Well Jefferies for their part don’t seem to think the CG issues are a big deal and have given a price target of 7000.

https://twitter.com/LearningEleven/status/1746861676354322900

Well Jefferies for their part don’t seem to think the CG issues are a big deal and have given a price target of 7000.

https://twitter.com/LearningEleven/status/1746861676354322900

A fun read about the Polycab tax fraud episode: Who exactly did Polycab defraud?

–

Whenever a company does some fraud I like to think of it in terms of who really did the company defraud. If a company pays less tax than it owes, it has defrauded the government and/or the tax-paying public. If a company fakes its revenue to show that it has earned more (or less) than it has, it has defrauded its investors.

Depending on who the company has defrauded, investors may or may not like the company. If a company is accused of defrauding the public, for instance, investors might even like the company better. Defrauding the public means more money and making more money is (nearly) always better than making less money, as I like to say.

I’m being a bit facetious. If a company publicly does some fraud, investors are going to be wary of investing in that company and if it’s a listed company its share price is more likely than not going down.

But still, when investors evaluate a company that’s accused of fraud, a useful question for them is “who is it that’s getting shafted?” If it’s the investors, it’s bad. If it’s anyone else, not so bad.

Anyway, last week the Income Tax Department said that it conducted massive raids on Polycab India’s offices, factories, even distributors, and found evidence of tax evasion. Polycab’s stock price fell by 23% in a single day when this news came out.

Here’s the press release from the tax department:

Preliminary analysis suggests that the flagship company indulged in unaccounted cash sales, cash payments for unaccounted purchases, non-genuine transport and sub-contracting expenses, etc for suppression of its taxable income.

Credible evidences recovered during the search have established that the flagship company has made unaccounted cash sales of around Rs. 1,000 crore which are not recorded in the books of accounts. Evidences of unaccounted cash payments of more than Rs. 400 crore made by a distributor, on behalf of the flagship company towards purchases of raw materials, have also been seized. Further, non-genuine expenses in the nature of sub-contracting expenses, purchases and transport expenses, etc. aggregating to about Rs. 100 crore have also been identified in the seized evidences from the premises of the flagship company.

If a company is trying to pay less tax, it has to show a lower profit. It can do this by either reducing its revenue or increasing its expenses. The tax department says that Polycab did both. It says that the company:

Understated its sales or revenue by ₹1,000 crore ($120 mn).

Exaggerated its expenses by ₹100 crore ($12 mn).

But also… understated its expenses by ₹400 crore?? ($48 mn)

Points (1) and (2) are straightforward. Polycab sold some cables and wires in cash and didn’t account for that money in its books. And it faked some bills to show expenses which it didn’t really have. Classic. But point (3) is tricky. The tax department says that Polycab’s distributor bought some stuff worth ₹400 crore on behalf of Polycab and the company didn’t account for it in its books?

Am I missing something? Please let me know if I am. But it makes absolutely no sense for Polycab to simultaneously fudge its books to show ₹100 crore more in expenses while also hiding ₹400 crore of perfectly legitimate expenses. Sure, steal that ₹100 crore if you must but also take those legit expenses! [1]

Who was shafted?

Let’s assume the tax fraud stuff is true. Polycab understated its revenue, exaggerated its expenses, and committed tax fraud. Who was shafted?

The government was, no doubt. Polycab paid less tax. But Polycab’s investors were also shafted. It showed a lower profit, so ultimately its investors made less money.

But if the tax department is right, Polycab actually has a pot of cash that it hid from investors all this time. Sure, in the short term, Polycab would have to pay that tax it escaped along with whatever penalties. But once that’s done, what would have been a hidden pot of cash from the next year onward will come right into the company’s books and to the investors. [2] So if the tax department is right, Polycab’s value should actually go up! The government is helping Polycab’s investors find their hidden pot of cash.

