Agree, and thanks for sharing your thought process - If i am not a buyer in FMCG at current valuations then i should sell my holdings. I think I am still a buyer in dips as far as FMCG is concerned…only reason I stopped is I feel my allocation levels are reached for the moment.

Just like you, I also came some in cash during the crash period - mostly after listening to seniors who came all out in cash - at least they said so…and i guess most of them are deploying in export oriented pharma or already deployed in crash. For me, I deployed part of it in some FMCG I didnt have exposure to (specially MNC, ITC) and now kind of developed a liking for MNC Pharma - as they seem very close to FMCG companies because of their branded play.

What are your thoughts on MNC Pharma - They are the real branded play with strong sustainable moats. Also, something like United Spirits and United Breweries - Both MNC controlled branded plays on premiumization, responsible drinking and increase of disposible income.

The reason I ask you this is because you have been liking and investing in FMCG and these have very similar characteristics…

Disc: Hold many FMCG company and other shares named above so views will be biased. Not a buy/sell recommendation.

Hi…

My knowledge about MNC pharma operating in India is limited.

Off the cuff…I can say a few things-

-

Abbott India has a very good reputation of launching products from its listed arm. Pfizer does the opposite and is hence - infamous. Will have to check about the likes of GSK and Sanofi.

-

Even the Indian heavyweights have very good presence in branded generic domestic market. Like- Cipla, Sun, Alembic, Lupin etc.

Traditionally, the growth rates of their domestic business has been as good as the MNC counterparts like Abbott India. Same is the case with the profitability of their domestic business.

It was their US business that was facing a lot of headwinds due regulatory and pricing related troubles. Both these aspects, in all likelyhood are nearing resolution ( an informed opinion ). Therefore, these companies may have better prospects going forward. ( again …an opinion )

- As we know by now, over and above US generics, branded generics, complex generics , speciality products and biosimilars…another space that has a lot of potential is the API space due potential shifting of supply chains from China. Here, the likes of Sun, Dr Reddy, Cipla, Alkem, Alembic etc etc etc may end up benifitting as they may also selectively jump in and benefit thereof. I dont see MNC pharma getting into API manufacturing. So…thats another factor.

However, I need to do some more work on point no-3 to be a little more sure. So…take it with a bucket of salt. But, I will come back to you on this …ASAP !!!

Regards,

Ranvir Dehal

Thanks for answering, regarding point 3, my assessment is that you are right MNC pharma would not go into API manufacturing or becoming a low cost generic manufacturer for developed economies and precisely thats why I have started liking them for their focus and full energy on only one aspect and that is brand building, top quality blockbuster drugs and OTC products launching. They are into slow, steady and sure marathon (maybe with booster doses of any new blockbuster entry). While agree with the tailwinds, Indian export oriented pharma are in a sprint. For them, to be a part of marathon, they need to consciously & gradually move to the other side like how Indian IT is trying today to move up the value chain. Last 5 years no doubt some of them like Cipla have done good work in domestic brands and OTC products.

Precisely thats why in Pharma, if at all I invest for long term, I would try to develop my portfolio around strong domestic focused branded play and buy them slowly in dips (as they are richly valued). Although I would not get a sprint type returns but it will give me a more simple, boring, easy to understand and less variable portfolio like my FMCG part…

Eager to know your thoughts

Very well said.

Abbott is surely the king of domestic MNC pharma, but I am somehow not comfortable with the valuation that Abbott currently commands at 55PE. Sanofi trades at 44PE. How much one would like to pay for them is the question now!!

I watched in Screener about how high PE the pharma companies used to command during the last pharma bull run and saw that ~ 45 PE was the peak valuation and companies (Sun, DRL, Glenmark etc.) stayed at that valuation only for a very brief while.

So, how long the MNC pharma companies can sustain their peak PE? Isn’t PE compression a real possibility if the growth momentum tapers a little bit in the coming quarters? I feel that the margin of error is very little for them.

