Company had a recent IPO in February 2021

WHAT DOES NURECA DO? https://www.nureca.com/

It caters to home healthcare sector.

· Chronic Device Products – blood pressure monitors, pulse oximeters, thermometers, nebulizers, self-monitoring glucose devices, humidifier and steamers.

· Orthopaedic Products – wheelchairs, walkers, lumbar and tailbone supports and physiotherapy electric massagers.

· Mother and Child Products – which includes products such as breast pumps, bottle sterilizers, bottle warmers, car seats and baby carry cots.

· Nutrition Supplements – which includes products such as fish oil, multivitamins, probiotics, botin, apple cider and vinegar.

· Lifestyle Products – which includes products such as smart scales, aroma diffusers and fitness tracker

The company has 3 brands Dr Trust, Dr Physio and Trumom under which it sells these products

STOCK TRADING HISTORY

· IPO happened at Rs400/share in February 2021.

· It listed at Rs634.95/share on February 25, 2021

· Today it is at Rs1610

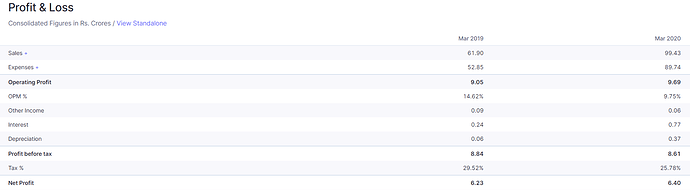

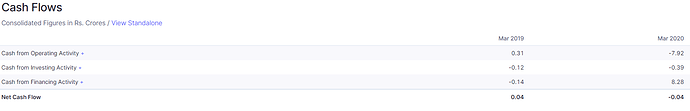

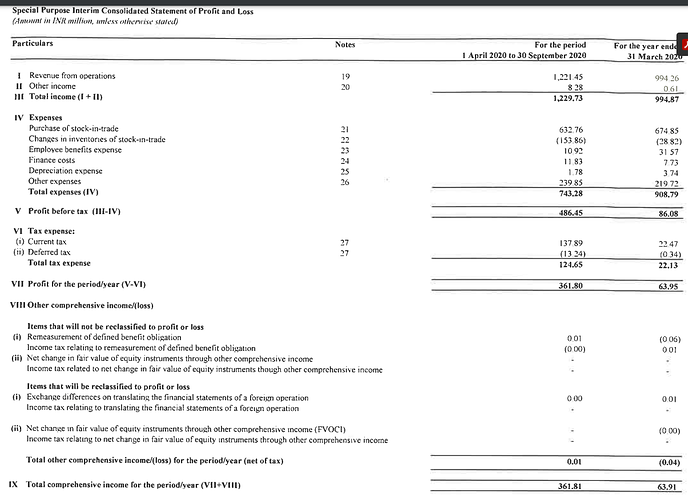

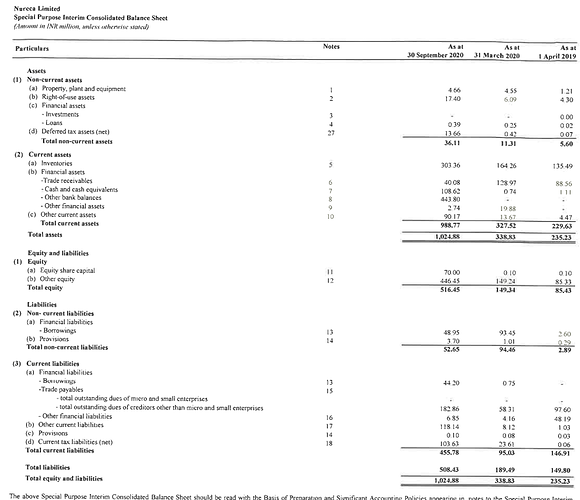

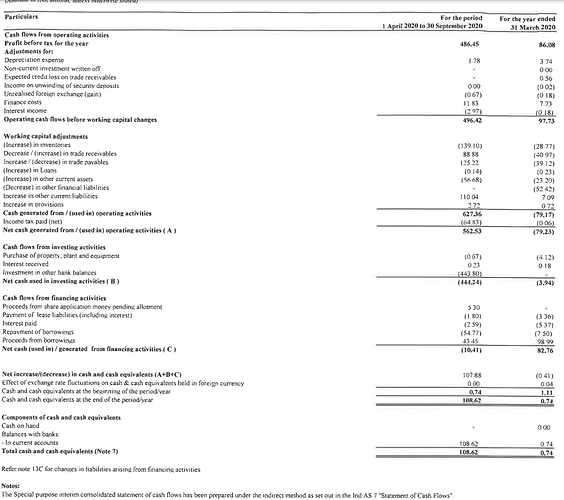

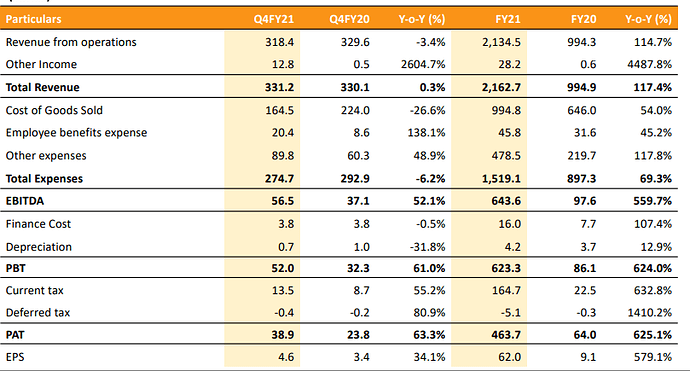

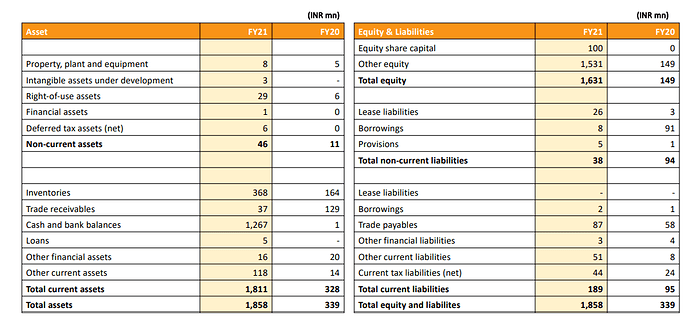

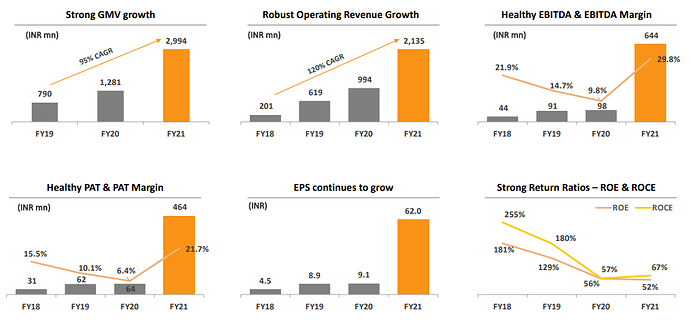

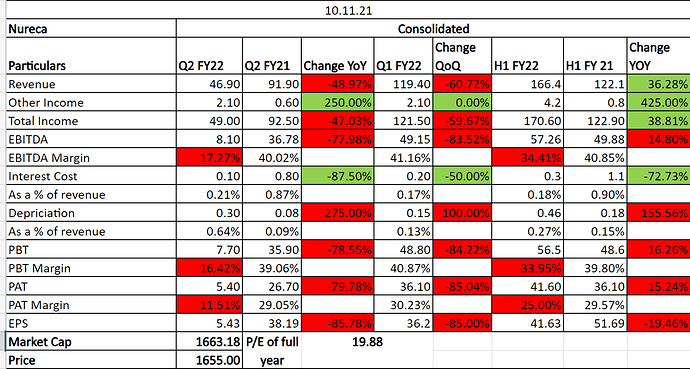

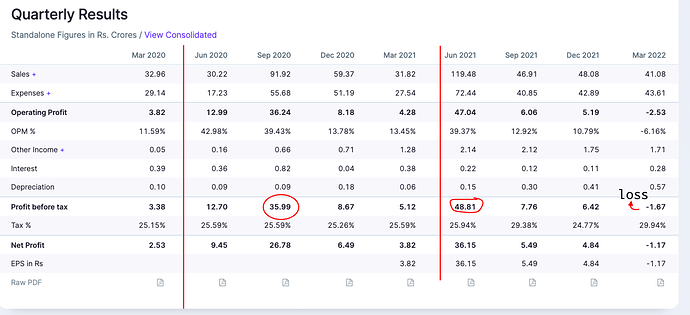

FINANCIALS AVAILABLE

· FY20 : Revenues of Rs99.4crs and Profits of Rs6.4crs

· 1HFY21 : Revenues of Rs122.1crs and Profits of 36.2crs

· If you extrapolate 1HFY21 profits to 2HFY21 one is looking Rs72crs profits. At current market capitalization of Rs1614crs its trading at 22x FY21 P/E

AUDITOR: BSR & Co LLP who is considered decent

BUSINESS ANALYSIS

Outsourced manufacturing

· Company gets all its products from 3rd parties. Generally, does not have long-term contracts with vendors committing them to supply products.