To plug in some numbers: Polycab’s market capitalisation was at around ₹71,000 crore ($8.2 bn) before the tax fraud news. After the news, it fell by ₹15,500 crore ($1.9 bn). Even if Polycab has to pay the entire value of the newly discovered pot of cash—₹1,000 crore—as penalties, this seems excessive. [3]

Of course, when investors buy a company’s stock, they don’t just pay for its discounted future cash flows, they also pay for the trust in the company’s management. If Polycab has defrauded its investors today, it might very well defraud them again in the future. So some investors would rather stay away.

Ultimately, Polycab would be worth more (because of the discovery of the pot of cash) but also worth less (because of the loss of trust). [4] Right after the tax fraud news investors decided that Polycab was worth 23% less, but the stock has gone up 10% in the last few days so looks like they’ve started to think it’s worth a bit more.

Footnotes

[1] One reason to do this would be to help the seller save on GST. If whatever was bought cost ₹400 crore excluding taxes, a legitimate transaction would include tax and would cost more. Yet, the reduced expenses (18%) here don’t compare with the possible gain (25–30%) with the expense being accounted for.

[2] It would be funny if Polycab did some tax fraud this year, got caught, and did some tax fraud again in the forthcoming years.

[3] I have no idea what the penalties could be so please don’t take this figure at face value.

[4] There’s also the possibility of SEBI coming in and penalising Polycab or its management for fudging the company’s financial statements.

If any PMS/mutual fund house is trimming the position, this doesn’t mean stock is bad or not grow from current levels

So don’t take your sell decision by seeing this

Quite normal for corporates these days to face cyber issue. Non event in my view

Disc: no recommendation to buy or sell

Who is Company auditor? Any one from big4?

Stumbled on this post and would be remiss of me not to point out increasing cyber risks companies are facing, that can cripple operations.

Innumerable firms, esp skewed towards digital businesses face Denial-of-service attacks. Typically, ransom demanded in a DOS / DDOS is demanded in Bitcoins or in other crypto currency, throwing firms’ IT in a panic because systems may not be accessible bringing firms to an operational halt, and you need to get Bitcoins / crypto by some illegal means.

Most firms (in India) may not disclose it publicly because it will cause reputational damage. But damages can be inferred from disclosed attacks on US firms (which also may not disclose but now have to).

Some examples:

a. In June 2021, WSJ reported how an Eastern European hackers made mroe than 100 million on ransom after crippling many US hospital chains.

https://www.wsj.com/articles/the-ruthless-cyber-gang-behind-the-hospital-ransomware-crisis-11623340215

b. On May 7, 2021, the hacker group DarkSide breached the Colonial Pipeline’s network, using ransomware to encrypt the company’s data and demand a large payment in exchange for the decryption key. The attack shut down the pipeline’s operations for about five days, causing localized shortages of gasoline, diesel fuel, and jet fuel. *

c. Two big Las Vegas operators faced attacks that caused serious business interruption. A summary being cut-pasted below

FBI has issued specific guidelines on how to act if there is a cyber ransom, in many cases asking companies to withhold ransom payments. That puts firms in a real bind because not paying ransom money is damaging every minute, but paying it would mean you are not helping the cause. From the cases that I have read, firms take some middle ground often, they pay some, they hold some. But net net executives are quite not prepared to deal with these.

Insurance covers are yet evolving to cover damages and may not adequantely protect from such risks. Cyber insurance is a new area that is rapidly evolving but not fully established to provide cover under all events / for all damages.

US SEC Form 10K filers now have to separately report cyberattacks on their businesses. This means companies have to disclose how they were affected in their annual reports. I would say more often than not the 10-Ks I have read report such incidents, either on them or their suppliers, that cause many breaches. India may not take customer related info breach seriously, but disruption to operations (say gumming up an SAP system) can be dangerous to valuation.