All these re-rating happened when export facing pharma companies were facing the heat and with the good growth in domestic markets the MNC pharma companies were seen as a secular story like FMCG. Now with export facing companies approaching a bull run there is a chance that buyers who were earlier hoarding the MNC ship may rush towards those companies, leading to PE compression.

Abbott already came down from the peak valuation of 65.5 PE to current valuation of 54.5 PE, and Sanofi from 47.5 to 43.5 PE. However, still seems too expensive to me. I am not comfortable giving the best one, Abbott, more than 45 PE.

I somewhat agree with the FMCG like thesis for them, but Pharma companies can’t advertise directly like FMCG, except for the OTC brands, and face threats of Price Control (NLEM), and trade generics.

Hi…

I kind of agree with both @Investor_No_1 and @sujay85

Obviously, there are no absolute rights and wrongs in investing, otherwise it would become a science. But…as we all know, its an art.

As Warren Buffett once said- once should try and be aproximately right instead of being precisely wrong.

Thats one mantra which is very close to my heart and I try and follow it in letter and spirit.

On MNC pharma ( pure India Branded formulations ) vs Domestic Pharma ( India branded + Export generics )…one can have a long debate and come to different conclusions.

I would say, it may be prudent to make a Basket of stocks with small allocations like Sanofi, Abbott, Alkem, Cipla, Sun etc and then monitor the industry and company dynamics.

Over a period of time, expertise and analytical skills would catch up and then one can add or subtract according to one’s convictions.

AGAIN - TRYING TO BE APROXIMATELY RIGHT

And…

Not to forget Dr Reddy’s.

This one is also looking promising.

A new thread has also been started on the same on this forum. Stalwarts like Donald are active participants there.

My rec- ppl interested in pharma space must go through the above mentioned thread and see if they like the company.

Disc: I have a small position in Dr Reddy as well

True while FMCG is the king, branded pharma would have much more variables…some which even the most stalwart investors have missed earlier and would miss even now. One peculiar aspect of branded pharma for chronics I would mention from personal experience is that just like in lockdown we had to stock biscuits and salt, the ones having chronic issues like thyroid and need a pill a day stocked up on thyroxine. If I do not get a parle g, I will not mind a sunfeast. I will not look for another store for the rigidity of getting a parle g but those who had been taking a particular brand of thyroxine would insist and make sure they get that brand even if it meant looking multiple places online or on road.

Having said that one point need to be remembered is that a four decades solid lead in thyroxine brand in India by another MNC was broken in around 2005 by Abbott by interesting campaigns. Now even a suspected contamination issue could not stop the leadership of Maggie but Abbott somehow by their couple of years multi-pronged attacks toppled another MNC leader…now what makes us sure that couple of years down the line Abbott would not meet same fate at hands of some other company? What’s the moat here? Points to ponder…and same point makes us even more appreciate the moats of an FMCG

HI,

I was going through the year ending Mar 2020 investor PPT of Sun Pharma…was pleasantly surprised to see that Sun manufactures aprox 300 APIs inhouse.

Now thats some cometitive advantage besides the Formulation knowhow , quality control and regualtory complainces.

The management also indicated that they intend to ramp up the production of 20 APIs per year for captive and third party sales.

Given the API tailwinds…this did sound encouraging.

Also, Sun pharma sells aprox 1900 cr worth of APIs to third parties besides captive consumption.

Another thing that caught my eye was the fact that the PPT refered to API division as the -

ONE OF STRATEGIC IMPORTANCE

I always used to wonder, how can generic pharma continue to keep doing well going fwd…in the face of increased competition and pricing pressures. This kind of backward integration provides some answers to the nagging thought I had.

Off the cuff, I know that DR REDDYs contribution of API sales ( besided captive consumtion ) is even higher. ( will come out with exact numbers shortly ).

Now…this not only improve their backward integration,provide cost leadership in various molecules, also gives them a huge opportunity to play the China to India API shift.

