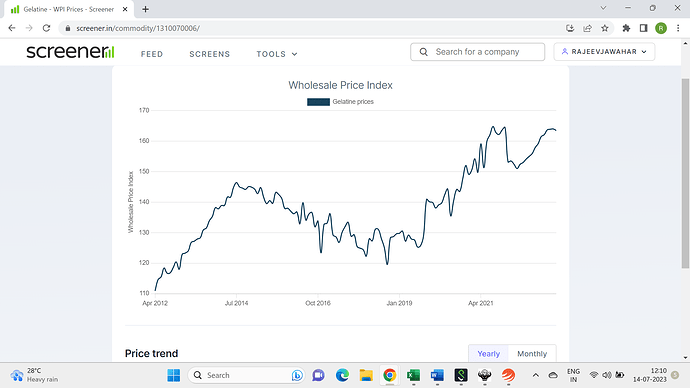

Thanks @Dev_S for your inputs. Appreciate it. Didn’t realise that the price graph was available on Screener.

I think the impairment of 5.31 crores of assets in Reva plant in Gujarat was done in the previous years. The company just mentioned that the provision for impairment of 5.31 crores it carried on the books were adequate.

The majority of collagen peptides sold in the export market (Korea, USA, SA) are oriented towards B2B transactions, thereby limiting their pricing power. Gelixer (Sold in India), on the other hand, is a B2C product, but its production volume accounts for only around 1% of the total collagen peptide production.

Recording of AGM 21-22 Discussed at around 37th minute.

This video also explains the rise in the recent margins.

Thanks a ton @Prakhar_Sankrityayan for sharing the recording of the last AGM. The answers provided by the mgt to shareholder queries gave some very useful insights into the business, especially for those of us who were not shareholders at the time of the last AGM.

The Co. clearly is benefitting enormously for its association with its Japanese promoters & being the largest producer of Collagen peptide in the country will give a big boost to the Co. as the domestic consumption of the same picks up gradually. The expansion of the collagen plant is already underway & once completed in about 12-15 months from now would increase capacity by about three times.

You’re welcome! But don’t you think that it’s in a very nascent stage considering that their total Gelixer production is 1% of their total collagen production and the collagen export market for them is primarily B2B?

The Annual report for 22-23 reports a drop in demand for Collagen peptide due to recessionary conditions in the US. Collagen, in any case constitutes only about 10% of Sales for the Co. This has been more than made up by the increasing demand for Gelatin, largely from the Pharma industry, which has resulted in continued high Gelatin prices.

The price trend for high gelatin prices has continued in the current year as well as is evident from the graph, which has been updated up to May 2023.

Gelatin plants consume high energy/ power costs which has made it unviable for gelatin manufacturing plants in Europe, many of which have shut shop. Besides, it is a highly polluting industry & as is typical of the developed world, such industries are gradually outsourced to the developing countries. High gelatin prices seem to have come to stay & appear to be a new normal.

At current levels of about 715 crs of market cap, the valuations do appear to be quite attractive.

Seems like gelatin industry is going through commodity upcycle rather than any structural changes essentially benefitting from falling raw material prices and supply issue from European manufacturer.

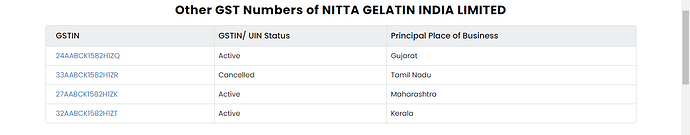

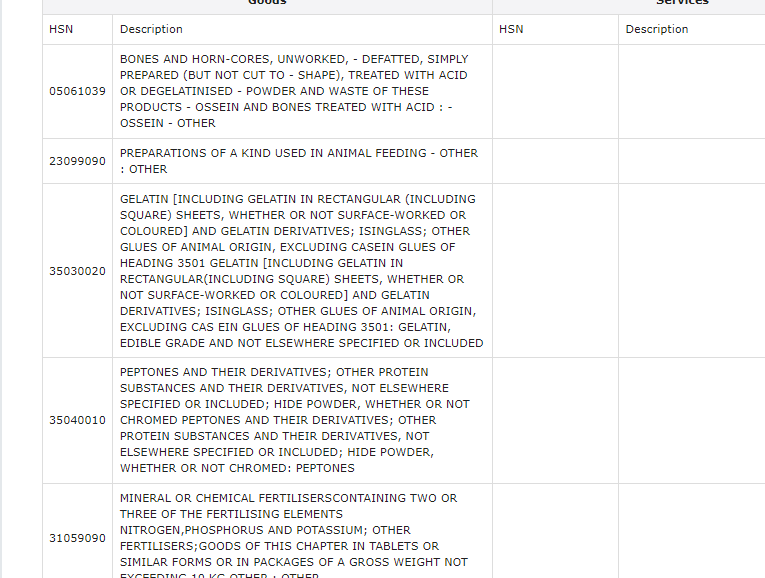

Nitta Gelatin primarily deals in 5 products (Goods & Services Tax (GST) | Services)

using export data (https://tradestat.commerce.gov.in/meidb/comq.asp?ie=e) we can find out price and Qty trends.

