Hello Everyone

[Ref: AR, Mgmt Interviews, Screener, Investor Presentation]

PS: While i have contributed in small ways to certain threads, first instance of starting a new one. Apologies for anything which doesn’t conform to the recommended guidelines.

Established in 1989, OK Play India Limited operates in the manufacturing sector, specializing in plastic-molded products, automotive components, and e-vehicles.

The company’s plastic-moulded products encompass toys, school furniture, outdoor play equipment, and point-of-purchase products.

Within the automotive components division, OKPlay offers a diverse range of products, including plastic fuel tanks, urea tanks, and water tanks for commercial vehicles, tractors, and construction equipment. Additionally, the company manufactures various other plastic parts, such as bus seats, fenders, consoles, and cabin roofs, catering to the construction equipment, tractor, and commercial vehicle industries. Notably, OkPlay has earned a reputation for producing high-quality goods and has become a market leader in the plastic fuel tanks for heavy commercial vehicles having 85% market share.

Since 2015, OKPlay has been actively involved in the EV space, positioning itself advantageously to capitalize on India’s growing EV penetration and secure a substantial market share.

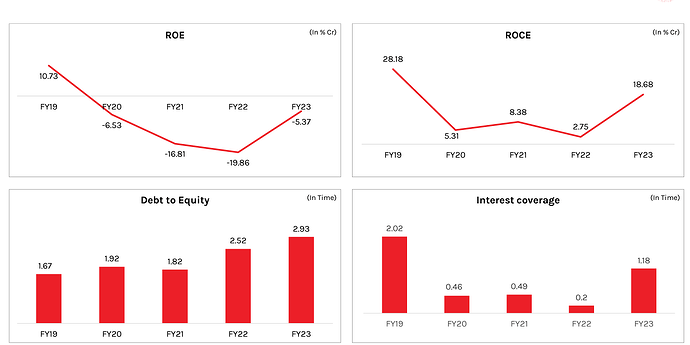

So far the finances and ratios of company has not been something to speak about but now winds of change are blowing.

Don’t think Company was doing Earning Conference Calls earlier, started only couple of quarters back.

Indian Toy Industry

- Estimated Toys market in India anywhere between 18000-20000 Cr and is currently highly Unorganized.

- So far it is highly cheap Chinese Import dominated.

- Lately Government Policies has been supportive of Indian Toys Industry

- Introduced BIS Norms from April 2020

- Import Duty increased to 70%

- PLI Scheme for Toys Industry

OkPlay Toy Vertical

- Mainly deals in 3 segments

- Indoor Toys

- Outdoor Toys

- School Furniture Segment

- Oldest Player but had very small market share due to China dominance

- So far have been primarily B2B

- Clients includes School Chains, Builders, Resorts, Hospitals

Automotive Segment

- Leader in Plastic Fuel Tanks with 85% market share

- Single source supplier to Ashok Leyland

- In talks with Tata and if that’s successful may setup a plat in JSR or Pune

- Fortunes Linked with CV Market

- Other Client includes: JCB, Eichers, Volvo etc

EV Segment

- First company to make EV vehicles from engineering grade plastics.

- Total 12 variants on 3-W platform including E-rickshaws, vending carts, E-Loaders, Garbage vans

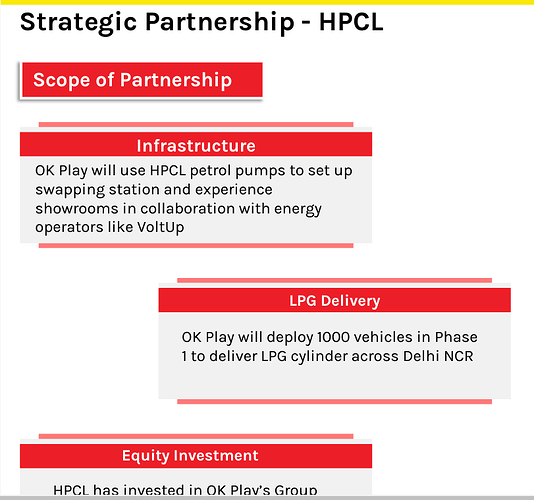

- HPCL has taken a stake in this vertical. Also partnered to supply vehicles for gas delivery. 1000 EV delivery planned for next few Qrtrs.

- Eyeing Last mile delivery for logistics companies

- Started EV Segment in 2015, lot of investments so far.