Lets see how it goes.

One request - these are some of my observations. I would love to hear some counter views.

Disc: invested in both.

Views are biased.

Indians are excellent in Chemistry…both Organic and Inorganic… Once upon a time all these Pharma Companies were API players in a big way…1990’s…

Then the Chinese came and started dumping API’s in india at a throw-away price (China had advantages of economies of Scale) which made our Indian API unprofitable… All our pharma companies gave up API business and switched over to branded Generics/ formulations for survival…some of them still continue to make some API …

Now since situation demands and the Govt is willing to support…a lot PE funds are flowing …we are going back to our drawing board to re-commence API production…

It is possible , though will take time…

Hi…

Sharing some important highlights from LUPINs 2020 AR-

Sales - 15,142 cr vs 14,318 cr

EBITDA- 2838cr vs 2893 cr

PBT - 1505 cr vs 1745 cr

PAT - 908 cr ns 852 cr

Both PBT and PAT - adjusted for exceptional items.

Ranked -1 in Hypertensive drugs in US

Ranked-1 in 63 products in US , out of a total of 164 products

Ranked-4 in Chronic therapies in India

Ranked-4 amongst Generic players in Aus + NZL

R&D spend - 10.3 pc of revenues

Manufacturing sites -

New Jersy, Mexico, Brazil - 1 each

India- 12 sites

R&D sites -

India-2

Mexico, Brazil, Netherlands - 01 each

US- 2

Debt to Equity - down to 0.12 vs 0.38 last year ( positive development )

Divestment of Kyowa has helped reduce debt.

API sales as a percentage of total sales - 9 % ( APIs have a lot of tail winds )

Company seeing reduction in pricing pressures in US mkts. ( lets see how this pans out )

Levothyroxine ramp up in US- progressing well.

Etanercept - Biosimilar got EU approval.

Na Muscla - Speciality product ramping up well in Europe

Expects to launch first major Inhalation product- Albuterol in US in 2020-21

Expects to launch gFostair ( limited competition product ) in US

Ramp up of Solosec- sub par. Company has high hopes from this speciality product

India business grew 13 % - 34 pc of company sales. Now, the company has 10 products among top 300 vs 6 produsts 3 yrs ago

All USFDA in last 2 Qts went off well. Lets see if the company can resolve the pending sites

A lot of talk about cost control, throughout the AR

EBITDA for 2019-20 at 18.7%- subpar by company admission

US growth-3 %- 38 pc of company revenues.

Apart from regular ANDAs, company has a descent pipeline of FTFs, Injectables and inhalation products

Intends to launch Pegfilgrastim in US in FY 21- first US-biosimilar launch for the comapny

In India, Lupin is No-1 in anti TB meds, 2nd in respiratory and 3rd in anti- diabetes meds and cariology meds

Company intends to ramp up India OTC products- Softovac, Lupizyme and Aptivate

Lupin is Ranked 2nd in Mexico in Opthalmology. Mexico is a fast growing, large pharma mkt

Besides Brazil and Mexico, company has recently entered Chile , Peru and Columbia

Company intends to enter cardio, pain management and CNS segments in Mexico ( to diversify beyond opthalmology )

Lupin has 2.1 pc Mkt share in Brazil ( 15th largest )- grew 28 pc last year

Company intends to enter similar segments as in Mexico

Asia - Pacific, Latin America - 4 pc of sales each

Divested Kyowa ( Japnese Subsidiary )

Intends to launch complex generics and biosimilars in Japan via marketing tie-ups

Launched Etanercept ( bio similar ) in Japan

Australia rank-4 amongst generic players

Phillipines rank-5 amongst generic players

Intends to launch complex generics and injectables in both Mkts

EMEA, Europe, Middle East and Africa- europe growth last yr-13 pc, intends to launch first respiratory produsct- fostair in europe, fast growth in South Africa specially in OTC and CVS products

APIs-

06 manufacturing sites

9 pc of sales over and above the captive consumption

Biosimilar pipeline-

Pegfilgrastim - helps increase production of WBCs

Ranibizumab - helps prevent decreased vision and blindness

Aflibercept- oncology drug

These notes are not exaustive. However, cover imp highlights.

