Source: https://www.bseindia.com/xml-data/corpfiling/AttachLive/2faf0a9e-9367-44ce-a460-ad7f082cc2f0.pdf

Nitta Gelatin Expansion Plans

- In the past, they talked about increasing their production of Collagen Peptide, a substance they make. They were planning to add 1000 metric tons (MT) of it.

- However, they’ve changed their plans. They looked at the project again because of things happening around the world, like worries about a global economic downturn. These concerns are affecting the demand for Collagen Peptide from customers overseas.

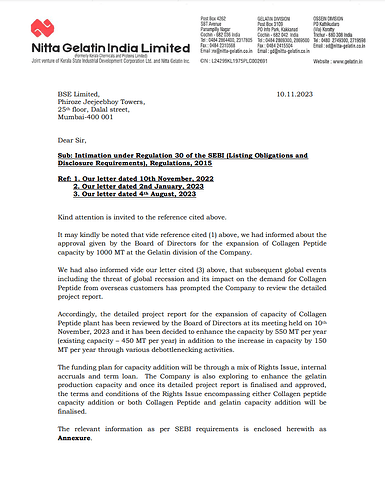

- After discussing it, they decided to increase their Collagen Peptide production by 550 MT per year (on top of the original 1000 MT plan). This means they’ll be making 550 MT more of this substance every year.

- To pay for this increase, they’ll use a mix of things: a Rights Issue (a way to raise money from existing shareholders), their own earnings, and a term loan (a type of loan).

- They’re also thinking about expanding their production of gelatin, another substance they make. But they’ll make a final decision once they’ve finished the plan for it.

The company is changing its plans for making Collagen Peptide, and they’re thinking about expanding another product, gelatin. They’re also figuring out how to pay for these changes.

You are right, this company pops up on my radar a lot of times. However I have stopped myself due to the risk of potential alternatives and regulation on animal products.

The alternatives to conventional sources of gelatin will not easily replace the animal source because (1) Vegetable sources are far less nutritional than animal/fish sources. The vegetable source is relatively low in vitamins and essential nutrients. (2) The application needs specific preparation. (3) They cost 3 times that of Gelatin from animal and fish sources.

@RajeevJ are you still following this company ? If yes, what are your thoughts about the sustainability of their margins and potential risk of regulation and alternatives

Any body has revenue breakup of Gelatin and Collagen peptide ?

What could be the asset turn for this 200 Cr of investment ?

As per their Annual report, price erosion of Gelatin & Collagen is happening. This could impact the rev & margins going forward. Closure of the subsidiary will impact the top line by 10%.

Will watch out 2-3 Quarters for any opportunity for entry

From Crisil rating update report released yesterday link

“The group plans to incur a capital expenditure (capex) of ~Rs 250 crore over fiscals 2025 and 2026 to expand capacity in its gelatin and collagen peptide unit. It has announced withdrawal of its proposed rights issue of Rs 40 crore to fund the above capex and plans to finance the proposed investment through a mix of internal accrual and external borrowings. Though this could be partly debt-funded, financial risk profile is projected to remain comfortable on the back of expected annual cash accrual of over Rs 50 crore and adequate liquid surplus, which stood at Rs 76 crore as of March 31, 2024.”

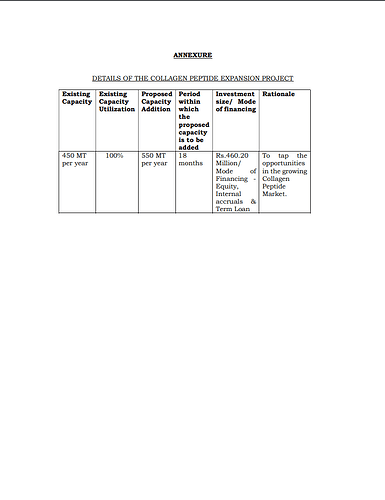

Hi does any one has an update on the latest status of their capacity expansion. Seems they did the bhoomi poojan in April 24 (https://gelatin.in/uploads/userfiles/Letter%20to%20BSE-Press%20Release%20Bhoomi%20Pooja.pdf). However i haven’t seen any spike in their quarterly sales yet, so not sure if the additional capacity has been delivered yet.

Collagen new capex Production will commence mid of 2026

The collagen capacity expansion from 600 ton to 1150 t/ year is scheduled to start operations in June 2025 as per Nitta Gelatin’s parent company.

Kudos to the OP for putting forward a great opportunity and hope he stuck to the company throughout the years cause he would have made handsome returns over the years.

Nitta Gelatin India Ltd (NGIL) is a 50-year-old niche manufacturer of edible and pharma-grade gelatin, collagen peptides for nutraceuticals and cosmetics, and byproducts like dicalcium phosphate and chitosan. As part of the century-old Japanese Nitta Gelatin group, NGIL benefits from established technology, strict process discipline, and a reputation that supports both domestic sales to Indian pharma and food companies and exports to Europe and Japan.