| Products (HSN Code) | Period | Amount (in lakhs) |

Quantity (in Kgs) |

Price | Period | Amount (in lakhs) |

Quantity (in Kgs) |

Price |

|---|---|---|---|---|---|---|---|---|

| OSSEIN | Q1-2022 | 2648.51 | 1090 | 2.43 | April & May’23 |

1964.82 | 638 | 3.08 |

| 05061039 | Q2-2022 | 2930.74 | 1035.6 | 2.83 | ||||

| Q3-2022 | 3578.35 | 1181.02 | 3.03 | |||||

| Q4-2022 | 3544.09 | 1169.88 | 3.03 |

| Products (HSN Code) | Period | Amount (in lakhs) |

Quantity (in Kgs) |

Price | Period | Amount (in lakhs) |

Quantity (in Kgs) |

Price |

|---|---|---|---|---|---|---|---|---|

| GELATIN EDIBLE | Q1-2022 | 10352.8 | 1602.23 | 6.46 | April & May’23 |

7808 | 976 | 8 |

| 35030020 | Q2-2022 | 10894.2 | 1547.77 | 7.04 | ||||

| Q3-2022 | 11482 | 1544 | 7.44 | |||||

| Q4-2022 | 12484 | 1604 | 7.78 |

| Products (HSN Code) | Period | Amount (in lakhs) |

Quantity (in Kgs) |

Price | Period | Amount (in lakhs) |

Quantity (in Kgs) |

Price |

|---|---|---|---|---|---|---|---|---|

| PEPTONE | Q1-2022 | 1875 | 205 | 9.15 | April & May’23 |

907 | 79.3 | 11.44 |

| 35040010 | Q2-2022 | 1325 | 112 | 11.83 | ||||

| Q3-2022 | 1157 | 92 | 12.58 | |||||

| Q4-2022 | 1278 | 114 | 11.21 |

| Products (HSN Code) | Period | Amount (in lakhs) |

Quantity (in Kgs) |

Price | Period | Amount (in lakhs) |

Quantity (in Kgs) |

Price |

|---|---|---|---|---|---|---|---|---|

| Calcium Hydrogenortho | Q1-2022 | 4782 | 3529 | 1.35505809 | April & May’23 |

2950 | 2192 | 1.34580292 |

| 28352500 | Q2-2022 | 5145 | 3198 | 1.608818011 | ||||

| Q3-2022 | 4316 | 2609 | 1.654273668 | |||||

| Q4-2022 | 5273 | 2953 | 1.78564172 |

Looks like margins will be maintained but demand scenario is weak.

This is very interesting company / story that has been highlighted on this forum.

On the business strategy of the Parent, their Vision seems to indicate that they want to grow Op Income from 2bn Yen / ~$15mm in 2024 to 4bn Yen / ~$30mm by 2031, or a 10% CAGR.

Given the expected tailwinds from value added products, shift from gelatin to collagen peptide - doesn’t this seem a bit low?

I’m just trying to understand if we can expect higher growth at the India entity, esp with the expected 3x in Collagen Peptide capacity

Thanks!

How did you find that GSTIN number?

Search gst Nitya gelatine

Momentum continues for Indian gelatine player

Amazing no. By Nita gelatin mind blowing

Revenue has not increased, cost of materials has gone down. and the 1180.63 change in inventory also makes the numbers look much better.

Will they be able to sustain such numbers in the coming quarters?

Anyone attended AGM ? Please share notes if you have. Looks like they are slowing down on expansion of Collagen Peptide

It may kindly be noted that we had announced the expansion of capacity by 1000 MT per

year for the manufacture of Collagen Peptide at the Gelatin division of the Company and the

approval of issuance of equity shares of the Company on Rights basis for part financing the

said capacity expansion vide our letters cited (1) and (2) respectively.

Though preparatory work on the project commenced on 1st January, 2023, subsequent

global events including the threat of global recession and its impact on the demand for

Collagen Peptide from overseas customers has prompted the management to review the

detailed project report.

