Based in Vadodara Gujarat RPEL is promoted by by Mr. Ramanand Sanghvi and currently managed by Mr. Vijay Sanghvi and family. They currently hold about 55% of the company. The company had recently issued its initial public offering at a price of 98.

About the Company

The company was incorporated in 2002 and was involved in the manufacturing of stainless steel washers, pipes , tubes , sheets and solar mounting hooks. The company produces 2500+ washers in different sizes and international standards.

Difference between normal and stainless steel?

In my previous newsletters i have discussed briefly the difference between normal and stainless steel. Stainless steel is better than traditional steel because it has a higher resistance to corrosion, superior aesthetic finish and higher life span.

Cold rolled products are globally more popular and account for 47% of the global stainless steel production followed by hot rolled products.

Company’s manufacturing capabilities

Company has four manufacturing units two of which are located in GIDC, the other one located in Vadodara and the last one located in Vatva. All of them are located in Gujarat.

Company reduces its cost by backward integrating. SS Sheets, washers and solar hooks are manufactured in plant 1. The first two units (Unit I and II) are dedicated for manufacturing the products which are used for sales , the other two units (Unit III and IV) are dedicated towards processing the byproducts generated in manufacturing the products and converting it back into the raw material for the products. This gives the company strength and maximizes its return on investments as compared to its peers. Around 11% of raw material is generated through backward integration and the rest 89% through procuring from external suppliers.

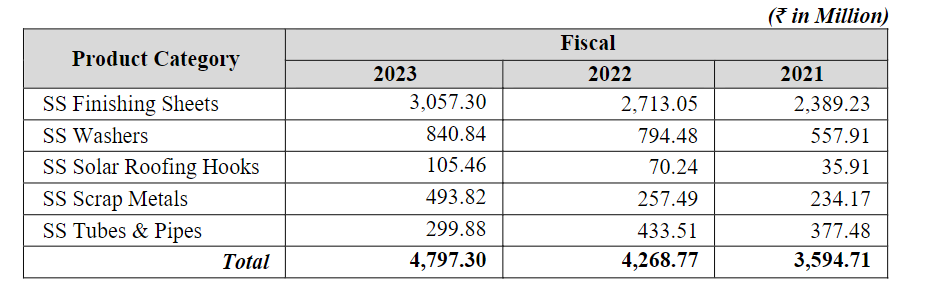

Turnover of different products for the year 2021, 2022 and 2023.

Product Profile

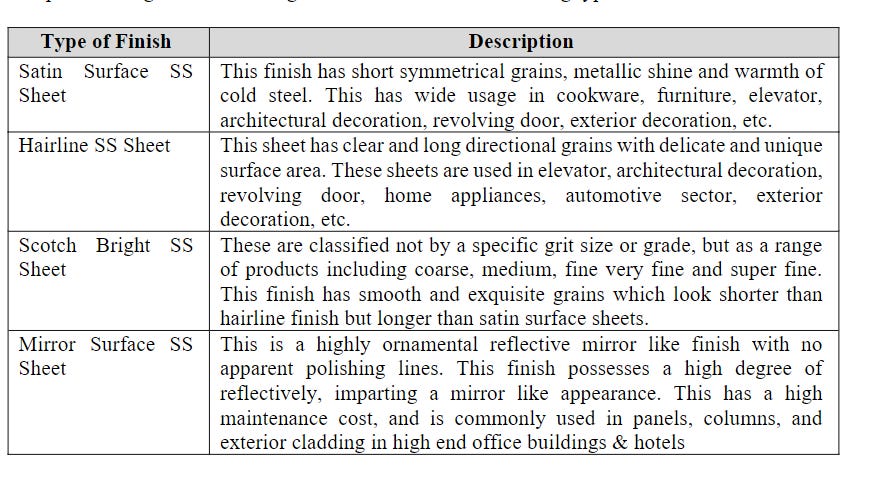

- SS Finishing sheets

A flat piece of stainless sheet used in architecture, building and construction also used in food industry, railway and aerospace industry. SS flat piece under 6mm is considered a sheet and above 6mm is considered plate. Usage in kitchen and sanitary applications is a normal use case and its recyclability and prevention from bacteria contamination make it a popular product. It usually requires 300 and 400 series of steel to be manufactured. We will talk about steel series later.

