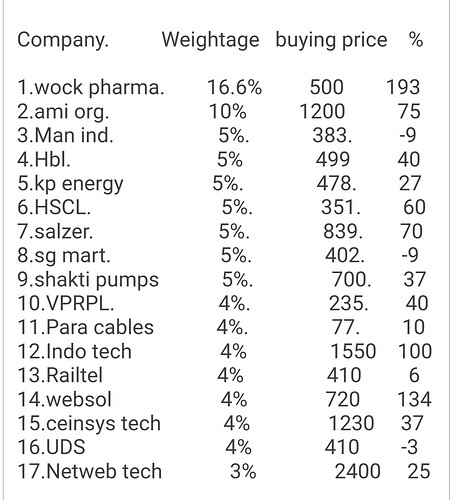

Wock pharma: seems like a turnaround story after the management has given decades towards R&D.Approvals of various patents and upcoming drugs with approximate TAM looks lucrative

Ami organics: segments like electrolyte business and speciality chemicals makes it a favourable business as far as growth is concerned.

Man Industries: one of the rare company to be approved for green hydrogen transportation pipes with continuous expansion zeal for oil and gas transportation

HBL: direct beneficiary of train TCAS(kavach) with limited competition. conventional battery business and investment in new technologies like FUZES and retro fitment of heavy vehicles in to EVs…

Kp energy ltd : wind power generation play(renewables)- futuristic

Guidance is to grow at 40-50% till FY30.

Even in the Q2 concall (which is their first), management said they have a revenue visibility of 3,500 crores for the next 2-3 years. sector

HSCL: The company is a key player across various product segments, including battery materials, coal tar pitch, carbon black, naphthalene, refined naphthalene, SNF, and specialty oils. It serves a diverse range of industries, such as lithium-ion batteries, paints, plastics, tires, aluminum, graphite electrodes, agrochemicals, defense, and construction chemicals.

Salzer : The Co is the largest manufacturer of Cam Operated Rotary Switches with 25% market share. Latest entrant into smart meters.

SG Mart :seems to be a big monopoly.Trying to move everything under one roof.Guidance and execution looks achievable as well as lucrative.

VPRPL, Para cables, indo tech : selected emphasizing on pure water,cables,transmission sectors.Following companies are selected after detailed analysis and comparison with peers on their business,valuation and size.