Hello All - For the benefit of those who want to understand the basics of NESCO’s business, I have written below long post :

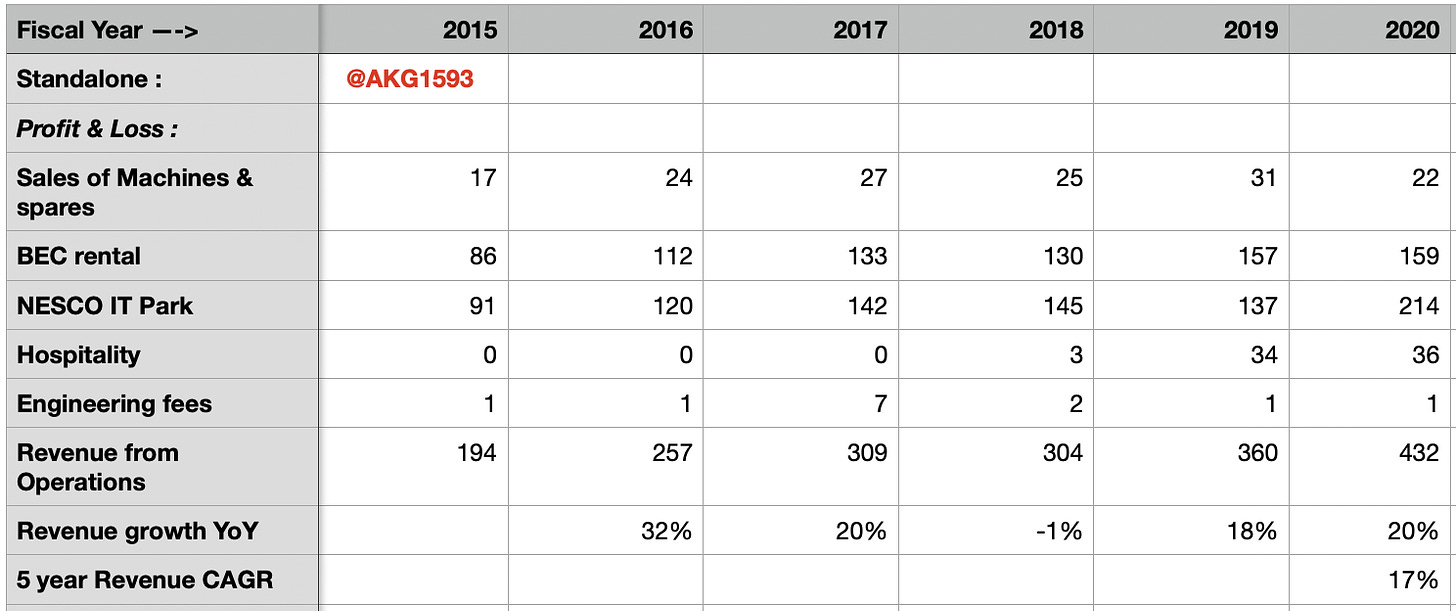

What do you do if you have a ~70 acre parcel of land in the heart of Mumbai where land is scarce and expensive? Sumant Patel, promoter of NESCO Ltd., decided to start an exhibition business by building the Bombay Exhibition Centre (BEC) in 1991 on that parcel of land.

As India opened its gates to globalisation, companies rushed in to exhibit their products at BEC’s trade fairs and exhibition events. The business took off.

Today, from the steady, recurring cash flows of the BEC, NESCO has :

