The name of the stock is Hariom Pipe Industries Ltd . The company is headquartered in Hyderabad and manufacturers Mild Steel (MS) Billets, Pipes and Tubes, Hot Rolled (HR) Coils, and Scaffolding Systems and other top-quality products that cater to a variety of industrial applications across multiple sectors.

The company is a premium manufacturer of Iron and Steel products and its major revenues come from MS tubes which constitutes 66% of its FY22 revenue.

MS means Mild steel and SS mean stainless steel. Mild steel is comparatively cheaper and is used in construction and Industrial use cases. SS that is Stainless Steel is on the expensive side of the spectrum and is used for household appliances and in the automotive industry. It helps to create shine in products and is usually rust free in some cases.

The company has two strategic manufacturing units which are located in Andhra and Telangana. Hariom is focusing on mainly the southern market which kind off makes sense because the northern region is dominated by Jindal Steel and other big regional manufacturers. Its strategic location of its factories provides it with easy access to labour, materials and electricity. The factory is situated near the market area thereby saving logistic costs.

The company is presently dealing with 200+ distributors and dealers in Telangana, Andhra Pradesh, Karnataka, Tamil Nadu, Kerala, Maharashtra, Dadra & Nagar Haveli, and Puducherry under brand name Hariom Pipes . It has 1500 point of sales in the southern region and plans to enter the western market.

The company has an installed capacity as of FY 22 as follows

The % signifies the capacity utilization.

Induction Furnace - 95832 MTPA - ~77%

Rolling Mill - 84,000 MTPA - ~80%

Piping Mill - 84,000 MTPA - ~52%

Scaffolding - 1,000 MTPA - ~93%

Sponge Iron - 36,000 MTPA - ~84%

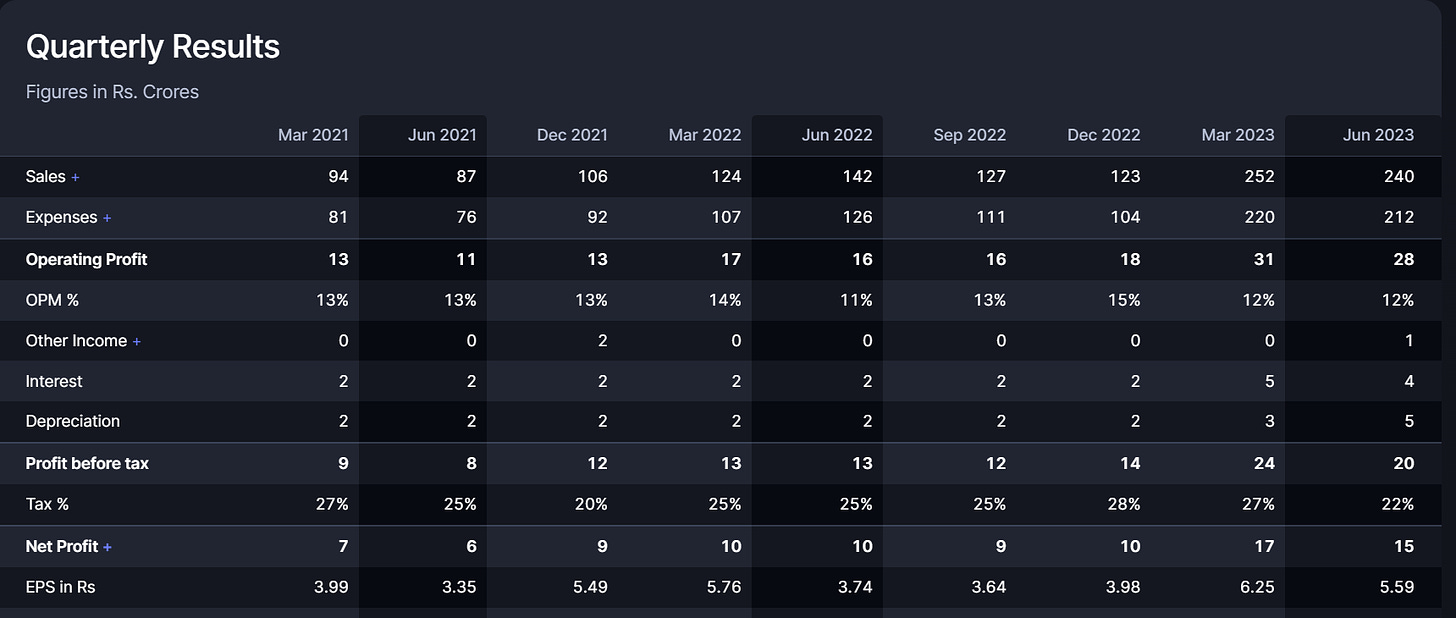

Now the reason why I am writing about this company is because i came across this circular.