Financially, the business is strong, with low debt (debt-to-equity around 0.2×), steady Owner’s Earnings averaging around ₹110 Cr in recent years, and most CapEx funded internally. The real strength of NGIL is its consistent cash generation, customer stickiness due to high validation costs in pharma, and support from its Japanese parent which adds credibility and governance stability. The business also has clear growth drivers: rising demand for collagen peptides globally (8–10% CAGR), increasing capsule consumption in India, and potential in value-added byproducts.

At the current share price of about ₹810, the stock trades at a large discount to intrinsic value which I estimated the business to be worth around ₹2,000 crores, offering a significant margin of safety. Even assuming no growth, intrinsic value of the business still appears comfortably above ₹1,600 crores. Risks include raw material price volatility, environmental regulations, and currency fluctuations, but these are partly mitigated by pass-through mechanisms, ongoing compliance investments, and natural hedges from imports.

Overall, this is a simple, durable business with low debt, real cash earnings, and conservative management, overlooked by the market likely due to its small-cap nature. It fits a classic Buffett-style investment case: understandable operations, a moat from quality and customer relationships, low leverage, and a price well below intrinsic value. The key exit triggers would be a sustained drop in Owner’s Earnings below ₹60–70 Cr, debt exceeding equity, or a decline in governance standards. For a patient investor, NGIL offers the chance to own a fair business at a wonderful price, backed by steady demand and disciplined capital allocation.

As buffett recommends individual investors with small sums to invest in obsure stocks rather than seeling wonderful business at fair valuations, I’ll be investing in the company over a period of one week.

i came across this update on linkedIn tried verifying but no one verify it does any one has any thing on it?

The post is 1 month old means after the Nitta gelatine collagen capex plant begins operations.my understanding is collogen will be the nxt big think for nitta gelatine since its the only established player.

if anyone can pls verify what the linkedIn post says with company.

Nitta was prodicing collagen earlier as well. The new capacity would come online in July as per the parent company. The company was doing D2C sales through amazon and also mentioned that they were manufacturing for other companies as well. Its good to know that they are working with Dabur on this one. I believe the demand for collagen products is still to pick up. If Dabur can get that demand up, it would definitely be good for Nitta.

There has been a lot of activity in this space as well. Nestle acquired vital protein in 2022,

Gelnex was acquired by Darling ingredients in 2023. Collagen is claimed to have many benefits for skin, joints and even for diabetes. There are a lot of brands available in the international markets.

Even in Indian gelatin market, Pioneer - Jellice acquired Narmada Gelatin and India Gelatin.

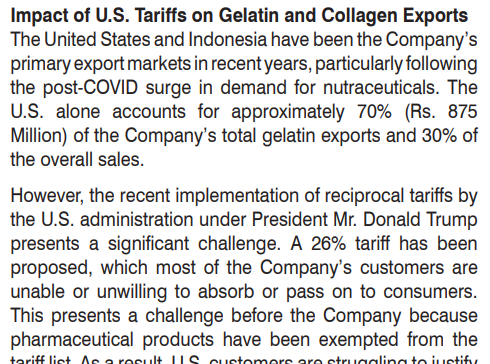

However, a short term concern is US tariffs.

The U.S. accounts for ~70% of NGIL’s gelatin exports, i.e., ₹875 million, or roughly 30% of total company sales. If even half of this volume drops, total sales could decline 10–15%.

The U.S. has proposed a 26% import tariff on gelatin (classified as a food material, not a pharmaceutical excipient).

This tariff does not apply to pharmaceutical products, but gelatin even though used in pharma capsules — doesn’t qualify under that exemption because of its primary classification as a food additive (70% of gelatin globally is used in confectionery).

NGIL is working with Nitta Gelatin North America and Nitta Japan to clarify regulatory exemptions which is a use of its MOAT compared to other competitors in India.

-

Exploring whether “Vertebra-free Halal gelbones” of U.S. origin can help qualify under different tariff or certification categories.

-

Engaging customers to check if duty-refund (export credit) mechanisms can apply when gelatin is re-exported as capsules or nutraceuticals.

If you read Nitta Japan’s communications, they are already working with USTR and FDA to clarify that gelatin used in pharma/nutraceuticals should qualify as pharma excipient, not food additive.

Once that happens, tariffs should reduce or refund mechanisms will emerge.

So think of this as a 2025–26 earnings dip, not a long-term impairment.

I believe it is just a policy hiccup in a secular growing industry and if you’re a long term investor it’s actually a great time to accumulate more and not exit.

Is NGIL below intrensic value? ![]()

Does NGIL have durable moat (high switching cost/ regulatory approvals/quality/industry knowledge how’s) ? ![]()

Does NGIL has good management? ![]()