A brief description of SS Sheets and its types

- SS Washer

They are basically used as a tool to absorb shock and distribute the load to fasteners. They are made of variety of materials like stainless steel , carbon steel , zinc, copper, brass, plastic rubber , fiber and ceramic. There are three type of washers plain washers , lock washers and spring washers.

The company produces inner ring washers , spring washers , nord lock washers , retaining rings , internal tooth washers and external tooth washers.

- SS Solar roofing hooks

Solar roofing hooks are used for solid fastening of photovoltaic systems on pitched roofs. Roofing hooks serve as a foundation for photovoltaic mounting systems for tiled roofs and are to be mounted directly on the roof battens and rafters. Basically they are efficient and are required for the working of solar power systems. They are small hooks that are quite popular because they are low cost and increase endurance.

- SS Tubes and pipes

One of the most important tools in the industry and are used in the application of oil and gas, capital goods , power and other industry. Used to manufacture Industrial goods and used in the pharma , dairy , sugar and other sectors. Since majority of tubes and pipes are used in capex their demand is related to the capex cycle. India is currently experiencing a capex boom in almost all sectors which makes it a perfect opportunity for Ratnaveer.

Competition

SS Sheet manufacturing is a fragmented industry in India with small and mid size players dominating the market. Easy availability of raw materials, no intellectual property for production processes and no brand loyalty have made this industry attractive for small and mid size players. With capital requirements of as low as 50 lakhs one can easily start a steel trading business .

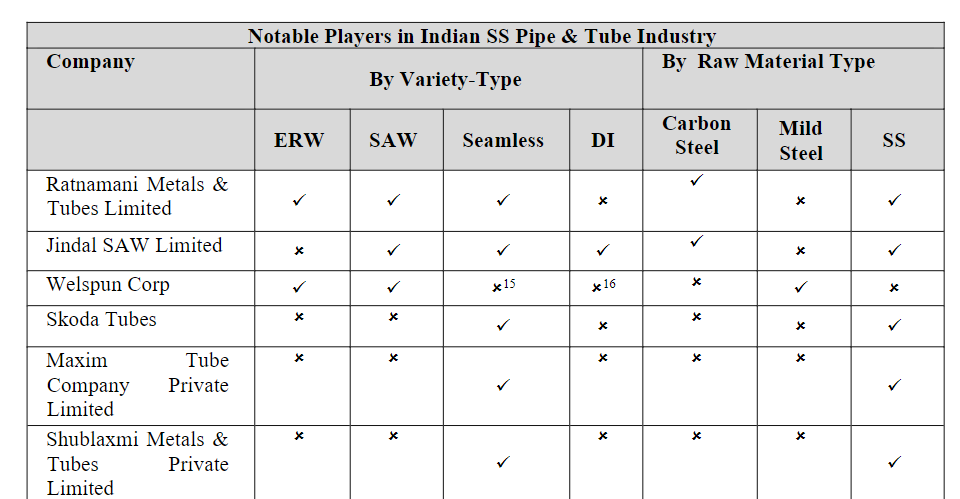

Notable competitors include Panchdeep Metal Corp , Jyoti steel India and Jindal Stainless Steelway Limited. This is a commodity business and hence cheaper prices attract more sales but margins are compromised. While other products manufactured by the company like washers and roofing hooks the competition is regional and mid size players. For SS pipes and tubes the competitive landscape changes. Here is a table to make you understand the different players in the industry and their competitive advantage.

Jindal being on of the biggest players in India today controls the entire stainless steel market directly or indirectly by controlling prices or influencing government decisions for import restrictions.