- The onset of recession in the second half of 2022-23 impacted the global Collagen Peptide market, leading to a drop in demand in overseas markets, especially in North America and Asia. However, domestic and African markets remained favorable.

- The lower sales realization in North America and Asia caused a decrease in overall sales quantity during the 2022-23 period.

- The Company is trying to control the cost of production and tap into new markets with its new innovative manufacturing process to increase sales. Major market segments targeted include beauty from within, joint health, sports nutrition, general wellness, and other new functionalities. High functional Collagen Peptide and Diabetes management Peptides are new products under development.

- The Company couldn’t operate the Collagen Peptide plant at full capacity, especially in the second half of 2022-23, due to the recession’s impact on health supplement demand in North America and Asian markets, resulting in a more than 60% reduction in demand.

- To revive Collagen Peptide sales, the Company plans to enter new markets in South East Asia, Asia Pacific, and Europe by offering improved high-functional products.

- The Company initiated a partnership with Crushed Bone suppliers to improve the quality of the material, reducing impurity and other unwanted content, thereby reinforcing the supply chain. This partnership’s success will be replicated with other potential suppliers to enhance overall productivity and reduce costs.

- There are two contradictory statements regarding the price of fish protein, the raw material for Fish Collagen Peptide manufacture. One statement mentions a 20% decrease in fish protein price due to low Collagen Peptide demand worldwide, while the other states a 7% increase in Fish Collagen Peptide prices, with raw material (fish protein) prices recording a 14% increase, impacting margins for Collagen Peptide sales.

- The global Collagen Peptide market size was valued at USD 897 Million in 2022, with an anticipated CAGR of 5.7% from 2023 to 2028.

- The Company has fully absorbed and improved upon the technology transferred by overseas collaborators for the manufacture of Ossein, Di Calcium Phosphate, Limed Ossein, Gelatin, and Collagen Peptide. Continuous efforts are being made to further improve technology, economize on utilities, and enhance product quality and productivity.

Continuation of that circular:

As an alternative, the Company is also evaluating the option of debottlenecking the existing

Collagen Peptide plant to increase the current capacity and to de-risk the higher capital

expenditure involved by going in for a 2-stage implementation of the expansion project.

As far as I understood this, it is more of a commodity product and due to some recent disruptions, their have been shortages and prices are shooting up and prices should be tracked with hawk eye as the realizations are directionally proportionate to this.

Also, the industry itself is very small and growing at a low pace, so the only way any company in this segment can outperform the industry is by gaining market share.

And since we’re entering into a world where cruelty free products are slowly taking preference, it is only about the time some alternate comes up.

But biggest of all concern is price erosion, not sure at all if the margins are sustainable.

Started reading about it recently. Any inputs on this would be of great help.

Also, Indian Gelatine and Chemicals looks better since they also have USFDA, which opens up US access.

Disc.: Not invested, studying.

Revenues grew by 12% on-year in fiscal 2023 to Rs 566 crore, driven by higher realisations in products like gelatin and di-calcium phosphate (DCP), while volumes continued its modest growth. This, coupled with steady raw material prices led to an all-time high operating profitability of 20.8% for the fiscal as compared to 13.5% in the previous year. This trend continued in the first quarter of fiscal 2024, with the company reporting around 30% operating margins. While margins could soften going forward as the global demand-supply gap eases, supported by improved operating efficiencies, overall profitability is expected to range between 12-14% over the long term. With customers becoming more health conscious, demand prospects for gelatin and other protein-based products is expected to remain comfortable.

The company budgets to incur ~Rs. 200 crore of capital expenditure over fiscals 2024 and 2025, mainly to undertake capacity expansions in its gelatin and peptide unit. While this could be partly debt-funded, the financial risk profile of the company is nevertheless expected to remain comfortable, supported by annual cash accruals expected of over Rs 50 crore.

The ratings continue to reflect the established position of the NGIL group in the gelatin industry, steady support from joint venture (JV) partner, Nitta Gelatin Inc, Japan (NGI), and the strong financial risk profile. These strengths are partially offset by susceptibility to fluctuations in input prices and foreign exchange (forex) rates, and probability of disruption of operations or sub-optimal capacity utilisation due to pollution concerns.

– Source: CRISIL Ratings, September 01, 2023

The Nitta Gelatins Group company is a Japnese listed company and number one in the industry. They were planning to make India a production hub for asia region I think (need to verify again). Thats the reason for 200 cr investment,.

After sleeping for many decades, they have waken now to improve the performance at group level.

Two issues, If research says Gelatin is does not add value and having negative impact on our body. The whole market will crumble. Also, 40% is owned by Kerala govt which itself is a risk in my opinion.

But valuation looks good, mgt is good and clean books.