Disclaimer:

This thread is probably NOT for the Purists, those who already live by a well-set Investment Philosophy, those who have probably seen through at least a couple of bull-bear-bull cycles.

This thread IS for Learners like me, who want to remain flexible, want to remain curious, want to understand markets and investor behaviour, and attempt to adopt strategies successfully executed by folks we trust and respect, who we have seen being there, doing that.

As thinking practitioners of the ART of investing, we have found the need to re-calibrate our Portfolios from time to time. As we experience more, we become more alert to shifts in Market cycles.

I still remember in early 2012 on our Gujarat trip. Ayush & Hitesh would keep talking about Pharma boom being all over the place, and I had absolutely no clue

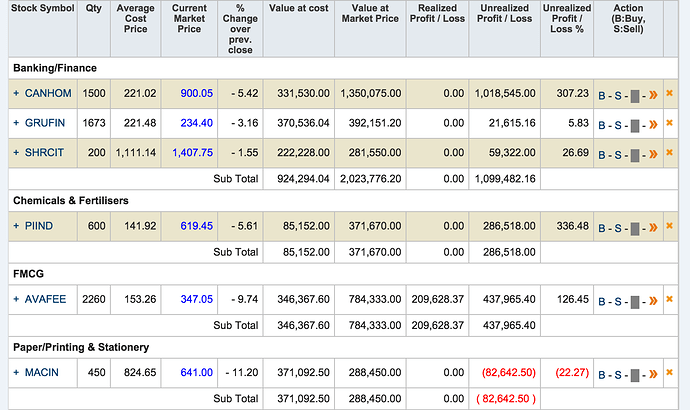

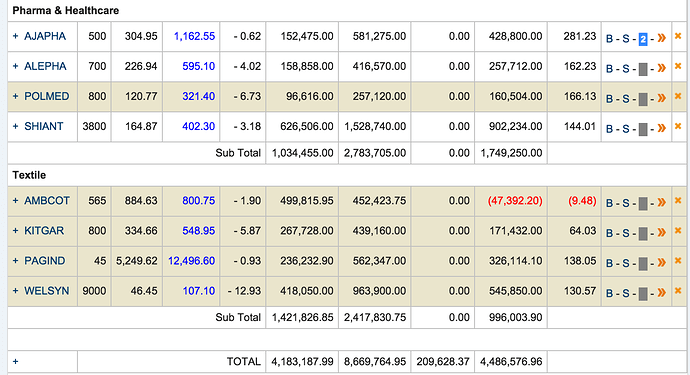

In early 2014, I was acutely aware of the need to shift from a completely aggressive small cap portfolio, to one that could lend more stability in times of market shifts, end hence allocated 25% of Portfolio to stabilisers like HDFC, GRUH. Think that made a huge difference to my Portfolio weathering this current carnage with calmness. We also made sure to add 2-3 new Opportunistic Bets every year (again, some 25% of Portfolio) where we found the growth visibility very strong and no-brainer valuations (big gaps between Performance & Perception) like as in Canfin Homes, Avanti Feeds, Welspun Syntex, and the like. These added the extra kickers that ensured a more robust outperformance, while leaving us free to allocate some 50% to long-term high-growth compounders.

On the other hand, I have always marvelled at VP’s own Peter Lynch (coined by Hiteshbhai) - Ayush’s family stabilising plank of a stream of Opportunistic bets every year. They have never needed to shift to Large Caps/Defensives/Highest Quality. They just sort of roll-over some significant money to a new set of Opportunities every year - where the Growth/Visibility seems pretty strong - and that is something that obviously the Defensives can never match :). Of course their’s is also a much more diversified portfolio strategy.

Now I am always greedy about exploring smarter compounding.

Is there a way to adopt part of this strategy to restructure our Portfolios, better??

I have observed over last 2-3 years, when we play this game well, it is almost as good as the Defensive planks in your Portfolio, even in times of churn. Actually if we play concentrated and do the hard work of getting insights to choosing the best stable growers among the new opportunities, we end outperforming by some margin. At least the possibilities are immense. Markets, as we all know, just love where there is good growth, where there are possibilities of sustained Growth. Equities without Growth become like Bonds.

That’s the backgrounder from my side - on setting the ball rolling. I am sure all of us who attempt this will benefit from the exercise, in many ways! So this exercise for me is 3-fold

-

Look critically at the above portfolio; Examine Growth planks/sustainability critically, and weed out/partially/fully-exit growth-valuation mis-matches

-

Focus on the next set of hard work for insights into the best among Opportunistic bets/High Quality bets opportunities that all of us can collectively spot (as valuations become more attractive)

-

While VP will always remain a bottoms-up stock-picking philosophy/strategy, is it possible to make sure we are not on the wrong side of market shifts.

My understanding is limited to good old produce/sell companies and it is very important to be aware of our limits!

My understanding is limited to good old produce/sell companies and it is very important to be aware of our limits!