Elevator Pitch

Having met the promoter and management a few times now, and following a site visit to their plant, I would like to introduce NewJaisa to this forum. I believe it possesses:

-

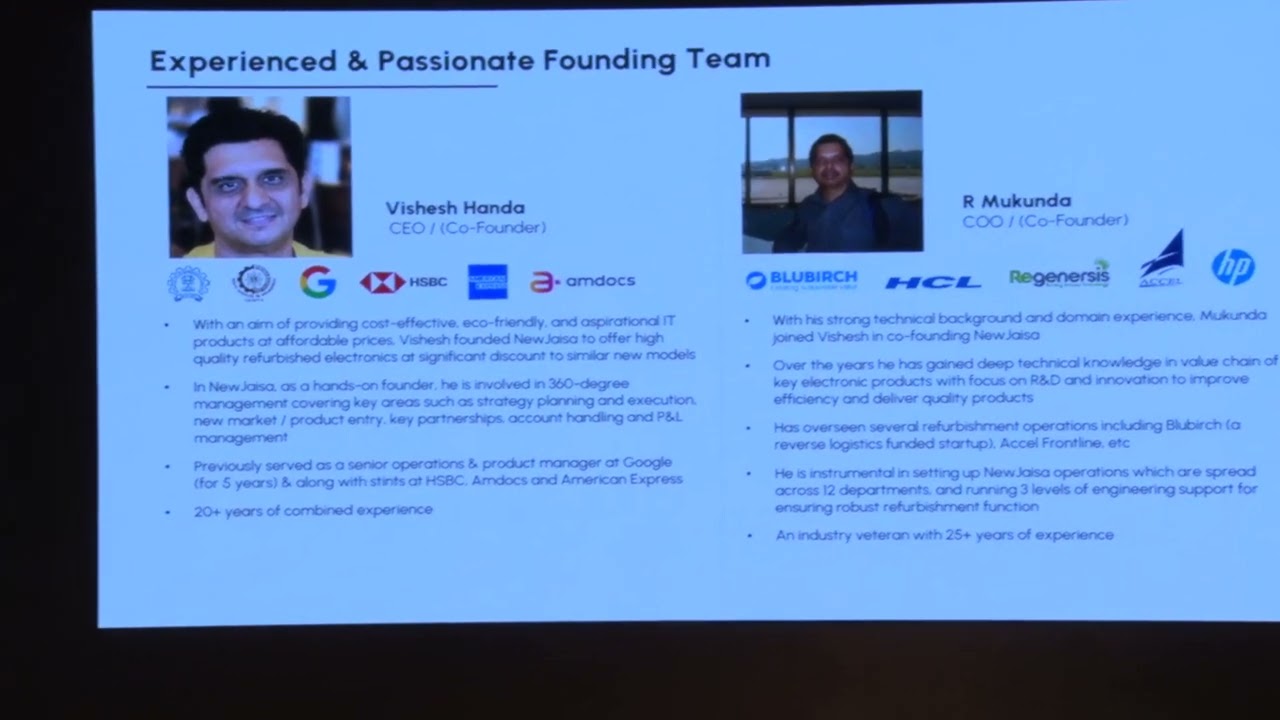

A passionate promoter who left a well paying job to create a bootstrapped business of his own.

-

Consumer facing B2C/D2C offering generating 60 Cr. of revenue within 3 years of operations. Estimated TAM of ~8000 Cr.

-

Immense attention to detail to produce in house capabilites that require a very specific mindset to replicate.

-

Attractive unit economics not yet visible in the numbers.

Business Model

NewJaisa sells refurbished laptops at ~15,000 rupees per laptop. Usually when one thinks of buying a refurbished laptop, there are several concerns that come to mind:

-

Scratches and dents

-

Missing / broken keys

-

Poor battery life

-

Damaged screen

NewJaisa’s USP is that they offer a product that is virtually indistinguishable from a brand new laptop. This means a laptop with a flawless surface without any dents, a screen with no dead pixels, and a battery that lasts for several hours. They even offer a warranty on laptops that they sell.

