I don’t think they want to delegate the marketing function to the other company.

Dental products is a product category where distribution commands good margin. Even Ecom operations are profitable, as per Dentalkart numbers. My own view is that the subsidiary can become a marketing company or Ecom operators supplying dental products of various companies, including that of Prevest. This business looks good, profitable, within the competence of promoters and growing- the subsidiary has been incorporated for this trading.

Prevest Denpro SME KamayaKya IC.pdf (1.5 MB)

Recently initiated coverage on Prevest. Bullish on long term prospects, but have enlisted my concerns in the “risks” section of report. Would be happy to know esteemed members opinion on the same.

The biggest concern is promoters/family drawing such a huge remuneration vs size of the company. Adding to that some of the family members also drawing commission and rent.

The other risk I see is, no clear succession plan, considering Atul Modi getting old (who does all the talking in the conference calls and Namrata Modi appeared just an eye wash).

Promoter is justifying son in law’s salary (marketing head) by saying his compensation is basis his last salary. But do these guys need such an expensive resources?

Prevest topline 50 cr, marketing head salary ~1.2 cr

Also 2% commission on incremental sales in domestic market. Commision to newly appointed marketing head inspite of such high salary?

It looks like the family is having a good time at the expense of shareholders.

They also look satisfied with the current performance (where QoQ topline declined) which is a sign of lack of ambition.

Time to scrutinize this thoroughly and take a decision to stay / exit post the current quarter results.

Also, I ran some background check on Mr. Vaibhav Munjal. Feedback from all three of the colleagues/reportees was negative.

In the last con call, he asked to repeat almost every question that was asked to him. Answers to those questions were also not satisfactory.

Will the co. be having a call to discuss the Q2 results…anybody having any info?

Normally they do arrange a call. Hopefully they will continue with the same.

Result seems not good. I do not understand why such a small company is facing problems in growing their sales.

There will be a call, details shall be announced shortly.

Link to register:

https://services.choruscall.in/DiamondPassRegistration/register?confirmationNumber=4093735&linkSecurityString=175b5b942f

Did anyone attend the call. Any takeaways?

The company’s topline has been about flat, and operating profits/margins have been declining for the last 4 quarters. For FY24, net profit may not exceed 15cr. There has been a change in geo mix, exports have dropped, and domestic sales filling the gap. But domestic sales it seems are less profitable. The company’s stock price can be under pressure until there is improvement.

However, the family taking a big chunk from the company as salary is a big sore point for me.

Edit: The call may happen, but dates are not decided yet.

Disc: interested, but no holdings.

I have been interested in this company for a while. During my initial look 1.5 years back, I didn’t find the company exciting enough or see any long-term potential. But on a second viewing, I found this company interesting enough to go deeper. I think the company is extremely interesting for the following reasons.

- Asymmetric bet - The Indian dental consumables market size is around 1000 crores. The company earned around 25 Crores from the domestic market which accounts for 2.5% of the market share. Assuming the company improves on its products and can capture a 10% market share can result in huge revenue growth over the long term.

I believe it is not a hard shot that the overall Market at some point can be around 1500 (maybe even 2000) crores by the next 5-6 years. And getting as low as 10% market share will result in a huge revenue growth domestically. My bet is that market share will increase in the coming years because of more acceptance by dentists and better marketing.

-

OPM - Currently their OPM is around 40%. It fluctuates to around 30% in some quarters. Taking a first look at this makes it seem too good to be true given that distributors get a better margin for their products. That must mean they manufacture the products extremely cheaply. Management claims that EBITDA margins may increase in the future. Executing that in my opinion would be extremely tough.

-

Exports are one area that I am optimistic about. The advantage of being a low-cost producer and selling it in markets way bigger than India with higher margins does open room for a lot of possibilities. They have 20 USFDA approvals as of now (May 2023 concall) and have a dedicated distributor for the next 5 years (while also doing small private labeling for some companies in the USA). Some con call snippets on the USA and international market.