Growth Triggers and Opportunities

- **Completion of Capex and focusing on Value adding Products with increased margins.**Company is doubling its capex which will cost them about 46 crores. This is being done through funding and bank loans which is estimated to be completed by 1/7/24.

- New Product Launch

- Company will be launching Disc, Lock washer, Circlips, Nut and bolts. This will also be launch by 1/7/24 and will be sold domestically as well as be exported to USA, Europe, Middle East and South Asia. The company also has a e-clip and a ring application division that has been approved by its customers and will attract higher margins.

- Backward Integration and SynergyThe company has a backward integration model which helps to procure 11% of its raw material. The main raw material includes SS Coils and wires which are then processed to value added products. Usually the scrap generated from these products are sent back to the units which helps the company to procure materials at a cheaper price.

- Marquee Customers and diversified Client baseThe company deals with regional and foreign customers and typically serves to the navy, aeronautical, motors, windmills, automobiles and railways sector.

- Consistent Financial Performance and result oriented managementSales are growing at 12.75% CAGR with the management promising to increase the sales further by introducing new products and increasing existing capacity. The promoters have been in the industry since three decades and have made this company from a small manufacturing hub to a big mid size player. The company expects to generate 850 crore turnover in FY2025 and has also incorporated a subsidiary in the UAE to increase the export business.

-

Risks and threats

1. Cyclical nature of the businessThe business is cyclical in nature and is affected by capex cycles and prices in the steel industries. The steel sector currently is facing a uptrend and past trends show that there is a downturn every 5 years.

2. Working Capital Intensive businessAs every manufacturing business this is also a working capital intensive business. The working capital days is 170 days majority due to high inventory days.

3. Highly competitive business with no brand loyalty and awarenessThe company operates in an industry where it is easy to capture market share due to the commoditized nature of the business. The industry works on prices alone. Cheaper prices attract more sales. With competition from regional and unorganized traders and distributors the company has to increase its competitive efficiency.Financials