In today’s refurbished electronics market, most (if not all) competitors are traders. They look to source laptops that are already in near pristine condition, and sell them after doing minor touch ups / quality checks.

NewJaisa has invested in developing capabilities to repair as much of a laptop as possible in-house, and minimise the parts they have to replace. This is visible in the 47% gross margins they are able to make on their products. More on this further in the post.

Sourcing and Philosophy

NewJaisa sources their laptops from two places: corporates and recyclers. Sourcing from either has its pros and cons, and it comes down to a business philosophy to choose between them.

Recyclers

Recyclers are traders that sell used laptops to refurbish / second hand companies like New Jaisa. They themselves usually buy from corporates. Laptops are usually sold in lots, and are classified based on the condition that they’re in, scored on a grade from grade A (best quality, almost pristine, no marks) to grade B, C, etc. The lower one goes on a grade, the more visible damage, but the cheaper a lot is.

Competitors in the used / refurbished space hunt the grade A lots, as this requires the least amount of work before selling them to another person. The cost here is very high and everyone is interested in these lots. NewJaisa usually targets grade B / grade C lots where there’s lower/no competition and has trust in the in house team to restore these laptops at the lowest cost. They bid for lots after factoring a 45-50% gross margin.

If there is a dud in a lot that doesn’t start, there is flexibility to return the piece, or not pay for it. Even if there is a scrap in the lot, they have the ability to repair while other players would discard the piece. Their philosophy is that whatever condition the lot is in, they should be able to repair it at the lowest possible cost.

Corporates

Corporate tech companies (Infy, Wipro, TCS) have a steady stream of laptops that they replace every year. These belong to employees, and the lots are usually in better condition than laptops procured from recyclers. Corporates usually liquidate larger lots at a time. The people buying from them have almost zero bargaining power.

Pros & Cons:

-

Recyclers allow you as much time as you need with each lot to inspect quality for each and every laptop in the lot. Corporates don’t give you much time (2-3 hours) to do an inspection because there is more competition for a lot, and it is scrap to them.

-

Corporates require payment for any lot up front, while recyclers who give you time.

-

Recyclers allow you to pick and choose which pieces you want, corporates have a take it or leave it approach to a lot.

-

Gross margins are higher in laptops sourced from corporates and these laptops are in much better condition than those sourced from recyclers.

-

Lot sizes for a corporate are much larger than those from retailers.

-

There is more to mine from a relationship (longer term) with a corporate than a recycler (more on this later).

-

Any duds / scraps in a lot sourced from a corporate cannot be returned to them, while the relationship with a recycler allows someone like a New Jaisa to return duds back to them or adjust the price for a lot. This is an extremely important distinction, and forms one of the key risks in the model (more later).

Today, most of NewJaisa’s sourcing comes from recyclers. Their plan in the next few years is to source more from corporates (more on this later).

The Facility / Line

The line that New Jaisa has built is the most important part of its USP in my opinion. One has to visit to see just how much thought and effort they have put into this. They have tremendous intent and attention to detail to bring a laptop to perfection.

-

From the moment they receive inventory, they have a QC team that immediately checks some 70+ parameters for each laptop to understand what parts can be repaired in house, and what parts need to be procured.

-

All laptops are logged onto the ERP for complete traceability of workflow from the moment they receive it, to all the work done on the laptop, and finally the finished product. They know which employee has worked on any given laptop, etc.

-

Each laptop is disassemblied into its constituent parts, and worked on by the repair team. Each part is tagged with a QR code. The repair process includes a clean room facility which has the capability to repair damage to screens. Displays are the costliest components to replace with new parts, and New Jaisa claim they have become one of the top players in the country on screen repairs.

-

Something that came to light during the site visit was their dedication to repair even the most minor cosmetic damage - tiny parts that would be easier to just leave alone. From small grills that cover fan vents, to hinges. They repair any and all damage to the bodywork.

The entire operations line is the co-founder’s (Mukunda’s) brainchild. He’s an industry veteran with a lot of experience in hardware, and is the head of operations for the facility in Bangalore.