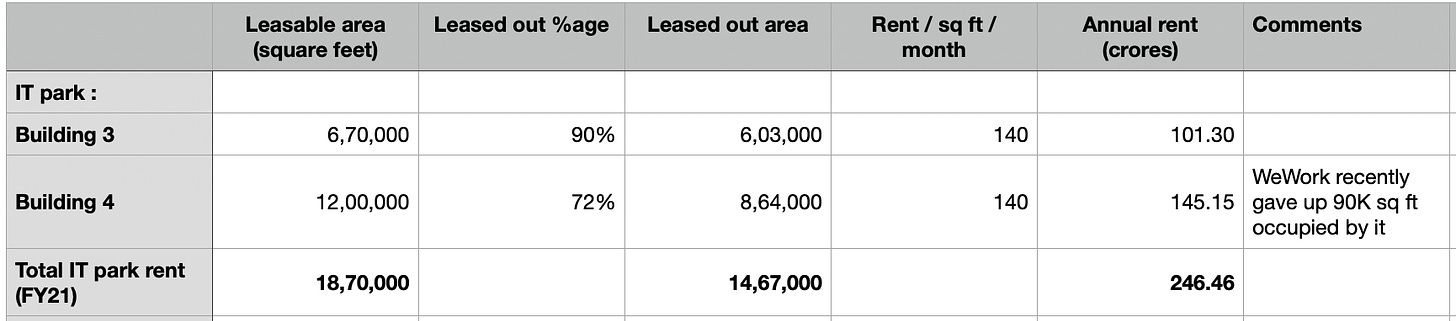

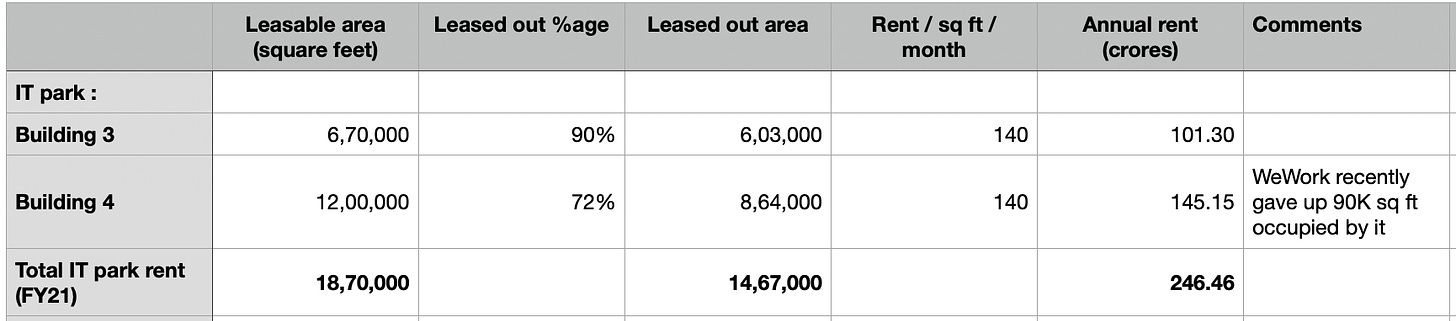

- built IT parks - 2 buildings are currently operational & generating ~₹20 crores in rent per month from MNCs & banks

- built a hospitality business - NESCO Foods - to cater to office goers, &

- planning to build another 2.9m sq ft of leasable area which will have 2.6m office space and 0.3m 300 room 4-star hotel for a capex of ₹2,000 crores

NESCO’s moat :

Traditionally, real estate players need to :

- invest a lot upfront in acquiring a piece of land

- then spend years & (mostly) borrow money building it

- then wait for their payday till the entire building is sold or leased out

However, since NESCO has captive land purchased decades back, it doesn’t need to pay exorbitant sums to acquire it at today’s prices - and it has steady cash flows from the BEC & IT Parks with which it builds additional buildings on the land - so it doesn’t need to borrow to build. And NESCO is able to lease out soon after building because demand for office space in Mumbai is evergreen.