Even in the case of Polycab, their announcement has not clearly specified the damages and to what extent it has been remedied. Their release says, “Currently, the Company’s systems are up and running, all factories are operating, and the Company continues to serve its customers. The technical team of the Company along with a specialized team of external cybersecurity experts are working actively on analyzing the incident.”

They do not say if the factories are operating normally (as before the attack). They do not mention if they paid any ransom or if there were any financial damages to remedy the attack. Their last sentence implies that the damages are not fully taken care of, for the future, because it is still being ‘analyzed by external cybersecurity experts’

*(AI generated based on my search)

It’s been 4 months since my distilled analysis. The price has largely stabilized though not yet at 5500 levels but much above the depths of 3600. It’s too early to predict future but it is time to remind ourselves of a few points.

Never say no one will buy or get into moral pontification. Example: A student copied in the exam. It is both morally and ethically wrong. The max that can happen is debar as per our law. You can not hang the kid for it.

Scandals always happen in all the economies. Our job as analysts is to estimate the impact and buy if the fall is reversible.

Some Investors may be offended by the above. I would like to remind what Warren Buffett did during Amex salad oil scam. He calculated rationally and bought a huge chunk of Amex. Not taught Amex on how to be ethical.

There will be some Investors who will sell at that time it’s their prerogative, but don’t get influenced. Take your decision on its merits.

All the above doesn’t mean I support promoters activity or I know all the future outcomes. BUT Do quantify the outcomes and Invest.

I am thinking of posting my timely insights in a single thread, so that I can revise if there’s been any changes in thesis. Please DM me on which place is ideal for a such posts.

Disc: Invested. I’m not a SEBI RIA. Please consult an RIA before investing.

Fraud was not done by Amex but by one of its customers.

WB went to Walmarts and saw common folks still using Amex cards and it gave him confidence.

It’s true but Amex had responsibility of oversight. My understanding is that they were like Auditors of a company.

This NOTE does NOT delve into Polycab specifically but provides an Insightful Sectoral overview of ALL the 20 listed Power Cable companies in India.

![]()

Power Cables are to Electricity, what Roads are to Automobiles.

If we’re going to hit the 5$ Trillion GDP mark, we’re going to need a hell lot more Energy/power/electricity!

Wires & cables being the carriers of Electricity, are fundamental to our growth goals as a nation ![]() So, In this note, we’ll conduct a mostly Quantitative Analysis of 20 Listed Power Cable companies in India.

So, In this note, we’ll conduct a mostly Quantitative Analysis of 20 Listed Power Cable companies in India.

Some (not all) of the Ratios we will be using are :

Also, just some ultra-basics: Power cables are usually categorised according to the voltage of the current they can carry.

They are categorised into Low voltage (< 1000 Volts), Medium ( 1 - 36 KV) & High Voltage (36KV+).

Their respective use across the Power Value Chain are illustrated below

With that basic background, Let’s Go! ![]()

Log scale (Data as of 5th April 2024)

Source: screener.in data | Left to right: Highest Market Cap to lowest.

‘Size Matters’! This is evident from the chart below which shows Polycab & KEI seem to have consistently high ROCE, most likely because of their larger size (NOTE: Size should ideally be measured in Gross block terms no M.cap)

Dynamic Cables is an anomaly in that it has consistently (last 5 years ROCE) maintained high ROCE vs 18 other peers.

The sector is experiencing is positive uptrend (Improving ROCE). Not surprising given the increased spending on the Power/Real Estate/Infra Sectors.

