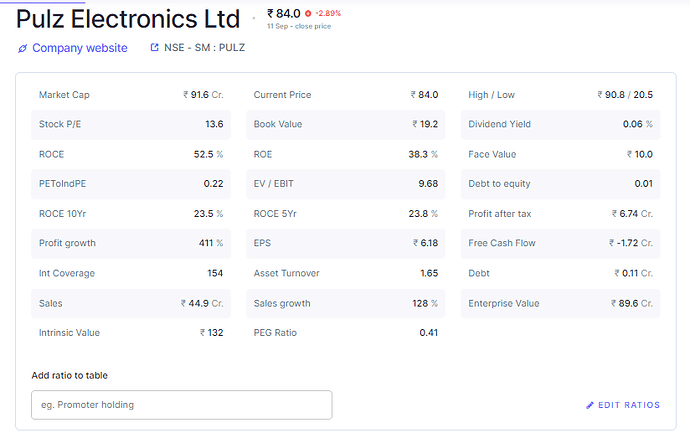

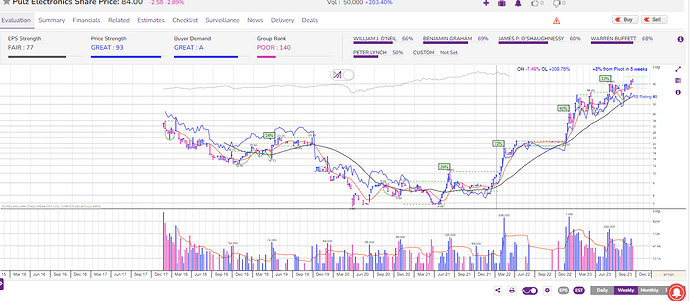

I found this stock while looking for Micro-Caps (< 50 crore market cap) which show good returns and growth with zero debt. It is currently trading below its recent IPO price of Rs 56 (Current Price - 38, Market Cap 10.36 Cr.)

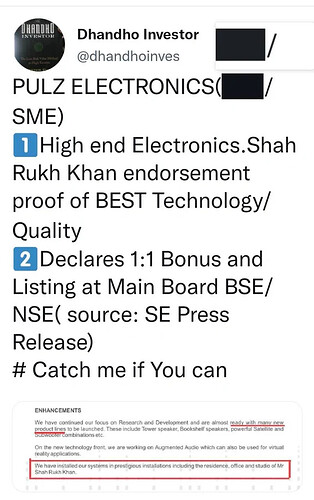

Company is in the business of manufacture and installation of high end speaker systems in multiplexes and studios in corporate setup. It supplies to likes of PVR, Cinemax, UFO and INOX as well as corporates like Reliance, Hindujas as well as Government to Army, Navy, Airports etc. It installs the audio systems on project basis and also undertakes AMCs which forms a small portion of its current revenue.

They have a plant near Mumbai and also a warehouse. They import from OEMs in Europe. I am still trying to understand the value addition that Pulz does as well as what is the competition to the company. This will be key to understand the sustainability of the growth.

The growth numbers are strong with 3 year Sales CAGR of 23% with around 10% NPM. Key numbers

| Mar-13 | Mar-14 | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 | |

|---|---|---|---|---|---|---|---|

| Sales | 5.28 | 9.21 | 11.77 | 12.98 | 13.76 | 18.04 | 24.00 |

| Operating Profit | 0.39 | 0.48 | 0.46 | 0.67 | 2.21 | 2.33 | 3.40 |

| Net profit | 0.21 | 0.10 | 0.01 | 0.30 | 1.34 | 1.62 | 2.46 |

| EPS | 4.20 | 2.00 | 0.20 | 6.00 | 6.70 | 5.94 | 9.02 |

| Price to earning | 6.49 | 4.42 | |||||

| Price | - | - | - | - | - | 38.57 | 39.87 |

| RATIOS: | |||||||

| Dividend Payout | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 5.69% |

| OPM | 7.39% | 5.21% | 3.91% | 5.16% | 16.06% | 12.92% | 14.17% |

IT has paid dividend for the first time this year.