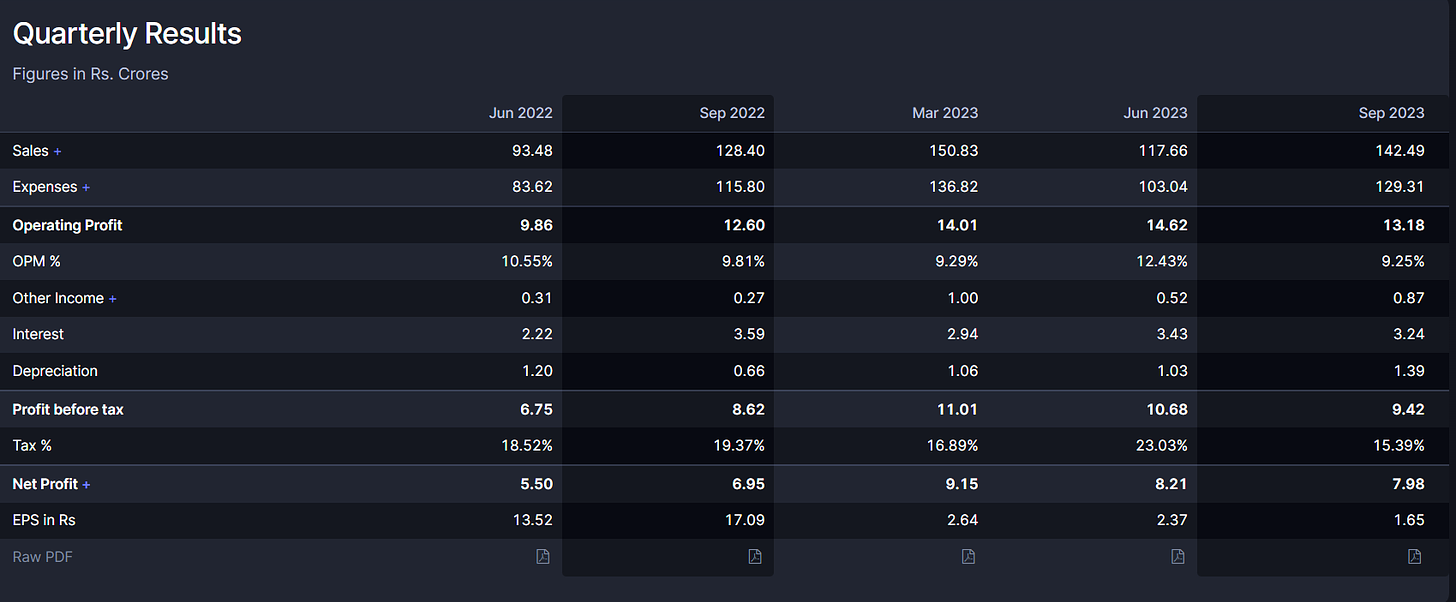

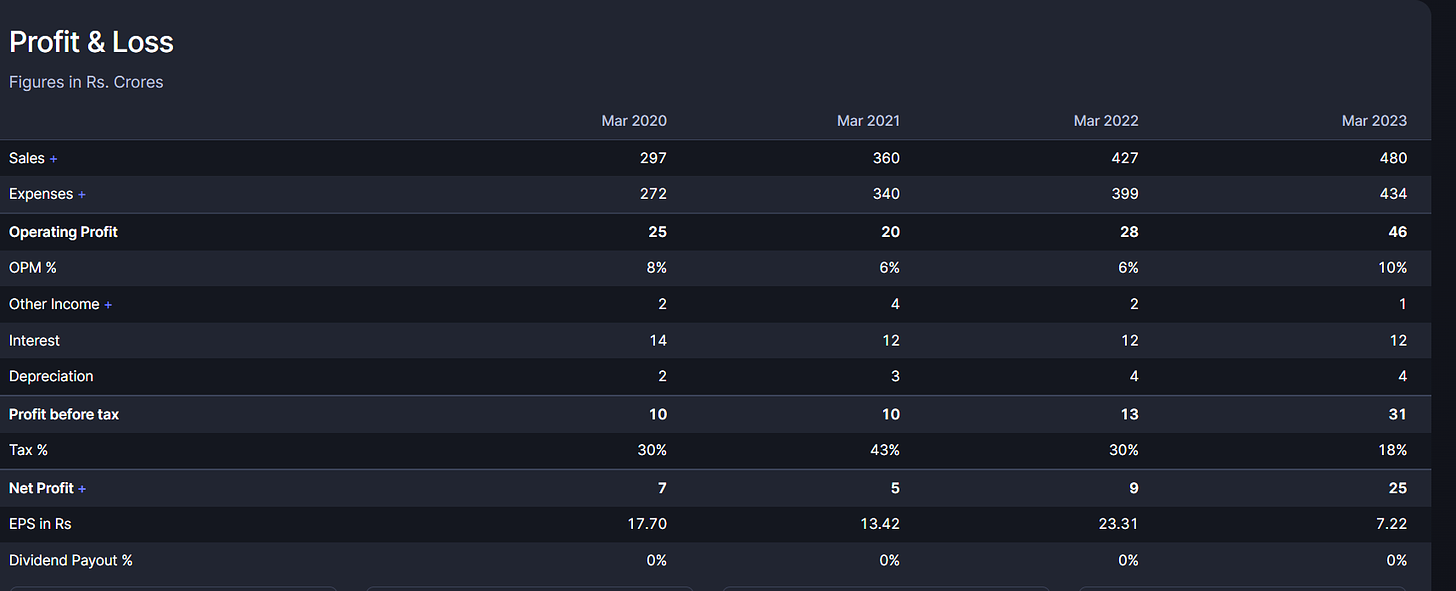

Margins have contracted due to increase in raw material prices however increased demand due to capex cycles has increased sales. Profits and sales were up YOY and are expected to increase in near future.

Sales have been increasing at a steady pace of 12.75%. Margins have increased due to new value added products being introduced in the market and focus on exports.