Some of the differences in ROCE amongst players may be explained by the Business Models i.e. their B2B vs B2C mix, their product mix etc. That analysis would be a logical next step i.e Performing Deep dive into specific companies

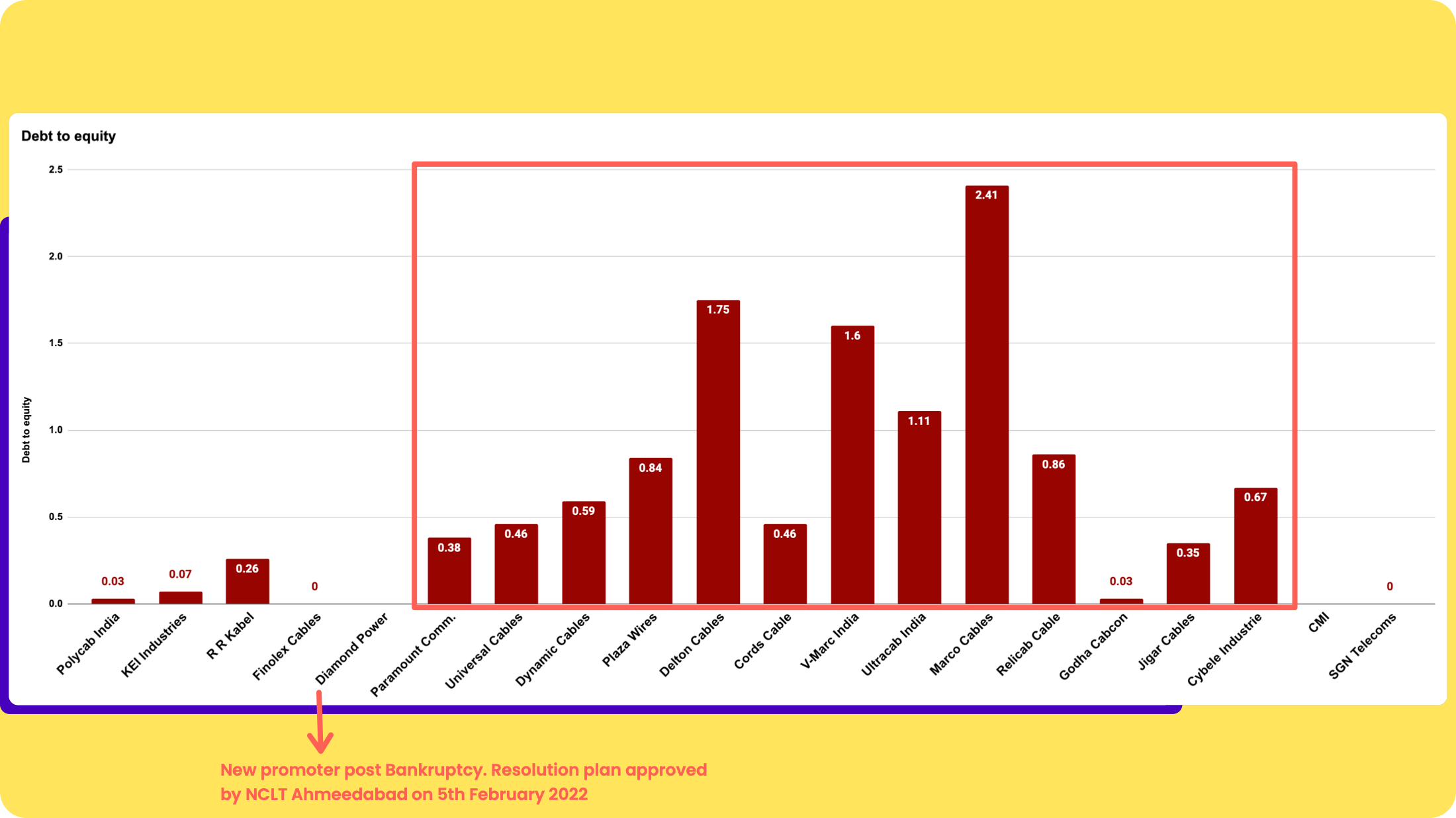

3. Smaller companies have higher Debt & lower Interest Coverage

Left to Right: Highest Market Cap to Lowest Market Cap companies in the sector.

![]() The higher debt for smaller companies is mostly working capital Debt.

The higher debt for smaller companies is mostly working capital Debt.