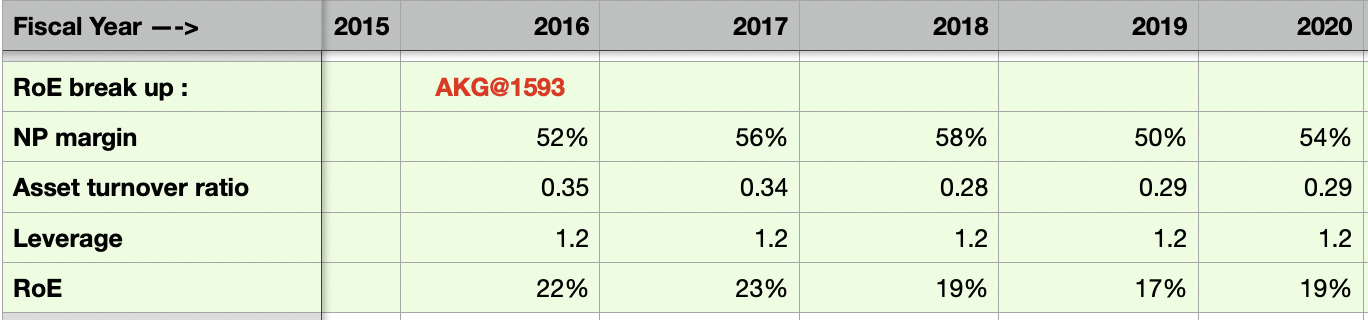

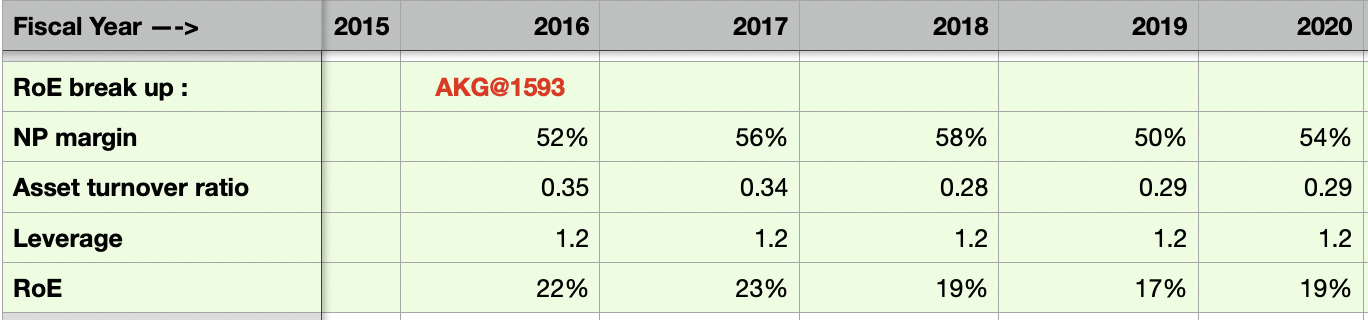

NESCO’s cash generating engine is growing at a steady rate of ~15% with an RoE of 19-20% and no debt on the Balance Sheet - which is unique for a commercial real estate player.