Net profit is increasing at 37% CAGR and with increasing margins and a higher turnover profits should increase at this rate in the future.

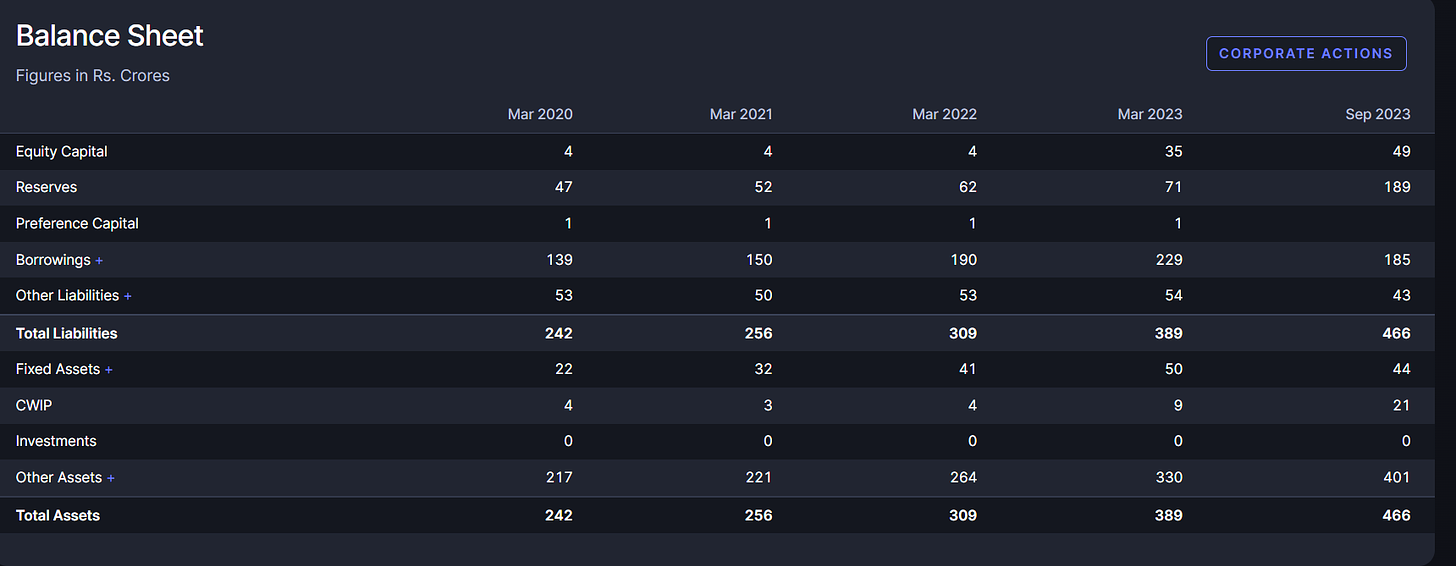

Borrowings have been reduced due to funding received from IPO . However expect them to increase this year due to ongoing capex. Fixed assets should increase too and with more development in the steel industry the balance sheet size could increase further. Overall the balance sheet looks healthy.

Negative CFO however is a big red flag with much money stuck in inventory as stated above. Company needs to move its inventory faster. From the above trends sales always increase in the march quarter which might be a cause of increasing receivables. One will need to watch carefully the Cash flow statement to know the true picture.

Company is newly listed so framing a technical chart is very difficult. However broker reports suggest that the company might achieve a target of 231 in the next 12-18 months.

Conclusion

The company is newly listed and has lots of potential. Markets are at an all time high and finding value stocks has been tough. This company looks like a value buy. I do not to do DCF Analysis because understanding the business and looking at future prospects of the company is enough to understand if it would be a future multibagger. Having talked to regional players about this industry there seems to be a shortage which could increase prices of materials and eventually margins.

FII activity has to be closely monitored along with volumes and delivery % to see if smart money is entering this stock.

I regularly write about stocks on my substack consider subscribing if you liked this post