The company had recently been listed at the stock exchange at 153 rs per share. Since then the stock is currently trading at around 600. Now if you read the circular carefully you can see that the capacity for MS pipes has increased by almost 50% and the capacity for galvanized pipes has been commissioned to 120k pipes. With these projects the company is expected to generate cash accruals worth 175 crores which makes it a very undervalued business.

Lets look at the quarterly trend to see what the business is up too

Sales for June 23 have decreased but there hasnt been any substantial decrease.

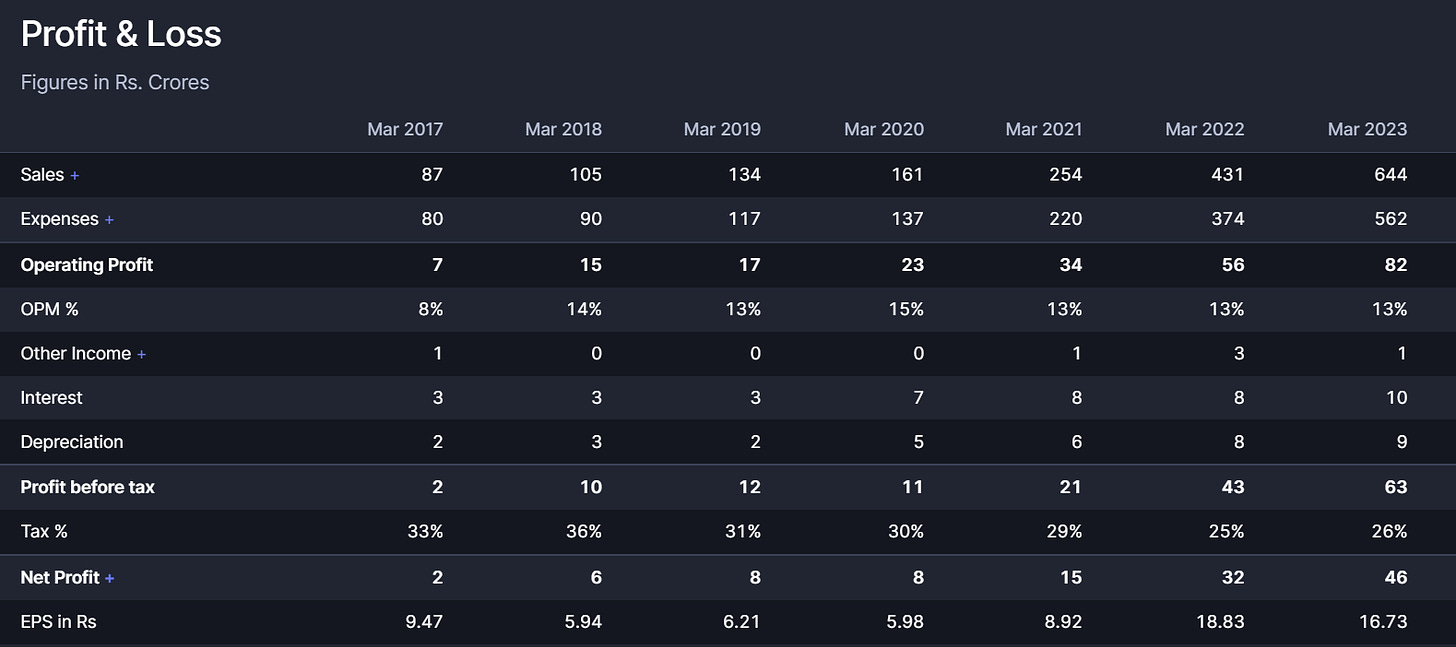

If you look at the PNL as a whole you could see sales have been increasing pretty consistently but we also need to factor that the company had an ipo in 2022 so figures for the year 2021 and 2022 will obviously be inflated to increase valuations for the company. Operating margins have been consistent at 13% and with new value added products we could assume the margins to increase.