Working capital days (No. of days to convert working capital to sales) for smaller companies tend to be higher (unsurprisingly). Higher WC days would lead to higher Working capital debt (measured as % of WC to Sales)

Larger players tend to have higher Asset Turnover (Sales / Assets) which means they’re able to squeeze out more rupees in sales from every rupee of assets held.

There are also positive and negative anomalies amongst the pack, as shown below.

source: Screener.in Data |

RR Kable and Dynamic Cables are examples of positive anomalies.

Finolex and Universal cables are examples of negative anomalies.

At least amongst the top 4 players, FMEG could be the reason why RR Kabel has a notably higher Asset Turnover.

RR Kabel derives 11% of its Revenues from the FMEG Segment - Fans, lights, switches etc whereas Polycab derives ~8% of its Revenue (9MFY24) from FMEG, Finolex (< 5% Revenue from FMEG) whereas KEI is NOT present in FMEG at all.

Operating profit Margin (%)

Dynamic cables and KEI Industries have the most consistent margins across timeframes and Ultracab & Relicab (< 200 Cr M.Cap) have shown the sharpest improvements in OPM (%).

Finolex’s shrinking margins could be a sign of shrinking pricing power (assuming it has some, to begin with) or poor operating expenses management etc.

Whatever the root cause, shrinking margins make markets unhappy. This may be one (of the many) reasons why Finolex trades at a significantly lower PEx (< 26X) vs peers.

The above chart also displays one of the hallmarks of Wealth creation in the stock markets: P/E Re-rating. And when it rains, it pours!

Every single (almost) co’ in the sector has undergone significant re-rating (Exceptions: V-Marc & Ultracab) and judging by the the multiples, it’s unlikely there is room for further expansion, at least for most companies in our cohort.

As for Why V-Marc India trades at such a low valuation? It’s just Fraud baby! ![]()

Finally, the growth metrics. Firstly, the last 3 years Avg growth may not be the best metric for visualising/judging the recent change in Sales/EPS, however, using the data below there are 2 key observations we would like to comment on.

![]() RR Kabel and Finolex have not been able to grow EPS as fast as Sales (why? Worth exploring in the next step: co’ wise research)

RR Kabel and Finolex have not been able to grow EPS as fast as Sales (why? Worth exploring in the next step: co’ wise research)

![]() Ultracab has shown EPS growth much significantly higher than Sales (including Jigar cables & Cybele Industries)

Ultracab has shown EPS growth much significantly higher than Sales (including Jigar cables & Cybele Industries)

Want to guess which stocks gave the highest returns in the last 1 year? (Not that it has any predictive value). Here’s the jaw-dropping data :

![]() 7 / 20 Stocks gave a 100% + Return

7 / 20 Stocks gave a 100% + Return

![]() 9/20 Stocks gave an 80%+ Return

9/20 Stocks gave an 80%+ Return

This reminds of some Key lessons we can learn/re-learn from the stock price behaviour of stocks/sectors :

![]() If you get the sector right, the probability of making satisfactory returns goes up!

If you get the sector right, the probability of making satisfactory returns goes up!

![]() When a Sector Turns, the best stocks in the sector rise at first and as the cycle continues, the relatively worse (sometimes smaller) players tend to do better than even the best companies (returns wise) because of the delta-from Shit to hit!

When a Sector Turns, the best stocks in the sector rise at first and as the cycle continues, the relatively worse (sometimes smaller) players tend to do better than even the best companies (returns wise) because of the delta-from Shit to hit!

Delton Cable surely has my attention and curiosity. The question is: Is it another pump or Dump or is it a special business? Should we find out more?

Tell me in the poll below because a logical next step in my opinion (you can share yours in the comments) is doing a deep dive on any 3, under 2000 Cr Market Cap companies and I need your help to decide ![]() which ones.

which ones.

Just name your Top pick ![]() Go !!

Go !!