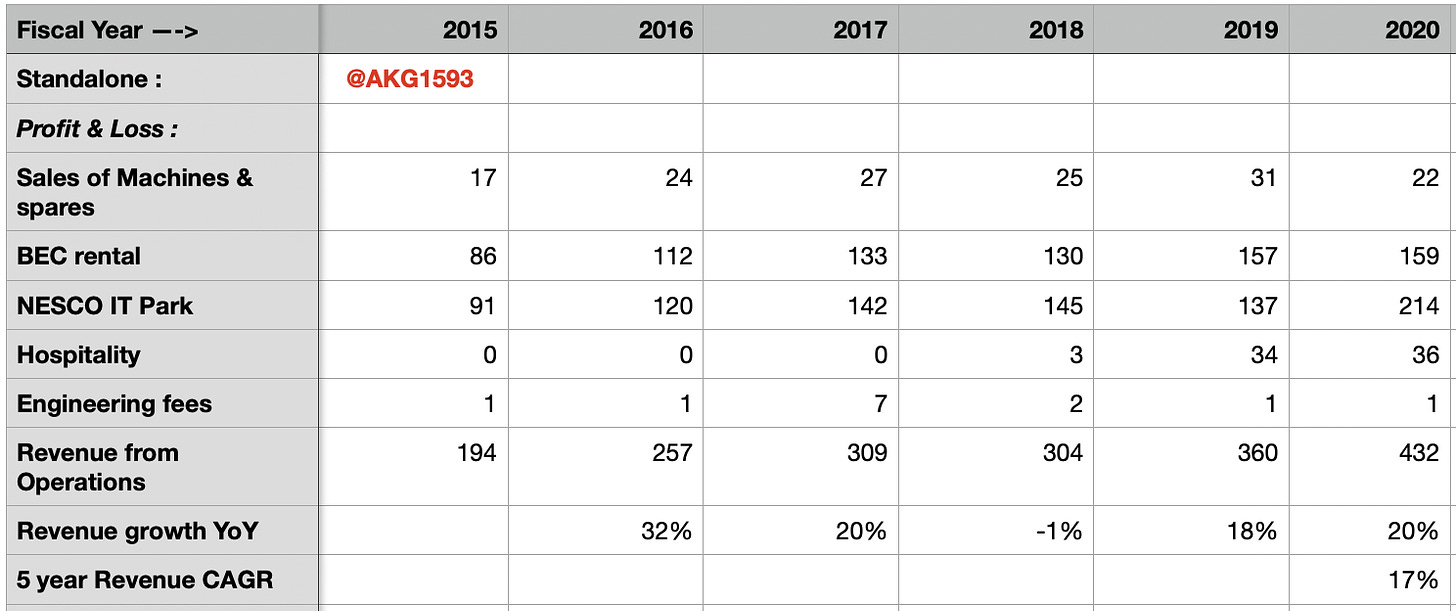

Revenue break up

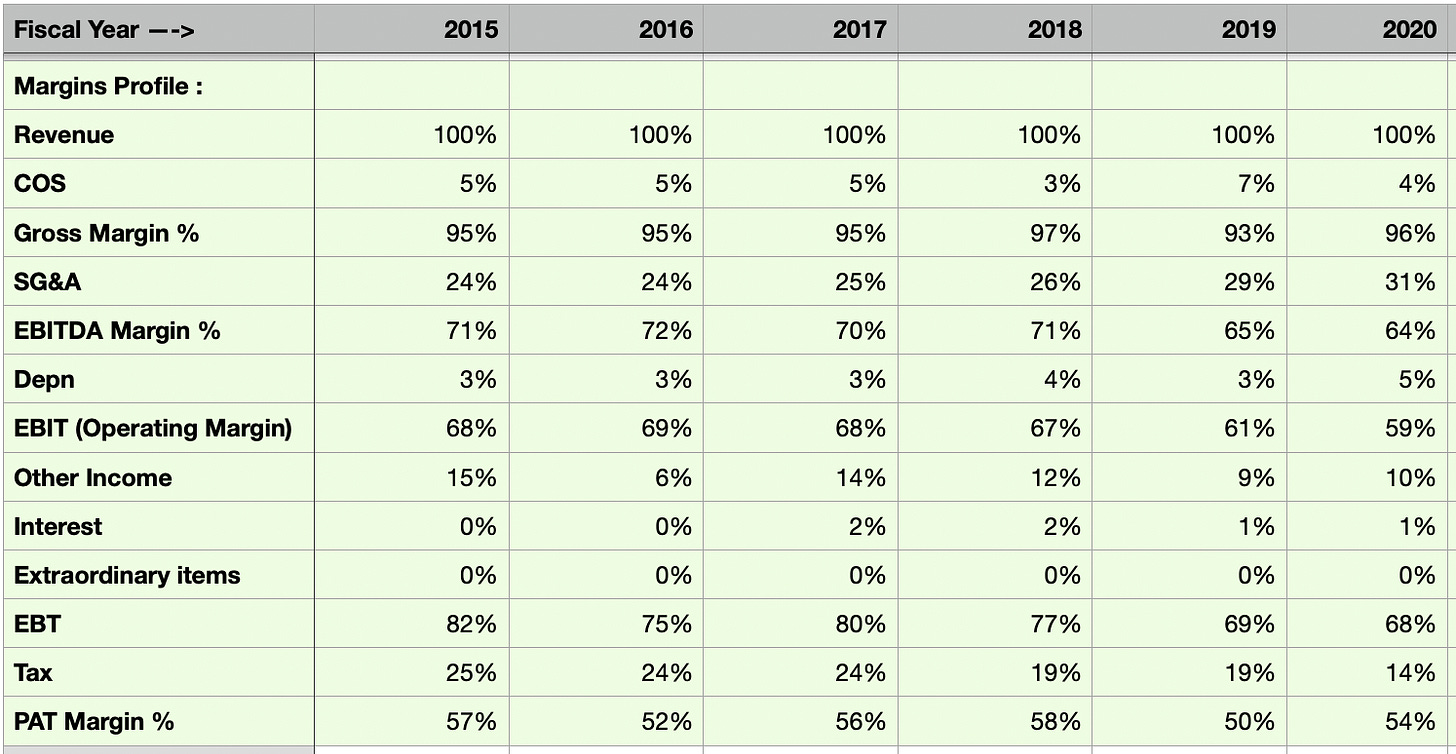

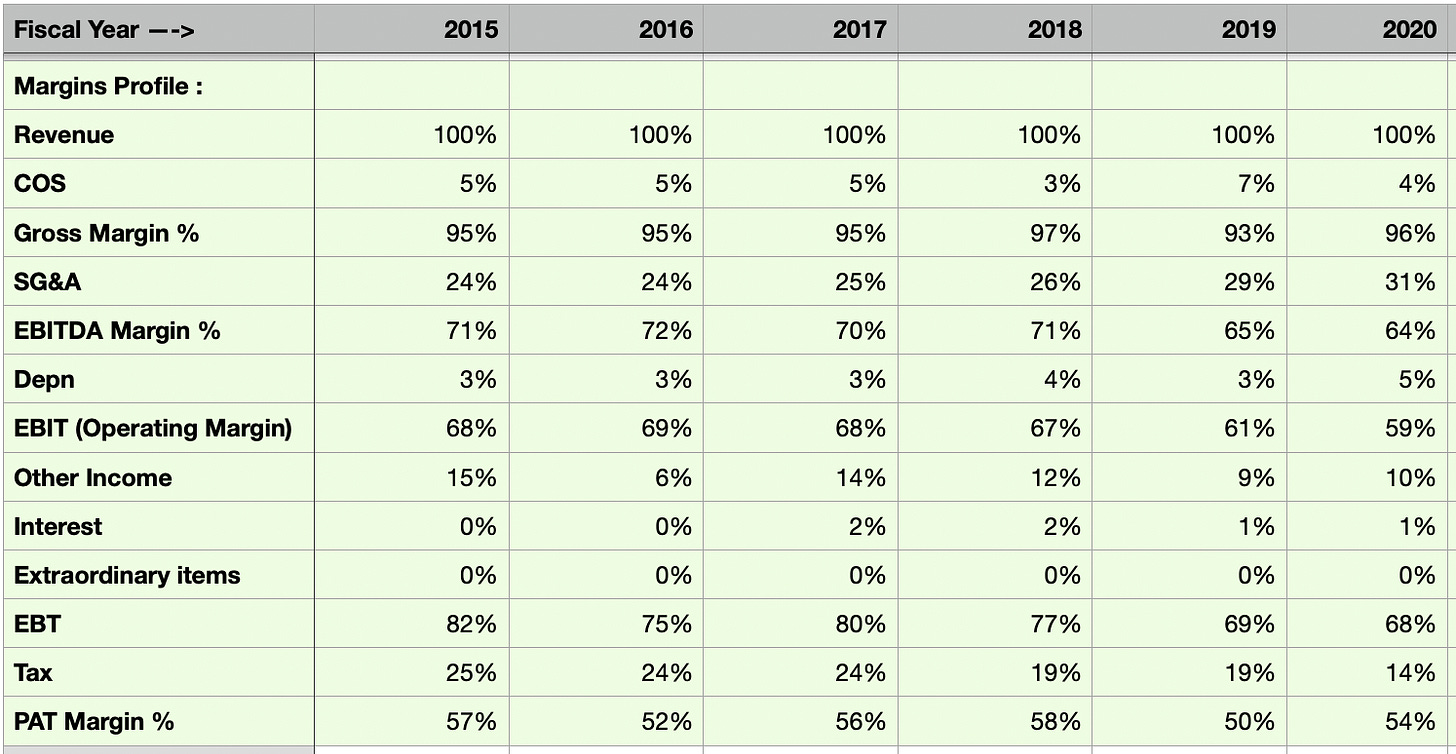

Margins Profile

RoE break up

Risks :

However, there are some obvious risks which might derail NESCO’s growth plans :

- COVID-19 has made physical contact almost prohibitory - NESCO’s businesses - both IT parks & Exhibition - earn when people come together in big groups.

- IT companies are planning to allow people to work from home at least some of the time - this will reduce demand for premium office space & might also eliminate it completely over a long period.

