Orchid Pharma -

Q4 and FY 24 concall and results highlights -

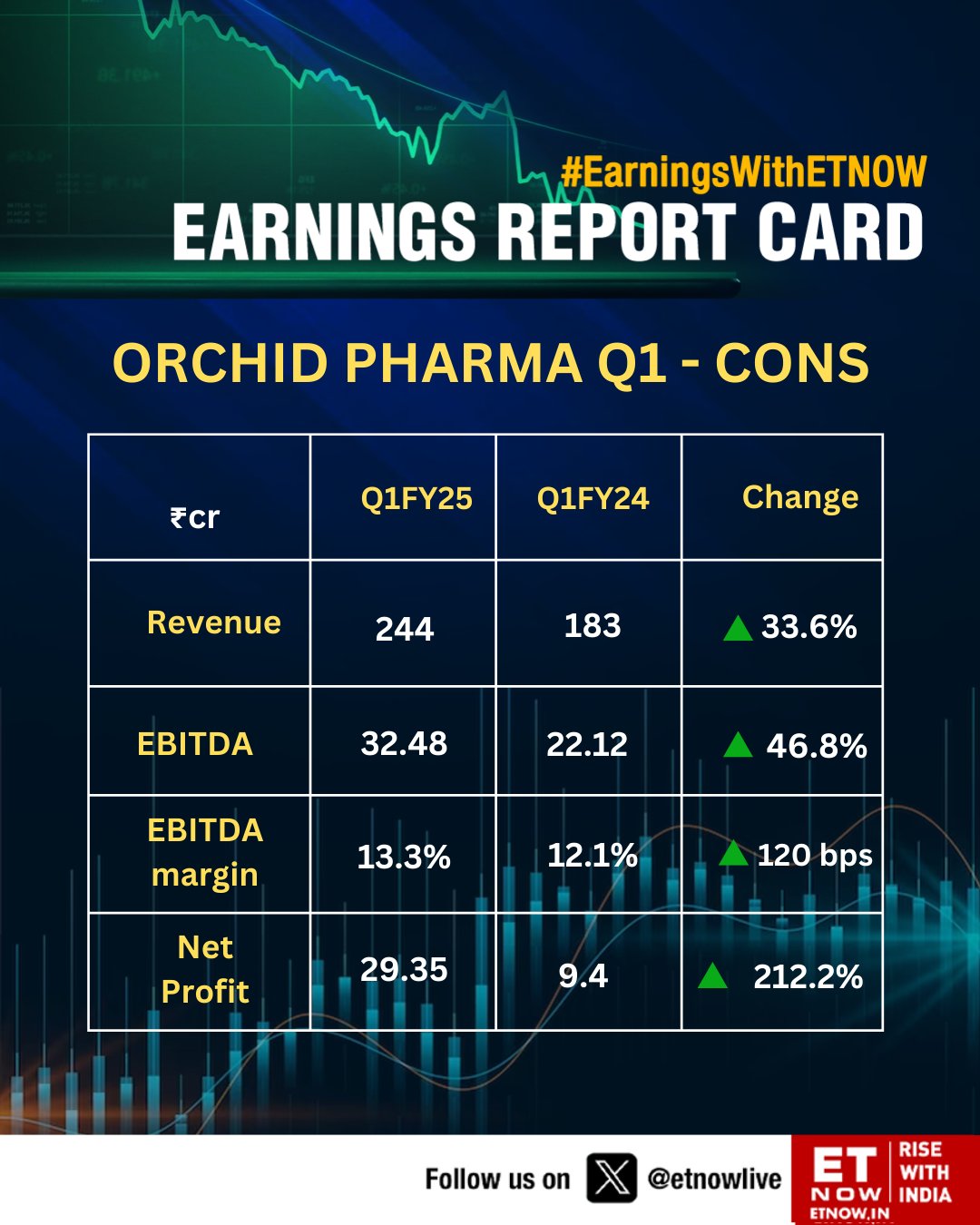

Q4 outcomes -

Sales - 217 vs 209 cr

EBITDA - 42 vs 41 cr

PAT - 33 vs 66 cr (due exceptional gain in previous FY)

FY 24 outcomes -

Sales - 819 vs 666 cr

EBITDA - 154 vs 132 cr ( margins @ 17 vs 16 pc )

PAT - 94 vs 55 cr ( despite exceptional gain of 32 cr in Q4 of last FY )

Enmetazobactum has been approved in both US and EU. This opens up lucrative royalty opportunities for the company in the near future

Expected to launch Enmetazobactum in India by Q2 FY 25. Have partnered with Cipla for sales and marketing in the Indian mkt

Have filed ANDA for Cefepime + Enmetazobactum combination in the US mkt. This should also aid company’s US revenues in a meaningful way

Have completed the land acquisition near Jammu for company’s 7ACA project ( it is a key intermediate for manufacture of Cephlalosporins ). Should commission this facility by Mar 26. Aim to ramp up production to > 60 pc levels within first year of operations

Should also be able to commercialise the Cefiderocol manufacturing facility ( a molecule in-licensed from Shionogi, Japan ) by mid 2026

Regulated : Unregulated revenue share @ 40 : 60

Oral : Sterile revenue share @ 75 : 25

Company’s base business ( except Cefiderocol, Enmetazobactum ) should continue to grow at 20 pc CAGR for next 2-3 yrs

Company has hired 40 odd employees to launch their dedicated hospitals division selling antibiotics directly to Tier-1,2 city hospitals

Company has out-licensed Enmetazobactum to Allecra Therapeutics for sale in US and Europe. Expected to be launched by Q2 FY 25 ( tentatively ). After the ramp up is complete ( in 2-3 yrs ) expected to generate a topline of $ 200 - 300 million with a 6-8 pc kind of royalty to Orchid Pharma

Disc: holding, biased, not SEBI registered