While the Returns are good Inventory has been building up which is sometimes seen in growing business but is a definite watchout as it has been increasing.

| PULZ ELECTRONICS LTD | Mar-13 | Mar-14 | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

|---|---|---|---|---|---|---|---|

| Sales | 5.28 | 9.21 | 11.77 | 12.98 | 13.76 | 18.04 | 24.00 |

| Debtors | 0.30 | 0.35 | 0.69 | 1.01 | 3.11 | 1.07 | 1.26 |

| Inventory | 2.78 | 4.61 | 4.54 | 3.80 | 4.46 | 7.25 | 10.56 |

| Debtor Days | 20.74 | 13.87 | 21.40 | 28.40 | 82.50 | 21.65 | 19.16 |

| Inventory Turnover | 1.90 | 2.00 | 2.59 | 3.42 | 3.09 | 2.49 | 2.27 |

| Number of days of Inventory | 192 | 183 | 141 | 107 | 118 | 147 | 161 |

| Return on Equity | 11% | 5% | 0% | 12% | 35% | 18% | 21% |

| Return on Capital Emp | 11% | 10% | 14% | 48% | 32% | 34% |

Management Quality

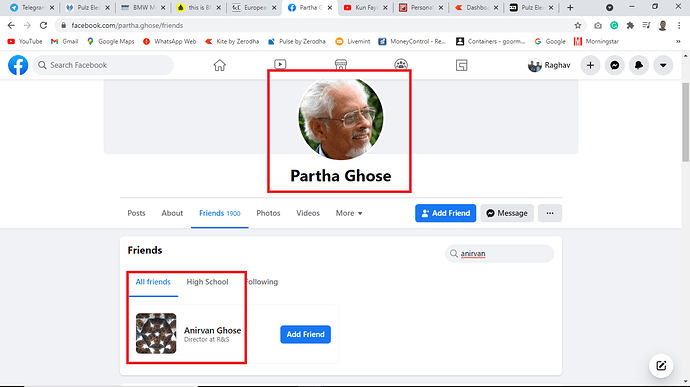

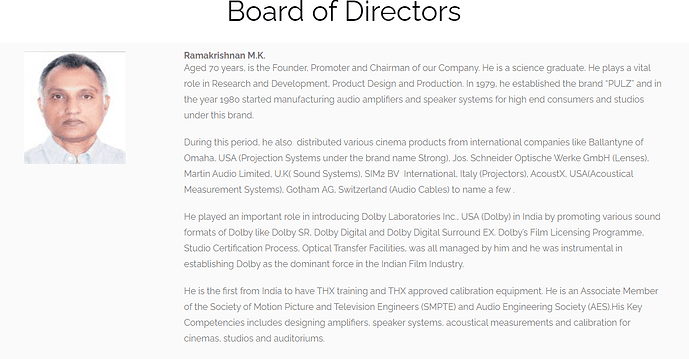

Overall information about this group is little hard to come by and the promoters seem to be well qualified for the industry

Mr. Ramakrishnan Krishnaraju Manden Kattilaged 69 years, is the Promoter and Executive Director of our Company.He holds graduation in Science. His Key Competencies includes designing amplifiers, speaker system, Acoustical measurements and calibration for cinemas, auditoriums and studios. He plays a vital role in the management of the Company.

