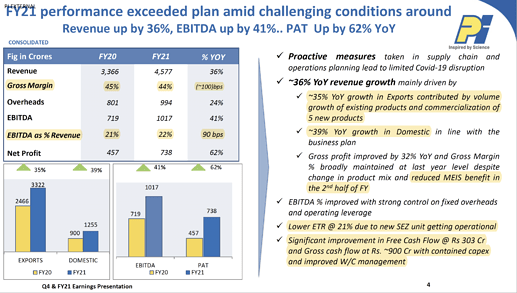

Another incredible set of results, FY21 showed 36% sales growth and 62% profit growth. FY21 EPS ~ 50. Strong cashflows. Guides for 15% sales growth in FY22. Here are my notes from their presentation.

- 4 CSM products commercialized, 7 new customer relationships established and received >40 enquiries in FY21. FY22 should see commercialization of 5-6 new molecules

- CSM order book of $1.5bn provides visibility for the next 3-4 years

- In domestic business, cotton crop protection portfolio grew by >40%. Awkira (wheat herbicide) grew 5x. There will be 5 new product launches in FY22 (to strengthen rice, cotton and horticulture portfolio)

- Jivagro: 25% sales growth, commercialized 5 products, capacity utilization stands at 75% and expect 3 products to be commercialized in FY22. Aim is to grow at >25% CAGR for next 4-5 years

- Fixed asset turns ~ 1.95, capex ~ 459 cr., Net cash position of 2070 cr.

- 90% of CSM revenues comes from patented molecules and >60% of domestic revenues comes from in-licensed molecules

Looking forward to tomorrow’s concall.

Disclosure: Invested (position size here)