· For oximeter, thermometer, nebulizer, rehabilitation products and blood glucose monitoring device company has a single-source finished goods vendor.

· Until recently, company used to get products from few local vendors under own brand name.

· Presently, they majorly outsource the manufacturing of products to certain foreign vendors and as well as certain vendors in India under our own brand name.

Distribution channel

· 95% of sales is online. Has recently tied up with Chroma also for offline sales

· Dependent on limited number of our channel partners such as 3rd party e-commerce players, distributors and retailers for a substantial portion of our revenues.

You can see product listing here

Promoter

· Hold a 70% stake in the company post IPO

· Promoter is Saurabh Goyal and his family

· Saurabh Goyal worked for 10 years in Nectar Lifesciences in India for 10 years before he started building this company Nureca in 2015

Key current investors in the company:

Quant Mutual Fund (1.63%), Abbakus (2.38%) which is a PMS started by ex-CIO of Reliance Mutual Fund Sunil Singhania, Next Orbit Venture Fund (4.08%)

Personal experience in using products

I had purchased a pulse oximeter and a thermometer of this company in the first half of 2020. Still working well

Financials

IPO Prospectus: Listing

Others

Downside Risks

- Depend on 3rd parties to manufacture our products. If these organizations are unable or unwilling to manufacture products, or if these organizations fail to comply with FDA or other applicable regulations or otherwise fail to meet our requirements, business will be harmed.

- Depend heavily on channel partners such as third party e-commerce players, distributors and retailers and failure to manage the distribution network efficiently will adversely affect performance.

- Availability of look-alikes, counterfeit healthcare devices, primarily in domestic market, manufactured by other companies and passed off as Nureca’s products.

- Intense competition and may not be able to keep pace with the rapid technological changes

Disclosure: Invested