" So first of all the first challenge was to get our products FDA registered because the US is guided by FDA process this thing, and these are Class 1 products, so these have to be FDA certified. We got them certified and now we are evaluating different opportunities to grow in US which is a much bigger market. But as you would understand, we just recently entered that and it would take some time for us to capture the US market. " (Nov 2023 Concall)

**The international market is a huge market. It is a $20 billion market. And this is like a notion we are a very small company compared to the other multinational companies, but it’s a huge market. The huge market is about $25 billion market for the dental material. America is the biggest market, there are about $8.5 billion in the American market and the rest of the world together, Asia is a very big market, and Europe is a big market, but America is the biggest market. So $8.5 billion is the present market size of the USA.

They have started registering their products in Brazil, Australia, and NZ and already doing business in Russia. Currently, they are growing well on exports by the year and it signifies shows that their products have a high probability of being used in the future as well.

- The balance sheet is very clean. They have around 40 Cr in cash at hand with around zero debt. This allows them to undergo a CAPEX in the coming years without taking on leverage. Currently, they are operating at around 40% Capacity. It means the company doesn’t need any big CAPEX for quite some time. And gives them room to grow revenues without any capital outlay. Management claims productivity can be enhanced by more shifts/ longer working hours once they reach 80-90% utilization. Also, they estimate that their current plant can deliver 150 Cr of revenue.

The total investment and research on the research and development and setting up of the new facility was about INR35 crores. So we had only INR17.7 crores for the capital expenditure. The rest of the amount was the investment in the land and building and other durables. So out of the INR17.7 crores, we have spent about INR7 crores on the R&D INR10 crores is for the new facility, and rest of the investment has come from our internal accrual.

- Another thing I like is their renewed focus on marketing. They have incorporated “Denvisio Biomed Limited” as a marketing company for their products. Marketing growth can lead to more awareness and better revenues. Management in concall has claimed that they will be extremely conservative in the past on sales and marketing. Currently, some dentists still avoid using their products and they may change their opinion slowly and steadily as products get better. Some snippets from concalls.

They have hesitation. Despite their hesitation, we are growing. We have grown 30% in the domestic market. It is not that all dentists are hesitant to use the previous. There is always a mindset, there is always a preference for one particular type of product. So we cannot say that the dentists are hesitant to use our product

In this industry, all companies sell via distributors. And they in turn sell to dealers and sub-dealers. No company sells directly (except some sell online). A way to check management focus on marketing and ground reality of company products would be to talk regularly to such distributors. And they also try to sell to institutes, academia and budding dentists as over the long term, it will make dentists more comfortable with using Prevest products.

Top 10 products contribute 30% of revenue and they have around 10% market share on them. 50% of the business comes from North India while rest of India makes up 50%. Exports are around 45% of their turnover as of yet.

Growth areas - They are also entering medical device disinfectant market which is USD 2 Billion-dollar market worldwide (they just need regulatory compliances in order). They might consider custom manufacturing for other brands in future.

My scuttlebutt

So, I did a little scuttlebutt on the ground in North India by checking up on few local dentists and a distributor.

I did a scuttlebutt with a local dental distributor in North India to understand more about the dynamics of the dental consumables market.

Some of my insights were:

- Other than Prevest, the other major Indian-origin dental company is PrimeDental. There are few other Indian players as well. Indian players have a price point that is way lower than MNC counterparts such as 3M, Shofu, Ivoclar , etc

- They see more focus on marketing these days from the company. This goes in line with company claiming in concall on their push in marketing and hiring a well-paid marketing executive (who is also their son-in-law).

- Dentistry is a competitive field. There are many new dentists out there trying to build their name and margins are low. Thus, many dentists like to reduce their costs with decent quality Indian counterparts to earn a few extra bucks. Thus companies like Prevest seem to appeal to many dentists especially ones who have started practicing.

- The quantum of products in the Dental consumables market is extremely high. You need to just take a short look at the product catalog for that. Thus it is hard to figure out revenue by products. But the way the market works is that every company has a few products that stand out among the rest of the crop. Very similar to certain drugs of certain companies being favorable in the pharmaceutical market. This kind of market leaves space for a lot of players to grow.

- The margins the distributor got were higher in Prevest and Prime than their MNC counterparts. Thus, higher margins do give impetus to distributors to sell more and push the product.