- Additional threat from co-working spaces like WeWork (although the flip side to this is that even co-working companies need office space - NESCO itself leased out roughly 10% of leasable area to WeWork)

- Reliance Jio Convention Centre which might compete with BEC exhibition business

- NESCO enters into low RoE businesses like Hotels

Management :

I like managements which are conservative & are cautious of excessive leverage - this is what Mr. Sumant Patel has said about the upcoming capex program

The cash flows of about ₹2,000-2,200 crore will be staggered over a period of 5-7 years. As a policy, we will not be going in for any external debt and all our outflows will be funded by our internal accruals in its entirety.

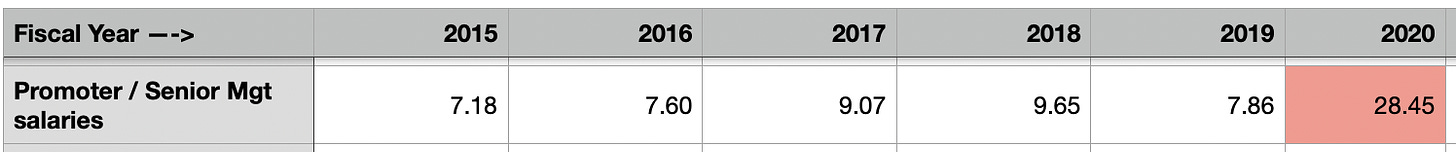

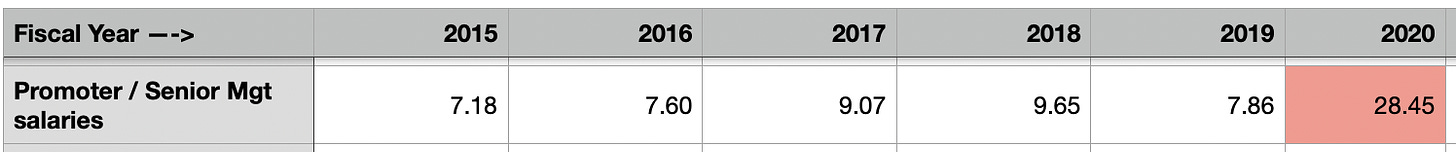

Management salaries has been an area of concern : in FY20, Patels’ total take home from NESCO jumped almost 4x!

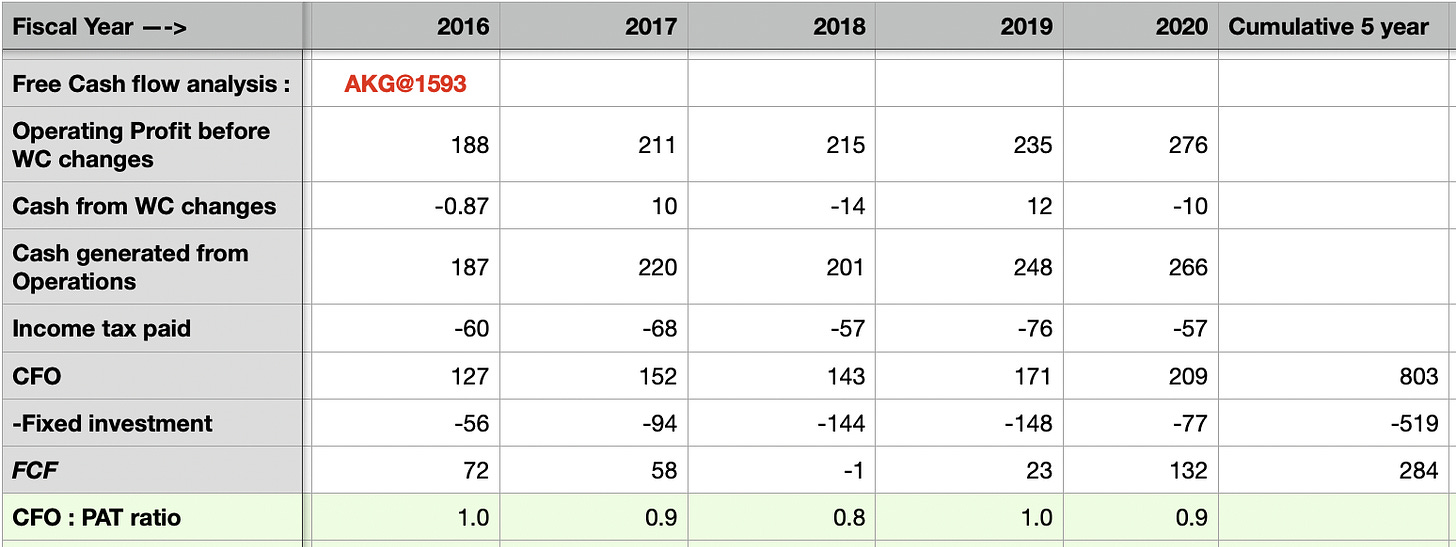

Cash Flow :

