^^Much of the money from stocks sold by promoters will eventually again be invested in stock market, I guess.

Sorry I did not post it on time because it looked like folks don’t need it anymore, but again based on requests, looks are deceiving seems like!!

Attached is the Nifty trailing 12 month PE (weighted) as at August 14, 2019.Nifty PE Q1 FY20 for valuepickr.xlsx (43.9 KB)

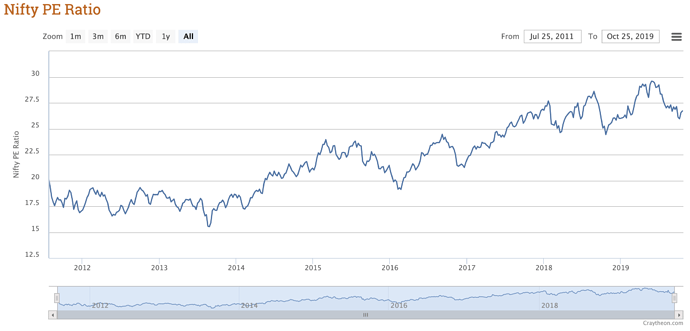

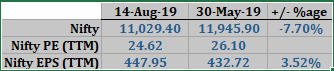

- My computation shows TTM Nifty PE at 24.62 on August 14, 2019 vs 26.10 about 2.5 months ago on May 30, 2019. Nifty fell by 7.7% and its earnings per share grew by 3.5% during the same period.

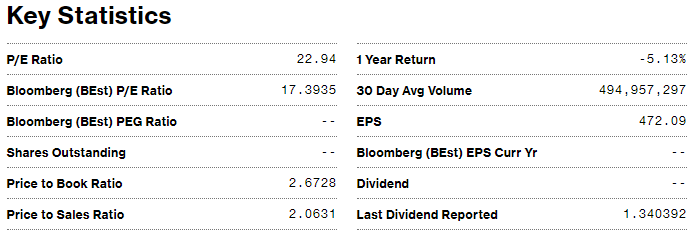

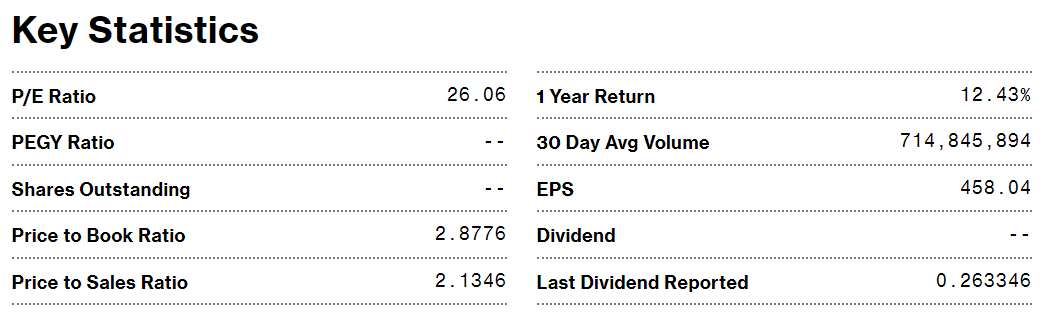

- The Nifty EPS numbers from Bloomberg is higher by about 5.4%, and I don’t know why. The Bloomberg snapshot as of 23 August is as below:

- FY 20 onwards firms are required to give full consolidated numbers every quarter, along with comparable numbers for the previous years, so previous years numbers have changed to that extent.

Hey Krishnaraj - do your latest EPS match Bloombergs?

I’m curious if recent corporate tax cuts delivered profits.

Bloomberg’s EPS history (from this thread)

Nov’18 485

Feb’19 442

Apr’19 428

May’19 456

Aug’19 472

Oct’19 475

Craytheon’s Nifty PE suggests 25+ rich valuations

I haven’t computed Nifty EPS since the results are still coming in. The corporate tax cuts may not do much in terms of earnings for Nifty. I recall a Kotak report that said that the effective tax rate for the Nifty firms were between 26-27%, and the effect on the Nifty firms may not be much.

I will put up the EPS once the results are out.

Dear friends,

Attached is the Nifty trailing 12 month PE (weighted) as at November 14, 2019 after results of all firms were declared. Nifty PE Q2 FY20 for valuepickr.xlsx (52.5 KB)

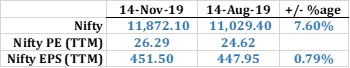

- My computation shows TTM Nifty PE at 26.29 on November 14, 2019 vs 24.62 3 months ago on August 14, 2019. Nifty grew by 7.6% and its earnings per share grew by a nearly infinitesimally small 0.79% during the same period.