- The quality of their products has been inferior over the years. But things are getting better recently and acceptance among dentists has started increasing. More acceptance will lead to better long-term tailwinds for the adoption of their products by dentists.

Other than that, I spoke to a few dentists.

- The first dentist sent a fairly positive review of Prevest Denpro products. He said they are mostly middle-tier and widely used.

- The second dentist (who is also an investor) wasn’t positive about the company and didn’t look at it much. But acknowledged their products can be better now compared to a few years back

- Third dentist used some of their products often.

- Another famous high-end dentist in the city has a fixed set of supplies (mostly 3M) and doesn’t like to change what is working well for him. It also should be implied that the ortho-dentist mentioned is a premium one and charges high to customers as well.

So, I guess the way the market is positioned is a lot more complicated and companies like Prevest have a distinct customer base of their own.

Risks

- Management risk is there. It is there in every micro-cap company due to lack of data and limelight. A few things that stood out for me:

• They claimed on concall that they have excellent quality products. Any dentist can make sure that this is a bit overboard.

• Salary of 10 lakhs per month and 2% commission for son-in-law. That is high for anyone in a company with a turnover of around 50 crores. The company defended him saying he has experience and skills and should be adequately compensated. Regardless, I do believe incentives can be a powerful trigger for sales. Let’s see how this works out.

And during the domestic market, he will be offered, he has been offered an incentive of 2% for his efforts in taking this business over the existing business level of INR20 crores. So, this is nothing we know it is just an award of 2%

The salaries are as Atul Modi - 1.2 Cr, Namrata Modi - 1.24 Cr, Sai Kalyan - 31 L. That is high for a 50 Cr revenue company. Atul Modi is getting old and Namrata Modi doesn’t seem to add any significant value to the company.

• No ESOP to any employees, which I believe is good. Management discussion and analysis in AR do not contain much useful information or insights. Neither is it descriptive. Their banker is HDFC Bank. It looks clean to me on the Related Party transactions side and bad debts/ provisions/other expenses side.

• They have a litigation case pending to direct tax but don’t acknowledge the same in AR 2022

• They added 97L of vehicle assets in FY22 which is probably a BMW X5 if you see company photos. Might have bought it before or after IPO in Oct 2021.

• The company hasn’t complied with some accounting standards in the past, and they corrected them in updated financial statements.

Regardless of all this, I believe every micro-cap in the country will have some concerns with the management. It is how they evolve accordingly with growing topline that is something to watch out for and can lead to value creation. They have increased topline and marketing in previous years alongside entering new territories which looks promising to me.

- Growth/ Valuation risk- The way the stock is priced, the market expects some growth from this business on the earnings front. But that seems true for every stock in this richly valued market. Neither was their last quarter any promising. So, a lack of growth coupled with falling valuations is a potential future risk.

Also, they are facing short-term headwinds in exports, but I see this story from a long-term perspective

As we have already informed you there is a decline in the export revenue in this quarter because of the prevailing recessionary situation in the world and also there are foreign exchange prices in many countries. We are facing this situation, but very optimistic that we will have a good business in this quarter and we will present a good set of numbers for this quarter. (Nov 2023 concall)

Conclusion

In conclusion, this to me seems a very interesting asymmetric bet. The promoter holding is 73.6% which implies good skin in the game. There aren’t any major FII or DII holding the stock. The balance sheet and OPM are amazing. Neither are there any major marquee investors except a couple of unknown names. So, the story is quite undiscovered yet (or maybe I am missing something out).

The valuation is a bit on the higher side. At the current Market Cap of 430 Cr, the company earned around 17 Cr in the past year. But as a microcap, the growth can often ease off valuation concerns. However, I do believe that there isn’t as much Margin of Safety as I would generally like in this stock as a lack of revenue growth can lead to PE de-rating.

I do agree there is some uncertainty regarding whether they can take market share or maintain their OPM. There is some lack of clarity. But the price of clarity in markets is expensive. I do think that from a long-term perspective, the company can do extremely well from its CMP due to the size of the opportunity. Even though reality can sometimes have other ideas.

Do let me know what fellow VP’ers think about this scrip!!!

Disclosure: Invested small %age of PF. I would look to add/reduce according to how the story develops.