Key monitorables -

The street is sick of exceptional items. Lets hope, not many are in store now.

Pricing scenario in US business.

Scale up of complex generics, speciality and bio-similar portfolio

Domestic performance

Sucess of cost control measures.

Disc: invested.

Small portion of portfolio.

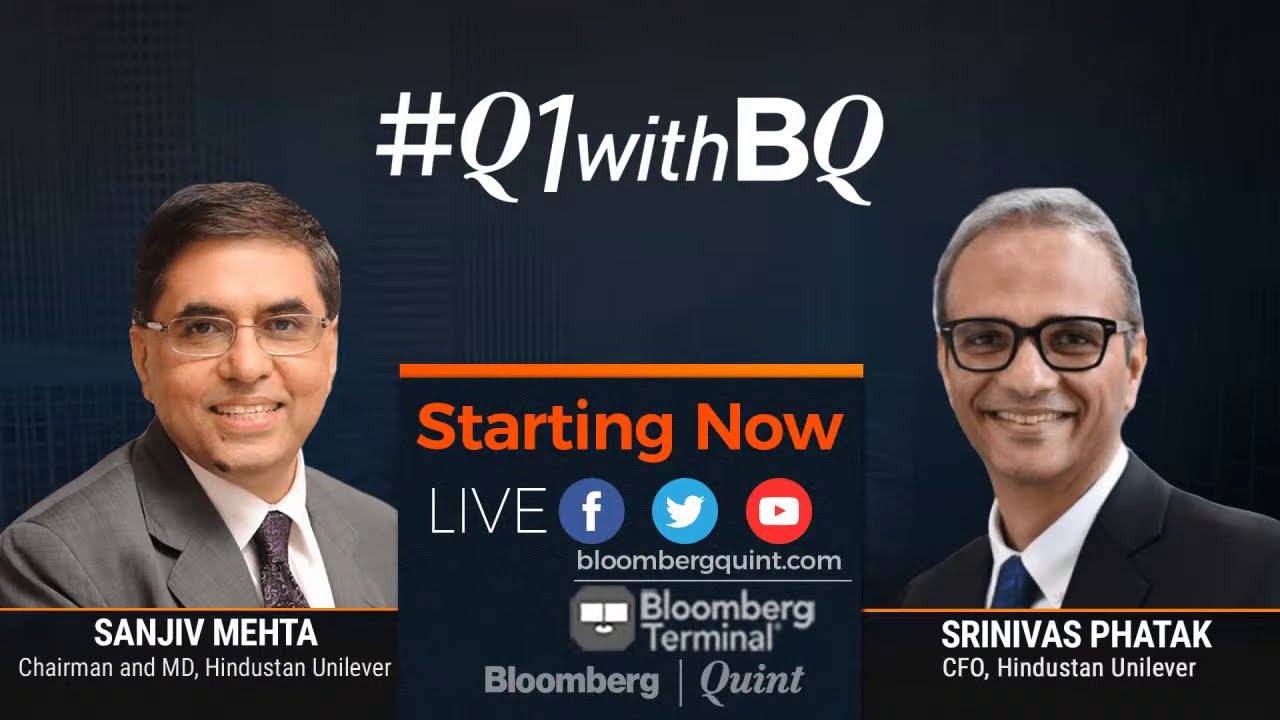

HUL q1 commentary

Some key highlights-

Because of GSK integration, volumes are up 4 pc.

Excluding that, Volumes are down 7 pc.

Still a commendable performance considering brands like Pureit, Lakme, Elle 18, Axe, Fair and Lovely had a really bad ( almost a washout ) qtr.