D2C Sales Channel

In the first two years of operations, New Jaisa sold laptops mainly through Amazon, but in the last year, they’ve set up their own website which already has scaled to be 25% of their sales.

- Traffic looks to be between 3000-10,000 daily users according to similarweb.com

- Engagement metrics stand out, with a low bounce rate, many pages per visit, and a long visit duration.

Compared to two peers, New Jaisa’s engagement looks much better. Note the average visit duration.

Electronics Bazaar:

RenewIT:

Growth Levers

-

Promoter wants to entrench his relationship with the corporates and build an offering that allows them to entrench themselves in the corporate supply chain. Sourcing directly from corporates could allow them to raise their gross margins by another 10% in the future. Plan is to take sourcing mix from corporates to around 80%.

-

The repair capabilities they’ve built can be used for several adjacent electronics: Macbooks, Phones, Air Conditioners. In the future, these are several product categories they can branch into.

-

Exploring offline sales channels with schools / colleges, that allows students access to cheap, quality laptops. They’re also looking at offering these to MSMEs.

-

Similar initiatives in the export market.

-

They are working on a CSR initiative, wherein the laptops they source from corporates could go towards the corporate CSR expense. These initiatives and a better relationship could lead to them getting incrementally favourable terms while sourcing laptops (more time with each lot, etc). This is still very much a work in progress.

-

They have just closed a pref round, raising 30 Cr. 12 Cr. of this will be for a new facility at the same site as the current one. They are preparing to expand in FY26.

-

Currently the facility works one shift a day. There are plans to introduce a second shift sometime, which improves the utilisation in the current facility. At peak capacity, this facility should be able to do 200+ Cr. of revenue. (More on this in the model section)

Forensic Q&A

- Notice the large build up of inventory in FY24. Management’s response to our question was that this was bad timing. They had a large lot that was delivered in the last week of March 2024, and shows up as inventory. This has added to their RM inventory that is being processed by the repair team.

-

This line item is also related to the lot above. Most of their purchases work on making the payment first, then picking up the lot after 9-10 days. During the end of the year, corporates also have targets on liquidating inventory and this line item only came up in the last week.

-

These responses make sense to me as these two items are not as large in the H1FY24 balance sheet. Seen below,

Challenges and Risks

1. Working Capital

- With scale, after the first year of operations, New Jaisa’s inventory turnover has fallen, and inventory days have risen from 60 days to 200 days. Promoter needs a lot of working capital to scale, as lots of RM are bought, repaired and then sold. This is a problem that he’s conscious of, and is working on, but unless they can improve the inventory turn, this business will see dilution for growth.

2. Bandwidth

- The current top management have skin in the game, and their hands full with several areas of the business. Promoter is very driven, but he has 30 different things to solve, and is working out things on priority. Similarly, the head of marketing is also the sourcing head for the business. They need an efficient middle management layer to ease the workload on the senior management, but this will come with time and scale.

3. Inventory Management

-

Inventory for a New Jaisa can be thought of as comprising three diferent stages: inventory that has just been sourced from a corporate / recycler, inventory that is being processed by the repairs team, and inventory that is ready to be shipped.

-

From any lot sourced from a corporate (not recycler), there are dud / scrap laptops that do not start and are in a state that cannot be repaired. The cost of this scrap is borne by New Jaisa. They have said that in any lot, a very minute portion (<3%) is scrap waste, and needs to be written off. Investors need to be mindful of this as New Jaisa plans on increasing their corporate sourcing to 80% in the next few years. This amounts to taking on bigger lots with time (which may sit idle). One key monitorable is whether they can convince corporates to give them more inspection time to do proper QC. The counter argument to this risk is that sourcing from corporates allows them to make 10% higher gross margins than from recyclers, so a small scrap percentage in each lot is offset by the higher GMs.

4. Marketing a D2C Brand at Scale

-

New Jaisa has taken on the challenge of creating a category and changing consumer perception on refurbished electronics. My opinion is that there is a disconnect between the attention to detail and care in the operations line, and how much of this percolates down to the end consumer.

