 years is approx INR 3200cr, so if we discounted this at a discount rate of 13%, we’d get an NPV of INR 1500cr. So on liquidation, they can transfer these rights to another developer for 1050cr, taking a 30% haircut on this.

They have a net cash surplus of 233cr (cash - all the debt)

Putting it together

Catalysts

- As the CEO Mr Sahni said in the Q1 FY26 Earnings call,

But we have to stick to our knitting really if we continue to show growth with healthy margins and our game is really a ROCE game and the IRR game. Today if you see, we have the highest ROCE of all the players put together. I mean so far cumulatively we have delivered 26% ROCE. Going forward also we will continue to deliver more than 20% ROCE. Once the market sees this consistently over a one-year period about six quarters or so, automatically I think it will be difficult for the market to ignore us.

So, continued execution and delivering on guidance would make it very difficult for the market to continue discounting Raymond Realty to its peers.

Once the company can fully publish its full-year results as a standalone company, it would reflect better, purely from a restating of the accounting numbers that are presented in financial results and stock screeners that would pick this up.

- While Raymond Realty is a pure play real estate company, Raymond has now turned its focus towards engineering. However, Raymond continues to be a part of the NIFTY Realty Index, whereas Raymond Realty was excluded. So if Raymond Realty is picked up by the indices that it was excluded from, there’s the potential for shares to appreciate, with the stock seeing inflows.

- Institutional selling pressures come down - most passive mutual funds and index trackers have sold out, and I would assume the arbitrageurs have exited their positions, so maybe once the Q2 FY26 shareholding pattern comes out in October/November 2025, we can see the evolution of shareholding to get an idea of the holders

- Analyst Coverage

TLDR: Price Targets

Disclaimers:

Not Financial Advice

I own the stock and look to purchase more