Except for these brands, volumes were up 6 pc which is commendable.

Excellent insight by Mr.Krishna Prasad about all this API shift from China to India.

It is very very very long time process, at least we have to start some where, we have to beat china by better technology and mostly importantly cost wise.

He says still the raw materials for API’s are coming from china - say for example Methanol, so it should start not just the API’s only, it should be from the basic raw materials then only it makes sense.

Hi…

Just a portfolio update -

Have started buying- V Guard industries.

Purely from PE perspective, it may look expensive. However, the business stability shown by the company in its Q1 performance has been commendable- atleast I think so.

As and when the operations normalise ( in next 2 qtrs maybe ), the business performance may resume normal service …which has always been excellent.

So…thats why took the plunge.

Just a disclosure, not a buy/ sell recommendation.

Regards,

Ranvir Dehal

Hi…

Just a portfolio update-

Resorted to mild trimming in my Alkem labs holdings. Bought Granules India in lieu.

Regards,

Ranvir Dehal

Hi Ranivr,

Would you mind letting us know the reason of trimming in Alkem labs?

Thanks,

Deb

Hi…

Its just that my portfolio wt for Alkem labs was on the higher side…so I resorted to mild trimming.

Otherwise…no company specific reason.

Plus…I am trying to keep the API/ CDMO / integrated generic player’s weight a little higher than that of not so integrated generic FDF players. Thats always there at the back of my mind.

Regards,

Ranvir Dehal

QTLY RESULTS PPT - GODREJ CONSUMER PRODUCTS

INDIA AND INDONESIA BUSINESS SHOWING REILIENCE

AFRICA BUSINESS WAS A BIG DRAG

OVERALL, SATISFYING RESULTS IN A VERY TOUGH QTR

Key monitorables - ramp up of protekt portfolio, revival of hair colour business, recovery in Africa business

Key positives- superlative performance in the household insecticide category

Disc: invested.

Hi…

Posting my current portfolio holdings-

HUL…12 pc…at 1900

Dabur…7 pc…at 420

Britannia…11 pc…at 2400

Nestle…5 pc… at 11000

Colgate…4 pc…at 1250

GCPL…3 pc…at 560

Marico…2 pc…at 260

Gold ETF…5 pc…at 4420

Godrej Agrovet…2 pc…at 431

V Guard…1 pc…at 165

RIL…4 pc…at 1550

Syngene…2 pc…at 438

Aarti Drugs…3pc…at 780

Alkem labs…4pc…at 2500

Ajanta Pharma…3pc…at 1450

Alembic Pharma…3pc…at 850

Cipla…3pc…at 650

Divis…4pc…at 2350

Dr Reddy’s…3 pc…at 3920

Granules…2pc…at 274

Lupin…1pc…at 910

Laurus Labs…3pc…at 570

Natco Pharma…2pc…at 620

Sun Pharma…2pc…at 480

Aarti Industries…3pc…at 960

Vinati Organics…2pc…at 945

Icici Lombard…1pc…at 1290

HDFC AMC…1pc…at 2410

Pre Covid, it used to be a concentrated portfolio with no Pharma stocks. Now, its full of them. Its been a very good ride though !!!

Covid outbreak forced me to study the sector to deploy cash as I was underconfident of buying into most Financials and Consumer discretionary stocks.

Initially, my knowledge of the sector was limited. Therefore, I decided to go in for a lot of diversification. The same is evident from the portfolio percentages.

As my understanding improves, will try and trim my positions in pure generic guys and add onto more specialised / API / CRAMS players like Laurus, Divis, Syngene, Granules etc.

Gold ETF finds a place in the portfolio as a hedge against - HELICOPTER FIAT MONEY and the fears of currency devaluations.

Tracking positions include- HDFC AMC, ICICI LOMBARD, V GUARD and LUPIN.

Will add to them if conviction improves.

Regards,

Ranvir Dehal

Portfolio update: I ve initiated a tracking postn in ITC ltd.

