62a9805d-e163-4113-8bc8-f7f60f5f75d2-2.pdf (3.0 MB) Q3 result declared… Net profit falls 50% impact of higher raw material price is seen…

I’m reasonably satsfied with the results actually. Significant top line growth shows that demand is definitely entering an upcycle. Once schools re-open, the raw material availability problem should be solved and the operating leverage will kick in.

Invested from 180 levels

But if the material cost remain high for long time how will industry survive without passing the cost to customers, given the fact that demand for packaging paper increases continuously and schools have opened now.

Raw material cost for NR Agarwal, i.e. waste paper, will start reducing once schools open up. In a sense the present situation is the bottom in terms of margins and profitability and it can only improve from here. The efficiency of NRA, the way I see it, is demonstrated in the fact that even in these times of peak raw material prices they are able to remain profitable

China not importing recyclable waste anymore and importing large quantities of pulp instead should augur well for recycle waste based paper producers like NR Agarwal in the long run, no?

This is a very useful credit rating report by India ratings. My key takeaways:

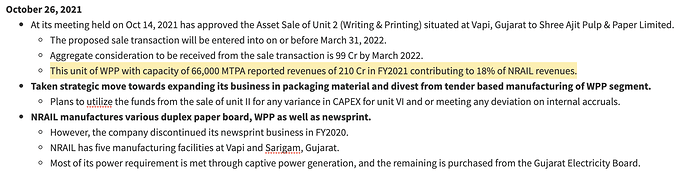

- China’s reduced waste-paper import means cheaper waste paper imports for NR Agarwal

- It also means increased wood pulp import by China and hence more expensive wood pulp imports for most Indian paper manufacturers

- WPP have higher margins than duplex boards. Whie schools and offices remain shut, WPP will struggle. But the increase in demand (and price) of packaging paper offsets some of the impact of reduced WPP sales. This is visible from the previous quarter results

- NRA is among the more efficient paper manufacturers and will be in a sweet spot when schools and offices start opening up with abundant operating leverage through high margin WPP

- At the end of the day, the paper sector is cyclical, but the relative valuations for NRA compared to the larger companies like JK don’t make sense

Hi Folks … Watch the following video for an overview about the paper industry … The presenter has also talked about the issue related to ban on import of waste paper by China.

Hi All,

Sharing the key details of the recent announcement that the company made w.r.t sale of one of its unit to Shri Ajit Pulp & Paper. You can read the detailed credit report from here.

Regards,

Yogansh Jeswani

Very detailed and excellent analysis.

A bit on how these products are used, what is customer requirements/dependency and pricing power of NRA or any of its competitors can add more depth to it.

Hats off to you for coming up such a piece in your first attempt.

It relies more on waste paper than pulp

FROM 2013 - 2022 :

Sales growth is decent

OPM has improved to double digit from 2017 but on decreasing trend for 2021 & 2022

Debt is more or less constant. decreasing trend only for 2020 & 2021

20-25% of operating profits are for interest payments

NPM is very low around or less than 4% | ~7% only for 2018 - 2020

CFO=868 , Capex=427 , FCF= 421 , Interest payed = 312 , other income = 72 , Debt decreased = 46 , dividend payed = 17

Cash Generated = 421 - 312 + 72 - 46 -17 = 118 ,

~ 75% cash generated is used of interest payments

Depreciation = 238

Operating profit / (depreciation & Capex) = 60%

At N R Agarwal, the biggest challenge was the unexpected downtime arising out of manufacturing infrastructure more than a couple of decades old.

Asset turnover & receivables are stable

Inventory turnover is deteriorating

Cash inflows = Reserves generated-426 , other liabilities-158

Cash Outflows = Inventory-124, Receivables stuck-110 , Net block-198 , other assets- 107, debt- 46

55% reserves generated are stuck in inventory and receivables

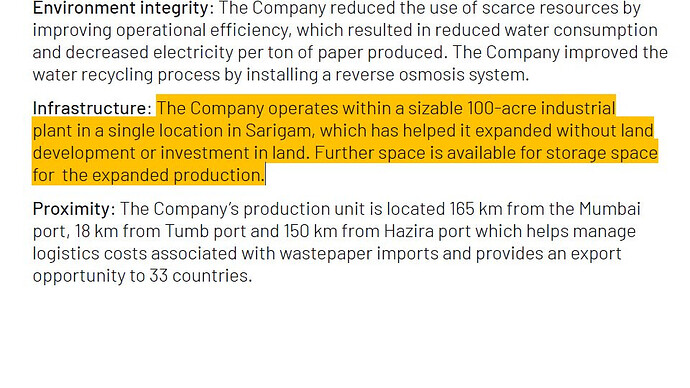

The company is always working at near full capacity & there is no scope for operations leverage at this scope. the company would need continuous capital expenditure. ( owing to the capex nature of industry and old machinery of company)

Managing the debt and improving the profitability is important . though the debt shows decreasing trend for 2020 & 2021 but this needs to be monitored .

