Hi,

This is my first writeup on VP, so consider any lapses kindly. I will keep the writeup short, and based on questions or conversations, attempt to find and update related information.

I wish to draw attention to a small scale regional player in plastic pipes - Prakash Pipes- PPFL.

Primary investment thesis - A subsidiary business with impressive performance while the primary business is likely to benefit from the tailwinds in the plastic pipes space.

Business history - Primary promoter in business since 1981. Initially part of Prakash industries which also has interests in steel, power and mining (Refer thread on Prakash Industries on VP). PVC pipes and plastics division demerged out in 2019 into separate entity with investors getting shares in ratio 8:1. (for 8 in parent, get 1 in new). Company starts trading on BSE/NSE as separate entity from June, 2019.

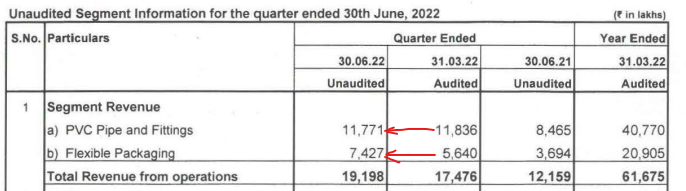

Current Business - Initially, as part of Prakash industries, PPFL was primarily a plastic pipes company. While plastic pipes industry faces reasonable tailwinds in the business today, Prakash pipes is relatively small and decent regional player in the north (UP primarily and then the Delhi, Haryana and Northwards belt, with influence gradually diminishing as we move north east or south). In 2018, however, PPFL diversified into the flexible packaging space. The key attractiveness of the business lies in the flexible packaging division which is growing at an incredible rate.

The story in numbers is as follows -

| Particulars | FY19 | FY20 | 9MFY21 |

|---|---|---|---|

| Total Revenue | 345.6 | 389.2 | 342.4 |

| EBITDA | 43.2 | 42.4 | 43.6 |

| EBITDA margin (%) | 12.50% | 10.90% | 12.70% |

| Depreciation | 4.7 | 6.5 | 6 |

| Interest | 0.2 | 1.6 | 1.5 |

| Profit Before Tax | 38.3 | 34.3 | 36.2 |

| Income Tax | 9.7 | 9.5 | 10.5 |

| Profit After Tax | 28.6 | 24.8 | 25.6 |

| PAT margin (%) | 8.30% | 6.40% | 7.50% |

| Sales Volume (MTPA) | FY19 | FY20 | 9MFY21 |

|---|---|---|---|

| Pipes & Fittings | 42,012 | 43,305 | 28,025 |

| Flexible Packaging | 316 | 3,227 | 5,227 |

Current year highlights (Q3 - Fy2021)

Quarter Ended Dec, 2020

- Revenue - INR 127 Crores, up by 37% (YoY)

- EBITDA - INR 16 Crores, up by 63% (YoY)

- Profit After Tax - INR 9 Crores, up by 25% (YoY)

9 Months Ended Dec, 2020

- Revenue - INR 342 Crores, up by 14% (YoY)

- EBITDA - INR 44 Crores, up by 34% (YoY)

- Profit After Tax - INR 26 Crores, up by 25% (YoY)

Pipes & Fittings Division

- Recorded sales volume of 10,013 tonnes in Q3FY21, up by 4% (YoY)

- Contribution of the Fittings in the sales mix has increased to 7%, up by 83% (YoY)

- Installed 3 new Moulding machines to expand the Fittings range

- Added Chlorinated Polyvinyl Chloride (CPVC) Pipes & Fittings in the product range

Flexible Packaging Division

- Sales volume grew by 60% (YoY) in Q3FY21

- Increased capacity by commissioning 3rd Printing Machine

- Commissioned Rotogravure Cylinder plant as a step towards backward integration

Incremental planned Capex - Company is planning significant further Capex in both its divisions, as of now, all funded through internal accruals.

| Capex | Current | Target FY21/22 | Percent Increase |

|---|---|---|---|

| Pipes & Fittings | 55000 TPA | 67000 TPA | 22% |

| Flexible Packaging | 9600 TPA | 19200 TPA | 100% |

It is interesting to note that flexible packaging incremental capex is comparable (12000 TPA to 9600 TPA) to its long standing pipes division in absolute terms, while in percentage terms absolutely blows the pipes capex out of the water (at 22pc vs 100 pc that’s a no-contest really) and in my opinion indicative of where the management thinks future profits will be from.