Reasons -

Was reading their AR and VP thread for the last few days. The present EBITDA margins of their FMCG business are around 4%. In 2010, they were around (-) 6 %. So…its been a good 10 pc swing over the last 10 yrs.

My personal expectation is that they might start clocking 8-10 % EBITDA over the medium term ( say…next 3-4 yrs ). The COVID pandemic has induced a lot of tail winds for their foods business which forms the lions share of their FMCG business.

( with brands like - Aashirwad, Bingo, Sunfeast, Yippee etc )

Once that happens, the stock may be in for some re-rating.

However…since the entire thesis is based on future outcomes, I ve only initiated a tracking position. If the hoped for performance actually happens, I may look to add more.

Risks : it has been a long and agonising wait for the ITC shareholders and it may stretch further…no one knows.

I hope the eventual outcomes are like RIL, HUL…where in the shareholders were eventually rewarded in a big way after 9-10 yrs long consolidation in stock prices.

Disc: views are biased. This is not a buy/sell recommendation.

Concall notes - Q1 ALKEM LABS -

-

Being a leader in Anti- Infectives, the company’s business was adversely affected by delay in surgeries , procedures, OPD footfalls etc…due Corona virus outbreak.

-

IPM declined by 5 pc…YOY due to the reasons mentioned above. Acute therapies like- pain management, anti-infectives, gastrointestinals de- grew even more. Fall in cardiac, dibetic categories- lower. Company’s India business degrew by 5.5 pc due actute heavy portfolio.

-

US business up by 32 pc. Constant currency growth at 28 pc…driven by new launches and mkt share gains.

-

Overall EBITDA margin expansion- aprox 11.5 pc !!! This is huge. Gross margins up by 190 bps. Rest of expansion due- cost savings and other income of arund 24 cr.

-

R&D expenses at 119 cr- 5.9 pc of sales.

-

Filed 4 ANDAs in US. 2 approvals. Cummulative- 148 filings, only half have been commercialized.

-

All 6 manufacturing favilities have EIR as on date.

-

Spillover sales from q4 to q1 this yr- aprox 143 cr…so that was an advantage. But some spillover has happened from q1 to q2 as well.

-

Cost reductions of q1 due savings on marketting and travelling etc will start to unroll in q2 and by q3 costs may bounce back to pre China Pandemic levels. So the elevated EBITDA margins may not be sustainable.

-

Growth in trade generics- in double digits. Company is a kind of Pioneer in trade Generics segment and is a very strong player.

-

Transportation costs have almost normalised.

-

A lot of gross margin expansion may be sustainable due - expansion of chronic, semi chronic and US business. Pre IPO, company was more or less an acute therapy company.

-

No agressive CAPEX planned for next 2-3 yrs. Capacities are already in place to drive growth.

-

Gross margin expansion due better product mix and better operating leverage in the US is sustainable.

-

Aim to launch 10-12 products in US every year.

-

India sales- branded generics- 72 pc, trade generics- 28 pc.

-

Q2 likely to be better than than Q1 as far as acute therapies are concerned.

-

Further growth in US will depend on new launches. Mkt shares in existing products are reaching their peak potential.

-

On Mr Trump’s announcements / executive orders wrt pharma Industry- management believes, its more hot air than anything else probably because this being an election year. However, they are prepared as they have manufacturing facilities in US as well.

-

Current API prices are higher, however the overall impact is manageable. Dont foresee huge price hikes unless the political situation realy deteriorates.

-

Company doesnt intend to be an API player. Company is more of a front end marketting player and a generics manufacturer.

-

At present, the company intends to remain in oral solids in US. No near term plans of moving onto injectables, topical products in US. They however intend to make specialised oral solids.

-

Company has launched Marinol in US. ( Marinol is used to treat vomitings / loss of apetite for patients undergoing chemotherapy and nausea / loss of apetitie for HIV positive patients)

Disc : invested from 2450 levels.