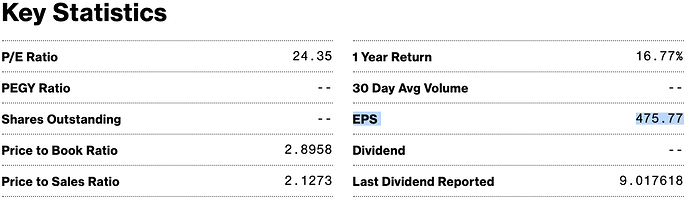

- The Nifty EPS numbers from Bloomberg is higher by about 1.45%. The Bloomberg snapshot as of 19 November is as below:

Feel free to ask for any clarifications.

Thanks Krishnaraj for your service to our forum, and specially for providing historical data in spreadsheet, which revealed latest EPS 451 is -9.5% YoY vs 473 in Nov’18

9.5 % reduction in Y-o-Y EPS after factoring the Corp.Tax cut benefits companies took in Q2 ?

Thank you Krishnaraj for all your effort.

I have 2 doubts in the calculations.

- You calculate PE ratio first and then calculate EPS based on NIFTY level. This is the reason that EPS changes daily by your process while the EPS calculation of Bloomberg changes only when new earnings data is available.

- You have not used the weightage of the stock in calculating the earnings (the current calculation is PAT of free float, does it need to be weighted based on the weightage of the stock in Nifty 50).

Thank you again.

Yup - latest Nifty earnings have negligible impact from corp-tax cut, cause tax-cut also take-away all exemptions.

You are welcome

You are welcome

On your queries,

It’s correct that I calculate PE ratio first and then use Nifty to compute EPS. Direct computation would require knowing some extra details, specifically a constant that is used to get free float MCap to Nifty, adjusted if needed for any corporate events, which are unavailable publicly.

However EPS need not change daily because as EPS is Nifty divided by PE, and both Nifty and PE will change daily keeping, so atleast theoretically, they will cancel out. This assumes that Nifty is an adjusted constant multiplied by “P” which it is. It’s like if I know the M Cap of a company and its PAT, then without knowing its per share price I know the PE ratio, and if I know the share price, then I will know that EPS = Share price divided by PE. So as share price changes PE ratio will change but EPS will remain the same.

Weightage is not needed - it is an output of free float M Cap and not an input, like you said it is PAT of free float, so we need to know the free float of each constituent (= free float MCap divided by total M Cap, and freee float M Cap is provided by NSE, it does not say as of which date, but I assume it to be the last date of the month) and multiply the profit by such proportion of free float.

I don’t know how Bloomberg does it, but I am sure that what I do is conceptually correct because I also validated it, some assumptions may vary though, like the one above. Do check a note I wrote in post #111 where I note a detailed note on it.

Nifty contribution is weighted. Different stocks have different contribution to the changes in Nifty. EPS should be calculated similarly. I believe, it should be a sum of weighted EPS of each of the NIFTY components.

Free float is used to calculate the weightage in NIFTY calculation, but once these weights are calculated, should they not be carried forward to calculate NIFTY EPS using earnings of the constituents. I have made some changes to your excel. Please check it out. Nifty PE Q2 FY20 for valuepickr_Updated_by_Ferrari1976.xlsx (61.1 KB)

This was how I was computing it earlier and realized it was wrong. I found that was wrong because weighted MCap was not changing in proportion to Nifty when there were no changes to its constituents, which it should. For instance if there are no changes to the constituents (including %free float) the ratio of weighted MCap q-o-q should be equal to ratio of Nifty q-o-q. It wasn’t. You may also check the same. Subsequently changed the method to what is it now.

I had written a note on it (post #111) when I changed the methodolgy, and also validated it with changes in Nifty. In other words when there are no changes to Nifty constituents changes in q-o-q changes in Nifty should be equal to q-o-q changes in free float MCap, which it was.

Attaching the note on computation again here.19112018 Note on error in Nifty computation and the revised method.pdf (668.9 KB)

Additioanlly this is also consistent with Nifty’s methodology ( https://www.niftyindices.com/Methodology/Method_Nifty_50.pdf ) where-in it says

"The NIFTY 50 is computed using a float-adjusted, market capitalization weighted methodology, wherein the level of the index reflects the total market value of all the stocks in the index relative to a particular base period."*

Got it. Thank you for the detailed explanation.

I am glad I could communicate it properly ![]()

![]()

Also lot of companies have deferred tax impact (negative or positive) for this quarter, so actual Nifty EPS after corporate tax cut would be for December qtr results

ICICI report on current fall

Corona Virus – a buying opportunity ??