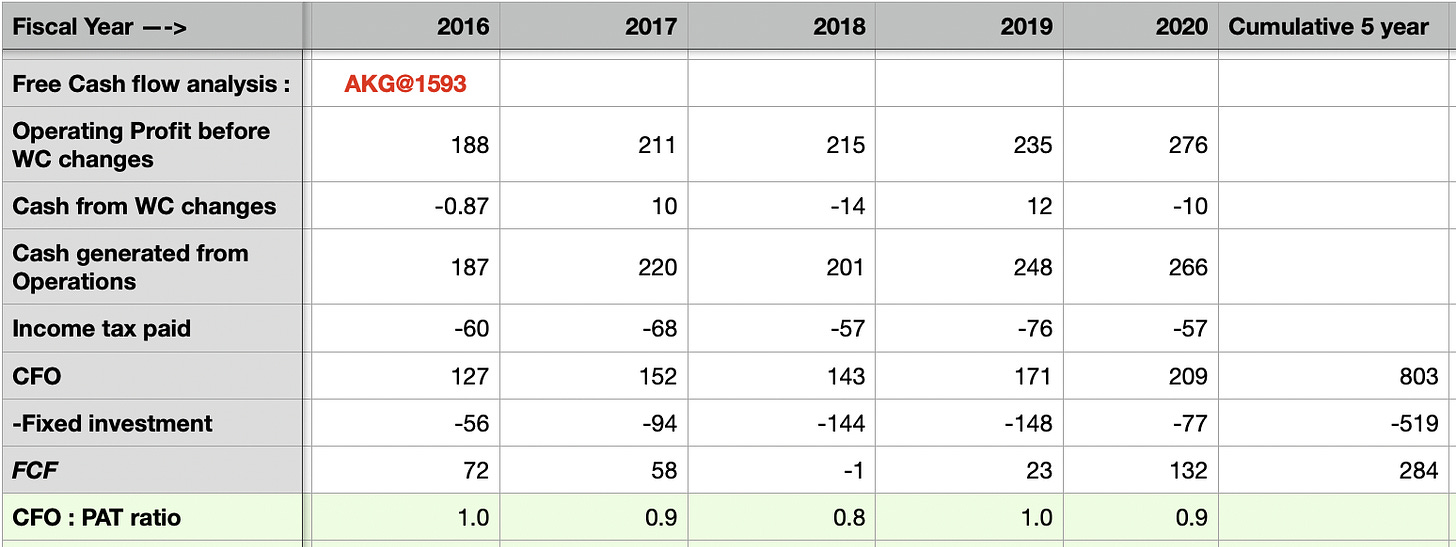

CFO/PAT ratio is almost 1 : 1 which indicates all earnings are in cash - a favourable feature of NESCO. Also, NESCO’s business doesn’t need net working capital investments which is another plus.

However, NESCO doesn’t generate a lot of free cash - which is a pitfall of avoiding debt. NESCO’s Operating cash flow gets spent on new buildings & very little is available for dividends or buybacks. For eg. out of cumulative ₹803 crores in Operating cash in last 5 years, free cash was ~₹284 crores. Dividend Payout ratio is only 9-10% & Dividend yield at today’s prices is 0.5% which is meagre. The ability to not take out cash from the business is a drawback for potential minority investors.

Almost₹670 crores of cash (as of FY20) is invested in short & long term MFs/debt funds presumably because mgt doesn’t want to borrow to meet future capex needs.

References :

- Urge you to read this piece by Professor Sanjay Bakshi which beautifully explains NESCO’s moat like characteristics : https://www.nooreshtech.co.in/wp-content/uploads/2011/10/NescoSanjayBakshi.pdf

- NESCO last 5 years Annual reports

- The Hindu article on Capex program : Nesco to invest ₹325 cr. to expand expo centre - The Hindu

I would love to have your feedback/comments on the above post here