Curious case of Rain Industries !

What am I doing ?

I am a retail investor with recurring income every month.

I am loving the way RainInd price is trading.

The longer it stays in the consolidation zone the more I get to accumulate and technically the breakout gonna be more berserk.

Bought it every-time it fell to 150 zone.

Buying it every month now for last few months

(Previously such systematic buying has worked for me for ITC and Laurus labs, might or might not work with Rain. No recommendation or advice here )

Now the important part , how is the business gonna turn in coming quarters , when will Rain start showing profits ?

Taking about my expectations about Q4 numbers

Rain continues to focus on bringing down the debt , another 50$ M was planned to be paid by 1 April 2025.

I am expecting Rain to report losses again.

Though cement sector is posting good numbers but Rain’s cement sector might not post similar results, this was mentioned by them after Q3 results.

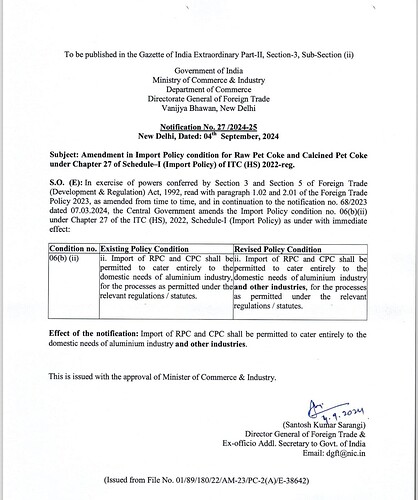

CPC prices are trending higher during the Jan month in China, this will reflect in March numbers

CPC prices were a bit higher for Dec quarter as well compared to Sep quarter. This might or might/might not reflect in Q4 numbers.

All in all, expect usual and normal quarter. No surprises there.

Now what can work for Rain in next couple of years

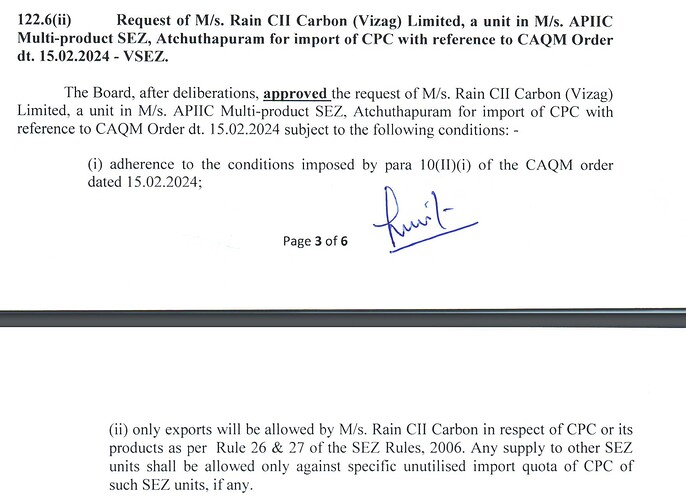

Yesterday’s announcement about setting up facility in AP SEZ zone is a strategic move considering its location.

AP is going to build oil refinery , Rain might get raw material at cheaper rates.

Rain can also cater to the demands of all the upcoming new industries there.

JSW was looking for new aluminium plant in Andhra(not sure if it’s final)

Rain’s location near the port helps in less shipping cost and less transport cost.

Indian plant should start working in full capacity sooner.

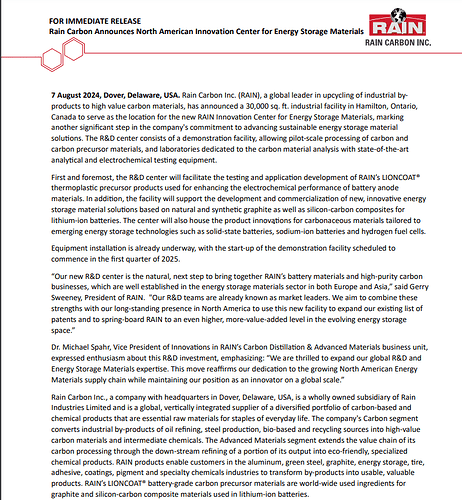

Rain is starting to develop EV materials so ready to cater this industry as well.

Institutions are buying.

But

Rupee is declining, Rain might have to pay more in debt(correct me if I am wrong)

How do rain generate more cash and pay its debts?

Will Rain do IPO for US subsidiary?

Will Rain sell the cement business (tailwinds in the cement sector , can sell it in good valuations)

Can we see margin expansions in upcoming quarter ? (And add to more cash?)

I dont know much, I am not following markets actively , I havent read about Rain much recently .

I will be active in the market post March 3rd week, so might have better inputs then.

This post is bit naive, half baked, written in rush.

Apologies for that.

I will definitely try to add more concrete and price datasets from next time.

Rest I believe in buying stocks and businesses that no one wants to buy(sort of contra bet)

There are numerous pieces of Rain scattered here and there , no one knows when these pieces will come together and also no one knows how big monsters can they create if they meet someday

Happy investing