Hope this was insightful, would love to hear your thoughts

Rahul

![]()

Polycab posted blockbuster Q4-2024 results on 10th May. The company reported 18039 crores of topline and 1803 crores of PAT for full year 2024; the topline was 28% and PAT was 41% higher compared to previous year. For the Q4-2024, topline was 5592 (29% yoy growth) crores and PAT was 553 crores (29% yoy growth). Following are some key call outs & observations from the earnings call

1- The Company is going to achieve the project LEAP topline target of 20K crores ahead of FY2026. The company would come up with a new guidance for the medium term in next few quarters.

2- While the Copper and Aluminium prices have gone up, the company believes that it has robust processes/mechanism in place to protect its margins and so does not see it impacting the profitability.

3- The cables and wires business is growing at a much faster clip – north of 30%. Cables are growing at high thirties and wires at low thirties. The company believes that it has gained the market share from other players and now it has 25% odd share compared to 23% odd a year ago.

4- The demand scenario for the cables and wires is robust, and company believes that with huge impetus from government on Infra it would remain so over the next few years.

5- FMEG continues to be lacklustre. While there is yoy growth in topline, it has come on low base. Also there were couple of one-time expenses which has impacted the profitability of this arm.

6- Polycab is actively working on fixing the identified gaps in FMEG, and expects things to improve in next 2-3 quarters. More focus on Switchgears where margins are better.

7- Exports grew fine except for US where the company is changing the mode of business to distributor oriented (as it is in India). This will make the growth in export look modest for the current year. Expect that all other countries (79 in number) will make up for the moderation brought from US in next couple of years.

8- NOT A SINGLE question asked by analysts on the IT raid. The promoter just said in the beginning that they have been providing all info to the IT department and they do not believe that there would be any material impact.

9- The overall EBITDA margin for the business would be in 12-13% range. For EPC it would be in high single digits.

10- Capex of roughly 1000-1200 crores every year over the next 2-3 years.

11- Polycab is the undisputed leader in cables and wires in India from Sales, growth and profitability point of views. It is far ahead of KEI and Havells in this segment. The tone in the earnings call was upbeat – the management gave enough pointers which leads one to expect the growth momentum to continue – revision in LEAP target, talking about public and private spend on Infra (Renewable – 500 GW, Underground cabling, spends on highways and railways etc.)

12- I expect Polycab to achieve 20% topline growth in FY 2024-25. There are multiple reasons behind this optimism – first, many avenues of growth from Infra push from the government resulting in huge demand for cables and wires. Second, Polycab was operating at 75% odd capacity in this year and so there is capacity available for further growth. Third, the company has demonstrated best in class execution over the years and it is reasonable to believe that it will be able to execute well soon too.

13- With 20% topline growth, and roughly 13 – 13.5% EBITDA and 10% PAT margin, the company should post 2165 crores of profit for FY 2024-25. This will result in EPS of roughly 142. The current market price is discounting this roughly 43 times. I will let all of you do the comparison with KEI and Havells.

14- I request my fellow investors to process the corporate presentation (this is different from earnings presentation) of Polycab. It has plenty of insights for cables and wires business and in general for Power (Renewables, Transmission and Distribution and many more).

I am small retail investor who knows very little. I go wrong with my interpretations and understandings very often. Thank you for reading.

Krishna

POLYCAB Q1FY25 Highlights -

SALES 4,700cr from 3,890cr (20% up YoY)

Operating Margins has fall to 12% from 14% YoY

PAT 402cr (flat YoY)

PAT Margins 8.5% from 10.3% YoY

Q1FY25 Concall Highlights –

- Company is reaching towards 20,000cr of topline target so Team is working on new mid-term guidance which will be released during the current financial year.