Annual Report provides good insight into the company`s future plans:

655 crores to be invested in the new packaging board plant(500TPD facility), new tech will help in 5% cost reduction as well. The plant will be commissioned in H2FY24

Funding: 35% from internal accruals and 65% debt

At peak capacity this can generate 1000 cr turnover and combined with existing capacity, the business can generate 2500 cr of revenue.

WPP will have a better contribution with re-opening of school and workplace, margin improvement due to lower cost in new plant, and moderation in RM cost as well

isn’t 655 cr for 500 TDPD plant too much ! knowing that at peak it can generate not more than 1000 cr of revenue. (it does not include land cost either!) building cost for say 40000 sq ft can not exceed 20 cr max max! how much plan shall cost?! looks overvalued to me

Disc: observing

I have been following the company for some time. Have tried getting in touch with IR to get responses to certain queries. The IR team is not interested in replying back to queries.

Taken from Q3 result declaration: They have shut down Unit-III duplex board plant effective Jan 6, 2023 due to unfavorable market conditions. They plan to take a fresh 140cr capex towards efficiency improvement and upgrading technology.

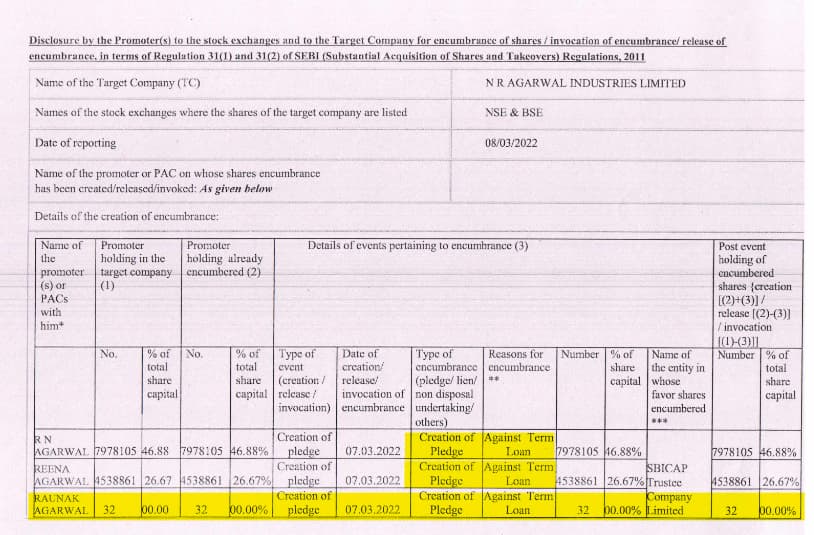

Note that their 655cr capex is also for duplex board packaging and that the promoter has pledged 100% of his holdings for the said capex.

Hi, does anyone have idea about the rough margin potential of the new plnt ? The facility was commissioned yesterday so atleast capex has gone live on time as indicated by the management earlier.

Results out :https://www.bseindia.com/xml-data/corpfiling/AttachLive/4d9b94c9-6f3d-49f7-8ab4-f2257a10998e.pdf

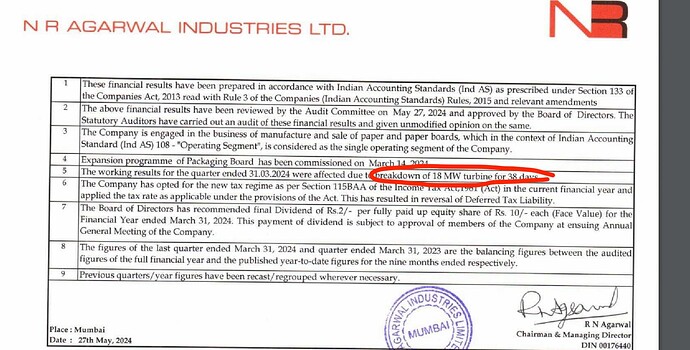

Topline falls from 335 cr to 247 Cr → drop of ~ 27% . Margins held up, despite the breakdown of 18Mw turbine for 38 days ( 40% of quarter effected)