PI Industries (PI) has built a solid business model. It has strengthened its presence in the Custom Synthesis Manufacturing (CSM) segment within the agrochemical industry. Going ahead, the company aims to diversify into the pharmaceutical segment and other niche chemistry. It continues to build a strong domestic agrochemical franchise by launching improved products in the crops and pesticide segments over the years.

PI Industries’ focus on CSM export has been the key differentiator from other agrochemical and chemical players in India.

From FY14-24, the company has an industry-beating track record of:

- revenue growth rate of 16% CAGR and

- a sustainable profit growth of around 24% CAGR

PI’s moat (i.e. the ability to maintain a competitive edge over its competitors) lies in its strong export-focused CSM business. No other Indian player offers the width and consistency that PI does. The company leverages this by consistently launching new molecules.

In 2023, the company ventured into:

- life sciences

- Contract Development and Manufacturing Organisation (CDMO) and

- pharma Active Pharmaceutical Ingredients (API)

through the acquisition of Therachem Research Medilab, LLC and Archimica SpA.

Despite a ₹70 crore PBT loss in its pharma segment, PI Industries reported an EBITDA margin of around 28% for the quarter. The company reaffirmed its goal of achieving a 50% to 51% gross margin and a 25% to 26% EBITDA margin for the year. Considering that quarter-to-quarter variations are expected due to changes in product mix and supply schedules.

On the domestic front, the company continues to provide farmers with advanced crop protection solutions with a steady flow of new products.

In Q1FY25, it launched two innovative brands:

- PRESSEDO, a patented broad-spectrum novel insecticide and

- OSHEEN ULTRA, a superior quality stable formulation for controlling sucking pests

With over 20 products in its pipeline for domestic launches, PI Industries is expecting a healthy visibility of growth in the coming year.

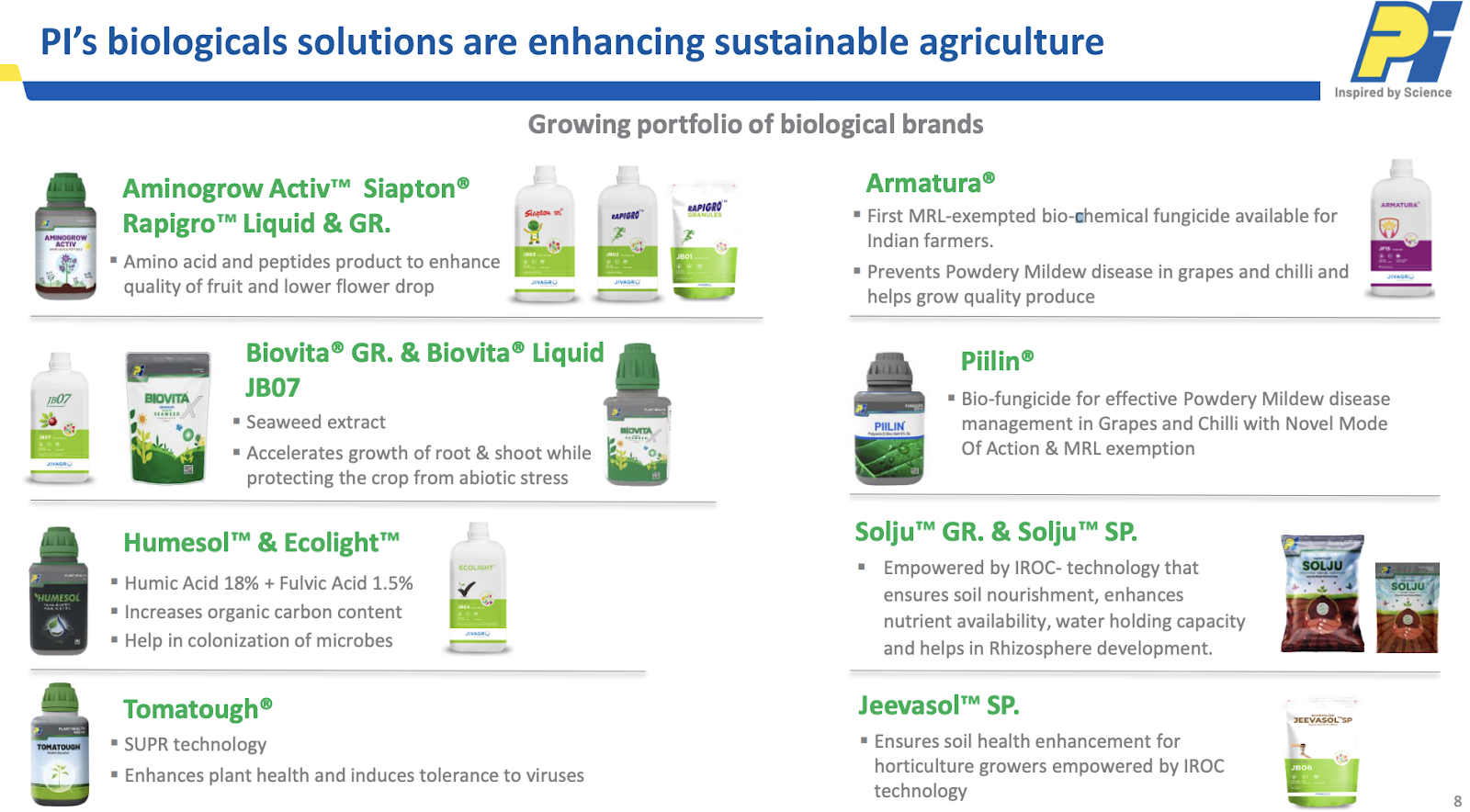

It formed a strategic alliance with Koppert to innovate in the Agricultural Biologicals domain. Biologicals revenue grew by 39% year-on-year, supported by a favourable product mix and operating leverage.

What do you think about this?