UBS has initiated research on Polycab and they have given target of 8,550 (25% upside in 1 year)

CMP - 6,800

Market cap - 1,02,000cr

P/E - 58 times

Key Points from Report -

Polycab’s strategy in the current growth-levered environment provides a significant edge, as evidenced by the company tracking ahead of its Rs200bn top-line target by FY26; Polycab may revise that target, with a strategic focus on long-term value creation.

Additionally company has guided for margin expansion in future.

Polycab plans to maintain capex levels between 1000-1100cr annually over the next three years, enabling it to not only meet current demand but also positioning the Company for sustained growth and market leadership in the future.

Polycab posted decent set of numbers for its Q3 FY-25 on 22nd Jan. Following are my notes from the earnings call

1- Sales grew 20% yoy to 5226 crores and PAT grew by 11% yoy to 464 crores.

2- The quarter saw turnaround in the margins - EBITDA for the quarter stood at 13.78% which is 228 basis points more from the previous quarter.

3- While the Sales grew yoy there was marked slowdown in the growth from the previous quarter. The reason for this was high inventory built up at the beginning of the quarter because of copper prices upswing and cooling down in quick time. The other reason was higher contribution from the EPC projects in the previous quarter.

4- Cables (again) grew faster than wires. International business also contributed handsomely.

5- One positive surprise was good growth in the FMEG business and even more importantly the marked reduction in the loss from this segment. The management seems confident to bring it to profitability in the near future.

6- Company has already achieved 20000 crores of topline in TTM which was goal for FY2026 (15 months before time) coded through project LEAP.

7- Company came up with new long term plan called project Spring. Over the next five years the company would aim to grow Cables and Wires business 1.5 time industry growth. And FMEG business by 1.5 -2 times the industry growth.

8- During call the management stated that the Cables and Wires industry is expected to grow at 1.5 times real GDP. So overall aim for growth in Cables and Wires for Polycab would be GDP X 1.5 X 1.5 …or roughly 2.25 times the GDP. With 6.25% - 6.5% GDP the goal would be to grow at 14-15%. Further add FMEG growth of 1.75 times industry growth (which again translates to 15% growth). My sense is the actual growth would be higher than this (the reason for this optimism is stated later in this post)

My own inferences

1- Polycab has doubled its revenue every three years over the last six years which is roughly 26% CAGR. Given the push on infra from government, international business opportunity, FMEG opportunity and leadership position of Polycab in Cables and Wires within India, it is reasonable to expect that it would grow 20% plus CAGR over the next three years.

2- In the last three years while the revenue doubled the PAT increased by 2.2 times. This happened despite company was continuously losing money on FMEG. In general company has managed its margins well during the Copper and Aluminium prices up and down cycles. With this context, it is reasonable to expect that company will be able to increase profit in similar proportion to sales as in the last three years.

3- My estimate is that company would post 1917 crores of PAT for current FY (ending Mar-25), 2470 crores for FY 26, and 3200 crores for FY 2027. This will translate into EPS of 125 for current financial year, 161 for FY-26 and 209 for FY-27. The current price of 5916 is discounting these earnings by 47 times for current FY, 37 times for FY-2026 and 28 times FY-2027.

Risks

1- The Biggest risk is strong competition in Cables and Wires business. Also there is big dependency of Cables and Wires business on Govt Infra spending and real-estate growth.

2- Big fluctuation in the prices of Copper (particularly) and Aluminium can impact margins.

3- Company’s growth is somewhat dependent on growth in exports. Big import duties (particularly from US) may slightly impact the growth plans. However please note that contribution of US in current state (and even in future per plan) is very small to impact growth in big way.

4- FMEG not turning profitable is another possible risk.

Please note this note is not a buy or sell recommendation. I may have incorrectly heard things in the call or my interpretations are completely wrong. I also go wrong with my analysis all the time. I am a retail shareholder and I have ownership bias.

Cheers,

Krishna

if the sales growth was a bit lower due to higher inventory buildup then it can be said that growth will be higher when there is lower inventory?

If so, how can we track it? anybody who has done this or is interested in doing so?