-

They’re being very cost conscious on marketing, spending between 2-4% of the topline on Google / Meta campaigns, but these two offer diminishing returns on capital at scale. This is not a problem now, but will be a problem if/when they get to 200-300 Cr. of sales.

-

Right now they offer a video call option while shopping that shows customers the product and operations line, but the overall marketing effort could be a lot stronger. Investors on the last concall transcript have also echoed this sentiment. Perhaps it’s a function of bandwidth, described above.

Valuations and Growth Bridge

NewJaisa has scaled from 10 employees to 450 in the span of three years. Due to this, the true unit economics of the business aren’t yet visible in the numbers. I have made a model based on my best understanding of the different moving parts, and it’s instructive to talk through the unit economics.

For newer folks, I’ve posted an explanation for this in the tab below. You can click to expand it.

Detailed explanation on why the unit economics are hidden

-

New Jaisa has scaled from 30 employees in FY21 to 400 employees in FY24. The employee cost has gone up from 0.7 Cr. in FY21 to around 11 Cr. in FY24. New Jaisa employees work 300 days a year. In FY24 they sold 54322 units, which amounts to repairing ~181 units per day.

-

However, we’ve confirmed with management that each employee currently does a throughput of 0.7 units a day. Therefore, with 400 employees, New Jaisa repairs 280 machines a day. This mismatch is due to there being a lag between employees being hired, trained, and then working a productive shift.

-

As of today, New Jaisa has hit the 300+ machine run rate, but have also continued hiring. They will finish FY25 probably around 90k units sold, but by then, would have hired employees to allow for 400+ units repaired per day in FY26. Due to this, the employee costs during the ramp up phase depresses EBITDA margins until they slow down the hiring.

Going piece by piece:

-

Gross margins have expanded from 33% in FY21 to 47% in FY24. Note how the realisations (Revenue / Units sold) have remained unchanged at around 11,000 in these three years. This points to in house repair being the reason for gross margin expansion.

-

Have sold 9000 units in the first year and 55,000 in FY24.

-

Revenue growth lags employee growth as employees have a period where they are being trained, etc. This subdues the EBITDA margins. Note how the revenue / employee has fallen from FY21 to FY24.

-

They sell four kinds of products today - laptops between 16-25k, desktops from 10-30k, monitors at 6-7k and accessories at 400-600 rupees. The blended realisations are around 11,500. If the mix changes, these realisations could change.

-

The current potential column is my best understanding of present unit economics should they stop hiring. Employees are akin to capex for them as it is a labour intensive business. As of today, each employee produces around 0.7 units / day. Therefore 450 employees * 0.7 = 315 units per day. They work for 25 days in a month, 300 days a year. This means they can process 94.5k units in a year. Assuming the realisations stay at 11,500, this amounts to a topline of around 110 Cr., 20% EBITDA margins, and around 13.5% PAT margins. Management has said that 15% PAT margins are sustainable in this business.

-

Currently, they are working one shift in the facility. The next lever for them is to start an 8 hour night shift. I’ve explained this working in the notes next to peak capacity potential. It looks like this facility should be able to generate 200 Cr. of sales if they introduce a double shift. At this scale, one would expect around 25 Cr. of PAT, or 16x forward depending on when they can implement this.

-

New Jaisa does not plan on stopping hiring, so it’s unlikely we will see topline growth translate into EBITDA / PAT. I believe they should be able to do 100-120 Cr. of revenue in FY25, but real unit economics will remain subdued. It’s roughly at 4x FY25 sales.

New Jaisa is a three year old company, and should be judged as one. In my opinion, they are entrepreneurs genuinely trying to build a solid business and have the intent to succeed. Any investment in the company today should be thought of as one in a startup.

The promoter gave a 15 minute presentation a year ago that offers insight on his mindset and the company:

Thanks to @nirvana_laha, @GourabPaul and @aga.ayush11 for all the work they’ve done on the company. Nirvana and Gourab were the ones that did the site visit.

D: invested, no transactions in the last 30 days. This is not investment advice, but meant to follow the journey of an interesting smallcap.