Did Hikal start as agrochemical and then go in to pharma as it matters a lot. You would expect to get into a commodity business and then graduate to a higher level. But not the other way around. If you do not have any better alternative to use the shareholder funds, it’s better to return as dividend or buyback rather than enter in a business which I am sure will reduce the overall ROE. In my mind a definite diworsification.

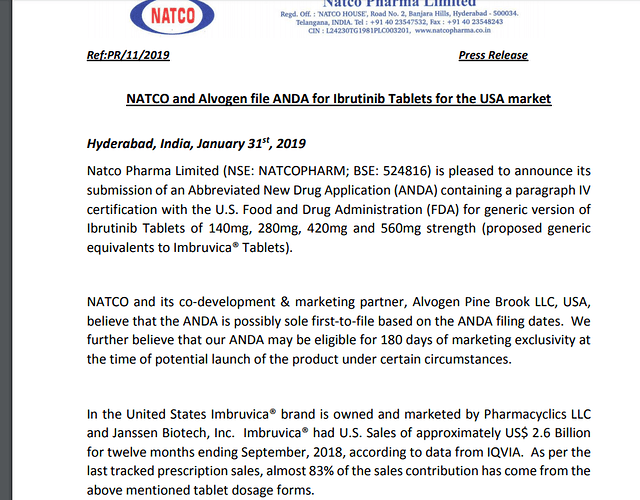

Excellent stuff from Natco. Ibrutinib is a wonder drug, used in treating certain blood cancers. Not a chemo drug… I am impressed. Patent expiry in 2026, so will have to wait a long time though!

Q3 FY2019 Result

https://www.bseindia.com/xml-data/corpfiling/AttachLive/767a4ceb-31b5-4c9b-bf11-60e8b1d23883.pdf

Guys… Any idea if Lupin-Natco combo can price it lower than other players in the market. This drug has always had a view of being costlier by all firms. Also a decent market size to capture if priced competitively

Just started following the company. Has it cancelled the buyback it announced in Nov? Can somebody point me to the background to this Event if it’s true and what was the reason? Seems like a decent company available at a reasonable price. What’s spooking it?

Buyback is open market buyback and not tender offer.

And I think its period is already on…till May 2019

Doesn’t the immediate 1 to 2 year period look little bleak with no significant launches?

As per their ad buyback will end on 25th March, mean just couple of days.

So expecting positive news or it will drag below rs.500

Any thoughts ?

Hi, I was looking at pharma companies and came across NATCO pharma. This company seems good in financial like good ROE/ROCE and low D/E. Does anyone know which it has PE of 12 when other pharma companies have PE around 20?

Has 250 crores of cash and marketable investments on the balance sheet as well. Wondering why it has fallen so much. Value buy or value trap?

Some points captured in one of the research report I read which may be the cause of stock hitting new 52wk lows :