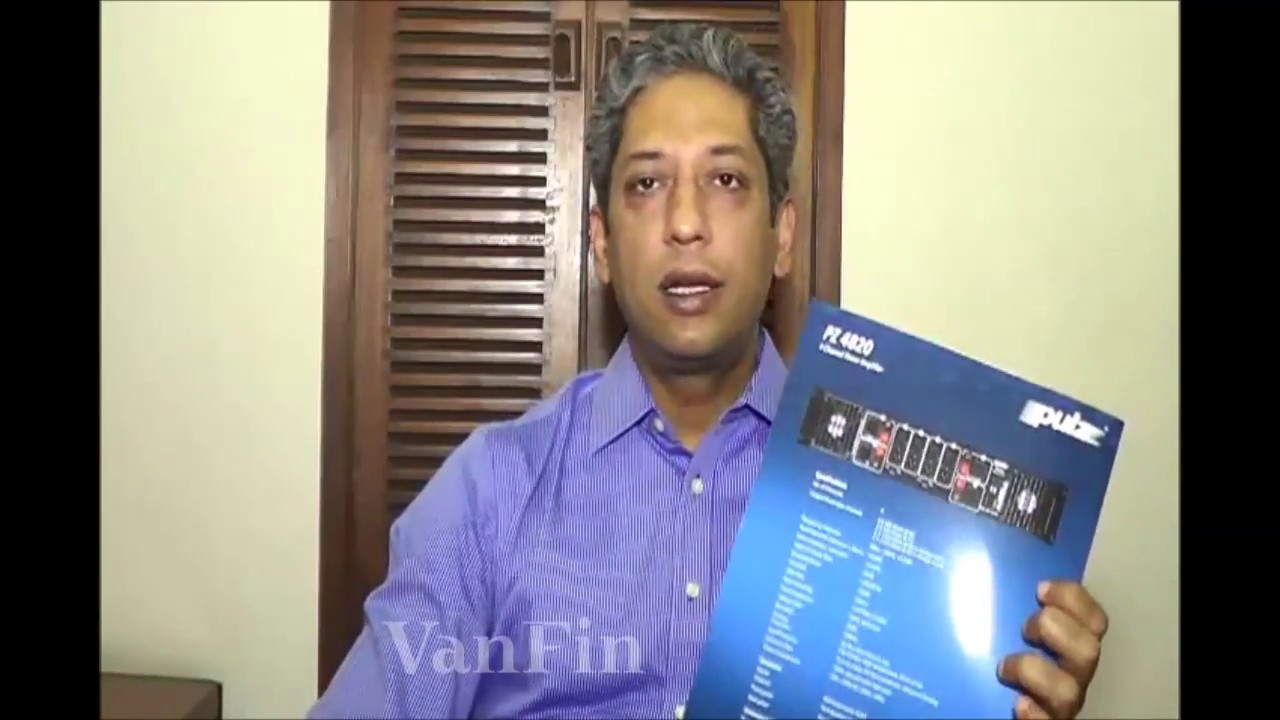

Mr.Anirvan Partha Ghose aged 43 years is the Promoter and Managing Director of the Company. He has done his graduation in Bachelor of Science from St. Xavier’s College, Kolkata and also completed a course in Computer Hardware from Institute of Electronics and Hardware Technology, Kolkata in 1994. He has done specialized audio video training from Dolby Laboratories, Sim2, Sound Engineering and Sound recording Course from Film & Television Institute of Pune in 1997. His Key Competencies includes designing Auditoriums, Cinemas and Recording Studios, Designing and Manufacturing of Audio Equipment, Installation, Calibration and Maintenance of Audio and Projection Equipment in Cinemas He is member of SMPTE, IFFI Technical Committee and NFDC Technical Committee.

Management compensation at 57 Lakh (23% of Net Profit) is on higher side and is another watchout for coming years

Valuation at current levels seem very attractive at PE of 4.2 and should provide good margin of safety.

Overall seems like a good business to be in as companies like PVR have been growing in investing in new multiplexes especially in smaller towns. There should be a good runway for growth in medium term as mix of single screen vs. multiplexes continues to change.

Still researching the company and few things I want to understand are -

- How much of value addition is Pulz doing?

- Understand the competition and power that suppliers have in Multiplex infrastructure

- Understand the audio technology and find out what kind of OEMs are supplying to Pulz and is there any edge due to these relationships.

- Understand the management track record more as this is a recent IPO and there is not much of historical data

- Understand the nuances of investing in a microcap space and even a small investment will be illiquid with Just 10 Crore market cap of which promoters hold 70% +

Disc: Interested but not yet invested.