- Commercial started only 3-4 months back so last Qtr. contributed only 2.5 Crore revenue

Growth Triggers

- 2nd generation of Promoters have taken up day to day working and seems to have better clarity of vision

- Preferential allotment around 60 rs recently to promoters and other non-promoter group

- BIS certification can be strong tailwind for toy segment

- BIS Certification is not easy for cheaper Chinese products

- Actively Venturing on B2C with Online and Modern retail channels

- Available on Hamleys, Firstcry, Amazon etc

- Venturing into contract manufacturing for private label products for US/UK

- Recent tie up with MGA Entertainment for contract manufacturing

- Another tie up with Australian company Kmart for contract manufacturing of ANKO brand

- Company started supplying windmills covers for German company MANN-HUMMEL

- Toy business to grow over 100%

- Expect substantial amount of non-automotive business going forward

- EV Segment can be big lever for growth. Mgmt. confident of 5X growth (on smaller base) for next few years.

- Targeting 20%+ EBIDTA margin

- PLI Scheme for Toy: 3500 Crore PLI scheme. Only listed Toy company eligible

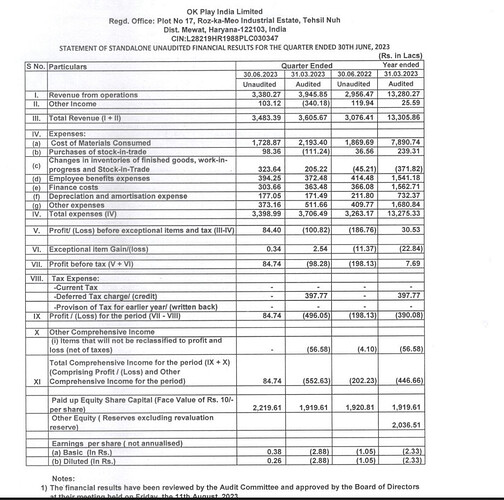

- FY 23 revenue was around 182 crore which is up 80% over FY22.

- Mgmt guided for 300 crore+ revenue in FY24.

Risks

- Debt to Equity stands around 2.93

- Promoters Pledge is close to 72% (37.68% out of total promoter holding of 51.83%) which again is not comforting

- Net Cashflow remains negative though cashflow from operations are improving

- EV business is highly competitive, and 3-w is highly fragmented too. While mgmt is bullish, need to watch out for next 3-4 Qtrs for the actual revenue figures

- HPCL Pilot of EVs for gas delivery vehicle is non-binding for distributor. Need to watchout if distributors opt for it or not.

- Stock has run a lot in recent past in anticipation of better prospects

Disclosure: Holding 1% of PF at around 105 average. Would wait and watch before increasing the qty. Q1 results are on 11th Aug.

Ratios at a glance

Clients Across the Segment

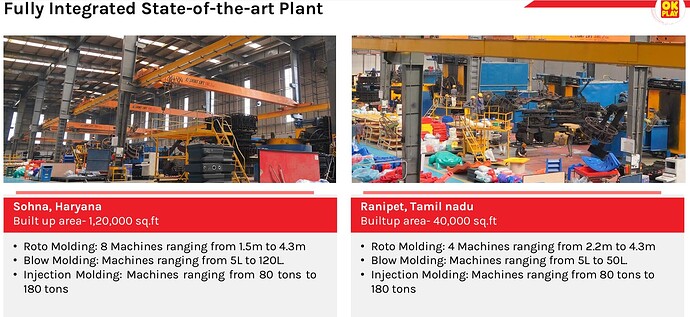

Plants

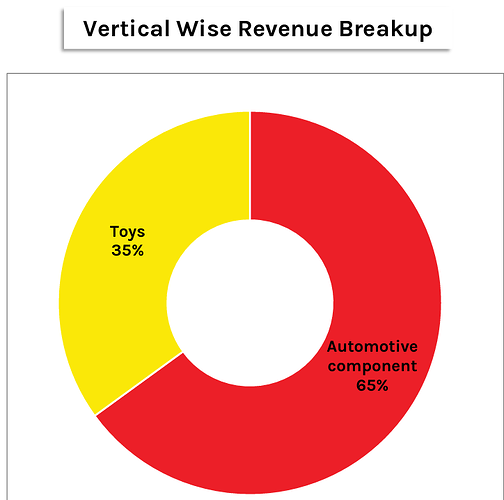

Revenue Mix [ EV is miniscule]

HPCL Strategic Partneship