Heard the concall, felt good about it.

Can we estimate topline for FY 2024?

-Normally taking 30% growth on existing products takes the topline to 65 crores.

-Conservatively we can estimate 5Cr. from USA and other new markets.

-5 crores can come from new products.

On 70 crores revenue from first two items, 20 Crore PAT can be expected. Let us presume that there shall be no profit on new products.

Thus, presently the company is available at 410 Cr. Mcap, merely 20 times forward earning. Looks attractive.

[Disclosure- Invested]

Joining all the dots and made a analysis report

https://drive.google.com/file/d/1rTaWgXg416d97DPK-wCaWmuuhMsIspxe/view?usp=drivesdk

Hope you like that

Hello

Thanks for the inputs. Did you go ahead with market research on their products at that time?

If yes, what were the results?

Yes , i lived in small town so here there is no big dental hospital but i visited some of the dental hospital but i don’t any information about their products.

What are the factors/reasons behind her bullishness? Also, are there any trends which she could have provided justifying her bullishness?

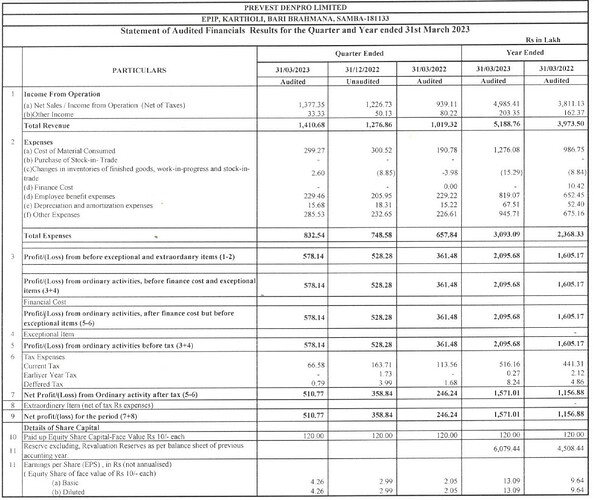

Great results, better than expected.

Have a few questions for concall (in case it happens):

- US market - any more $1M+ orders in progress? What about orders from 2 companies with which we were in advance stages of finalization?

- New facility for new products was to be ready by end of FY23 - is it ready? - what about regulatory compliances for same? - how soon production can start?

- Canada market entry - update?

- Main board migration - listed in oct’21. In 6 months it will be eligible for mainboard migration - what is the plan?

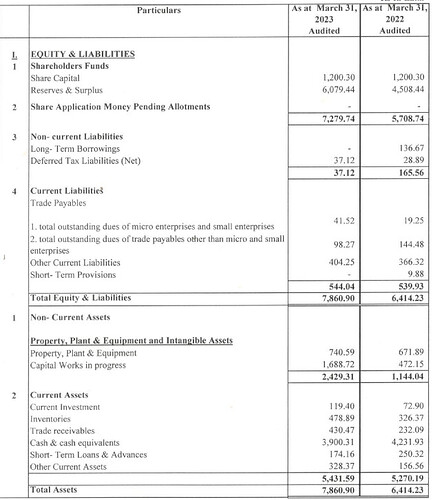

- How do you plan to utilize the 39cr cash on balance sheet. Future capex? Dividends? etc…

- Why was current tax lower this quarter vs last quarter? this spiked the EPS

Cash Generated from Operations seems to have a misprint, scared me for a second haha

One more question to add Vaibhav,

what is the need and possible structure of subsidiary company? In their filing they have mentioned that board has given approval for the same.

I spoke to 3 practising dentists and few of the findings are as follows:

-

One of them had no idea about their products.

-

One of the dentists who is practising since past 10+ yrs in Udaipur was using their products. On comparing their products with 3M, he said, " 3M is like BMW and Prevest is like Maruti Suzuki. You cannot compare them. Prevest products are vaue for money and I use them for procedures in which bulk material is required. I procure it through a distributor in Udaipur. Products are good and the company should do well in coming years as the demand for all types of procedures is growing and a lot of people are looking for affordable solutions."

-

The third dentist had heard of the product but never used. She has connected us to the distributor from whome she procures the products. We are preparing a questionnaire for the distributor. If anyone has any Qs, please add in comments.

Hi Guys… I am Living in southern part of Tamilnadu. I spoken with 4 dentists. 2 Dentists told like they never heard the brand. Third guy told like Prevest Products quality are at par compared to foreign products. He used at 3 to 4 times. He said the problem is dealers not supplying the prevest products in offline to Him. Fourth Guy is mostly purchasing prevest products for filling purpose (temporary fillings and permanent fillings) Surprisingly All the 4 Dentists are purchasing in Offline mode only. So my understanding as of now is

1, Prevest management still needs to work on Brand Promotion.

2. Still majority of the sales are happening through offline mode only. So they have to more focus in domestic sales distribution.