This is very exhaustive and helpful, @Ketan_Chheda.

I have a very tiny immaterial exposure as well…and to me the key risk, as in any other microcap stock, is the ability of the management to scale operations from here on, without taking any shortcuts.

Feb 2024 concall

PERFORMANCE

1…Export

=We continue to face

headwinds from the currency exchange fluctuation, and shortage of foreign exchange in some

of our major markets. However, I am happy to share that these challenges are gradually easing we anticipate a renewed business growth in these regions in the coming period.

2…Domestic

=growth of 35%

3…Margin

=However, as we navigate through this phase of growth, it is essential to note that our profit margin and EBITDA margin have shown a marginal decrease.

=This can be attributed to the strategic investments made in launching and promoting our new product range, Oradox.

=Additionally, our participation in both domestic and international dental exhibitions has incurred promotional expenses aiming to enhance the visibility of our brand.

=Furthermore, we are actively expanding our team across various departments for existing facilities as well as new facilities including sales including sales & marketing, research & development

==========================

FUTURE GROWTH

1…Export

=While our export business has encountered challenges due to foreign exchange crisis in some of our major exporting countries, I am pleased to inform you that we have successfully navigated these difficulties

A…Egypt peru, africa, argentina, sudan

=These are the 4 countries which were our major exporting countries. Because of the foreign exchange crisis and currency situation, they have not been able to give us sufficient orders.

=The situation is improving

=These are very high potential countries

=We are very confident that this is not a permanent situation. This situation

will definitely improve, and once the situation improves, business will grow in these 4 major

countries as well as the countries where now we are making all-out efforts to grow

B…USA

We have explored new countries. And our business in the USA has increased

0.8% to now it is 2.44%. So, we see a lot of opportunities in the US market.

C…Other countries

=we have also explored new countries where there is a potential so that we can grow in these countries to compensate for our business loss in the 4 countries which we have just mentioned

=.We have expanded our export footprint into new territories such as Venezuela, Senegal, Mauritius, and more.

=We have started selling in Australia also this year and

another country. Some more countries we have added.

= In Saudi Arabia, we have done

extremely well in this financial year.

=We are very confident that in the next financial year, we

will have much better business from these countries. We are very

efforts, growth in the export market will come back.

2…Domestic

=It is evident from our results that we have a growth of 35% in the domestic market, which is a phenomenal growth.

=And we are

very confident that this growth will continue further with the efforts of our marketing team and

with the high quality of products which we are manufacturing in our factory.

=New market/New produvt

=Growth in the domestic market, we are not even looking at

stopping at one location. We are looking at growth from our existing set of products, exploring

newer markets and pitching in new products to the markets where we are not reaching. And

that is where our online foray works.

=Parallelly, to improve our turnover in the domestic market, we are also looking at the new

range of products. For example, Oradox.

3…Oradox

=One of the highlights of this

quarter is the successful launch of our new product line under the brand, Oradox.

=The overwhelming response fro

indicates a promising future for this brand which will undoubtedly boost our top line growth in the coming months.

=These products are very innovative and most of them are first in India.

=And many of these are not available in India, and hence the direct competition to the bigger players in this market doesn’t exist because these are very specialized products.

=3 ways of marketing these products

-

an online consumer part is already there.

-

From an offline point of

engage with our dentist channel partners. Already we have a huge reach to these dentists

through our team, through our dealer network in India, which we have 60+ dealer networks

there and we are already reaching to them. -

The dental exhibit

will provide us another opportunity to launch these to dentists.

= These are the 3 ways we are

looking at moving these products to the end consumer.

4…Disinfactants

=Our venture into the disinfectant segment is progressing well.

=With products in the pre

trials in various institutions to validate the product quality.

=We anticipate that this segment will contribute significantly to our top line in the coming yrs

=The global antiseptic and disinfec

anticipated to reach around $63 billion by 2030, growing at a CAGR of roughly 10% between

2022 and 2030. We are fully ready to enter these growing segments of the

dental industry and

see a bright future for our company in terms of business

5…Dental 3 D printing material

=This market is growing@15% cagr

=This market is driven by the increasing prevalence of dental

diseases and demand for high-quality dental products.