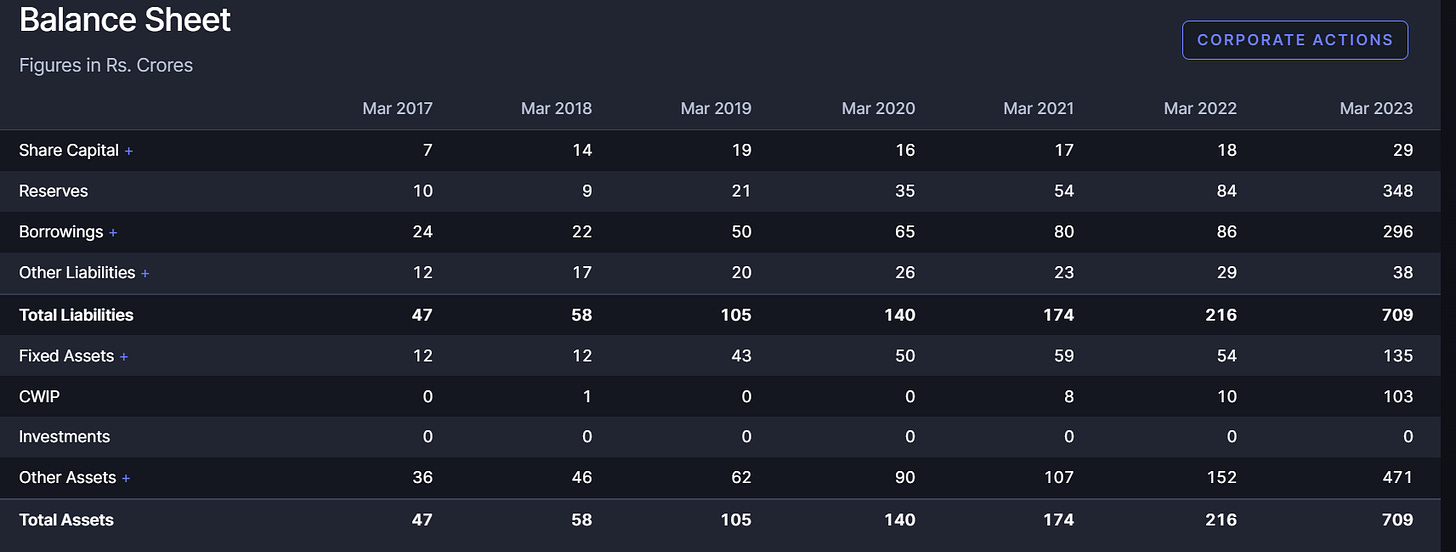

Analyzing the balance sheet one could see there has been a substantial increase in the balance sheet size with the company using borrowings and the IPO money to fund its own capex cycle. Company has a negative CFO ( Cash flow from operations) which is usually a red flag if you ask me because it means that the company is having high receivable days as shown in their cash conversion cycle and if you compare it with peers like Usha martin which has a lower cash conversion cycle it means the company is having some problems with managing its working capital. Company currently has around 105 crores of cash equivalents as off march 2023.

With the new capacity expected to be operational from Q3 we could see the expected effects soon.

BIS and its impacts

With the Indian government focusing on BIS which is bureau of Indian Standards, Indian manufacturers have a golden opportunity of capturing the domestic market. See China used to dump all its steel be it stainless or Mild in India for dirt cheap rates and Indian traders and manufacturers( the regional ones) used to order a lot of containers from these manufacturers at rates which were around 25 to 30% lower than the industry rates which the domestic manufacturers used to offer ( comparing it with Jindal ). The Indian government realized that something was wrong and there was news of imposing anti dumping duties on Chinese made steel and to top it further Chinese manufacturers were forced to imply with the BIS otherwise the shipments would not be allowed to enter India. As of today Steel imports have declined compared to the previous quarter ( Note there are no official numbers available yet but simply intel gathered from steel players in India). The government has to play its cards very carefully since this is an election year and one wrong move could hamper their entire campaign.

Promoters and Related Party

The group is led by Mr Rupesh Kumar Gupta who is currently the MD. Mr Gupta is currently claiming rent of 75000 per month from the company which is considered modest. Furthermore Mrs Parul Gupta is also paid 35000 per month as rental expenses. She is not on the board as of FY2023. Mr Sailesh Gupta whole time director of the company is paid 50000 per month as rental expenses. Considering the size of the company these transactions seem normal.

However Ultra Pipes is owned by Mr Rupesh Gupta and Mr Sailesh Gupta which is a partnership firm and has some transactions which are bound to raise some eyes.

Company during the year had purchased goods worth 33 crores from Ultra Pipes and sold them goods worth 39 crores which is around 5% of the turnover of the company. It should be noted that the company has the power to authorize transactions worth 150 crores which could be a potential problem in the future if the turnover from Ultra Pipes exceeds to about 15%.

RISKS

The risks are general industry risk like cyclical risks that almost every industry faces and higher costs like power and logistics but the company has a solar plant which helps it to save costs and its location helps it to save logistics costs.

Commodity news

Pipes which are made from Coils and Plates have prices which are currently stable or reduced by 3 to 4% in China which signifies the demand is kind off stable or reduced to a certain extent. Prices in the Indian Market tend to follow the prices in the Chinese market and therefore we could see some price reduction this quarter.

Overall to sum up the company had undertaken capex to increase capacity and to venture into manufacturing new products, capex as promised has been completed and the company expects to see the influence in Q3. However BIS, China ban and other regulatory factors play a key role in deciding what the future beholds. Since Pipes are used mainly in construction and other infrastructual projects demand for them should not subsidize in the near future, however one must carefully monitor quarterly results to see where the industry is going and if ebitda margins are stable or changing at a rapid rate.