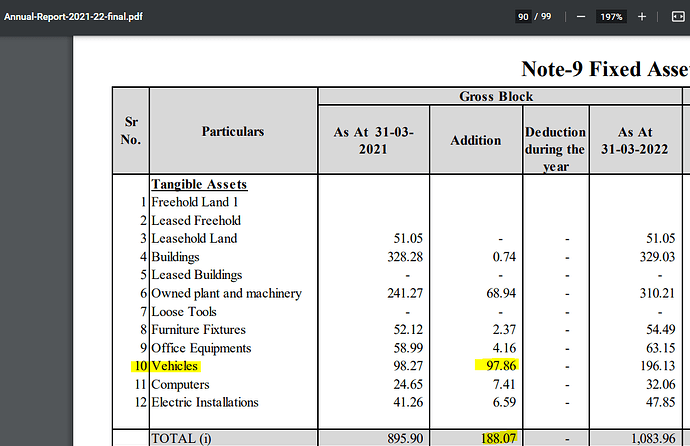

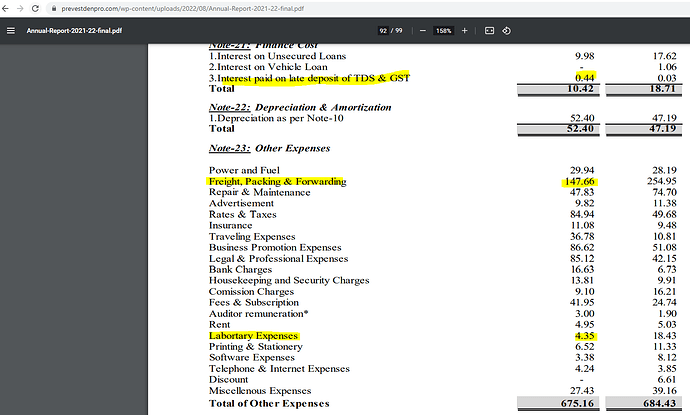

Few observations from the notes of FY22 AR:

-

52% of capitalized assets are in vehicles, way more than plant and machinery.

-

Although sales increased by 32% in FY22, fall in expenses such as “Freight, Packing & Forwarding” and “Laboratory Expenses” by 42% and 77% respectively seems counterintuitive.

-

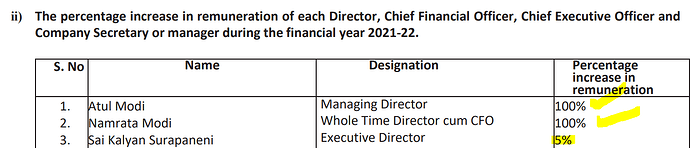

In FY22, promoter salary was increased by 100% when sales growth was 32%. Ironically, the director who looks after “manufacturing, quality control and R&D activities are supervised by our Executive Director, Dr. Sai Kalyan Surapaneni.” got a hike of 5%. That too when “The percentage increase in the median remuneration of Employees in the financial year: 20%”

If anyone could throw some light on the rising inventory and cash conversion cycle? Is it to assume they are taking advantage of the lower cost of raw materials right now given their product’s higher shelf life? or is it something else?

Sloppy update from mgmt - besides changing the PPT colors & including new financial statements - no change vs Q3 PPT

Business dynamics and fundamentals do not change every quarter.

True at a high level. But, lets talk nuances

- Slide 9 - Revenue by Geography - won’t this change qoq? - can’t they provide updates on new deals/WIP deals - Updates on US/Canada market entry?

- Slide 8 - Capex updates are missing - New facility for new products was to be ready by end of FY23 - is it ready? - what about regulatory compliances for same? - how soon production can start?

I am sure there would be 10 more things if we go deeper. Why share same Investor presentation for the sake of it. Idea is to update the investors, right?

Disc - invested

Interesting article on the origins of the company

A few takeaways from the results conference call held today at 4pm

-

Targetting 30% revenue growth conservatively in FY24. Should do more than this given new products are getting launched

-

EBITDA margins should expand on better fixed cost absorption

-

Should double revenues over the next 2 to 3 years. Will try to maintain margins over medium term.

-

Operated at 40% capacity utilization in FY23 on single shift. All new capacities have been commissioned. Don’t need to do meaningful capex over the next few years. Even after doubling revenues no need to add capacity as you can add another shift

-

Will evaluate investor feedback of giving dividends in the next board meeting

-

Atul Modi’s son-in-law Vaibhav Munjal has joined as the Chief Marketing Officer. He will focus on India markets to grow the sales network offline and online.

If someone else attended the call please add to the above notes.

In one of the update from the company over LinkedIn, they have mentioned that they are launcing the new product line soon. Probably someone who has attended today’s concall will be able to provide a better clarity.

I think the management is walking the talk 90%. We need to give some leeway to the management considering they are still an SME. They are doing concalls, providing updates regularly over the new developments, attending various international seminars and conferences to create the brand awareness and getting in people for better marketing because that is where they are currently lacking big time. This is something to be honest unheard of atleast in the SME listed cos. since most of the cos. even do not publish results on quarterly basis.

Though there are couple of points which do not go in the management’s favour viz. –

- Remuneration of the management and the expenses like vehicles, etc.

- Hiring family people at various positions, etc.

I do would like to give some slack to the management on the above points since many of the cos. have similar pattern but these info. are kept in dark, away from the investors. Here, atleast management is quite transparent in mentioning and sharing all such details. To me, the kind of margins this business as a segment has is enough for me to be invested for the long run since the cash in hand over the years would definitely at some point would be divided into shareholders if the management is good/honest.

Discl. – Invested at lower lowels and quite bullish on the future prospects.

Some interesting observations from yesterday concall

-

As of now prevest doing 20 crores (approximate) sales in domestic market. As per management domestic market size for them seems nearly 1000 crores. so they have roughly 2% market share. During Yesterday concall atul modi said they are targeting 4% domestic market share in this year. So it translates around 40 crores on domestic perspective only. Whether management capable of doing that? Let see

-

Regarding new plant products (disinfectants, mouth wash etc) management said they are more margin products compared to current products. More than 40%. Quite surprising to me.

-

Management said they are working for 2 potential customers in usa for private labelling. As of now trial orders going on. Management waiting for their response. My biggest concern is on export market. from last few years they are heavily working on export biz, but still not any decent orders coming. needs to track usa business…

As per management assumption they are conservative looking for to cross 67 or 68 crores odd sales in this year. But if they crack on domestic market i think 75 odds crores is possible too…

Disclaimer : Invested and biased