Margin pressure affected the numbers…

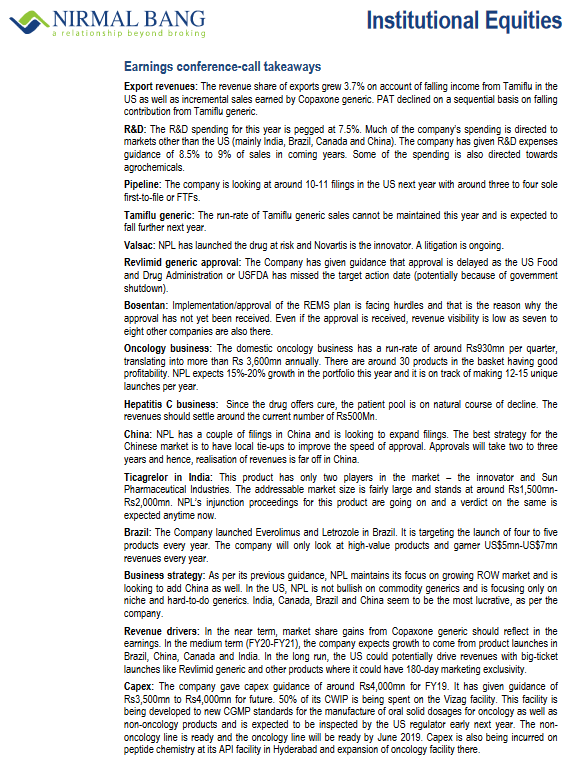

Higher competition in the flu segment (Oseltamivir) resulted in lower export formulation revenue which witnessed a degrowth of 11%(YoY basis) while do-mestic formulation sales was also flat or slightly negative. However, API (both domestic and international) grew by 22% YoY reflecting better sales momen-tum. Their latest US filing includes ANDA for generic version of Ibrutinib tablets which had sales of approximately US$ 2.6 billion for twelve months ending Sep-tember, 2018 (according to data from IQVIA). Focus will be on 10-14 key niche molecules in the US over a period of time.

EBITDA margin to stabilize…

EBITDA margin stands at 40% in Q3FY19 which is in premium to many other top players in the sector. However it is down by 1200bps on a YoY basis. This is primarily on account of lower margin from Oseltamivir sales in the US. However we expect this loss of revenue will be replaced by copaxone sales in the US which looks promising. The CAPEX for FY19 will be around Rs400crs which will be maintained in the coming years. The management has guided for higher revenue post CY20 as new niche molecules get approved (Revlimid). We therefore revise downward our Revenue/PAT estimates by 4%/3% for FY20 to factor lower sales from the US.

Higher focus on Emerging Markets (EM)…

The management has guided that there will be greater focus on the emerging markets like Canada, India and Brazil for the medium term. They have also start-ed working on green-field manufacturing facilities for producing niche agrichemicals which is expected to be completed by the end of 2019 (total CAPEX of Rs100crs). In India they have launched drug Valsartan-Sacubitril un-der its brand VALSAC which is used for certain types of heart failure. Another option they are exploring is China market where they have put a target of 10-11 filings. We are also expecting a good Q4 from Brazil while it will be muted for Canada (expecting good numbers in FY20)

In addition to what is mentioned in the conference call, further erosion of price may be due to their entry into agrochemicals which the market participants doesn’t approve? Most people expect Natco to have meaningful triggers from it’s US operations in two years from now. Management seems to be honest and they deliberately want to concentrate on complex molecules(less ANDA’s filed) and want to have partnerships with established players in US for distribution(less margins). That means they are doing the waiting game and are willing to have modest gain in US than go aggressive with increased risk of litigation/marketing. I am invested in it with the hope of triggers to play out in 2 to 3 years time. I am not sure what to make out from agrochemicals foray.

Copaxone sales in the US are below expectations as per Mylan concall - hence Q4 2019 profit is likely to be lower than Q4 2018 (just my guess/opinion). Con call transcript copy pasted below

https://finance.yahoo.com/news/edited-transcript-myl-earnings-conference-080248300.html

Discl- 15% of my portfolio and holding since a long time

(Good news for Biocon shareholders though - Fulphila doing well in the US with 15% market share. Herceptin and Insulin glargine sales in Europe will commence soon) Hold Biocon too…

Another competitor for Revlimid in the US - Alvogen. I don’t think this will affect Natco Revlimid selling volumes between 2022-2026…Court case with Dr Reddys still ongoing…The other possibility is that Natco might be allowed to sell Revlimid in the US before 2022 - this would be a fantastic outcome for Natco!!

Results are out…

Looks bad on initial look but I believe it was already expected …

Views from experts tracking this awaited

What I liked is - good jump in PPE + Capital WIP. (Fixed assets). And that too is without significant increase in long term debt. Seems, expansion from mainly internal funding. We need to trust in mgmt capabilities. Pure value Investor’s stock at this moment in absence of growth in near term.

Disc- holding. 3% of PF. No transaction in last 6months. May add more.