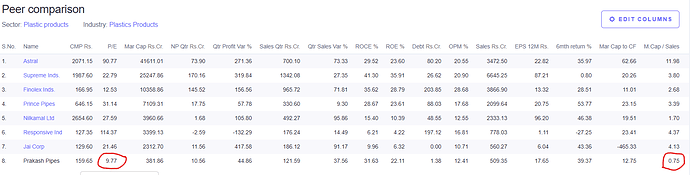

From screener, With ROCE at healthy 29%, EPS of 14, P/E of 10, and debt-free, it seems pretty fairly valued with respect to its pipes competitions as well as packaging competition.

Short Business Note - Pipes

- Current plant at Kashipur UP.

- 500+ dealer and distributor network

- favorable tailwinds with consolidation in pipes industry and Jal Jeevan Mission, Krishi Sinchayee Yojana and Pradhan Mantri Awaas Yojana.

For a fuller discussion of the pipes industry please check this link - https://www.valuequest.in/deep-dive-series-plastic-pipes/

Short Business Note - Flexible Packaging -

- again, plant at Kashipur UP.

- backward integration with printing inks, blown PE films and Rotogravure cylinders.

- very healthy client list with repeat business across FMCG, food and Infrastructure/Others.

Overall, company looks favorably poised to benefit from the pipe industry tailwinds, with the flexible packaging division serving as the cherry on the pie. At current prices and valuations, looks like there is significant upside to the stock, even after the nearly 5x runup over the last year.

Views/questions/opinions invited from esteemed members of this forum.

Disclosure: Invested and accumulating.

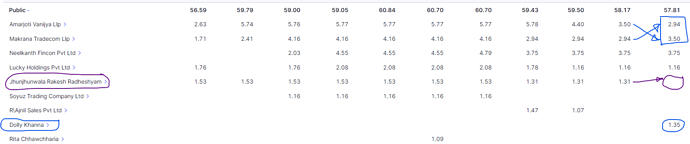

Edit 1 : Apparently, RJ is invested in this from lower levels.

Edit 2: In response to Sahil’s questions below. Have added what I think are the key risks as well as links and pointers to more information (as much as I could find).

Key risks

- PVC resin imports is the most significant raw material needed. India imports 56% of its PVC resin needs. Larger players have better cost efficiencies in procurement. Not sure where PPFL stands in this regard. PVC resin import also has ADD (Anti Dumping Duty) applicable, but again, whether that’s a good thing or bad thing for smaller players is subjective based on costs involved for the player and the ability to pass the cost downwards to its customers…

- Promoter risk - Prakash Industries, the founding company, is involved in lawsuits filed by CBI against certain operations of its mining businesses.

Business and prospects details -

Pipes - the value quest article above is a good starting point. It has several details about the process, the inputs, the market segmentation and the overall industry business prospects.

Flexible Packaging - the best source of information I could find was this pdf presentation by Dr Ranweer Alam, Director, IIP (Indian Institute of Packaging). http://missp.ch/docs/1590652928The%20Indian%20Packaging%20Industry%20-%20Post%20Covid-19%20as%20an%20Opportunities%20in%20Packaging%20Business.pdf. Most other articles and research reports are behind a paywall.

Other links

- Indian Packaging Industry Riding On The E-commerce Wave | IBEF | IBEF,

- Covid-19: Packaging industry sees higher volume growth in June-qtr | Business Standard News

- Packaging Market in India 2020-2024 | Shift Toward the Use of Flexible Packaging to Boost Market Growth | Technavio | Business Wire

- Packing industry holds potential for high growth - The Hindu BusinessLine

- The India Packaging Market was valued at USD 50.5 billion

The Annual report of the company is a very good read. The overviews of the business landscape, both overall and division wise are excellent. The rest of it is also eminently readable, unlike most, where you actually have to push through.

In addition, one other point, although minor, does make a good impression. Both the annual report, and the site, are among the most polished of any small business I have seen. The Annual report is excellent in terms of its readability, while the web-site is slick and fast.

Web-site - https://prakashplastics.in/

Annual report link - Annual Report - Prakash Pipes Limited

I’m sure someone else (which might very well end up being me because I am excited to study this business soon) will take up the mantle and post answers to these basic questions about what are the goods or services provided in each segment. What is flexible packaging? What are cpvc pipes ?

I’m sure someone else (which might very well end up being me because I am excited to study this business soon) will take up the mantle and post answers to these basic questions about what are the goods or services provided in each segment. What is flexible packaging? What are cpvc pipes ?