=3D printing offers more treatment

choice, cost effectiveness, and customization options for the patients and clinicians.

6…Raw matrial depenence

=Our commitment to self

our dependence on imported raw materials.

=We are geared towards achieving this objective, allowing us to break free from our reliance on imported products

7…Online portal

=We have already secured partnerships with three of the biggest online portals and our range of products are now available on Tata 1mg, Amazon, and Flipkart in addition to our own portal.

=In line with our commitment to innovation and customer ,we have taken bold step by launching our own e portal prevest directly

=It had allowed us to engage with our customers directly and has already yielded promising results.

=Initial respose has exceeded our expectations indicating rapid expansion potential, especially in our underdeveloped markets.

8…Huge capacity after expansion

…After expansion,we are operating at 40%. There is huge capacity available for business growth

9…Branding and marketing

=Our company is joined by a very good marketing team led

with respect to other marketing people

= We have increased our

employees from 100 to 141. Mostly, this increase is with respect to the marketing team.

=There is an increase in exhibition expenses. Since we are

exploring new markets world over, we are going to as many as possible number of exihibitions

= In addition to this, we have

consultancy fee which has increased, say at least 2x to 3x in this current year since we have got the US FDA approval

10…Capex

Capacity utilization @ 40%

=We have enough capacity for the next 5 yrs

=CAPEX.

=We have already invested Rs. 24 crores on the capital expenditure for setting up of the new facility and also for setting up of the research center.

=With the new product

manufacturing facility, we have sufficient capacity for the next 5 years and sufficient products

for marketing in the next 4 to 5 years.

11…R and D

=We are continuing our research activities so that we can add some more biomaterial products

=We are developing bone grafting materials, we are also developing oral wound dressings. There are many

products which are under development. And our R&D is working on the development of these

products. Once these products are developed, we will take them for commercial production.

12…Competitiors

=Chinese products are very low quality

We dont consider them as competitiors

=We compete with MNC

=In india ,the top 5 companies who have the maximum market share are all multinational companies.

No. 1 is Dentsply. No. 2 is GC Fuji, is a Japanese company; Coltene;

=We have the highest market share among the Indian manufacturers

=Within India, we are the biggest player. In terms of turnover or market share perspective, we are bigger than any of the other players

13…Other

=As of now, there is no product we are trading. All the products that are there, are manufactured by us

=20 countries@80% revenue

Total 90countries

=Top 20 products@40% revenue

Disc…invested

Can any dentist or any expert in dental area confirm on the quality and usage of prevest product. Specially new range Oradox?

Company is now at good valuation and growth potential is very high if product is acceptable in market.

Can anyone confirm when is the company going to be migrated to main board?

In earnings call held on August 12 2022 mgmt told they will migrate in a year. Any update on this?

Next FY, they mentioned in the recent call

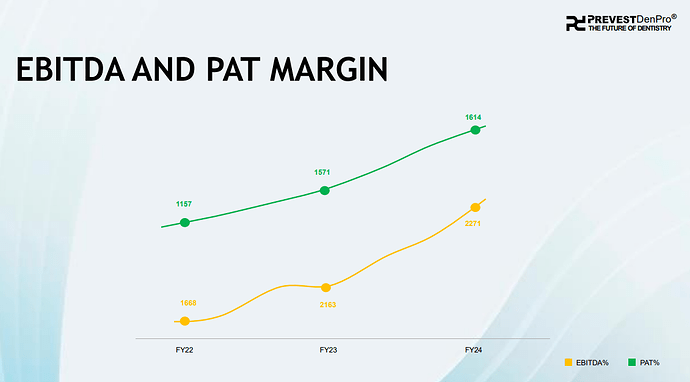

The recent ppt released from prevest has multiple anomalies.

If you have nothing signifcant to talk about the competition, then why do you even want to add this slide? it looks like an MBA ppt from the highly paid employee cum commission agent (son in law)

The legend indicates the data to be in % but it is actually in INR lacs.

The scale used on Y-axis is creating the illusion that the growth in the current FY is more than the last FY (which is incorrect).

Playing out exactly as a below average student…